- Home

- »

- Plastics, Polymers & Resins

- »

-

Global Automotive Refinish Coatings Market Size, Industry Report, 2024GVR Report cover

![Automotive Refinish Coatings Market Size, Share & Trends Report]()

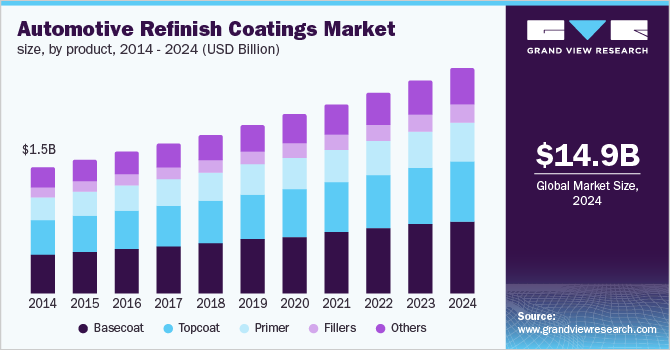

Automotive Refinish Coatings Market Size, Share & Trends Analysis Report By Product (Primer, Filler, Topcoat), By Resin Type, By Technology, By Vehicle Age, By Region, And Segment Forecasts, 2016 - 2024

- Report ID: 978-1-68038-950-0

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2013-2014

- Industry: Bulk Chemicals

Report Overview

The global automotive refinish coatings market size to be valued at USD 14.88 billion by 2024. The market is expected to witness significant growth in the forecast period on account of rising vehicle ownership in economies including China, India, Mexico, South Korea, and Brazil. Growing trend of aftermarket modifications and rising road collisions is anticipated to fuel the product demand. Growing usage of refinish coatings for automotive maintenance, repair, and aftermarket painting on account of visual appearance, surface protection, and resistance to corrosion, extreme weather, temperature, heat, and water is expected to promote industry expansion. Moreover, growing need for customized designs and paints on the vehicles is likely to support the growth.

Increasing awareness regarding the protection of vehicle paints by healing scratches and damages on the vehicle surfaces has surged the market growth in U.S. Moreover, expanding consumer base in Asia Pacific and Middle East countries on account of rising disposable income is expected to support the growth in the forecast period.

Increasing consumption of waterborne, high solids, and UV-cured coatings owing to zero VOC emissions is expected to stimulate automotive refinish coatings market growth over the forecast period. However, volatility in raw material prices, along with rising spending on road infrastructure, will hinder industry expansion.

Technological advancements, coupled with continuous product development to enhance the performance of refinish coatings, will propel market growth over the next few years. Moreover, government efforts on reducing VOC emissions by deploying eco-friendly technology will create new market opportunities over the forecast period.

Increasing investments in R&D and introduction of new technologies have enhanced the product quality that provides superior protection to automobiles. Rising production of light commercial vehicle and passenger cars is anticipated to drive the demand for refinish coatings in the coming years, thus supporting the market growth.

Automotive Refinish Coatings Market Trends

The growing automotive industry and increased ownership of vehicles in developing nations like China, India, Mexico, South Korea, and others are the significant factor leading the market for automotive refinishing coatings. Moreover, there has been a rise in the number of road collisions, which resulted in the repair and maintenance of vehicles, thereby enhancing the market growth. Awareness of vehicle owners to protect their vehicle against any scratches and damage on the surface, is a major aspect fueling the market growth. Significantly, the strong inclination towards adopting water-borne refinish coatings owing to the presence of lower VOC levels, is causing an increased demand for the coatings.

A major driver of the market is the emerging trend of customization of vehicles such as cars that has impacted the need for finished coatings globally. This trend has effectively resulted in customizing the appearance of their vehicles by applying coatings to the surface. Thus, the enhanced appearance and durability of vehicles supported by the coatings are leading to the growth of the automotive refinish coatings market. Furthermore, the scope of environment friendly coatings with the low solvent content is a significant contributor to the growth. This facilitated investments into the R&D activities for the automobile sector which led to the production of low weight vehicles, which is expected to drive the market growth during the forecast period. The increasing demand for commercial vehicles in the mining industry for their various purpose, is a major opportunity for the growth of the market. The rising demand for passenger cars and the need for personalized services aroundthe world are expected to generate solid growth opportunities for the market. The manufacturers in this industry are creating greater returns from the sale of refinish coatings to the vehicle owners thus, increasing market share in the economy.

Despite the increasing importance, the growing costs of raw materials, and the strict governmental regulations, the VOC (Volatile Organic Compounds) level products are expected to cause hindrance to the growth of the market. Furthermore, an increase in the spread of toxicity in the environment due to some of the refinish coatings is expected to impact the market growth adversely.

Technology Insights

Solvent-borne technology accounted for 49.6% share of the global volume in 2015. The segment is expected to witness slow growth owing to stringent regulations on VOC emission levels. However, improvements in technologies and innovations have led to the development of high solid formulations.

High-quality finish and reduced emissions provided by high solid formulations increased its use in the automotive industry, thereby boosting the growth of solvent-borne technology. Increasing applications in luxury cars, coupled with consumer preferences for vehicle maintenance, are projected to increase the consumption of refinish coatings.

UV-cured technology is expected to expand at a CAGR of 5.8% in terms of volume over the forecast period on account of its availability in custom color, fast cure time, and outstanding performance at a competitive cost. Furthermore, increasing usage of this technology in clear coats and primer will spur its demand over the next few years.

Resin Type Insights

Polyurethane was the most widely used resin in 2015 and accounted for 44.2% share of the global volume. The segment is expected to witness significant growth owing to superior properties including excellent performance in various environmental conditions and resistance to extreme temperatures.

Increasing demand for polyurethanes on account of its high resistance to abrasion and impact, along with excellent resistance to grease, oil, and water, will stimulate market growth. Extensive usage of polyurethane in tropical environments owing to properties such as fungus resistance and UV protection is expected to augment segment growth over the upcoming years.

Acrylic refinish coatings hold a significant automotive refinish coatings market share on account of its benefits including smooth finish and longer lifespan. Mid-range automobiles including passenger vehicles and commercial vehicles accounted for the largest share of the total consumption of these coatings. Moreover, refinishing of old cars and mini trucks is likely to fuel the product demand.

Product Insights

Topcoat emerged as the prominent product segment in 2015 and accounted for 35.1% share of the overall volume. It is extensively used in automotive refinishing as a final coat to the automobile surface. Rising consumption of the product due to its high durability, gloss finish, abrasion resistance, chemical stability, and protection from UV radiations is expected to boost the segment growth.

Primer is applied on the vehicle surfaces in order to create a base for the desired paint to be applied. Automotive manufacturers are expected to continue using these products as they help in smooth finishing of the paints and protect the surfaces from the external environment. Rising automotive production in developing economies is likely to propel industry growth.

Filler is majorly used in the restructuring of old vehicles, wherein the gaps and scratches need to be filled for smooth surfaces. These are the thick chemicals applied on the surfaces, which get harden over a period of time to allow paints. Increasing number of old vehicles and rising collisions are anticipated to increase the demand for fillers in refinishing applications.

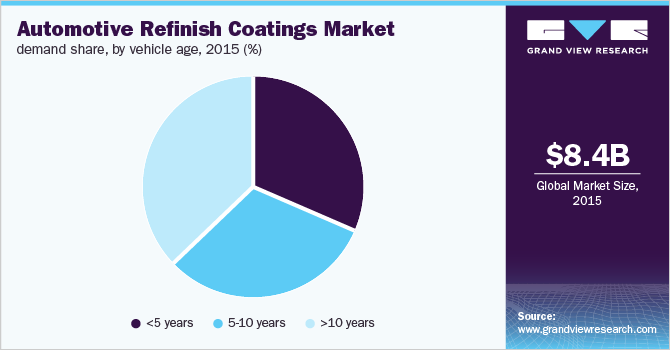

Vehicle Age Insights

Vehicles aged more than 10 years generated a revenue of USD 1.8 billion in 2015 and is anticipated to witness a substantial increase as they require frequent maintenance and repair. Old vehicles need paint work owing to surface corrosion, color fading, scratches, and cracks.

Rising interest of the youth to refurbish old cars by applying coatings and replacing equipment is expected to drive the automotive refinish coatings market over the next few years. The build quality of cars and trucks has compelled consumers to retain their existing vehicles, which, in turn, will stimulate industry growth. Furthermore, introduction of customization in paints and designs of the vehicles is likely to fuel the product demand.

Growing need for repainting work in vintage cars, coupled with an increasing number of refurbishing of old cars and repairing of accidental vehicles, is expected to support the demand for automotive refinish coatings. Moreover, increasing production of passengers cars backed by growing demand from the middle-class population is likely to augment the market growth.

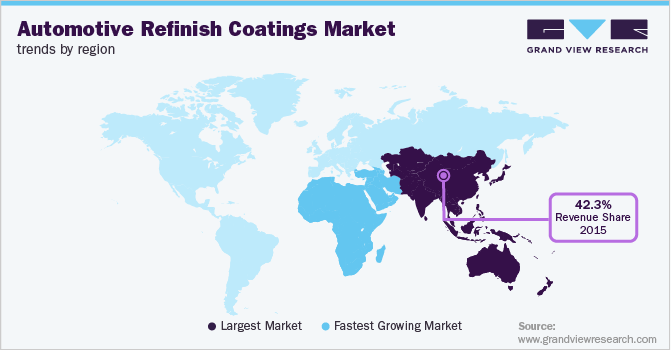

Regional Insights

Asia Pacific accounted for 42.3% share of the global revenue in 2015 and is expected to continue its lead in the forecast period. Robust automotive manufacturing base in China, Japan, and India, coupled with increasing passenger vehicles sales, is expected to augment market growth over the upcoming years.

Underdeveloped road networks, lack of proper safety laws, and growing demand for vehicle maintenance, repair, and modification are expected to have a positive impact on the industry growth. Increasing use of old refurbished vehicles on account of lifestyle trends is anticipated to support the product demand over the projected period.

China is expected to witness high growth on account of increasing number of road accidents, coupled with rising vehicle ownership over the forecast period. Rapid development and modernization are likely to lead to an increase in the number of vehicle sales. Moreover, the presence of major automotive manufacturers including Changan Automobile, Dongfeng Motor Co., Ltd., and FAW Group Co., Ltd. is likely to drive industry.

Middle East and Africa is likely to expand at a CAGR of 5.5% in terms of volume over the forecast period on account of rising demand for maintenance of luxury vehicles and performance vehicles in UAE and Saudi Arabia. Increase in disposable income in the region on account of mature oil and gas industry has ascended the sale for luxury vehicles in the region, thus, supporting the market growth for refinishing applications.

Key Companies & Market Share Insights

The industry is extremely competitive in nature due to the presence of the key players involved in R&D and continuous product innovation. BASF SE, AkzoNobel, PPG Industries, and Axalta Coating Systems are the major players, accounting for over 50% share in 2015.

In March 2015, Axalta Coating Systems established a new waterborne coatings plant in Shanghai to meet the demand for growing automotive industry in China. In April 2015, BASF entered into an agreement with Guangdong Yinfan Chemistry Co., Ltd. to manufacture coatings for the automotive refinish market. The recent developments, which took place in this market are enlisted below:

Recent Developments

-

Recently on June 1, 2022, AkzoNobel has made the decision to expand its African footprint by making an agreement with Kansai Paint and implement its activities related to coatings within the region. Kansai Paints constitutes a revenue of EUR 280 million which will benefit AkzoNobel to create a platform for its market growth in the future. Moreover, this agreement will focus on commitment in terms of innovation as well as sustainability, thus resulting in the expansion of products and provision of suitable solutions for customers

-

PPG Industries has constituted the acquisition of Tikkurila and its environment, social, and governance initiatives. This supplied PPG with the progressed increase possibilities via an extended portfolio of the coating’s merchandise, and the rising new technologies. Through this acquisition, PPG has made its route closer to decreasing the emission through 15% by the year 2025, that's predicted to cause increased possibilities for the coating’s marketplace

-

On September 2021, Axalta Coating Systems, a global dealer in liquid and powder coatings, declared its successful acquisition of the “U-POL” Holdings Limited. The acquisition of this company has made a significant step in the growth strategy as the acquired company supported them in providing the accessories, coatings, aerosols, and products for the automotive sector. The benefits of this acquisition by these offerings will expand the target market base of Axalta into the refinish coatings segment, which is expected to drive high growth in the forecast period

Some of the key players of this market include:

-

BASF SE,

-

AkzoNobel,

-

PPG Industries,

-

Axalta Coating Systems

Automotive Refinish Coatings Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 14.88 billion

Base year for estimation

2015

Historical data

2013 - 2014

Forecast period

2016 - 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2016 to 2024

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, technology, product, vehicle age, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Brazil

Key companies profiled

BASF SE; AkzoNobel; PPG Industries; Axalta Coating Systems.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Refinish Coatings Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2013 to 2024. For the purpose of this study, Grand View Research has segmented the automotive refinish coatings market on the basis of resin type, technology, product, vehicle age, and region.

- Resin Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)

- Acrylic

- Alkyd

- Polyurethane

- Others

- Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)

- Solventborne

- Waterborne

- UV-Cured

- Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)

- Primer

- Filler

- Basecoat

- Topcoat

- Others

- Vehicle Age Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)

- <5

- 5-10

- >10

- Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2013 - 2024)

- North America

- U.S.

- Europe

- Germany

- UK

- Asia Pacific

- China

- India

- Latin America

- Brazil

- MEA

- North America

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."