- Home

- »

- IT Services & Applications

- »

-

Application Management Services Market Size Report, 2030GVR Report cover

![Application Management Services Market Size, Share & Trends Report]()

Application Management Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Deployment (Hosted, On-premise), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-378-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Management Services Market Summary

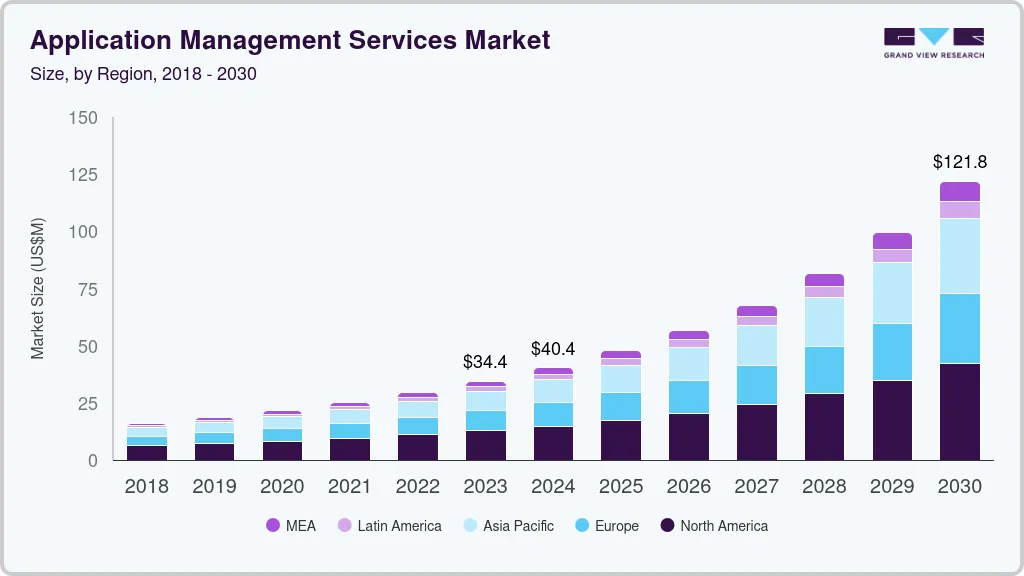

The global application management services market size was estimated at USD 34.40 billion in 2023 and is projected to reach USD 121.75 billion by 2030, growing at a CAGR of 20.2% from 2024 to 2030. The changing technological landscape worldwide and demand from small enterprises for application management services (AMS) are driving the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, application portfolio assessment accounted for a revenue of USD 34.4 million in 2023.

- Application Portfolio Assessment is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 34.40 Billion

- 2030 Projected Market Size: USD 121.75 Billion

- CAGR (2024-2030): 20.2%

- North America: Largest market in 2023

With changing technological innovations, organizations strive for best-in-class technology integration with their systems, driving market growth.

Enterprises outsource application management services to a third-party AMS provider to manage their applications and ensure smooth operation. By outsourcing these services to expert vendors, organizations can focus on their core competencies and save on financial and human resources, thus optimizing their functioning.

AMS providers function as outsourced IT partners. Their core function is overseeing the lifecycle of a company's software applications. This involves comprehensive management, encompassing continuous monitoring, seamless user support, and proactive application maintenance. AMS providers facilitate adopting new applications through installation, configuration, and rigorous testing before deployment. Their services extend to cloud-based applications and software upgrades, ensuring optimal performance. Additionally, application management service providers are responsible for mitigating any issues arising from malfunctioning applications.

The proliferation of cloud-based applications calls for specialized management practices. AMS providers possess the required skills and tools to navigate cloud environments, ensuring optimal performance and security for these applications. Additionally, the rapid evolution of technologies such as artificial intelligence (AI), machine learning (ML), and automation requires ongoing adaptation of application management strategies. AMS providers possess the expertise to effectively address these advancements, allowing businesses to leverage cutting-edge solutions without significant internal investments.

Services Insights

Application security services accounted for the largest market revenue share of 19.7% in 2023. Application security is a crucial component of AMS. The ever-evolving cyber threat landscape poses a significant risk to businesses, with data breaches and vulnerabilities in applications leading to substantial financial losses and reputational damage for organizations. Incidences of cyber-attacks such as ransomware, phishing, malware, and distributed denial of service (DDoS) on the global level are on rise. Application security services offer a cost-effective alternative, providing access to specialized expertise without the need for significant in-house investments.

Mobile application security services are expected to register the fastest CAGR during the forecast period. The contemporary business landscape revolves around mobile technology. Smartphones have proliferated across every global economy. The ubiquitous use of mobile devices for critical tasks and access to sensitive data requires robust security measures for applications that facilitate these activities. This increased dependence on mobile applications has created a heightened focus on their safety and security, driving the demand for specialized mobile application security services.

Deployment Insights

Hosted deployment accounted for the highest market revenue share in 2023. Hosted services are also known as cloud-based solutions. These services offer a significant cost advantage over on-premise deployment. They eliminate the upfront capital expenditure required for on-premise infrastructure. It allows companies to pay for services on a subscription basis. Additionally, hosted deployment provides superior scalability and flexibility according to the changing demands in the market. These factors of affordability and flexibility have resulted in a heightened demand for cloud-based AMS.

The on-premise segment is expected to register a significant CAGR during the forecast period. On-premise solutions are favored over cloud-based AMS by numerous industries, such as finance and healthcare, which handle highly sensitive data. Regulatory requirements in these sectors are stricter and require data to remain within the organization's physical boundaries. On-premise deployment solutions offer greater control over data security by allowing organizations to implement their robust security protocols and maintain physical custody of their data. It is critical to ensure compliance with stringent data privacy regulations. These data security and privacy concerns are effectively addressed by on-premise solutions, leading to segment growth.

Enterprise Size Insights

The large enterprises segment dominated the market in 2023. Large enterprises have a vast and complex network of software applications. Each application serves specific functions and requires integration with others. Managing this complex ecosystem within the organization is highly resource-intensive and requires a large IT team with specialized skills. AMS providers offer expertise in handling complexities, streamlining operations, and improving application management efficiency. Based on historical data, large organizations are frequently prone to attacks by cybercriminals. This vulnerability requires such companies to allocate sufficient funds toward digital security, which is an important factor for the dominance of this segment.

The small and medium enterprises (SMEs) segment is expected to register the fastest growth during the forecast period. SMEs operate their businesses on limited financial resources. An absence of dedicated staff with the specialized skills and experience required for effective application management poses a substantial threat to these organizations' software infrastructure. AMS providers offer a cost-effective solution, plugging this expertise gap and ensuring applications are maintained and optimized for performance.

End-use Insights

The BFSI accounted for the highest market revenue share in 2023. BFSI organizations store a substantial amount of classified and sensitive financial data. Consequently, light mismanagement or leakage of this data may cause considerable losses to stakeholders. Additionally, the rise of Fintech solutions is transforming the financial services landscape. Such advancements require integrating existing applications and creating a complex and dynamic environment. AMS providers possess the expertise to effectively manage these issues of data security and technological integrations, driving growth in the BFSI sector.

The manufacturing sector is expected to register the highest CAGR during the forecast period. The sector is undergoing a significant transformation, driven by Industry 4.0 principles such as adopting industrial automation and the Industrial Internet of Things (IIoT). These technologies rely on a complex network of interconnected devices and applications that generate vast amounts of data. Effectively managing this data requires robust application management services (AMS) to ensure optimal performance, security, and real-time insights. As manufacturing operations increasingly rely on these technologies, the demand for AMS in this sector is expected to surge.

Regional Insights

North America accounted for the highest market revenue share of 37.0% in 2023. It is attributed to the extensive presence of advanced IT infrastructure, including high-bandwidth internet connectivity and robust data centers, in this region. This strong foundation facilitates adoption of cloud-based AMS solutions, which are becoming increasingly popular due to their scalability and cost-effectiveness. Additionally, increasing competition in the region requires innovative solutions with optimized expenses. AMS providers have offered valuable expertise in optimum application performance and implementing new technologies, leading to regional industry dominance.

U.S. Application Management Services Market Trends

The U.S. is well-known worldwide for Silicon Valley, the global hub for technology innovation. The concentration of prominent technology companies such as Google, IBM, Amazon Web Services, and Dell makes them early adopters of modern IT solutions. These companies are at the forefront of developing and deploying complex applications, driving a high demand for sophisticated AMS services. They have global operations, and adhering to the data protection regulations of each country becomes vital for an uninterrupted supply of services. These factors lead to a high market revenue share for the U.S.

Europe Application Management Services Market Trends

Europe accounted for a notable market revenue share in 2023. The region has a well-developed IT infrastructure, with many businesses adopting sophisticated software applications. This established foundation fuels the demand for effective application management services to ensure optimal performance and security. Additionally, the General Data Protection Regulation (GDPR) in Europe enforces data privacy and transfer regulations. AMS providers play a critical role in helping organizations comply with these regulations, creating promising market opportunities.

The UK is home to some of the most prominent application management service providers, such as Micro Focus (now OpenText). These established players offer a wide range of services and cater to diverse industry needs. Additionally, the country's skilled IT workforce, with expertise in application management best practices, serves a wide range of organizations' AMS requirements. This confluence of factors creates a strong ecosystem for the country's application management services market.

Asia Pacific Application Management Services Market Trends

Asia Pacific is anticipated to register the highest growth rate during the forecast period. Cloud computing adoption is accelerating across the region, driven by factors such as cost-efficiency, scalability, and agility. Managing cloud-based applications requires specialized expertise. A large pool of IT professionals offers the necessary skills and tools to optimize cloud application performance and security, catering to this growing regional demand. Additionally, outsourcing of business operations by Western companies due to cost optimization has led to exponential growth of the AMS market in Asia Pacific.

India is witnessing a high smartphone penetration rate, and consumers are increasingly integrating the internet and e-commerce into their daily lives. This scenario requires specialized management for mobile applications. AMS providers offer solutions to ensure optimal performance, security, and user experience for mobile applications. Furthermore, organizations can optimize their IT budgets by outsourcing to an AMS provider while ensuring optimal application performance. This lucrative alternative has further propelled market demand in the country.

Key Application Management Services Company Insights

Some key companies involved in the application management services market include Accenture, Amazon Web Services, and HCL Technologies Limited.

-

Accenture is an American multinational IT service provider with operations worldwide. The company offers services in different sectors, such as cloud, cyber security, data and AI, emerging technology, enterprise platforms, and marketing and experience. Accenture’s offerings in AMS include DevOps integration, application portfolio management, application modernization, end-to-end support, and cloud-centric modernization.

-

HCL Technologies Limited is an Indian multinational IT services company with a presence in over 60 countries globally. The company offers the ASM 2.0 (Application Support and Maintenance 2.0 framework). This next-generation approach to managing applications is designed to improve efficiency and deliver better business outcomes for enterprises in the digital era. The framework leverages DevSecOps principles for better security in the application management cycle.

Key Application Management Services Companies:

The following are the leading companies in the application management services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services, Inc.

- Dell Inc.

- HCL Technologies Limited

- Infosys Limited

- IBM

- OpenText Corporation

- Oracle

- SAP

Recent Developments

-

In July 2024, Accenture entered into a partnership with Proximus, a digital services and communication company. Through this strategic partnership, Proximus will utilize the cloud-agnostic Accenture Video Solution (AVS) platform to manage its digital video content and enhance viewer experiences. Furthermore, as part of the agreement, Accenture will conduct training activities for Proximus employees in different verticals.

-

In July 2024, Infosys announced its long-term collaboration with Sector Alarm, a prominent European security solutions provider. Infosys will collaborate with Sector Alarm to modernize the company's core business systems. This initiative comprises migrating Sector Alarm's current on-premises, fragmented Enterprise Resource Planning (ERP) platform to Microsoft Dynamics 365 Finance and Operations (F&O).

Application Management Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.42 billion

Revenue Forecast in 2030

USD 121.75 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Services, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Accenture; Amazon Web Services, Inc.; Dell Inc.; Google; HCL Technologies Limited; Infosys Limited; IBM; OpenText Corporation; Oracle; SAP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Management Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application management services market report based on services, deployment, enterprise size, end-use, and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Portfolio Assessment

-

Application Security

-

Web Application Security

-

Mobile Application Security

-

Application Modernization

-

Cloud Application Migration

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecom and IT

-

Government

-

Retail and Ecommerce

-

Healthcare and Lifesciences

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.