Market Size & Trends

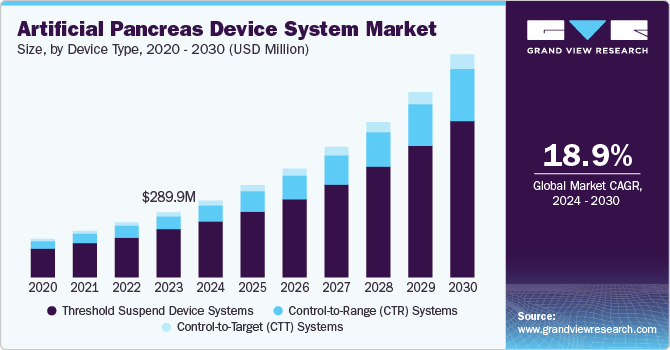

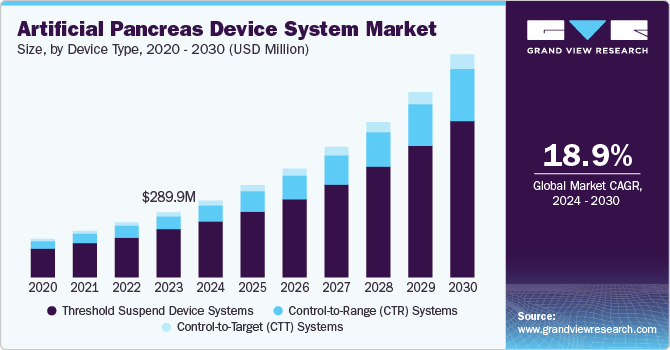

The global artificial pancreas device systems market size was valued at USD 289.9 million in 2023 and is projected to grow at a CAGR of 18.9% from 2024 to 2030. The increasing cases of Type 1 diabetes, robust research and development efforts by pharmaceutical companies, and rising demand for automated systems for glycemic control are the factors driving the market growth. Artificial pancreas device systems (APDS) control the blood glucose level in diabetes patients. These devices are less invasive and largely adopted by the patients. The increasing geriatric population, growing prevalence of diabetes, and rising incidence of obesity define growth.

The advancements in continuous glucose monitoring systems and insulin pumps have enhanced the accuracy and dependability of artificial pancreas device systems. The increasing awareness about these devices' effectiveness in managing diabetes conditions and avoiding health complications has fueled their demand. The different government programs and reimbursement policies worldwide are expanding the accessibility and affordability of these devices for a large population. The increasing geriatric population, which is more susceptible to diabetes is fueling the need for medical devices.

The rise in digitalization across healthcare is poised to propel market growth. For instance, patients with Type 2 diabetes benefit from wearable devices. These devices track the user's vital movements and easily communicate the essential measures to follow. Besides, the huge demand for wearables creates numerous market opportunities. Therefore, digitalization offers new avenues for development and growth.

Additionally, changes in treatments, such as the transition to more personalized therapies and the integration of artificial intelligence in the healthcare sector, contribute to developing new solutions. However, the cost of these devices is comparatively high, and cybersecurity and ethical issues may limit future developments.

Device Type Insights

Threshold suspend device systems dominated the market and accounted for a share of 73.8% in 2023 mainly due to these systems offering safety features by automatically suspending insulin delivery when glucose levels fall below a threshold, reducing the risk of hypoglycemia. The threshold suspend device systems are the first automated insulin delivery systems to receive regulatory approval in many countries. Additionally, the device is designed to help during sleep or when the body cannot respond quickly to low blood sugar levels. In addition, the population embraces their simplicity, enabling more traction for the segment.

The Control-to-Target (CTT) systems segment is expected to register the fastest CAGR of 21.3 % over the forecast period attributed to a more advanced and accurate approach to glucose management. These devices help prevent hypoglycemia and maintain blood glucose levels within a range. Furthermore, technological advancements in sensors, algorithms, and insulin delivery are making this system more accurate and user-friendly, and the integration of artificial intelligence in healthcare is further driving innovation.

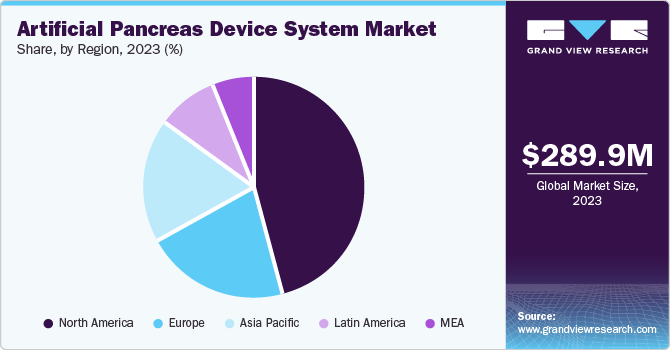

Regional Insights

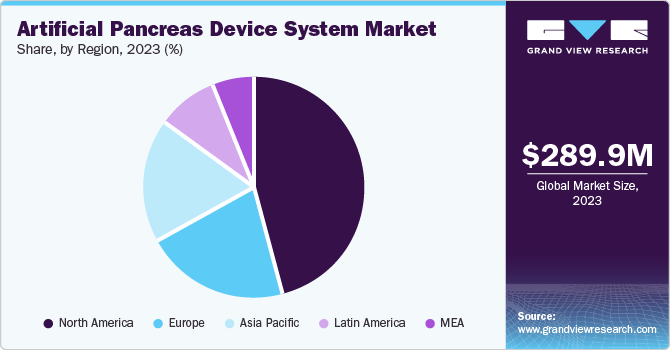

North America artificial pancreas device systems market dominated with a share of 45.8% in 2023. The high prevalence of diabetes in the region, advanced healthcare infrastructure, patient awareness, and increasing investments in research and development under public-private partnerships boost regional developments. The major market players and their distribution networks contribute to the availability of artificial pancreas device systems across the region.

U.S. Artificial Pancreas Device Systems Market Trends

The U.S. artificial pancreas device systems market dominated North America in terms of revenue share in 2023 due to the increasing demand in the geriatric population for advanced diabetes management solutions. The rising prevalence of diabetes and technological advancements in glucose monitoring systems and insulin pumps add to the exponential growth.

Europe Artificial Pancreas Device Systems Market Trends

Europe artificial pancreas device systems market was identified as a lucrative region in 2023. The market is growing due to the rise in geriatric population with a high prevalence of diabetes. A well-established healthcare system and government policies that support diabetes management encourage the demand for automated systems and devices.

The UK artificial pancreas device systems market is expected to grow in the coming years due to patient awareness and demand for more effective diabetes management solutions. The focus on research, medical technology, and a higher adoption rate of advanced diabetes management solutions further enlarge the market share.

Asia Pacific Artificial Pancreas Device Systems Market Trends

Asia Pacific artificial pancreas device systems market is anticipated to witness significant growth in the forecast period. The rising healthcare expenditure, strong healthcare infrastructure, and growing awareness among the population for advanced diabetes management solutions. In addition, the region’s large population and increasing disposable income are expected to fuel the market demand.

Japan artificial pancreas device systems market is expected to grow rapidly in the coming years due to the country's increasing aging population. The rising incidence of diabetes among the elderly population drives the need for clinical devices. The advanced healthcare infrastructure and a strong emphasis on technological advancement are increasing the demand for market expansion.

India artificial pancreas device systems market held a substantial market share in 2023 owing to the high prevalence of diabetes in the population. Moreover, the rising use of digital health monitoring devices is pivotal for market developments. The growing awareness among patients about advanced diabetes management solutions is driving the market growth.

Key Artificial Pancreas Device Systems Company Insights

Some key companies in the artificial pancreas device systems market include Medtronic Plc, Bigfoot Biomedical, Tandem Diabetes Care, Inc., TypeZero Technologies, LLC, and others.

-

Medtronic Plc is a global medical technology company that provides services and solutions. The company is known for the MiniMed series of insulin pumps integrated with continuous glucose monitoring (CGM) systems. This advanced hybrid closed loop series automatically adjusts insulin delivery based on CGM reading.

-

Pancreum, Inc. is a medical device company that focuses on developing advanced diabetes management. The company emphasizes creating modular artificial pancreas systems to provide a more flexible and customizable approach to insulin delivery.

Key Artificial Pancreas Device Systems Companies:

The following are the leading companies in the artificial pancreas device systems market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- Bigfoot Biomedical

- Tandem Diabetes Care, Inc.

- Pancreum, Inc.

- TypeZero Technologies, LLC

- Beta Bionics

Recent Developments

-

In July 2024, Tandem Diabetes Care Inc. introduced the updated insulin pump software, t:slim X2, compatible with Dexcom G7 and Dexcom G6 Continuous Glucose Monitoring (CGM) Systems with Health Canada as the authorized distributor.

Artificial Pancreas Device Systems Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 343.5 million

|

|

Revenue forecast in 2030

|

USD 981.0 million

|

|

Growth Rate

|

CAGR of 18.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Device type, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Colombia; Mexico; Argentina; UAE; Saudi Arabia: South Africa

|

|

Key companies profiled

|

Medtronic Plc; Bigfoot Biomedical; Tandem Diabetes Care, Inc.; Pancreum, Inc.; Type Zero Technologies, LLC; Beta Bionics; Advanced Micro Devices

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Artificial Pancreas Device Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial pancreas device systems market report based on device type and region.

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Threshold Suspend Device Systems

-

Control-to-Range (CTR) Systems

-

Control-to-Target (CTT) Systems

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)