- Home

- »

- Clinical Diagnostics

- »

-

Arbovirus Testing Market Size, Share & Growth Report, 2030GVR Report cover

![Arbovirus Testing Market Size, Share & Trends Report]()

Arbovirus Testing Market Size, Share & Trends Analysis Report By Test Type (RT-PCR Test, ELISA-Test), By End-use (Hospitals, Diagnostic Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-178-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Arbovirus Testing Market Size & Trends

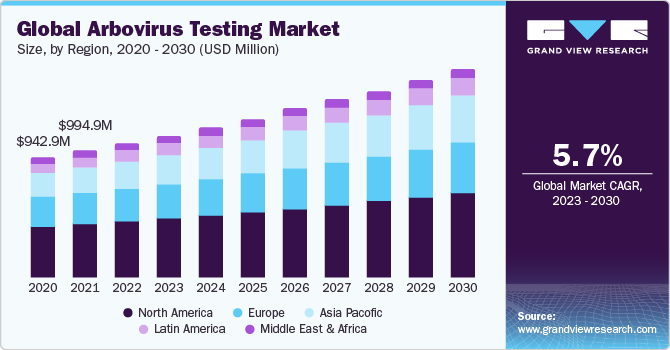

The global arbovirus testing market size was valued at USD 1.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.71% from 2023 to 2024. The market is expected to grow due to rising government activities on increasing awareness of neglected tropical diseases (NTDs) such as dengue and chikungunya caused by arbovirus. Furthermore, growing public awareness of these illnesses and benefits of early arbovirus testing among patients and physicians are projected to fuel market growth in the coming years.

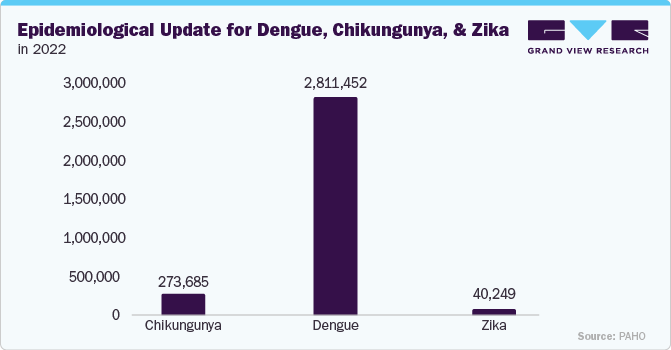

Arbovirus testing has emerged as a pivotal tool in preventing the spread of these neglected tropical diseases (NTDs). According to WHO estimates, around one-fifth of the population—about 1.7 billion people—mostly in developing and lower-income nations- must receive diagnosis and treatment for at least one non-communicable disease (NTD) annually. The dengue and chikungunya NTD epidemic impacted almost 40% of Africa. These illnesses are more common in impoverished communities in tropical and hard-to-reach locations due to a favorable environment for virus growth and lack of hygiene. Thus, most NTD cases worldwide are from nations like Brazil, Yemen, India, Bangladesh, China, and several countries in Central and East Africa. Thus, the rising incidence of dengue and chikungunya is anticipated to fuel demand for arbovirus testing, thereby driving market growth.

Moreover, several international organizations run programs to raise awareness of neglected tropical diseases (NTDs) worldwide. These include the United States Global Health Initiative, the Global NTD Program by the Centers for Disease Control and Prevention, the World Health Organization's Global NTD Programs, and the NTD Program by the United States Agency for International Development. These programs focus mainly on reducing or eliminating NTDs like dengue and chikungunya. In addition, the WHO is introducing a pilot program for a WHO Expert Review Panel for Diagnostic Products (ERPD) for neglected tropical diseases (NTDs) in October 2023. Enhancing the quality control and availability of NTD diagnostic tools for medical professionals is the goal of this pilot project.

Human arboviral diseases can range in severity from hemorrhagic fevers and encephalitis to asymptomatic states. The gold standard for diagnosing arboviral illness has always been serological techniques. Numerous arboviral infections, including Zika, dengue, chikungunya, and yellow fever virus, have been extensively diagnosed using techniques including lateral flow assays (LFAs), direct and indirect enzyme-linked immunosorbent tests (ELISAs), and LFAs. Next-generation sequencing (NGS) techniques have recently been used to detect arboviruses in specific conditions. Additionally, the NGS techniques have been demonstrated to have a similar sensitivity equivalent to traditional RT-PCR tests. Thus, growing technological advancement in arbovirus testing is expected to drive market growth.

Test Type Insights

On the basis of the test type, the market is segmented into RT-PCR tests and ELISA tests. The ELISA tests segment held the largest market share in 2022. This can be attributed to an increased focus on research and development of new ELISA tests and their advantages over RT-PCR tests in diagnosing diseases caused by arbovirus. The innovations and continuous improvements in new assay design, test sensitivity, and specificity, including research and development of new ELISA assay with enhanced diagnostic efficacy, and cost-effectiveness are anticipated to offer substantial segment growth.

End Use Insights

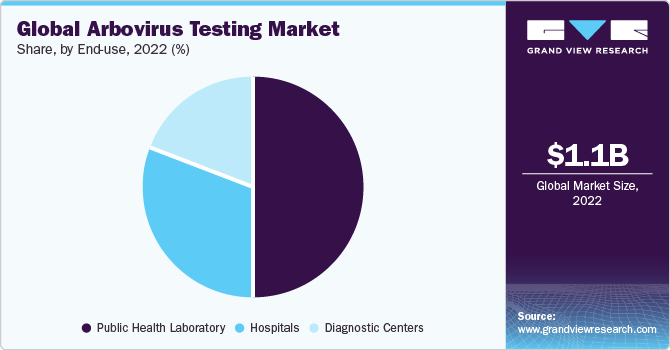

Based on the end use, the arbovirus testing market is segmented into hospitals, diagnostic centers, and public health laboratories. The public health laboratory segment held the largest market share in 2022. This can be attributed to the high demand for arbovirus testing in public health laboratories to diagnose dengue and chikungunya. Furthermore, a rise in government initiatives to provide different services, such as funding for diagnostic testing, is projected to fuel segment growth during the forecast period.

Regional Insights

North America dominated the market in 2022. This can be attributed to the rising burden of NTDs like chikungunya and dengue, higher healthcare costs, rapid technological breakthroughs, aggressive government activities, and a growth in patients' knowledge regarding the utility of arbovirus testing in diagnosing these NTDs. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. Factors expected to propel region expansion include increased government investment, the availability of skilled medical professionals, and the emphasis of multinational companies on diagnostic businesses for creating cutting-edge and unique IVD products such as arbovirus test kits.

Key Companies & Market Share Insights

Key players operating in the market are Abbott, Thermo Fisher Scientific, Inc., NovaTec Immundiagnostica GmbH, Agilent Technologies, Inc., and others. To capture a larger portion of the market, major firms are undertaking various strategies, including partnerships, collaborations, and the development of new products.

The following are some instances of strategic initiatives:

-

In May 2023, Astellas Pharma Inc. announced its contribution to the Global Health Innovative Technology Fund, which will fund the development of medications, diagnostic tools, and vaccinations that assist in fighting against various infectious illnesses, especially underappreciated tropical diseases.

-

In May 2022, a portable RT-PCR molecular test was launched by Anitoa Systems to detect infections caused by dengue virus. This test launch is expected to boost arbovirus testing in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."