- Home

- »

- Medical Devices

- »

-

Arthroscopy Market Size, Share, Growth, Trends Report 2030GVR Report cover

![Arthroscopy Market Size, Share & Trends Report]()

Arthroscopy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Visualization Systems, Fluid Management Systems, Ablation, Arthroscopes), By Application (Hip, Knee, Shoulder, Elbow), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-079-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Arthroscopy Market Summary

The global arthroscopy market size was estimated at USD 6.34 billion in 2024 and is projected to reach USD 7.84 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. The rising geriatric population is one of the key drivers, as this population bracket is more prone to injuries requiring arthroscopic procedures.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Asia Pacific arthroscopy market is expected to grow at the fastest CAGR of 5.0% over the forecast period.

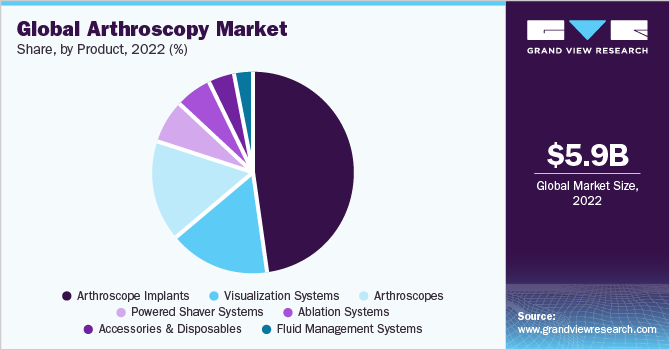

- In terms of product, the arthroscope implants segment dominated the market with a share of 47.6% in 2022.

- The visualization system segment is expected to grow at the fastest CAGR of 5.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6.34 Billion

- 2030 Projected Market Size: USD 7.84 Billion

- CAGR (2025-2030): 3.6%

- North America: Largest market in 2022

As per the latest report published by the World Health Organization (WHO) in October 2022, the population above 60 was 1 billion in 2020 and is expected to reach 1.4 billion by 2030.

According to a Global Burden of Disease (GBD) study, osteoarthritis affects 7% of the population globally; nearly 500 million are affected annually. In addition, China reported 132.8 million cases, followed by India and the U.S., with 62.36 million cases and 51.87 million cases, respectively.

Sportspersons and athletes frequently suffer from sports-related injuries such as torn ligaments, meniscus tears, and cartilage tears; arthroscopy effectively treats them accurately and allows athletes to return to their sports quickly. Meniscus tear is the most common sports injury. One of the most common arthroscopic procedures performed is an arthroscopy for meniscus problems. A soft, C-shaped piece of cartilage called the meniscus acts as a cushion between the shinbone and the thighbone. Many basic actions, such as walking and stair climbing, depend on the proper function of the meniscus.

Osteoarthritis, a degenerative condition affecting one or more joints, affects approximately 30 million Americans. Around a million people have rheumatoid arthritis (RA), and around 750,000 of the over two million arthroscopic procedures in the U.S. each year include knee surgery.

Visualization systems are used to identify the injury at the joint site. The images can be displayed in 3D format with technological innovations at the forefront. Furthermore, the rise in the use of fluid management systems to optimize the visualization process will spur demand.

Application Insights

Based on applications, the market is segmented into knee, shoulder, foot & and ankle, hip, hand & wrist, sports injuries, and elbow. The knee segment accounted for the largest market share of 41.7% in 2022. This large share is attributed to the growing geriatric population and increasing incidence rate of injuries.

The elbow segment is expected to witness the fastest CAGR of 5.9% during the forecast period, owing to the increasing number of Rheumatoid arthritis cases in developed economies such as the U.S. and other developing economies such as India and China. According to a study published in the American Health and Drug Benefits in March 2019, approximately 1.5 million people in the U.S. have Rheumatoid arthritis.

Product Insights

Based on products, the market is segmented into visualization systems, ablation systems, powered shaver systems, arthroscopes, fluid management systems, arthroscopy implants, accessories, and disposables. The arthroscope implants segment dominated the market in revenue with a share of 47.6% in 2022. Arthroscope implants are used in arthroscopy surgeries to reconstruct ruptured joints. These implants are very well-designed and do not require any additional bending. Interference screws and GPC ligabutton with and without loops are examples of this segment. In October 2020, Acuitive Technologies announced the 510(k) FDA approval for the CitreLock interference screw system.

The visualization system segment is expected to grow at the fastest CAGR of 5.2% over the forecast period. This is attributed to the increase in the number of surgeries, as visualization systems are used to inspect the degree of the injury. Hence irrespective of the type of surgery, visualization systems are required, which drives the market for visualization systems. Stryker announced in March 2019 the availability of Hipcheck, Hipmap, 1688 advanced imaging modalities, and a 4K visualization platform as visualization tools to enhance the surgical experience of arthroscopy. More than 2 million knee arthroscopy surgeries are carried out worldwide.

Regional Insights

North America dominated the market with a share of 45.9% in 2022. The U.S. dominated the region in 2022 owing to the advanced healthcare infrastructure, increasing healthcare expenditure, and the presence of key players in the region. In 2018 the old age population was 52 million in North America, driving the market. The national sports in the U.S. is American football and ice hockey in Canada; these sports are prone to injuries. According to the University of Rochester, knee injuries are most common in American football.

Asia Pacific is expected to grow at the fastest CAGR of 5.0% over the forecast period due to an increase in the population of older generations in Japan, China, and India. In 2020, the geriatric population was 414 million, and it is predicted that 40% of Japan and Hong Kong will be over 65 years by 2030 making them prone to arthritis and fueling the growth of the market.

Key Companies & Market Share Insights

The key players in the market are undertaking strategies such as new product launches, mergers, collaboration, partnerships, and acquisitions to improve their market position. In April 2023, Stryker partnered with project C.U.R.E. to provide medical equipment to 135 countries around the globe. In March 2023, Zimmer Biomet announced plans to unveil ZBEdge, an integrated software of digital and robotic technologies to improve efficiency and patient outcomes.

In addition, in March 2023, Smith + Nephew unveiled “precise in motion” in the arthroscopy sector, which uses AI technology to personalize surgery, advance efficiency, and optimize performance. Similarly, in January 2023, Arthrex, Inc received clearance from the FDA for their product Tightrope, the only device cleared for pediatric ACL surgery. Such developments are likely to foster the development of the arthroscopy market. The following are some of the major participants in the global arthroscopy market:

-

Conmed Corporation

-

Zimmer Biomet

-

Henke Sass Wolf GmbH

-

Johnson & Johnson

-

Karl storz GmbH & Co. KG

-

Arthrex, Inc.

-

Richard Wolf GmbH

-

Smith + Nephew

-

Medtronic

-

Stryker

Arthroscopy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.6 billion

Revenue forecast in 2030

USD 7.84 billion

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait;

Key companies profiled

Conmed Corporation, Zimmer Biomet, Henke Sass Wolf GmbH, Johnson & Johnson, Karl storz GmbH & Co. KG, Arthrex, Inc., Richard Wolf GmbH, Smith + Nephew, Medtronic, Stryker

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arthroscopy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2030. For this study, Grand View Research has segmented the global arthroscopy market based on product, application and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Powered Shaver Systems

-

Visualization Systems

-

Fluid Management Systems

-

Ablation Systems

-

Arthroscopes

-

Arthroscope Implants

-

Accessories And Disposables

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Hip

-

Knee

-

Shoulder

-

Foot & ankle

-

Hand & wrist

-

Elbow

-

Sports injuries

-

-

Region Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global arthroscopy market size was estimated at USD 5.9 billion in 2022 and is expected to reach USD 6.1 billion in 2023.

b. The global arthroscopy market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 7.9 billion by 2030.

b. North America dominated the arthroscopy market with a share of 45.9% in 2022. This is attributable to the high adoption rate for arthroscopic procedures, the increasing prevalence of joint-related disorders, such as osteoarthritis, rheumatoid arthritis, and sports injuries, and the increasing geriatric population.

b. Some key players operating in the arthroscopy market include Zimmer Biomet; Arthrex Inc.; ConMed Corporation; DePuy Synthes; Smith & Nephew plc; Stryker; and BioTek Instruments India Pvt Ltd.

b. Key factors that are driving the market growth include the increasing prevalence of musculoskeletal disorders coupled with growing demand for minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.