- Home

- »

- Electronic Devices

- »

-

ATM Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![ATM Market Size, Share & Trends Report]()

ATM Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Deployment (Onsite ATM, Offsite ATM, Worksite ATM, Mobile ATM), Managed Services), By Region, And Segment Forecasts

- Report ID: 978-1-68038-651-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

ATM Market Summary

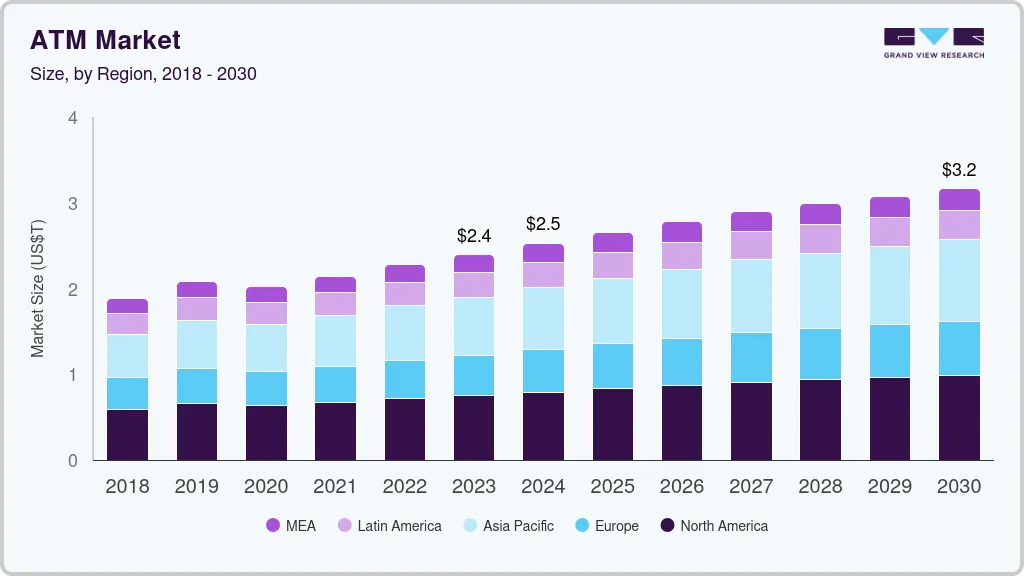

The global ATM market size was estimated at USD 25.29 billion in 2024 and is projected to reach USD 31.64 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Automated teller machines (ATMs) offer a reliable easy interface for cash withdrawal and features such as ease of fund transfer, withdrawal, deposit, and 24x7 availability of cash.

Key Market Trends & Insights

- North America ATM market held the largest share of 31.34% in 2024.

- The U.S. ATM market held a dominant position in 2024.

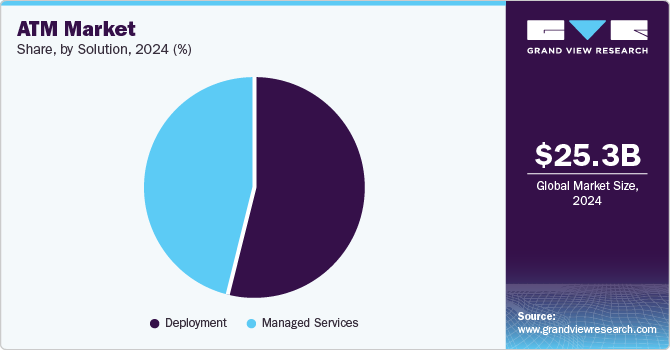

- Based on solution, ATM deployment solutions dominate the overall market with a revenue share of 54.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.29 Billion

- 2030 Projected Market Size: USD 31.64 Billion

- CAGR (2025-2030): 3.6%

- North America: Largest market in 2024

With advancements in technology, customers seek secure, faster, more convenient, and reliable means of accessing cash, favoring the widespread adoption of ATMs globally. Furthermore, improved security measures, including biometric and one-time password authentication systems to prevent fraud, and the advent of Smart ATMs for users with special needs contribute to market growth. The increase in demand for automation in the banking sector in several developed and emerging countries is also expected to fuel the demand for ATMs.

The COVID-19 pandemic had significantly disrupted ATM manufacturing operations and supply chains, impacting the overall ATM market. While the stringent restrictions on movement and varying degrees of lockdowns across several countries affected business activities, many people shifted toward digital platforms for banking transactions. However, the demand for ATMs is expected to rise after the pandemic is over owing to the high demand in rural areas of developing countries such as China and India.

With the rise of cyber threats and ATM fraud, enhanced security features are becoming a top priority for the ATM market. Financial institutions are increasingly implementing advanced security measures, such as biometric authentication, end-to-end encryption, and real-time monitoring systems. These innovations aim to protect sensitive customer data and mitigate fraud risks, instilling greater confidence among users. Thus, the integration of improved security mechanisms such as fingerprint, biometrics, and double authentication adds an additional security layer to technologically advanced ATMs, which is expected to help prevent fraud and drive the adoption of ATMs.

The easy flow of cash, rising number of transactional benefits, easy withdrawal, quick and prompt service, and the viability of offline shopping have powered the usage of ATMs across the world, which positively reflects on the promising growth prospects of the global market. Growing urbanization, in both developed and emerging economies, is the primary factor driving the growth of the market. Furthermore, the 24X7 availability of cash, along with the provision of fund transfer and bill payment features are driving the demand for ATMs globally. An increase in installation base and maintenance activities has impacted revenue generation significantly.

Technological advancements such as digital convergence, integration of IoT data analysis, and biometrics & cybersecurity are expected to fuel the market growth. Technological advancement has also allowed for the introduction of contactless ATM kiosks, which have been marketed as a safer and risk-free way of withdrawing cash amid the COVID-19 pandemic. Contactless ATM kiosks allow users to withdraw cash from the ATM by scanning a QR code on the screen without touching the interface. The number of ATMs that offer contactless cash withdrawals has been on the rise globally.

Solution Insights

Based on solution, the automated teller machine (ATM) market is segmented into deployment and managed service. ATM deployment solutions dominate the overall market with a revenue share of 54.11% in 2024. The segment is expected to grow at the fastest CAGR over the forecast period. The deployment of an ATM consists of installing, setting up, testing, running, and implementing an ATM. The segment is further bifurcated into onsite, offsite, worksite, and mobile ATMs.

Onsite ATMs are located in or beside the bank, where both the physical branch and the ATM can be used. These ATMs reduce the work pressure of bank employees, avoiding long queues in bank premises for withdrawals, cash deposits, and transfers. These ATMs also reduce the probability of errors with withdrawals and deposits and allow banks to have smooth financial transactions. These factors are estimated to increase the demand for onsite ATMs in the near future.

The mobile ATM segment is anticipated to witness a notable CAGR from 2025 to 2030. A mobile ATM is a movable ATM system that is strategically placed to reduce traffic in high-volume locations such as trade fairs, social gatherings, and sports events. Mobile ATMs provide flexibility and enhance branding & promotion for banking institutions.

Managed services allow financial institutions to move their non-core activities to a specialized and trained service provider and concentrate on their core financial businesses. Various industry participants such as NCR Corporation and Diebold Nixdorf provide managed services at low costs. Managed services contribute significantly toward strengthening the infrastructure of financial institutions for multichannel delivery and better customer retention, acquisition, and cross-selling opportunities. Outsourcing managed services to a service provider offers benefits such as reduced operational and infrastructure investment costs, improved operational profits, compliance with new regulatory policies, and simplified network operations and services.

Regional Insights

North America ATM market held the largest share of 31.34% in 2024. The growth is attributed to a number of factors, including the high demand for cash, the growth of e-commerce, the increased use of mobile banking, and the upgrade of existing ATMs. The region is expected to continue to grow in the coming years, as these factors continue to drive demand for ATMs.

U.S. ATM Market Trends

The U.S. ATM market held a dominant position in 2024. The growth of the market can be attributed to the rising demand for enhanced customer experiences and the integration of advanced technologies, such as contactless payments and biometric authentication. Financial institutions are upgrading their ATM networks to offer a wider range of services, including cash recycling, cardless transactions, and remote video assistance. The shift toward digital banking and the need to provide seamless access to cash in both urban and rural areas are also influencing the deployment of modern ATMs.

Europe ATM Market Trends

The Europe ATM market was identified as a lucrative region in 2024. The growth of the market is driven by the increasing emphasis on digital transformation and the need for integrated financial solutions. The region’s diverse regulatory landscape necessitates sophisticated software that can adapt to different compliance requirements across countries. Furthermore, the aging population in many European countries is driving demand for wealth preservation and retirement planning tools, thereby driving the market’s growth.

The UK ATM market held a substantial market share in 2024. The increasing demand for cash recycling machines and multifunctional ATMs that offer a variety of banking services, such as deposits, transfers, and bill payments, is one of the key factors driving the UK ATM market. Furthermore, several companies in the UK are focusing on launching multi-bank deposit ATMs to provide better access to cash to their consumers. For instance, in June 2024, NCR Atleos, an ATM solution provider, launched its first line of multi-bank deposit ATMs in the UK, addressing the critical need for cash access among UK consumers.

The Germany ATM market is expected to grow at a considerable growth rate during the forecast period. German consumers have a strong preference for cash, which keeps the demand for traditional ATM services high. The continued high demand for cash transactions and the need to provide reliable banking services across both urban and rural areas is a major factor contributing to the growth of the market.

Asia Pacific ATM Market Trends

The Asia Pacific ATM market is anticipated to grow at a significant CAGR during the forecast period. The growth of the regional market is attributed to the rising deployment of ATMs, predominantly in developing countries such as China and India. Lack of awareness about digital payment solutions in most economies in the region also strengthens the role of ATMs for cash-based and other financial transactions in this region. Of the over three million ATMs installed globally, the maximum is installed in Asia Pacific. Furthermore, the need to serve the large unbanked population across countries such as China, India, and Japan, as well as emerging markets across Vietnam and Indonesia is expected to fuel the demand for ATMs in the region.

The Japan ATM Market is expected to register a moderate growth rate during the forecast period. Digitalization in Japan is playing a crucial role in the evolution of ATMs, leading to the greater demand for ATMs with features such as biometric authentication, remote cash dispensing, and integration with online banking services. Furthermore, the aging population in Japan is influencing ATM design and functionality, with a focus on accessibility and ease of use for older individuals, thereby driving the market’s growth.

The ATM market in China held a substantial market share in 2024. The demand for advanced self-service solutions and a focus on financial inclusion, particularly in rural and underserved areas, are key factors driving market growth. In addition, the rise of digital payments is positively impacting the sector, as financial institutions increasingly integrate multifunctional capabilities into ATMs.

Key ATM Company Insights

Some of the key companies in the ATM market include Diebold Nixdorf, Incorporated, NCR Atleos, and FUJITSU and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Diebold Nixdorf, Incorporated emerged as the most prominent player in the ATM market. The company designs, develops, and delivers innovative self-service technologies, particularly in the banking and retail sectors. It specializes in ATMs, Point-of-Sale (POS) systems, and software solutions that enhance transaction efficiency and security.

-

NCR Atleos specializes in financial technology and ATM solutions. NCR Atleos offers a comprehensive suite of solutions encompassing traditional ATMs and advanced self-service technologies, catering to the evolving needs of financial institutions and retail businesses.

Key ATM Companies:

The following are the leading companies in the ATM market. These companies collectively hold the largest market share and dictate industry trends.

- Diebold Nixdorf, Incorporated

- FUJITSU

- G4S Limited

- GRGBanking

- Hitachi Channel Solutions, Corp.

- NCR Atleos

- Oki Electric Industry Co., Ltd.

- Guangzhou Yuyin Technology Co., Ltd.

Recent Developments

-

In May 2024, Diebold Nixdorf, Incorporated partnered with Bankart to modernize its payment processing platform across Southeast Europe, marking a significant upgrade in the region's financial technology landscape. This collaboration involves transitioning Bankart's outdated payment processing system to Diebold Nixdorf's Vynamic Transaction Middleware, a cloud-native solution designed to enhance payment capabilities for ATMs, POS terminals, and e-commerce systems in 20 banks in six countries. The upgrade aims to replace the legacy Base24 platform, providing Bankart the flexibility and scalability needed to introduce new products and services efficiently.

-

In June 2023, NCR Corporation, a provider of corporate technology, partnered with Members ATM Alliance (MAA) to deliver ATM as a service (ATMaaS) to credit unions. MAA is a Credit Union Service Organization (CUSO) that provides support to credit unions in the management and processing of ATMs. By adopting NCR ATM as a Service, MAA will have the capability to simplify its managed services portfolio, encompassing operations, deployment, transaction processing, cash management, and software management.

-

In February 2023, NCR Corporation, a provider of corporate technology renewed and expanded its long-term partnership with Walgreens, a leading global drugstore operator. NCR continues to supply ATM services in nearly all Walgreens shops in the U.S., Puerto Rico, and the District of Columbia under the new deal.

ATM Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.49 billion

Revenue forecast in 2030

USD 31.64 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Diebold Nixdorf, Incorporated; FUJITSU; G4S Limited; GRGBanking; Hitachi Channel Solutions, Corp.; NCR Atleos; Oki Electric Industry Co., Ltd.; Guangzhou Yuyin Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global ATM Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ATM market report based on solution and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Deployment

-

Onsite ATM

-

Offsite ATM

-

Worksite ATM

-

Mobile ATM

-

-

Managed Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ATM market size was estimated at USD 25.29 billion in 2024 and is expected to reach USD 26.49 billion in 2025.

b. The global ATM market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2030 to reach USD 31.64 billion by 2030.

b. North America dominated the ATM market with a share of 31.34% in 2024. The growth is attributed to a number of factors, including the high demand for cash, the growth of e-commerce, the increased use of mobile banking, and the upgrade of existing ATMs.

b. Some key players operating in the ATM market include Diebold Nixdorf, Incorporated.; Fujitsu; G4S Limited.; GRGBanking.; Hitachi Channel Solutions, Corp.; NCR Corporation.; OKI Electric Industry Co., Ltd.; and Guangzhou KingTeller Technology Co., Ltd. among others

b. Key factors that are driving the improved security measures, including biometric and one–time password authentication systems to prevent fraud, and the advent of Smart ATMs for users with special needs, contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.