- Home

- »

- Renewable Energy

- »

-

Biodiesel Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Biodiesel Market Size, Share & Trends Report]()

Biodiesel Market (2022 - 2030) Size, Share & Trends Analysis Report By Feedstock (Vegetable Oils, Animal Fats), By Application (Fuel, Power Generation), By Region (Europe, APAC), And Segment Forecasts

- Report ID: GVR-1-68038-513-7

- Number of Report Pages: 159

- Format: PDF

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodiesel Market Summary

The global biodiesel market size was valued at USD 32.09 billion in 2021 and is projected to reach USD 73.05 billion by 2030, growing at a CAGR of 10.0% from 2022 to 2030. Biodiesel is a renewable, clean-burning diesel substitute that can be used in existing diesel engines without requiring any modifications.

Key Market Trends & Insights

- Europe accounted for a share of more than 46.7% of the global market in 2021.

- Asia Pacific is also projected to register a significant CAGR from 2022 to 2030.

- By feedstock, the vegetable oil segment accounted for the largest share of more than 97.00% of the global revenue.

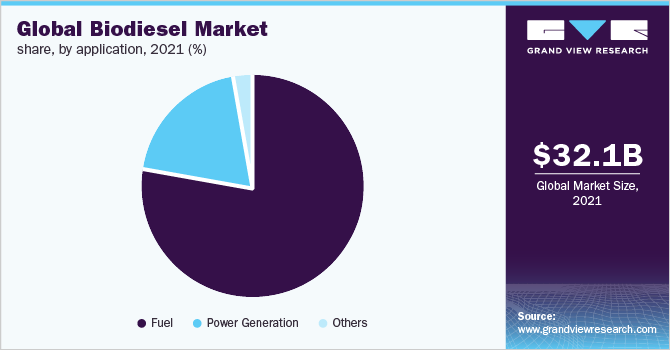

- By application, the fuel application segment accounted for the largest share of more than 77.7% of the overall revenue.

Market Size & Forecast

- 2021 Market Size: USD 32.09 Billion

- 2030 Projected Market Size: USD 73.05 Billion

- CAGR (2022-2030): 10.0%

- Europe: Largest market in 2021

It is composed of a growing variety of recycled cooking oil, agricultural feedstock, and animal fats. Increasing demand for biodiesel to replace traditional fossil fuels in power generation and automotive applications is projected to boost the market growth. On account of the existence of numerous dealers and suppliers, the market is highly fragmented.

However, the demand-supply gap caused by insufficient production capacity and a large scope for R&D in feedstock selection for product manufacturing is expected to create opportunities for new market players. The growing demand for environmentally friendly fuels that ensure complete combustion and can reduce Greenhouse Gas (GHG) emissions is a major factor driving the market. The high compatibility of biodiesel with the existing diesel engines is also driving the demand. The increasing population and the subsequent growth in the number of vehicles and other industries using biodiesel are also expected to boost the demand for biodiesel.

Biodiesel has a high demand in the automotive industry as it emits less GHG. As a result, the demand in the U.S. is expected to witness arise over the forecast period. The U.S. is one of the largest producers of soy. Soy is used as a feedstock for biodiesel after crushing. In March 2017, soybean oil was the largest feedstock used to produce biodiesel and accounted for 360 million pounds of the overall 857 million pounds of feedstock followed by corn oil and canola oil. Developing countries, such as India, China, Brazil, and some EU countries, intend to replace 10 - 20% of total fossil-based fuels with biodiesel used in the transportation sector.

Furthermore, a growing preference for replacing fossil fuels, which are associated with higher GHG emissions, with biofuel, which is renewable and biodegradable, is influencing demand growth in these countries. COVID-19 had an impact on the demand for biodiesel for the first half of 2020. The demand fell during the coronavirus pandemic. Furthermore, the increasing demand for eco-friendly and GHG emission-reducing gas is anticipated to aid the market growth. Also, government aid like subsidies and imposing mandates indicates continued growth of the market.

Feedstock Insights

Based on feedstock, the market has been further categorized into vegetable oils and animal fats. The vegetable oils feedstock segment is further sub-segmented into canola oil, soybean oil, palm oil, corn oil, and others. Simultaneously, the animal fats segment is sub-segmented into poultry, tallow, white grease, and others. In 2021, the vegetable oil segment accounted for the largest share of more than 97.00% of the global revenue. However, raw material selection varies by region, based on the availability and feedstock cost. Palm oil is expected to be a major feedstock for the market and has been widely used in the production of biodiesel in countries, such as Indonesia, Thailand, Germany, France, and Colombia.

Indonesia and Thailand dominated palm oil production, accounting for more than 80% of total output, with a large portion of the product used for biofuel production. Whereas the European countries were reliant on imports of feedstock from these Asian countries for biofuel production. Other vegetable oils, such as UCO and rapeseed, accounted for a significant portion of the industry, accounting for more than 17% of total feedstock demand. China and India are expected to be the most important markets for UCO-based biodiesel in Asia Pacific (UCOME). However, uncertainty about product availability has been a major concern for UCOME manufacturers in these regions, weighing on growth.

Application Insights

Based on application, the global market has been further divided into fuel, power generation, and others. In 2021, the fuel application segment dominated the global market and accounted for the largest share of more than 77.7% of the overall revenue. The automotive fuel segment dominated the demand for the product in 2021. The industry is expected to benefit from increased demand for fuel in commercial vehicles as a replacement for crude oil as it emits fewer Volatile Organic Compounds (VOCs) than traditional fuels, such as diesel.

Because it is biodegradable, free of aromatics and sulfur, and non-toxic, the product finds application in the marine industry and is expected to grow at a significant CAGR over the forecast period. Furthermore, the agricultural sector’s growth, combined with increased mechanization, is expected to drive product demand in agricultural applications over the forecast period. Governments around the world are constantly attempting to adopt renewable energy sources to generate power to reduce GHG emissions. As a result, the demand for the product in power generation applications is expected to grow at a significant CAGR from 2022 to 2030.

Regional Insights

Europe accounted for a share of more than 46.7% of the global market in 2021 and is expected to grow at a steady CAGR from 2022 to 2030. It has historically been the largest market for the product due to early acceptance of the product in the region as well as government emphasis on replacing carbon-emitting sources with bio-based sources. Rapeseed oil, UCO, palm oil, soybean oil, animal fats, and sunflower oil are the most common feedstocks used to produce biodiesel in Europe. The product demand in the region is primarily driven by Germany, which accounts for the highest share of feedstock production among the European countries.

The low-interest rate on raw materials is expected to lead to a rise in consumption, thereby propelling the overall regional market growth over the forecast period. Asia Pacific is also projected to register a significant CAGR from 2022 to 2030. Thailand is likely to be one of the fastest-growing markets, as demand for diesel-powered automobiles in the region is increasing rapidly. Malaysia and Indonesia produce more than 80% of palm oil creating a great opportunity for biodiesel manufacturing.

The production is expected to increase, which, in turn, is expected to propel market growth over the forecast period. However, palm oil is also used in the food industry, which is expected to hamper the market growth. The government’s initiative to promote green fuels to reduce pollution and reduce reliance on crude oil is expected to drive market growth over the forecast period. Furthermore, the Indian government planned to blend more than 5% biodiesel by 2022, which is expected to propel growth over the forecast period. In 2021, the production in Central & South America totaled 10,960.1 million liters. The increase was attributed to a rise in domestic consumption as a result of a growth in blending levels to utilize excess palm oil production.

Key Companies & Market Share Insights

The industry is highly competitive on account of the strong presence of major manufacturers. The companies’ production facilities are located near port areas, allowing for efficient fuel delivery. As a result, the cost of transportation falls, which is expected to boost participants’ profit margins over the projected period. Existing producers are expected to finance the expansion of their production capacities and geographical reach to support their market presence. Some of the prominent players in the global biodiesel market include:

-

Ag Processing, Inc.

-

Archer Daniels Midland Company (ADM)

-

Bunge Ltd.

-

Cargill, Inc.

-

Ecodiesel Colombia S.A.

-

FutureFuel Corp.

-

Manuelita S.A.

-

Renewable Biofuels, Inc.

-

TerraVia Holdings, Inc.

-

Wilmar International Ltd.

Biodiesel Market Report Scope

Report Attribute

Details

Market value in 2022

USD 34.10 billion

Revenue forecast in 2030

USD 73.05 billion

Growth rate

CAGR of 10.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million liters, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Feedstock, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Indonesia; Thailand; Brazil; Argentina; Colombia

Key companies profiled

FutureFuel Corp.; Ecodiesel Colombia S.A.; Manuelita S.A.; TerraVia Holdings, Inc.; Renewable Biofuels, Inc.; Ag Processing, Inc.; Archer Daniels Midland Company (ADM); Wilmar International Ltd.; Bunge Ltd.; Cargill, Inc.; Louis Dreyfus Company; Biox Corp.; Munzer Bioindustrie GmbH; Neste Oyj; Renewable Energy Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global biodiesel market report based on feedstock, application, and region:

-

Feedstock Outlook (Volume, Million Liters; Revenue, USD Million, 2019 - 2030)

-

Vegetable Oil

-

Canola Oil

-

Soybean Oil

-

Palm Oil

-

Corn Oil

-

Others

-

-

Animal Fats

-

Poultry

-

Tallow

-

White Grease

-

Others

-

-

-

Application Outlook (Volume, Million Liters; Revenue, USD Million, 2019 - 2030)

-

Fuel

-

Automotive

-

Marine

-

Agriculture

-

-

Power Generation

-

Others

-

-

Regional Outlook (Volume, Million Liters; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

Thailand

-

-

Central and South America

-

Brazil

-

Colombia

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global Biodiesel market size was estimated at USD 32.09 Billion in 2021 and is expected to reach 34.10 Billion in 2022.

b. The global Biodiesel market is expected to witness a compound annual growth rate of 10.0% from 2022 to 2030 to reach USD 73.05 Billion by 2030.

b. Vegetable oil dominated the industry accounting for 95.44% of the overall feedstock consumption in 2021 for biodiesel production owing to technology know how by majority of the manufacturers and high oil yields offered by these products.

b. Some key players operating in the Biodiesel market include FutureFuel Corporation, Ecodiesel Colombia S.A., Manuelita S.A., TerraVia Holdings, Inc., Renewable Biofuels, Inc., Ag Processing, Inc., Archer Daniels Midland Company (ADM), Wilmar International Limited, Bunge Limited and others.

b. The increasing threat of fossil fuel depletion and need to include renewable sources of energy in energy mix for a sustainable growth is anticipated to drive the demand for biodiesel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.