- Home

- »

- Clinical Diagnostics

- »

-

Lateral Flow Assays Market Size, Industry Report, 2033GVR Report cover

![Lateral Flow Assays Market Size, Share & Trends Report]()

Lateral Flow Assays Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Kits & Reagents, Lateral Flow Readers), By Application (Clinical Testing, Veterinary Diagnostics), By Technique (Sandwich, Competitive), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-880-0

- Number of Report Pages: 176

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lateral Flow Assays Market Summary

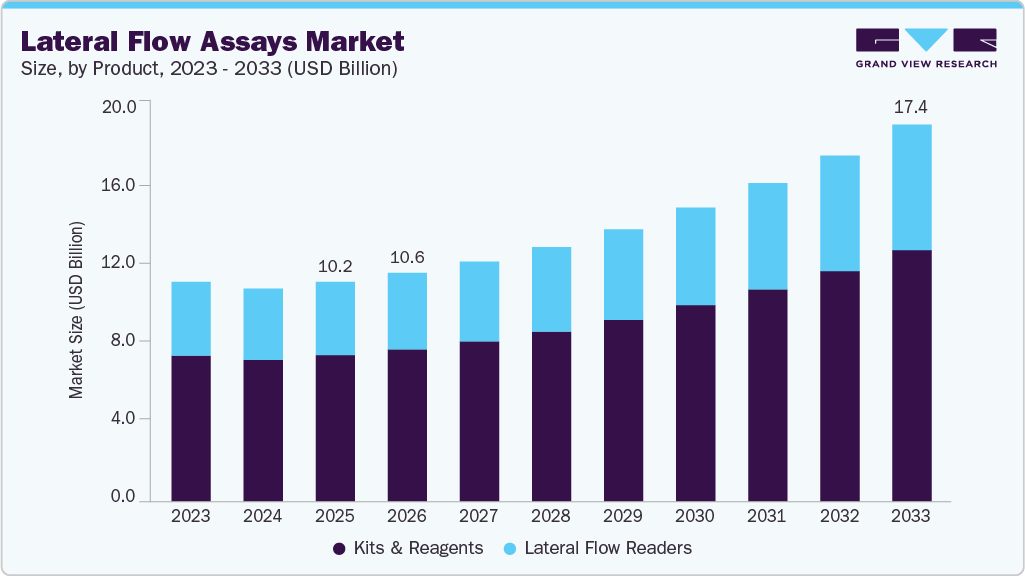

The global lateral flow assays (LFA) market size was estimated at approximately USD 10.17 billion in 2025 and is projected to reach USD 17.44 billion by 2033, growing at a CAGR of 7.41% from 2026 to 2033, driven by the increasing demand for rapid and cost-effective diagnostic solutions, particularly in Point-of-Care (POC) and home-testing applications. Infectious diseases remain one of the main global health challenges.

Key Market Trends & Insights

- North America lateral flow assays industry dominated the global market and accounted for the largest revenue share of 35.20% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on product, the kits and reagents segment dominated the global market and accounted for the largest revenue share of 66.56% in 2025.

- Based on application, the clinical testing segment held the largest revenue share of 74.20% in 2025.

- Based on technique, the sandwich assays application segment held the largest revenue share of 38.64% in 2025.

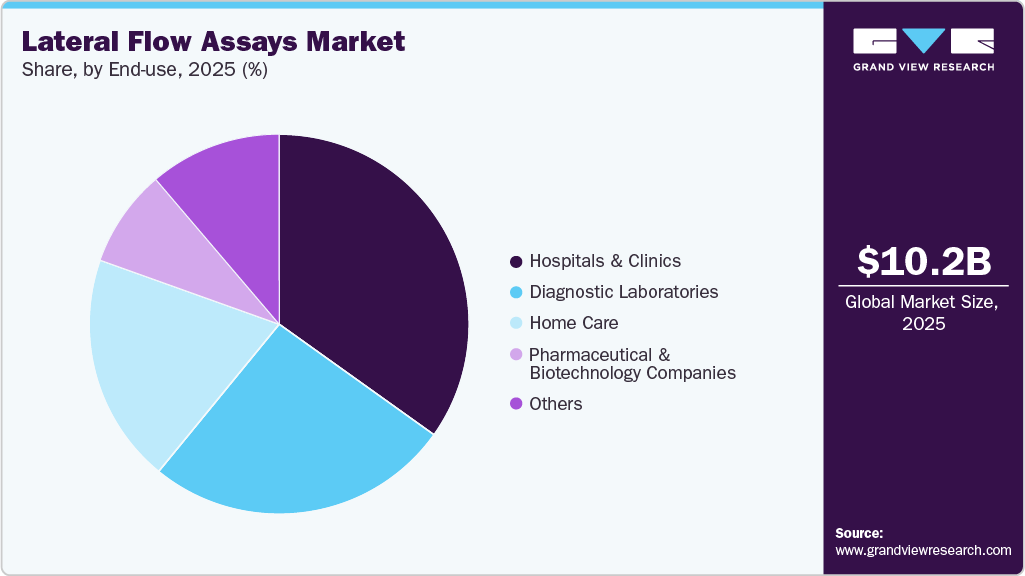

- Based on end use, the hospitals and clinics segment dominated the market in 2023 and accounted for a revenue share of 34.87% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10.17 Billion

- 2033 Projected Market Size: USD 17.44 Billion

- CAGR (2026-2033): 7.41%

- North America: Largest market in 2025

Infectious diseases remain one of the main global health challenges. In 2025, new infectious disease threats have emerged, further underscoring the need for LFAs. In Louisiana, a fatal case of avian influenza A (H5N1) was reported, linked to inadequate protective equipment among workers handling infected animals. The CDC noted 67 human cases of H5N1 in 2024, with 40 cases tied to dairy cattle exposure and 23 to poultry farms. The UK responded by securing 5 million doses of an H5 vaccine to mitigate risks in 2025. In February 2025, Ireland confirmed its first case of mpox caused by monkeypox clade I, a strain previously dominant in Africa. Simultaneously, Uganda declared an Ebola outbreak in January 2025, with the WHO confirming seven cases, including one fatality, by February. These outbreaks illustrate the unpredictable nature of infectious diseases, driven by global interconnectivity and environmental factors.

The high prevalence of infectious diseases worldwide has been a major driver for the market growth. These diseases necessitate novel diagnostic techniques for efficient treatment to stop the rising mortality rate. The COVID-19 pandemic, in particular, highlighted the need for rapid and accessible diagnostic tools, leading to a surge in demand for LFAs. Beyond COVID-19, other infectious threats have emerged. For instance, in 2025, a highly pathogenic avian influenza A (H5N1) virus infection resulted in a fatality in Louisiana, USA, despite the use of personal protective equipment that was deemed inadequate. According to the Centers for Disease Control and Prevention (CDC), while the general public faces a low risk, individuals working closely with infected animals-such as farmers, veterinarians, and wildlife facility staff-remain highly vulnerable. In 2024, 67 human cases of avian influenza were reported, with 40 linked to exposure to dairy cattle and 23 associated with poultry farms. In response, the UK proactively secured 5 million doses of the H5 vaccine to mitigate potential risks in 2025.

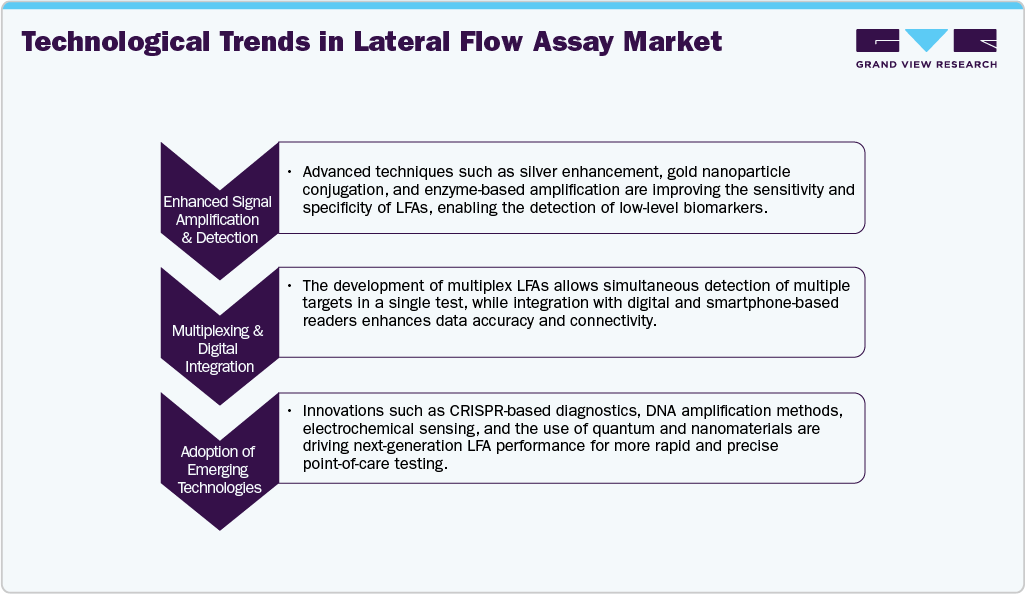

Technological advancements now allow for improved performance and use of lateral flow assays, including advances in sensitivity, specificity, multiplexing, and digital applications via smartphone apps and cloud-connected devices. The latter advances have meant that lateral flow devices may be used in areas outside infectious disease detection, including pregnancy testing, heart disease monitoring, veterinary diagnostics, environmental testing, and food safety. As part of the advances above, Abingdon Health plc (UK) has established itself as a key player in the lateral flow market. In May 2024, Abingdon Health plc launched Boots' own-brand saliva-based pregnancy self-test to the UK and online via Salignostics and Crest Medical. This product represents a technological shift from traditional urine-based pregnancy tests to non-invasive saliva testing, thus providing greater convenience and accessibility for the user. In addition to launching the product, the significant advancement in product innovation provided an opportunity to further strengthen Abingdon Health's strategic partnership with Boots as the first company to adapt a saliva pregnancy self-test into Boots' own-brand range. These advances demonstrate how biotechnology innovation, consumer health, and strategic partnerships continue to influence the direction of the global lateral flow assays industry.

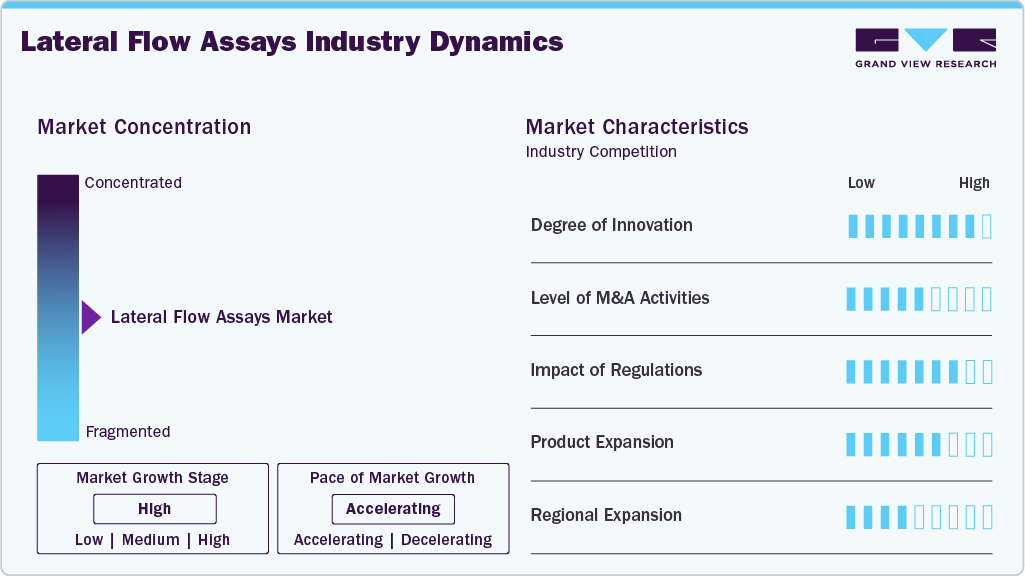

Market Concentration & Characteristics

Technological advancements have significantly enhanced the sensitivity, specificity, and usability of LFAs. Innovations such as multiplex lateral flow assays, smartphone-compatible test readers, and improved signal amplification techniques have broadened diagnostic applications. According to a PubMed Central study published in July 2025, significant advances in LFAs include the integration of multifunctional nanoparticles, smartphone-based readers, and enhanced signal-amplification strategies. Future advancements, such as next-generation chips, DNA amplification, and CRISPR-based technologies, hold the potential to further improve lateral flow assays' performance. The exploration of quantum and nanomaterials is also underway to boost sensitivity. Several market players, such as Abbott Laboratories, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, and Merck KGaA, among others, are actively engaged in inorganic developments.

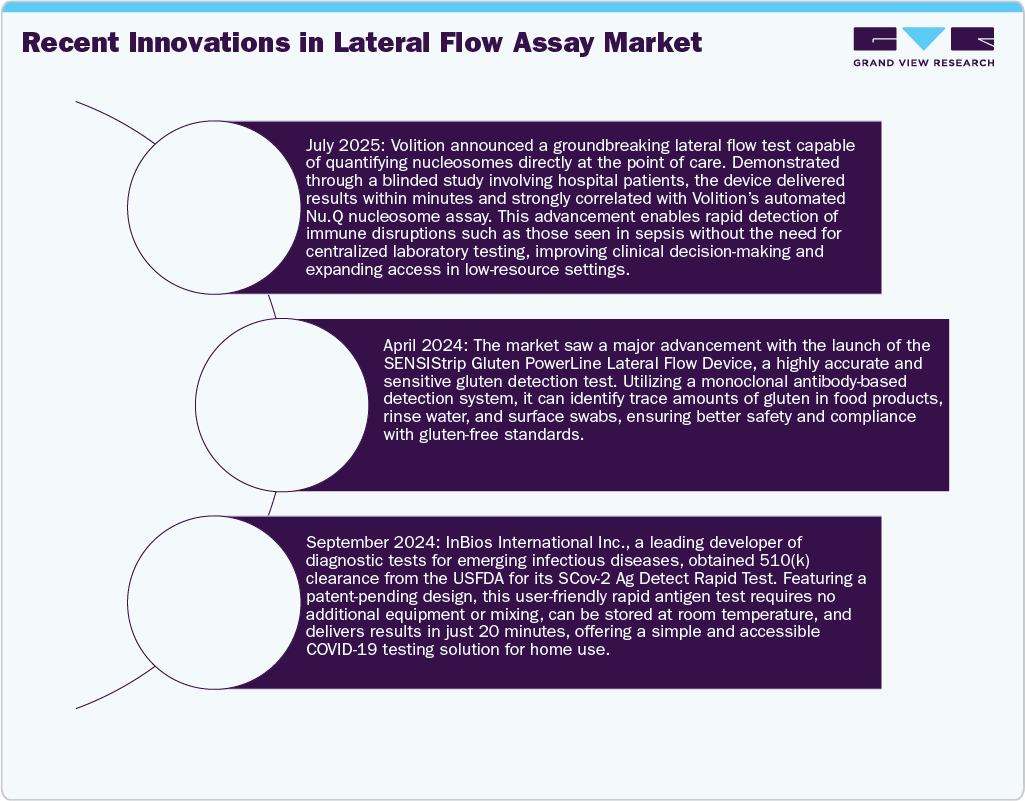

The LFAs market has witnessed active mergers and acquisitions, with major players investing in innovative diagnostic solutions. In January 2025, bioMérieux acquired SpinChip Diagnostics ASA, a Norwegian firm specializing in immunoassay platforms, to strengthen its point-of-care diagnostics capabilities. Similarly, various industry leaders have persisted in enhancing their portfolios via regulatory approvals and technology-led expansions, thereby solidifying their competitive standing in the swiftly changing lateral flow assays sector. These strategic initiatives improve companies' technological proficiency and broaden their market reach.

Regulatory approvals play a critical role in shaping the LFA market, ensuring test accuracy and reliability. For instance, in January 2024, regulatory focus increased as Abingdon Health emphasized significant issues for manufacturers navigating the FDA Q-Submission procedure, a critical channel that permits developers of lateral flow tests to seek early FDA comments prior to official submission. This technique has grown in importance as organizations strive to meet demanding U.S. regulatory criteria for diagnostic performance and consumer safety. The Q-Submission approach streamlines approval times, reduces uncertainty, and increases the possibility of regulatory success. Regulatory organizations, such as the US FDA and EMA, continue to have an impact on market growth by imposing high criteria for diagnostic accuracy, quality, and post-market surveillance, resulting in a more robust and reliable lateral flow testing landscape.

Leading companies are continuously expanding their LFAs product portfolios to meet rising diagnostic demands. Several manufacturers are introducing improved fast tests that offer increased sensitivity, the capacity to test multiple analytes at once, and better convenience in a variety of clinical situations. Dual-analyte detection, built-in digital readers, and self-testing formats are more widespread. These advancements enhance the functionality and flexibility of LFAs in many healthcare contexts, such as clinical diagnostics, home care, and point-of-care settings.

The lateral flow assay industry is experiencing significant regional expansion, driven by factors such as technological advancements, increased prevalence of infectious diseases, and rising demand for point-of-care testing. In North America, robust healthcare infrastructure and a strong focus on research and development have solidified its market presence. Europe's supportive regulatory environment and strategic collaborations among industry players have fostered growth in the region. Meanwhile, the Asia Pacific region is witnessing rapid market expansion due to rising healthcare expenditures and the increasing adoption of rapid diagnostic tests in emerging economies.

Product Insights

The kits and reagents segment captured the largest market share of 66.56% in 2025 and is projected to register the fastest CAGR over the forecast period. Its growth is primarily driven by the increasing adoption of lateral flow assays, which underscores the segment’s expanding role. Strategic mergers and acquisitions are expected to further enhance the market share of kits and reagents, while rising R&D activities are set to accelerate growth. In March 2024, the launch of the SENSIStrip Gluten PowerLine Lateral Flow Device marked a major breakthrough in allergen detection. This monoclonal antibody-based test offers a highly sensitive system for detecting gluten residues in food matrices, rinse water, and swabs. The introduction of a hook line prevents false negatives in highly contaminated samples, ensuring more reliable results.

In addition, lateral flow readers are also poised for robust growth due to the critical need for precise and accurate result interpretation in R&D and sample testing applications. These devices fall into two categories: digital/mobile lateral flow readers and bench-top lateral flow readers. Digital/mobile readers, in particular, are anticipated to witness exponential growth in the coming years as digital connectivity increasingly enhances their capabilities.

Application Insights

The clinical testing segment is witnessing significant growth, driven by the rising incidence of infectious diseases, increased government initiatives, and advancements in rapid diagnostic technologies. LFA are widely used for early and accurate detection of infectious diseases, including HIV, tuberculosis (TB), malaria, influenza, and sexually transmitted infections (STIs). According to the CDC, the total number of chlamydia, gonorrhea, and syphilis cases declined by 9% in 2024 compared to the previous year, marking the third consecutive year of overall declines. However, more than 2.2 million STIs were identified, representing a 13% increase from ten years prior. Notable trends include an 8% reduction in chlamydia occurrences, a 10% fall in gonorrhea cases, and a 22% decrease in primary and secondary syphilis cases. In contrast, congenital syphilis cases have continued to rise rapidly, approaching 4,000, indicating a 12-year rising streak and a nearly 700% increase over the last decade. These increasing disease burdens have fueled the demand for rapid and accessible diagnostic solutions, further driving LFAs market growth.

Meanwhile, the drug development and quality testing segment is projected to grow at a CAGR of 7.99% over the forecast period. LFAs are increasingly used for therapeutic drug monitoring due to their ease of use, cost efficiency, and capability to detect multiple markers in one sample. These assays, which provide both full and semi-quantitative results, are widely applied in regulated and less regulated industries. Key applications include the quantitative measurement of adalimumab in human serum for precision dosing and the authentication of piperaquine and dihydroartemisinin-essential components of artemisinin-based combination therapy. Moreover, the growing geriatric and adult populations, coupled with ongoing drug development, are further fueling segment expansion.

Technique Insights

Sandwich assays accounted for the largest revenue share of 38.64% in 2025 due to their high accuracy, cost-effectiveness, and ease of use. Their suitability for low-resource healthcare settings, where specialized personnel might not be available, further enhances their appeal. In addition, strong product availability is expected to drive segment growth over the forecast period. For example, Abcam’s Universal Lateral Flow Assay Kit enables the creation of custom sandwich assays by integrating GOLD conjugation with Ulfa-Tag kit technologies, offering flexibility to work with any pair of detection and capture antibodies.

Furthermore, the multiplex detection assays segment is anticipated to grow at the fastest rate during the forecast period. This approach allows for the simultaneous detection of multiple targets within a single test, eliminating the need for multiple individual assays. A key advantage of multiplex techniques is their ability to analyze several targets using only small sample volumes, which is particularly beneficial for diagnosing conditions that require the detection of numerous markers and for verifying the presence of contaminants in high-volume feed and food testing.

End-use Insights

The hospitals and clinics segment captured a significant market share of 34.87% in 2025, as these primary care settings remain essential for diagnosing, treating, and managing a wide range of medical conditions. Hospital lateral flow assays dominated the market owing to high TB patient footfall and integration of advanced diagnostic technologies. For instance, collaborations between public health departments and private hospitals have been pivotal. In Haryana, India, the health department partnered with private institutions like Medanta, Max, Artemis, Paras, and Fortis hospitals to intensify TB screening and provide nutritional support to patients, according to an article published by ETHealthWorld, in December 2024.

The home lateral flow assays industry is experiencing significant growth, driven by the increasing demand for convenient, rapid, and accessible diagnostic solutions. The rising preference for at-home testing, particularly for infectious diseases, has fueled the adoption of home lateral flow assays. Factors such as growing awareness of self-testing, technological advancements, and regulatory approvals have further accelerated market expansion.

In addition, the diagnostic laboratories segment is expected to grow at the fastest CAGR over the forecast period. The laboratory lateral flow assays industry is expanding owing to efforts to improve patient outcomes by providing diagnostic facilities at the retail level. Diagnostic laboratories are introducing advanced blood tests for screening and detection. For instance, independent laboratories like Dynacare and Life Labs offer tests such as QuantiFERON-TB and T-SPOT.TB at competitive prices to detect latent TB infection. Furthermore, these independent laboratories are facilitating online appointment booking for LTBI diagnosis, catering to customer convenience. The growing adoption of blood-based tests and customer preferences are projected to drive growth in this segment in the forecast period. Key market players like PerkinElmer are strategically focusing on automation to improve TB workflow efficiency. By offering plate- or strip-based sample preparation, these instruments meet variable throughput requirements, optimizing workflow and reducing hands-on time and costs. Automation also improves blood sample logistics, as samples can be stored at room temperature for up to 54 hours, simplifying sample processing and enabling sample batching.

Regional Insights

The North America lateral flow assays market captured the largest global revenue share of 35.43% in 2025, driven by the widespread availability and affordability of state-of-the-art LFAs. The region’s high incidence of respiratory infections such as COVID-19, influenza, and RSV-further boosts the demand for effective detection and treatment. In the U.S., the CDC’s 2024 report estimates 40 million influenza cases, leading to 470,000 hospitalizations and 28,000 deaths, while COVID-19 has recorded over 124.50 million cumulative cases by June 2025 in North America, sustaining demand for rapid testing. Furthermore, a robust healthcare infrastructure combined with substantial government research funding is expected to drive continued market growth.

U.S. Lateral Flow Assays Market Trends

The U.S. lateral flow assays industry is thriving, driven by ongoing product innovation, strategic investments, and robust government backing. Technological improvements have boosted test sensitivity and expanded applications, accelerating market growth. For example, in April 2024, Gold Standard Diagnostics launched the SENSIStrip Gluten Lateral Flow Device-its first allergen PowerLine test. This innovative, monoclonal antibody-based test accurately detects gluten residues in food matrices, rinse water, and swabs, enhancing food safety monitoring. In the U.S., LFAs play a critical role in home-based disease screening. The FDA authorized the BinaxNOW COVID-19 Antigen Self-Test enables at-home detection of SARS-CoV-2, delivering results in 15 minutes, hence, driving the home lateral flow assays industry.

Europe Lateral Flow Assays Market Trends

The lateral flow assay industry in Europe is witnessing robust expansion, driven by government initiatives and increased investments in rapid diagnostic testing. In addition to testing programs, increased investment and funding have further accelerated the market’s expansion. The European laboratory lateral flow assays industry is well-positioned for sustained growth, bolstered by ongoing advancements, robust government support, and substantial financial backing. This trajectory reinforces the critical role of rapid diagnostics in public health and enhances accessibility to vital testing services, ultimately contributing to improved health outcomes across the region

The UK lateral flow assay industry has experienced significant growth, fueled by government-driven COVID-19 testing initiatives and the introduction of user-friendly diagnostic products. The widespread adoption of rapid testing solutions has strengthened the market and broadened its applications beyond infectious disease detection. In addition to COVID-19 testing, the UK market is expanding due to ease of use and continuous product innovations. In May 2024, Abingdon Health plc announced the launch of Boots' own-brand saliva pregnancy self-test in collaboration with Salignostics and Crest Medical. This innovative product offers a non-invasive, saliva-based alternative to traditional urine tests, making pregnancy testing more accessible.

Germany lateral flow assays industry is also experiencing notable growth, driven by strategic collaborations and innovative research in diagnostic technologies, particularly in cancer detection and infectious disease diagnostics. The focus on developing advanced, rapid, and non-invasive testing solutions is expected to further propel market expansion in the coming years.

Moreover, Germany's statutory health insurance system covers diagnostic tests deemed medically necessary by the Federal Joint Committee (Gemeinsamer Bundesausschuss, G-BA). LFAs used for diagnosing infectious diseases such as COVID-19, influenza, HIV, and tuberculosis may be reimbursed if prescribed by a physician. For example, during the COVID-19 pandemic, the German government funded widespread testing, including rapid antigen lateral flow tests, through statutory health insurance and public health programs. However, with the pandemic subsiding, reimbursement policies have been revised, and free testing is now limited to specific high-risk groups.

Asia Pacific Lateral Flow Assays Market Trends

The lateral flow assays industry in Asia Pacific plays a significant role in the global market, driven by a large and diverse population, increasing healthcare needs, and growing adoption of point-of-care diagnostics. Rapid urbanization and rising disposable incomes in countries like China, India, and Japan fuel demand for accessible diagnostic tools. The high prevalence of infectious diseases, such as tuberculosis and dengue, alongside chronic conditions like diabetes, necessitates efficient testing solutions. Healthcare infrastructure varies widely, with advanced systems in Japan and Singapore contrasting with developing frameworks in India and Indonesia. This disparity influences market penetration, as urban centers adopt LFAs more readily than rural areas, where access to diagnostics remains limited.

The Japan lateral flow assays industry occupies a significant position in the Asia Pacific region, driven by its advanced healthcare system and aging population. With approximately 125 million people, including 29.3% aged 65 or older as per the Ministry of Internal Affairs and Communications (2024), the country faces rising demand for diagnostics to manage chronic and infectious diseases. High prevalence of conditions such as diabetes and influenza supports the adoption of point-of-care testing. Japan’s healthcare infrastructure, with 8,300 hospitals and 1.5 million hospital beds reported by the Ministry of Health, Labour and Welfare (MHLW) in 2022, ensures strong market penetration, particularly in urban areas. Technological advancements and government support for preventive care further drive the integration of hospital lateral flow assays.

The China lateral flow assays industry is rapidly expanding, driven by significant investments in healthcare infrastructure and technological innovation. Rising demand for rapid diagnostic testing in urban and rural areas fuels market growth, while strong government support and regulatory approvals further bolster progress. Leading companies are developing advanced LFAs for infectious disease detection and chronic condition management, enhancing diagnostic accuracy and affordability, solidifying China’s position as a major player globally today. Furthermore, partnerships between local and foreign firms, together with an increase in research funding, are speeding up the invention of new tests, confirming China's reputation as a prominent worldwide contender in the lateral flow assay industry.

Latin America Lateral Flow Assays Market Trends

The lateral flow assay industry in Latin America is experiencing robust expansion due to rising demand for rapid, cost-effective diagnostics in healthcare and environmental testing. Government initiatives, increased investments, and expanding healthcare infrastructure are propelling market growth. Heightened awareness of infectious diseases and local-international collaborations further accelerate LFAs adoption. Advanced technologies and supportive regulatory frameworks are improving diagnostic accuracy and accessibility, ultimately strengthening the market across the region globally.

The Brazil lateral flow assays industry is rapidly expanding, driven by an increased need for point-of-care diagnostics in both metropolitan and underserved rural areas. The usage of LFAs has increased as a result of increased public health measures, especially with regard to infectious diseases including dengue, Zika, and sexually transmitted infections. Government expenditures in diagnostic facilities, expedited approval procedures, and favorable regulatory conditions all contribute to the market's growth. Private healthcare providers and diagnostic laboratories are making major investments in LFAs technology due to their affordability, user-friendliness, and speedy findings. In addition, the need for testing kits appropriate for home usage and community settings has increased due to the public's growing awareness of the need of early disease identification and preventative healthcare. As manufacturers strengthen the sensitivity, specificity, and durability of their kits, Brazil is emerging as a key growth location for LFAs adoption throughout Latin America.

Middle East and Africa Lateral Flow Assays Market Trends

The lateral flow assays industry in Middle East & Africa is experiencing significant expansion due to improving healthcare infrastructure and growing investments in rapid diagnostic technologies. Government support and initiatives to enhance disease surveillance have boosted LFA adoption. Rising infectious and chronic diseases fuels demand for accessible, point-of-care testing. Collaborative efforts between local and international players, along with technological advancements, are expanding market opportunities across the region and ensuring improved outcomes.

The Saudi Arabia lateral flow assays industry has experienced significant growth, due to increased demand for quick diagnoses and the development of both public and private healthcare systems. The use of LFAs in hospitals, clinics, and primary care settings has expanded due to the rising prevalence of both communicable and non-communicable diseases. Government investments in healthcare infrastructure, supportive regulatory frameworks, and national screening programs have helped the simpler incorporation of point-of-care testing. Private diagnostic labs and hospitals are increasingly buying LFA kits because to their low cost, ease of use, and short turnaround time. Moreover, programs encouraging early disease identification and preventative care, as well as growing public health awareness, are driving market growth.

Key Lateral Flow Assays Company Insights

Leading players in the market, such as Abbott Laboratories, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc, among others are actively developing innovative products, and kits. These companies are making major investments in research and development to improve assay sensitivity, specificity, and simplicity of use, while also increasing their geographical presence through strategic alliances, collaborations, and distribution contracts. In addition, they are emphasizing on providing cost-effective choices for both clinical and point-of-care situations, notably targeted at growing countries that display strong demand. In the global lateral flow assay industry, their endeavors are driving market expansion, fostering technological advancement, and improving competitive posture.

Key Lateral Flow Assays Companies:

The following are the leading companies in the lateral flow assays market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Bio-Rad Laboratories, Inc

- Siemens Healthineers AG

- BIOMÉRIEUX

- BD

- QuidelOrtho Corporation

- F. Hoffmann-La Roche

- DH Life Sciences, LLC.

- Quest Diagnostics

- Qiagen N.V.

Recent Developments

-

In January 2025, The BIOMÉRIEUX announced an agreement to acquire SpinChip Diagnostics ASA, a Norwegian diagnostics company known for its innovative immunoassay platform. This acquisition aims to bolster bioMérieux's point-of-care diagnostics capabilities

-

In February 2024, The BIOMÉRIEUX entered into a strategic research collaboration with the U.S. Food and Drug Administration (FDA) to develop advanced tools for detecting food-borne pathogens, including Shiga-toxin producing E. coli, Cyclospora cayetanensis, Salmonella spp., and Listeria monocytogenes.

-

In October 2024, ProGnosis Biotech released a multipurpose lateral flow test designed for allergen detection in food production. This test employs a common extraction method, allowing food producers and testing laboratories to utilize a standardized protocol across various allergen types. This innovation aims to simplify operational procedures, minimize human error, and improve efficiency in testing

Lateral Flow Assays Market Report Scope

Report Attribute

Details

Market size in 2026

USD 10.57 billion

Revenue forecast in 2033

USD 17.44 billion

Growth rate

CAGR of 7.41% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in thousands, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technique, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Norway; Denmark; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Bio-Rad Laboratories, Inc.; bioMérieux SA; Quidel Corporation; Hologic, Inc.; QIAGEN; DH Life Sciences, LLC.; Siemens Healthineers

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lateral Flow Assays Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lateral flow assays market report based on product, application, technique, end-use, and region:

-

Product Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Kits & Reagents

-

Lateral Flow Readers

-

Digital/Mobile Readers

-

Benchtop Readers

-

-

-

Application Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Clinical Testing

-

Infectious Diseases Testing

-

COVID-19 Testing

-

Mosquito Borne Disease Testing

-

Malaria Testing

-

Dengue Testing

-

Zika Testing

-

Chikungunya Testing

-

Others

-

-

Influenza Testing

-

Sexually Transmitted Infection Testing

-

HIV Testing

-

HPV Testing

-

Chlamydia Testing

-

Gonorrhea Testing

-

Syphilis Testing

-

Others

-

-

Hepatitis

-

Tuberculosis

-

Others

-

-

Cardiac Marker Testing

-

Troponin I and T Testing

-

CK-MB Testing

-

BNP and NT-proBNP Testing

-

Myoglobin Testing

-

D-Dimer Testing

-

Others

-

-

Pregnancy & Fertility Testing

-

Pregnancy Testing

-

Fertility Testing

-

-

Cholesterol Testing/Lipid Profile Testing

-

Drugs of Abuse Testing

-

Others

-

-

Veterinary Diagnostics

-

Food safety & Environment Testing

-

Drug Development & Quality Testing

-

-

Technique Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Sandwich Assays

-

Competitive Assays

-

Multiplex Detection Assays

-

-

End-use Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Home Care

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lateral flow assay market size was estimated at USD 10.17 billion in 2025 and is expected to reach USD 10.57 billion in 2026.

b. The global lateral flow assay market is expected to reach USD 17.44 billion by 2033, growing at a compound annual growth rate of 7.41% from 2026 to 2033.

b. Clinical testing dominated the lateral flow assay market with a share of 74.20% in 2025. This is attributable to the increase in various chronic and infectious diseases globally.

b. Some key players operating in the lateral flow assays market include Abbott; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Bio-Rad Laboratories, Inc.; bioMérieux SA; Quidel Corporation; Hologic, Inc.; QIAGEN; DH Life Sciences, LLC.; Siemens Healthineers

b. Key factors that are driving the lateral flow assays market growth include the increase in demand for point of care testing and the rising incidence of infectious diseases is anticipated to result in demand for lateral flow assays globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.