- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Global Waterborne Coatings Market Size & Share Report, 2030GVR Report cover

![Waterborne Coatings Market Size, Share & Trends Report]()

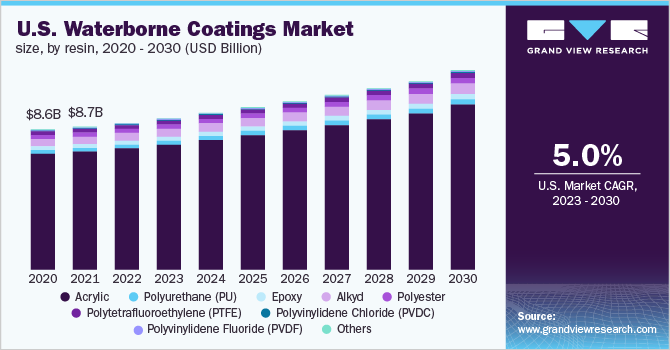

Waterborne Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Resin (Acrylic, PU, Epoxy, Polyester), By Application (Architectural, General Industrial, Marine), By Region, And Segment Forecasts

- Report ID: 978-1-68038-472-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Waterborne Coatings Market Summary

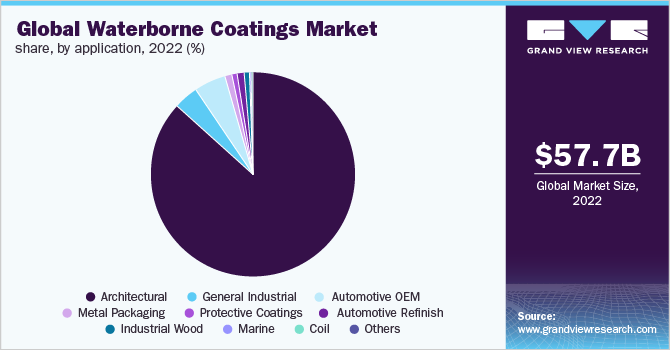

The global waterborne coatings market size was valued at USD 57.67 billion in 2022 and is projected to reach USD 89.35 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The growth is driven by the fostering of construction activities across the globe.

Key Market Trends & Insights

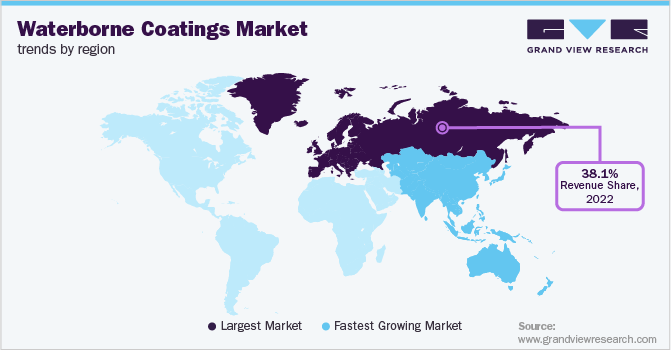

- Europe dominated the global industry in 2022 and accounted for the highest share of over 38.1% of the overall revenue.

- Based on resin, the acrylic resin segment dominated the industry with the highest revenue share of 83.4% in 2022.

- Based on application, the architectural application segment dominated the industry in 2022 and accounted for the highest share of 87.1% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 57.67 Billion

- 2030 Projected Market Size: USD 89.35 Billion

- CAGR (2023-2030): 5.6%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

Rising construction activities on account of rapid industrialization and urbanization across the globe are anticipated to drive product demand over the projected period. The excessive shift in coatings trend from low or high-volatility organic solvents to complete solvent-free coatings that have fewer emissions is likely to contribute to the growing demand for waterborne coatings in residential as well as commercial coating applications. Interior and exterior wall paint formulations mainly rely on waterborne coatings.

These formulations are usually based on acrylate/styrene dispersions. The product manufacturers are also focusing on reducing the average binder requirement in the formulation by 8–12% without affecting the property profile. Alkyd-based waterborne coatings are also preferred by many interior decorators as they are easier to apply, have a glossy finish, and provide better compensation for climatic variation in application and drying. A rise in automobile production capacities coupled with the growing innovation in design and aesthetics is anticipated to remain a key driving force behind the market growth in automobile applications. Automobile production is expected to rise owing to population expansion and rising per capita disposable income, particularly in emerging economies of Asia Pacific and Latin America.

Waterborne coatings are expected to witness an increase in demand from automobile applications due to which the coating manufacturers are investing in research & development to reduce manufacturing costs and, thus, reduce the price of their coatings. Operators working in automobile OEM & refinishing companies are expected to follow compliance to switch from solvent-borne to waterborne coatings systems. Conventional solvent-borne coatings contain about 84% VOC content and 16% solids. Typical waterborne coatings contain about 70% water, 20% solids, and 10% solvent. Waterborne coatings for automobile applications include fewer VOCs, which reduces health-related risks. The product is used for multiple hues & stripping has an advantage as they use a less clear coat to even out the surface for different layers.

These aforementioned factors are expected to increase product demand in automobile applications. On the other hand, the COVID-19 pandemic disrupted industry growth on the account of a temporary shutdown of construction activities, automobile manufacturing sites, and many other facilities due to imposed global lockdown for an uncertain period of time. The industry further sustained a major hit by the pandemic due to disruption in the supply chain caused by the international border restrictions. The pandemic caused a slight slump in market growth; however, it is anticipated to bounce back owing to the rapidly growing construction activities across the globe.

Resin Insights

The acrylic resin segment dominated the industry with the highest revenue share of 83.4% in 2022. Growing demand from infrastructure and automotive industries on the account of glossy color retention in outdoor exposure is anticipated to propel the demand for acrylic waterborne coatings. The demand for acrylic resin-based coatings is likely to grow substantially over the foreseeable future owing to increasing applications in radiation curing and electrodeposition. Growing demand in the transportation industry for refinishes in aircraft, autos, ships, railroads, and trucks is expected to drive Polyurethane (PU) coatings demand.

They are widely used owing to properties, such as abrasion resistance, toughness, and chemical & weather resistance. Stringent government regulations regarding reducing VOC emissions and consistent odors along with shifting consumer preference towards waterborne coatings over their solvent-borne counterparts is expected to remain a major factor driving product demand. Polyurethane coatings are commercially available in oil-modified, two components, moisture curing, and lacquers forms. Increasing PU coating demand in various end-use industries including electrical coils and automotive manufacturing is expected to positively influence segment growth.

Increasing demand for ultra-low VOC, low-odor epoxy resin-based coatings in the transportation industry and DIY flooring applications is projected to drive the segment growth over the forecast period. Epoxy coatings exhibit properties, such as strong adhesion and anti-corrosion resistance, which are useful for metal surface primers. These coatings are widely used in electrical insulation applications owing to their high heat resistance. The rapidly growing electrical insulation industry is projected to drive the growth of the epoxy coatings segment over the years to come.

Application Insights

The architectural application segment dominated the industry in 2022 and accounted for the highest share of 87.1% of the overall revenue. Waterborne coatings account for a major share of total architectural coatings and are expected to increase significantly over the next seven to ten years owing to increasing regulations regarding VOC emissions. Increasing construction spending owing to higher income levels in emerging economies of Asia Pacific, Latin America, and Middle East is expected to drive the segment growth over the next seven years. The rising usage of acrylic-based coating in the industrial coating is also expected to boost market growth. The advent of insulation and sound-damping coatings is expected to propel segment growth and provide lucrative opportunities for industry participants.

Waterborne coatings find wide application scope in general industries due to properties, such as excellent Ultraviolet (UV) light resistance, toughness, flexibility, and durability. All aforementioned factors are expected to drive market growth over the coming years. Increasing demand from the food & beverage industry in metal packaging applications will support market growth over the forecast period. Waterborne coatings are used for applications, such as beverage cans and canned food products. Changing food habits coupled with a busy lifestyle is expected to drive canned foods demand and drive waterborne coatings demand over the next seven years.

Regional Insights

Europe dominated the global industry in 2022 and accounted for the highest share of over 38.1% of the overall revenue. This is attributed to the presence of various major automobile manufacturers in the region. Furthermore, there has been a growing consumer preference for luxury in Europe. These factors are expected to increase the demand for waterborne coatings in automobile OEM & refinishing work. The highest growth in terms of construction spending is expected to be cantered in emerging economies of Asia Pacific including China, followed by India and Indonesia.

This, in turn, is expected to increase the share of the waterborne coatings industry, particularly in Asia Pacific. Residential and commercial buildings constitute a major share of the Asia Pacific construction sector. This factor will provide a wide scope for the waterborne coatings regional market in Asia Pacific over the forecast period. The demand for waterborne coatings in other countries, such as Indonesia, Malaysia, Thailand, and Vietnam, is expected to increase owing to the increasing construction spending for developing residential and commercial buildings.

Key Companies & Market Share Insights

The competition among global companies is likely to grow in future on the account of rapid innovations by new and emerging players in the industry. Manufacturers are targeting to improve their product portfolios, by innovating, designing, and launching a range of new products. This factor is expected to trigger competition in the industry. Some of the prominent players in the global waterborne coatings market include:

-

AkzoNobel NV

-

BASF SE

-

Axalta Coating Systems LLC

-

Berger Paints India Ltd.

-

Kansai Paint Co.,

-

Nippon Paint Holdings Company Ltd.

-

PPG Industries Inc.

-

RPM International Inc.

-

The Sherwin-Williams Company

-

The Valspar Corp.

-

Tikkurila Oyj

Waterborne Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 60.38 billion

Revenue forecast in 2030

USD 89.35 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Colombia; Saudi Arabia; South Africa

Key companies profiled

AkzoNobel NV; BASF SE; Axalta Coating Systems LLC; Berger Paints India Ltd.; Kansai Paint Co.; Nippon Paint Holdings Company Ltd.; PPG Industries Inc.; RPM International Inc.; The Sherwin-Williams Company; The Valspar Corp.; Tikkurila Oyj

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterborne Coatings Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global waterborne coatings market report on the basis of resin, application, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Polyurethane (PU)

-

Epoxy

-

Alkyd

-

Polyester

-

Polytetrafluoroethylene (PTFE)

-

Polyvinylidene Chloride (PVDC)

-

Polyvinylidene Fluoride (PVDF)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Architectural

-

General Industrial

-

Automotive OEM

-

Metal Packaging

-

Protective Coatings

-

Automotive Refinish

-

Industrial Wood

-

Marine

-

Coil

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global waterborne coatings market size was estimated at USD 57.67 billion in 2022 and is expected to reach USD 60.38 billion in 2022.

b. The global waterborne coatings market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 89.35 billion by 2030.

b. Europe dominated the waterborne coatings market with a share of 38.13% in 2022. This is attributable to growth in the construction market led by the recovery post-recession.

b. Some key players operating in the waterborne coatings market include AkzoNobel N.V., BASF SE, and Axalta Coating Systems LLC.

b. Key factors that are driving the market growth include waterborne coatings application for doors, trims, window frames, and interior & exterior walls coupled with increasing construction spending and restoration activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.