- Home

- »

- Plastics, Polymers & Resins

- »

-

Anti-fog Additives Market Size, Share, Industry Report, 2033GVR Report cover

![Anti-fog Additives Market Size, Share & Trends Report]()

Anti-fog Additives Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Glycerol Esters, Ethoxylated Sorbitan Esters, Polyglycerol Esters, Sorbitan Esters), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-860-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-fog Additives Market Summary

The global anti-fog additives market size was estimated at USD 2.21 billion in 2024 and is projected to reach USD 3.44 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033. Increasing regulatory focus on volatile organic compounds and food contact safety is pushing formulators to adopt low migration, water based anti-fog solutions. This creates market pull for certified additives that simplify compliance for converters and brand owners.

Key Market Trends & Insights

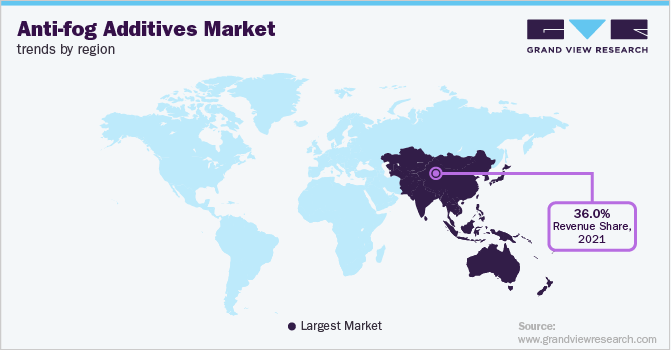

- Asia Pacific dominated the anti-fog additives market with the largest revenue share of 37.42% in 2024.

- The anti-fog additives market in India is expected to grow at a substantial CAGR of 8.8% from 2025 to 2033.

- By product, the polyglycerol esters segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

- By application, the food packaging films segment is expected to grow at a considerable CAGR of 5.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.21 billion

- 2033 Projected Market Size: USD 3.44 billion

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2024

The anti-fog additives market is moving toward multifunctional solutions that combine anti-fog performance with antireflective, antimicrobial, or antiabrasion properties to meet consolidated performance demands across industries. Manufacturers are integrating these additives into polymer masterbatches and surface coatings during production rather than as post treatment, improving process efficiency and consistency. There is a clear pivot from solvent based chemistries to water based and low volatile organic content systems as formulators respond to environmental and workplace safety priorities. Adoption is strongest where transparency and hygiene intersect, for instance, in food packaging, medical devices, and protective eyewear.

Drivers, Opportunities & Restraints

Rising demand for clear, safe visibility in hygiene critical and consumer convenience applications is a primary commercial driver for anti-fog additives. Growth in single use medical devices, protective face shields and flexible food packaging creates recurring demand for guaranteed fog free surfaces throughout product lifecycles. At the same time brand owners are pushing for integrated solutions that reduce secondary processing steps and waste, encouraging processors to specify pre compounded anti-fog masterbatches or inline coatings. This pull from downstream customers reinforces innovation and investment along the value chain.

There is a sizeable opportunity in developing bio derived and low migration anti-fog chemistries that satisfy both regulatory scrutiny and sustainability mandates from brand owners. Companies that showcase strong performance in demanding environments—such as sterilization cycles, high humidity, and low temperatures are well positioned to unlock new opportunities in medical, laboratory, and high-end optical markets. Licensing smart coating technologies to film and glass manufacturers or offering turnkey coating services allows additive producers to capture more margin and embed themselves deeper into supply chains. Geographic expansion into emerging markets with growing packaging and healthcare consumption presents an additional growth runway.

Cost pressure and formulation complexity remain significant restraints for wider anti-fog adoption across price sensitive segments. High performance additives often require precise dosing, compatibilizers and process controls that increase manufacturing complexity and total cost of ownership for converters. Regulatory concerns around migration, toxicity and long term environmental fate raise approval timelines and create uncertainty for new chemistries.

Market Concentration & Characteristics

The market growth stage of the anti-fog additives market is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies such as Clariant AG, AkzoNobel N.V., Ashland Inc., Croda International PLC, Evonik Industries, PolyOne Corporation, A. Schulman, Inc., DuPont, Addcomp Holland, Emery Oleochemicals, Palsgaard, Polyvel Inc., Ampacet Corporation, Sabo S.p.A, Lifeline Technologies, Fine Organics, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the anti-fog additives space is accelerating toward multifunctional and surface engineered solutions that go beyond simple surfactant migration. Developers are combining anti-fog performance with antimicrobial, self-cleaning and abrasion resistant properties to meet consolidated customer requirements, while parallel advances in nanocoatings and silane chemistry are extending durability and optical clarity under repeated wash and sterilization cycles. At the same time, physical surface modification techniques such as programmed plasma treatments are emerging as chemical free alternatives or complements, enabling long lasting hydrophilicity without adding migrating substances. For sellers and converters this technological broadening creates a two track market: improved additive formulations for conventional film extrusion and specialty surface treatments for high value optics and medical components.

The market is seeing credible substitutes to traditional migrating anti-fog additives in engineered hydrophilic coatings, inorganic nanoparticle based layers, and surface modification processes that render substrates inherently fog resistant. Examples include thin silica or PEG composite coatings that keep surfaces smooth and water spreadable, durable silane networks covalently bound to polymer surfaces, and fast plasma treatments that create super hydrophilic interfaces without added chemicals. These alternatives are attractive where migration, regulatory scrutiny or long term clarity are critical, but they often require new capital equipment or supply chain partnerships, creating a trade-off between performance and implementation cost for converters and brand owners.

Product Insights

Glycerol esters segment dominated the anti-fog additives market in terms of revenue, accounting for a market share of 32.13% in 2024, and is forecasted to grow at a 5.0% CAGR from 2025 to 2033. Glycerol esters remain the workhorse anti-fog chemistry because they marry low raw material cost with established food contact acceptability and straightforward processing into polymer masterbatches. Their compatibility with common polyolefin films and predictable migration behavior make them the default choice for converters seeking reliable clarity without adding processing steps. Strong incumbent supply chains and existing regulatory familiarity further reduce adoption friction for brand owners and packers.

The polyglycerol esters segment is anticipated to grow at a substantial CAGR of 5.1% through the forecast period. Polyglycerol esters are gaining traction as formulators chase higher performing, low odor, and bio based surfactants that deliver persistent anti-fog performance in demanding conditions. Their molecular architecture provides improved thermal stability and tailored migration rates, which maintain clarity through freezing, thawing and extended refrigerated display. Producers are therefore specifying polyglycerol chemistries where product quality and cleaner ingredient stories matter.

Application Insights

Food packaging films segment dominates the anti-fog additives market in terms of revenue, accounting for a market share of 66.72% in 2024 and is forecasted to grow at 5.0% CAGR from 2025 to 2033. The food packaging segment is driven by two converging customer imperatives: visible product presentation and food safety compliance. Retailers and brands demand transparent films that preserve shelf appeal while meeting stricter food contact and migration requirements, which creates pull for certified, low migration anti-fog solutions that can be integrated during extrusion. This combination of marketing and regulatory pressure keeps anti-fog demand concentrated in food film formats.

The agricultural films segment is projected to expand at a substantial CAGR of 4.8% through the forecast period. In agricultural films the primary commercial driver is agronomic performance rather than aesthetics: maintaining even light transmission and preventing water beading improves plant growth, reduces disease risk and can accelerate crop cycles. Growers and film manufacturers therefore select anti-fog systems that retain efficacy under UV exposure, repeated wetting and variable temperatures, which favors chemistries engineered for controlled migration and long service life. This yields a steady technical demand from greenhouse and high value crop producers.

Regional Insights

Asia Pacific anti-fog additives market held the largest revenue share of 37.42% in 2024 and is expected to grow at the fastest CAGR of 5.3% over the forecast period. Asia Pacific demand is driven by the rapid expansion of packaged food retailing and intensifying agricultural film use, supported by growing local film converting capacity across China, India, and Southeast Asia. Rising cold chain investments and modern retail formats increase the need for consistent anti-fog performance across longer distribution routes, while brand and retailer sustainability goals are creating appetite for low migration and biodegradable solutions. This confluence of volume growth, technical performance expectations, and cost sensitivity encourages regional manufacturers to partner with global additive suppliers for scalable masterbatch and extrusion coating technologies.

North America Anti-fog Additives Market Trends

In North America the anti-fog market is being pulled by a mix of evolving retail formats and industrial demand for reliable clarity across refrigerated display and protective equipment. Retailers and food brand owners are pressuring converters for integrated, low migration anti-fog solutions that reduce secondary handling and support longer shelf appeal in omni channel logistics. At the same time, healthcare and laboratory consumables are driving demand for certified chemistries that survive sterilization and single use workflows. These commercial requirements are encouraging formulators to invest in water based and masterbatch solutions that simplify converter implementation and traceability.

U.S. Anti-fog Additives Market Trends

The U.S. market dynamic is characterized by strong demand from food packaging and personal protective equipment combined with heightened scrutiny over food contact safety. Brand owners prioritize anti-fog systems that meet FDA expectations and that can be validated for low migration under real use conditions, which favors established chemistries and third party certification. Meanwhile growth in single use medical devices and protective eyewear following lessons learned during public health events is creating recurring volume requirements for dependable anti-fog performance. This mix of regulatory caution and steady end use demand is encouraging suppliers to offer application specific technical support to converters.

Europe Anti-fog Additives Market Trends

In Europe regulatory clarity and sustainability expectations are the primary commercial levers shaping anti-fog adoption. Ongoing work to revise food contact material rules and sharper enforcement under REACH and related frameworks means converters and brand owners increasingly specify low migration, fully characterised additives to avoid recalls and market access delays. At the same time, consumer expectations for recyclable packaging and reduced chemical footprints are pushing formulators toward water based systems and non migrating surface technologies. Suppliers that can combine regulatory dossiers with circularity credentials are therefore at an advantage in tender processes.

China Anti-fog Additives Marketis driven by unique regulatory and supply chain centric as national food contact standards undergo revision and enforcement tightens. Recent draft and finalized updates to GB standards for additives and food contact materials are prompting domestic converters and multinational packers to requalify anti-fog chemistries or switch to cleared alternatives to maintain market access. At the same time, the enormous domestic packaging and film manufacturing base offers a rapid commercialization pathway for additives that meet new standards, creating both compliance risk and fast scale opportunity for proven low migration solutions.

Key Anti-fog Additives Market Company Insights

The Anti-fog Additives Market is highly competitive, with several key players dominating the landscape. Major companies include Clariant AG, AkzoNobel N.V., Ashland Inc., Croda International PLC, Evonik Industries, PolyOne Corporation, A. Schulman, Inc., DuPont, Addcomp Holland, Emery Oleochemicals, Palsgaard, Polyvel Inc., Ampacet Corporation, Sabo S.p.A, Lifeline Technologies, and Fine Organics. The anti-fog additives market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Anti-fog Additives Market Companies:

The following are the leading companies in the anti-fog additives market.. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- AkzoNobel N.V.

- Ashland Inc.

- Croda International PLC

- Evonik Industries

- PolyOne Corporation

- A. Schulman, Inc.

- DuPont

- Addcomp Holland

- Emery Oleochemicals

- Palsgaard

- Polyvel Inc.

- Ampacet Corporation

- Sabo S.p.A

- Lifeline Technologies

- Fine Organics

Recent Developments

-

In September 2025, Palsgaard presented its food-grade, plant-based polymer additives at K 2025, highlighting sustainable solutions for the plastics and packaging industries. Their Einar series, made from vegetable oils such as sunflower, rapeseed, and certified palm oil, offered safe, high-performance alternatives to conventional fossil-based additives.

-

In December 2024, Emirates Biotech, a joint venture between UAE's SS Royal Kit Emirates Investment and Hong Kong’s Global Biopolymers Industries, announced plans to establish the world's largest Polylactic Acid (PLA) production facility in Abu Dhabi’s KEZAD free zone.

Anti-fog Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.34 billion

Revenue forecast in 2033

USD 3.44 billion

Growth rate

CAGR of 4.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Russia; Spain; Italy; Benelux; Turkey; China; Japan; India; Brazil

Key companies profiled

Clariant AG; AkzoNobel N.V.; Ashland Inc.; Croda International PLC; Evonik Industries; PolyOne Corporation; A. Schulman, Inc.; DuPont; Addcomp Holland; Emery Oleochemicals; Palsgaard; Polyvel Inc.; Ampacet Corporation; Sabo S.p.A; Lifeline Technologies; Fine Organics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-fog Additives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the anti-fog additives market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Glycerol Esters

-

Ethoxylated Sorbitan Esters

-

Polyglycerol Esters

-

Sorbitan Esters

-

Polyoxyethylene Esters

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Agricultural films

-

Food packaging films

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Gemany

-

France

-

UK

-

Russia

-

Spain

-

Italy

-

Benelux

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global anti-fog additives market size was estimated at USD 2.21 billion in 2024 and is expected to reach USD 2.34 billion in 2025.

b. The global anti-fog additives market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 3.44 billion by 2033.

b. Glycerol esters dominated the anti-fog additives market across the product type segmentation in terms of revenue, accounting for a market share of 32.13% in 2024 and is forecasted to grow at 5.0% CAGR from 2025 to 2033.

b. Some key players operating in the anti-fog additives market include Clariant AG, AkzoNobel N.V., Ashland Inc., Croda International PLC, Evonik Industries, PolyOne Corporation, A. Schulman, Inc., DuPont, Addcomp Holland, Emery Oleochemicals, Palsgaard, Polyvel Inc., Ampacet Corporation, Sabo S.p.A, Lifeline Technologies, and Fine Organics.

b. Key factors that are driving the market growth include increasing demand for convenience food along with the rising demand for anti-fog enzymes in vehicle windscreens and windows.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.