- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio-based Polyvinyl Chloride Market Size, Share Report, 2030GVR Report cover

![Bio-based Polyvinyl Chloride Market Size, Share & Trends Report]()

Bio-based Polyvinyl Chloride Market Size, Share & Trends Analysis Report By Product (Rigid, Flexible), By Application (Films & Sheets, Wires & Cables, Pipes & Fittings), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-125-7

- Number of Report Pages: 134

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

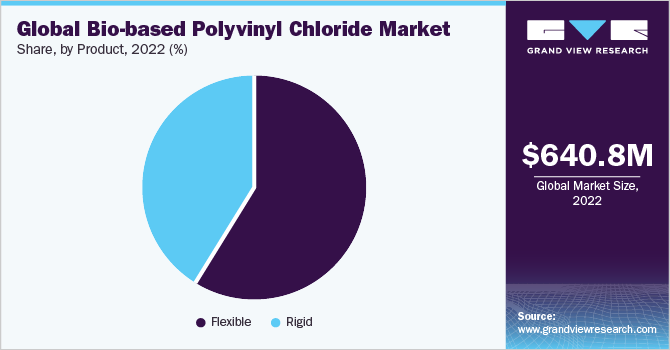

The global bio-based polyvinyl chloride market size was valued at USD 640.79 million in 2022 and is expected to grow a compound annual growth rate (CAGR) of 19.3% from 2023 to 2030. The increasing demand for sustainable and eco-friendly materials in various industries has emerged as a significant driving factor for bio-based polyvinyl chloride (PVC). Traditional PVC, which relies on petroleum-based feedstocks, has faced criticism due to its environmental impact, including the release of toxic chlorine gas during production and slow decomposition in landfills. Bio-based PVC, on the other hand, is manufactured using renewable resources, such as biomass-derived ethanol or plant-based plasticizers. This not only reduces the carbon footprint but also helps in mitigating the dependency on fossil fuels.

As governments and consumers worldwide become more conscious of environmental concerns, the adoption of bio-based PVC has gained traction, fostering innovation and investment in the development of greener alternatives. Furthermore, regulatory initiatives and policies aimed at promoting sustainable materials and reducing greenhouse gas emissions have bolstered the growth in demand for bio-based PVC. Many countries have introduced incentives, tax benefits, and stricter regulations on conventional plastics, pushing industries to explore and adopt bio-based alternatives.

The shift towards bio-based PVC aligns with global efforts to combat climate change and reduce plastic pollution, making it a compelling choice for industries seeking sustainable solutions while meeting stringent environmental standards. In this context, bio-based PVC has not only emerged as a sustainable material but also as a key driver for a more eco-conscious and responsible approach in various manufacturing sectors.

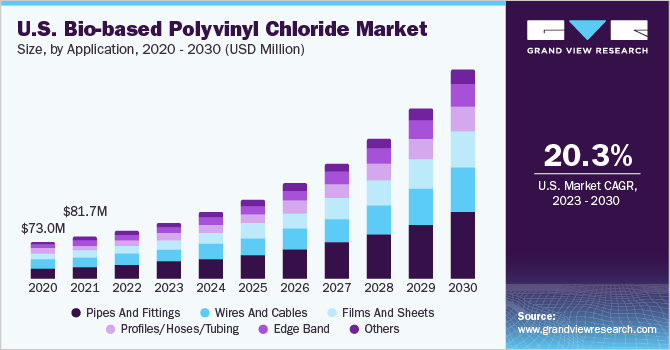

The bio-based polyvinyl chloride market in the United States has experienced remarkable growth in recent years, primarily driven by increasing environmental consciousness and the need for sustainable alternatives to traditional PVC. Consumers and industries alike are becoming more inclined to adopt bio-based PVC due to its reduced carbon footprint and reliance on renewable resources. This trend aligns with the U.S. government's focus on sustainability and the promotion of green technologies.

As a result, the bio-based PVC market has seen investments and research initiatives aimed at developing innovative production processes and expanding its applications in various sectors, such as construction, automotive, and packaging. Government regulations and initiatives have played a pivotal role in shaping the bio-based PVC market in the U.S. Environmental policies aimed at reducing plastic waste and supporting the transition to bio-based materials have encouraged businesses to explore and invest in bio-based PVC production.

In addition to its sustainability benefits, bio-based PVC aligns with circular economy principles, making it an attractive option for businesses looking to meet evolving environmental standards. With growing consumer demand for eco-friendly products and favorable regulatory support, the bio-based PVC market in the United States is expected to continue its expansion and contribute to a more sustainable and environmentally conscious industrial landscape.

Application Insights

The pipes & fittings segment was the dominating application area in the global bio-based polyvinyl chloride market and accounted for over 31.0% share of the overall revenue in 2022. Bio-based PVC's durability, chemical resistance, and low maintenance properties make it ideal for constructing pipes and fittings. These qualities ensure that the pipes can endure the rigors of transporting various fluids, including water and chemicals while maintaining structural integrity over an extended period. This durability reduces replacement and maintenance costs, making bio-based PVC pipes and fittings a cost-effective choice for infrastructure projects.

Additionally, the increasing emphasis on sustainability in the construction and water management sectors has driven the adoption of bio-based PVC in pipes and fittings. As industries strive to reduce their carbon footprint and dependence on non-renewable resources, bio-based PVC provides a greener alternative to conventional PVC. Its production from renewable resources aligns with environmental goals, making it an attractive choice for both governments and businesses looking to meet eco-friendly regulations and consumer preferences. With the ongoing focus on sustainable infrastructure development and water management solutions, pipes and fittings made from bio-based PVC are poised to maintain their dominant position in the global market.

Product Insights

Rigid PVC is a substantial contributor to the global bio-based polyvinyl chloride (PVC) market and accounted for over 41.0% share of the overall revenue in 2022. Rigid PVC offers exceptional durability and strength, making it a preferred choice for a wide range of applications, including construction, automotive components, and pipes. Its ability to withstand harsh environmental conditions and resist corrosion makes it invaluable in these sectors, driving significant demand. Moreover, the increased emphasis on sustainability and eco-friendliness has boosted the adoption of bio-based rigid PVC.

As a bio-based alternative to conventional rigid PVC, it aligns with the growing environmental consciousness among consumers and industries. By utilizing renewable resources and reducing reliance on fossil fuels, bio-based rigid PVC addresses concerns about the environmental impact associated with traditional PVC production, making it an attractive choice for companies aiming to meet sustainability goals and comply with stringent regulations. These factors combined have contributed to the strong position of rigid PVC in the global bio-based PVC market, with its versatility and eco-friendly attributes playing a pivotal role in its market share growth.

Regional Insights

Asia Pacific was the dominating region in the global market for bio-based PVC and accounted for more than 43.0% share of the overall revenue in 2022. Asia Pacific's robust industrial and construction sectors have generated significant demand for PVC products, including bio-based PVC, as it offers durability and versatility. The rapid urbanization and infrastructure development in countries like China and India have driven the use of PVC in applications ranging from pipes and fittings to automotive components and consumer goods. This sustained growth in industrial and construction activities has propelled the Asia Pacific region to the forefront of the bio-based PVC market.

Asia Pacific has been a hub for the production of bio-based PVC due to its abundant availability of raw materials, including biomass feedstocks and agricultural resources. This has facilitated the cost-effective manufacturing of bio-based PVC in the region, making it a preferred choice for both domestic consumption and export markets. The region's commitment to sustainability and environmental initiatives has encouraged the adoption of bio-based PVC as a greener alternative to conventional PVC, further boosting its market share. As sustainability continues to be a priority in the Asia Pacific, the demand for bio-based PVC in applications is expected to expand in the coming years.

Key Companies & Market Share Insights

The global market has been characterized by the presence of key players along with a few medium- and small-sized regional players. Major players are continuously working on developing polymers for the production of bio-based polyvinyl chloride (PVC), owing to the rising demand for bio-based polyvinyl chloride (PVC) components from end-use industries.

The global market for bio-based PVC is highly competitive due to the presence of major industries worldwide, with companies being comparatively concentrated and fiercely competitive, utilizing strategies such as product launches, acquisitions, mergers, and collaborations. For instance, in February 2021, Vinnolit, a subsidiary of Westlake Chemical Corporation, launched a bio-attributed polyvinyl chloride (PVC) with the brand name GreenVin, a lower-carbon alternative PVC that is widely utilized across the medical, automotive, and construction industries. Some prominent players in the global bio-based polyvinyl chloride (PVC) market include:

-

VinyLoop

-

INEOS Group

-

Braskem

-

Kaneka Corporation

-

BIO-TEC ENVIRONMENTAL

-

Westlake Vinnolit GmbH & Co. KG

-

Vynova Group

-

Solvay Indupa

-

Dow Mitsui & Co. Ltd.

Bio-based Polyvinyl Chloride Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 740.61 million

Revenue forecast in 2030

USD 2,544.65 million

Growth rate

CAGR of 19.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Thailand; Malaysia; Indonesia; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

VinyLoop; INEOS Group; Braskem; Kaneka Corporation; BIO-TEC ENVIRONMENTAL; Westlake Vinnolit GmbH & Co. KG; Vynova Group; Solvay Indupa; Dow Mitsui & Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-based Polyvinyl Chloride Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bio-based polyvinyl chloride market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Films and Sheets

-

Wires and Cables

-

Pipes and Fittings

-

Profiles/Hoses/Tubing

-

Edge Band

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."