- Home

- »

- Medical Devices

- »

-

Breast Implants Market Size & Share, Industry Report, 2033GVR Report cover

![Breast Implants Market Size, Share & Trends Report]()

Breast Implants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Silicone Breast Implants, Saline Breast Implants), By Shape, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-798-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Implants Market Summary

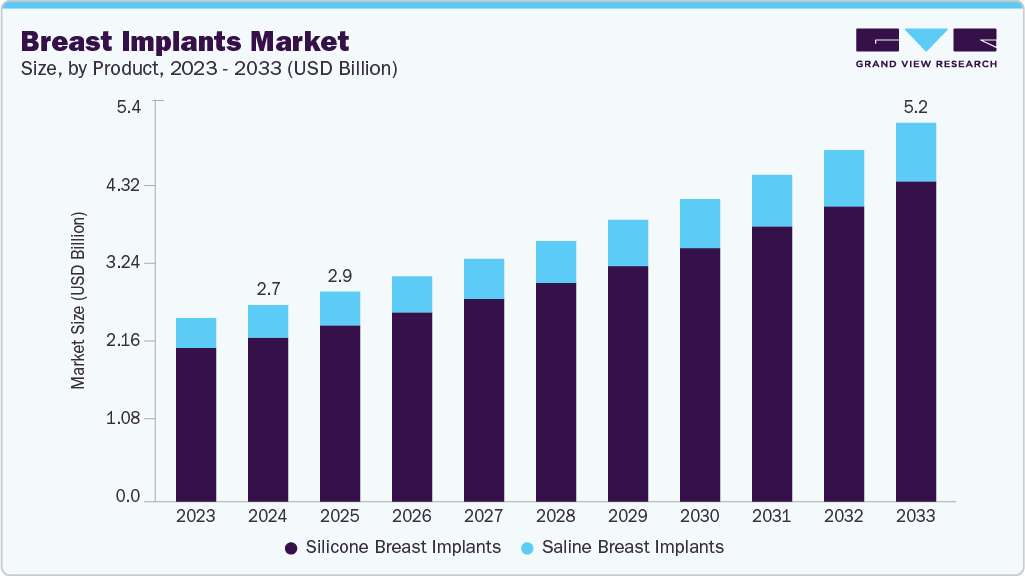

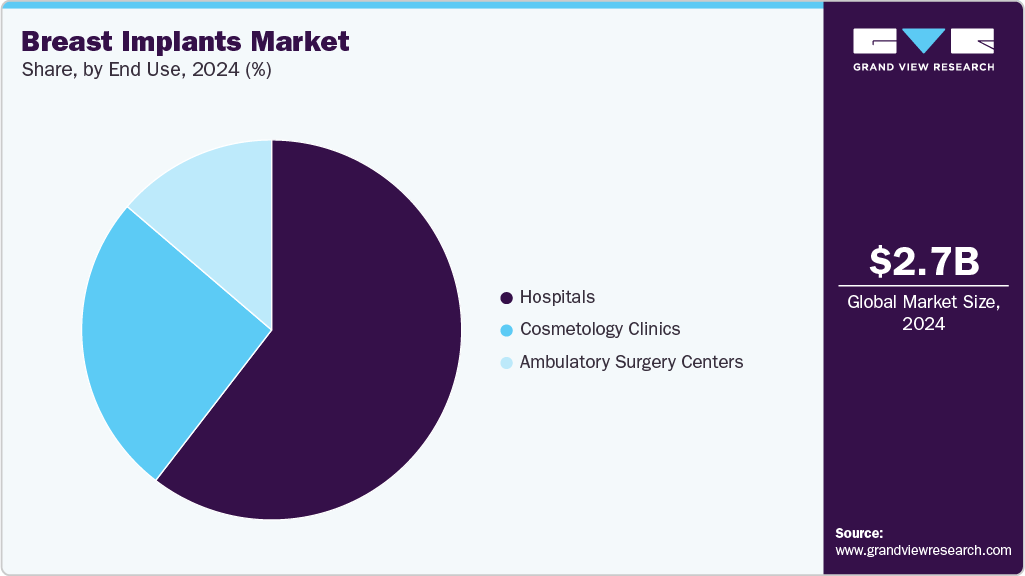

The global breast implants market size was estimated at USD 2.66 billion in 2024 and is projected to reach USD 5.16 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. Market growth is attributed to the rising demand for aesthetic enhancement procedures, technological advancements in implant materials, and increased awareness about body contouring solutions.

Key Market Trends & Insights

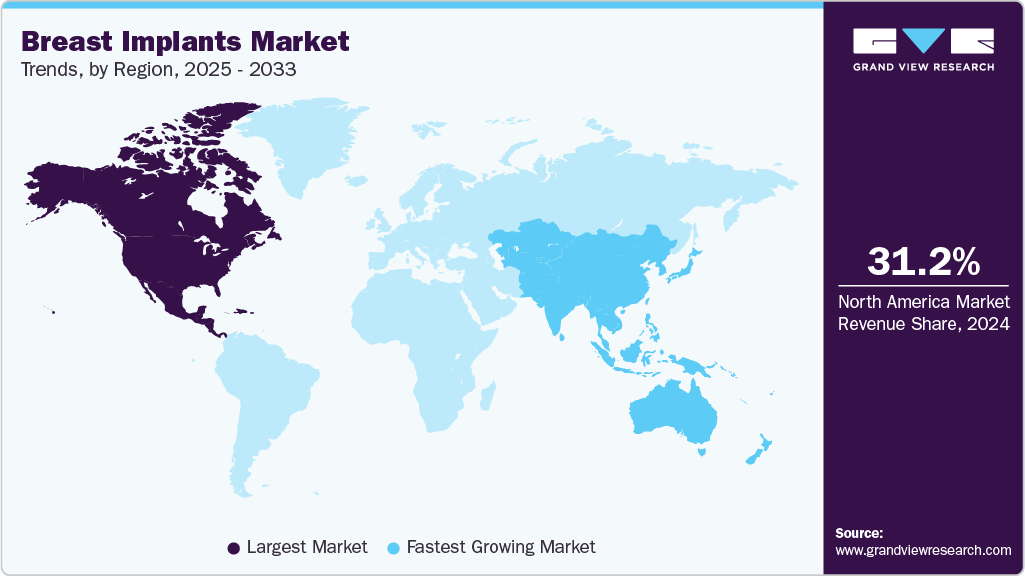

- North America dominated the breast implants market with the largest revenue share of 31.17% in 2024.

- The breast implants market in the U.S. accounted for the largest market revenue share of 78.97% in North America in 2024.

- Based on product, the silicone breasts implants segment led the market with the largest revenue share of 83.74% in 2024.

- Based on shape, the round segment led the market with the largest revenue share of 80.43% in 2024.

- Based on application, the cosmetic surgery segment led the market with the largest revenue share of 73.77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.66 billion

- 2033 Projected Market Size: USD 5.16 Billion

- CAGR (2025-2033): 7.67%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Growing social acceptance of cosmetic surgeries, coupled with the influence of media and celebrity culture, has encouraged more women to opt for breast augmentation. In addition, the availability of minimally invasive techniques and improved implant safety profiles has significantly reduced the hesitation around undergoing such procedures. The latest innovations in breast implant technology are significantly driving market growth by offering improved aesthetic outcomes and enhanced safety. Advanced implants in 2025 feature highly cohesive silicone gels that provide a more natural shape, better feel, and increased durability, reducing the risk of rupture and the likelihood of revision surgeries. Newer designs also incorporate thinner, customizable shells that conform more naturally to the body, resulting in better mobility and a more lifelike appearance. These improvements enhance patient satisfaction and broaden the appeal of breast augmentation procedures.

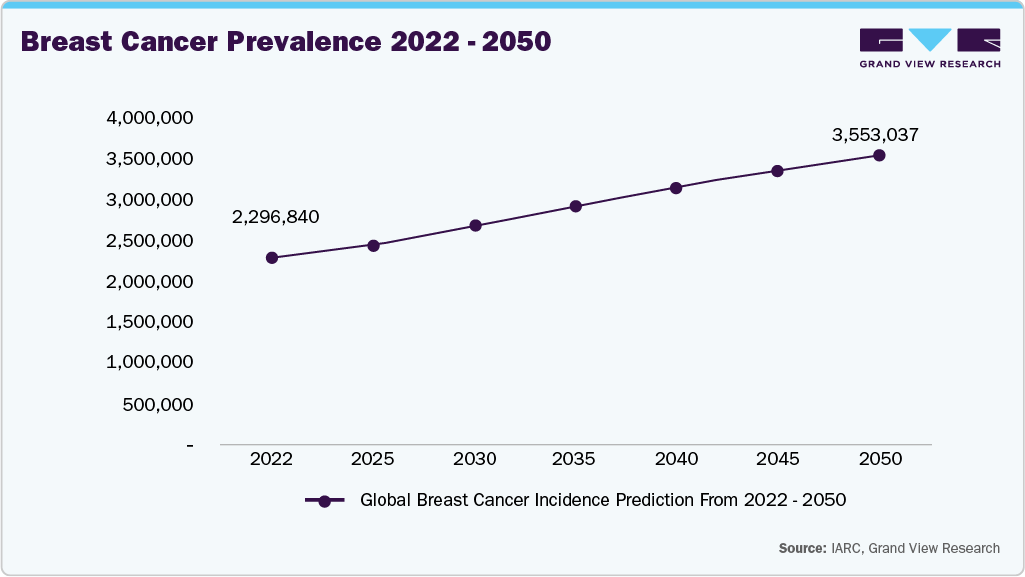

The increasing number of breast reconstruction surgeries post-mastectomy is significantly propelling market growth, driven by a combination of rising breast cancer incidence, improved awareness of reconstructive options, and supportive healthcare policies. With breast cancer remaining one of the most common cancers among women worldwide, mastectomy rates have risen, leading to a parallel increase in demand for post-surgical breast reconstruction. A newly published clinical study in Aesthetic Plastic Surgery (2025) provides one of the most comprehensive real-world assessments of anatomical breast implants. Dr. Paolo Montemurro and colleagues' review analyzes data from over 2,250 implants placed in more than 1,500 patients, delivering valuable insights into these implants' long-term safety and clinical outcomes.

The rising prevalence of breast cancer is a key driver fueling market growth, as it directly increases the demand for reconstructive surgeries following mastectomy. As breast cancer remains one of the leading causes of cancer-related morbidity among women globally, the number of women undergoing mastectomies has grown, resulting in a higher adoption of breast reconstruction procedures using implants. With improved survival rates due to early diagnosis and advanced treatment, more patients opt for reconstruction to restore their physical appearance and emotional well-being. In addition, increasing awareness about reconstructive options and favorable reimbursement policies in many regions supports the use of implants as a restorative solution, thereby significantly driving market expansion.

The multiple benefits offered by breast implants play a pivotal role in driving market growth. Beyond aesthetic enhancement, breast implants contribute significantly to a woman's physical and emotional well-being. They help boost self-confidence and restore breast shape and size that may have changed due to aging, pregnancy, hormonal shifts, or previous surgeries like mastectomy. In addition, breast implants offer a reliable solution for correcting asymmetry between breasts and allow individuals to achieve their desired breast size, tailored to personal preferences. As awareness of these benefits grows and surgical techniques become safer and more refined, more women are considering breast augmentation and reconstruction, thereby fueling the overall demand for breast implants.

Comparison of The Major Breast Implant Brands

Brand

Founded / Origin

Key Features

Variety

Warranty

Mentor

1969 / USA (Johnson & Johnson)

- 4-layer shell to reduce rupture- Specialized surface to minimize capsular contracture

1,000+ options

Lifetime (rupture/deflation), 10 years (complications)

Motiva

2010 / USA (Establishment Labs)

- Ergonomix shape mimics natural feel- SilkSurface for low complication- Qid safety tech

500+ options

Lifetime (rupture), 10 years (capsular contracture)

Nagor

1979 / UK

- British-made with multi-layer silicone shell- Complies with EU & Int'l safety standards

270+ options

Lifetime (rupture & capsular contracture)

Polytech

1986 / Germany

- B-Lite range is 30% lighter- Cohesive gel resists deformation- Approved in 80+ countries

2,000+ options

Lifetime (rupture), 10 years (capsular contracture)

Silimed

1978 / Brazil (Latin America)

- Biodesign range tailored to patient anatomy- Treated cohesive gel prevents rupture/leakage

Extensive (customizable)

Up to 10 years (capsular contracture, depending on implant)

Source: Cadogan Clinic, Grand View Research

Launching new breast implant products is a significant driver of market growth, as it brings innovation, enhanced safety, and broader customization options to meet diverse patient needs. Advanced breast implants now offer features like high-strength cohesive gels, ergonomic designs, lightweight materials, and improved biocompatibility, which enhance both aesthetic outcomes and patient comfort. These new offerings appeal to a broader demographic, including women seeking more natural results or undergoing post-mastectomy reconstruction.

Technological Advancements

Company Name

Product Launch

KOLs

Johnson & Johnson MedTech

In May 2025, Johnson & Johnson MedTech announced the U.S. launch of its MENTOR MemoryGel Enhance Breast Implants, addressing a significant need in the continuum of breast cancer care. These implants are specifically designed to support women who have undergone a mastectomy, offering advanced reconstruction options that combine aesthetic appeal with safety and comfort.

"Johnson & Johnson MedTech is delivering on our promise to make breast reconstruction more inclusive, supportive, and empowering for every woman,” said Alenka Brzulja, Worldwide President, Aesthetics & Reconstruction, Johnson & Johnson MedTech. “Too many women have been left without options that helped them achieve their desired outcomes. The availability of MemoryGel Enhance Implants brings us closer to addressing this gap, because every woman deserves access to reconstruction options that reflect her body and her goals.”

Establishment Labs Holdings Inc.

In September 2024, Establishment Labs Holdings Inc. received approval from the U.S. Food and Drug Administration (FDA) for its Motiva SmoothSilk Ergonomix and Motiva SmoothSilk Round breast implants. This approval allows their use in both primary and revision breast augmentation procedures, marking a significant milestone in expanding safe and advanced implant options for patients in the U.S.

“Today’s approval is transformative for breast aesthetics in the United States. This is a new era, in which women now have a choice of highly differentiated technology backed by rigorous scientific and clinical research,” commented Juan José Chacón-Quirós, Founder and Chief Executive Officer. “Motiva implants have changed the paradigm by proving that women do not have to compromise when it comes to their aesthetic goals. We have never wavered in our commitment to women’s health and our entire organizationis ready to bring this passion and technology to the United States.”

POLYTECH Health & Aesthetics GmbH

In April 2025, POLYTECH Health & Aesthetics GmbH, addressing growing concerns about unnatural-looking breast augmentation results and the increasing rate of revision surgeries, supported the launch of a new expert initiative: The Global Consensus on 'Natural Breast Beauty'. Introduced by a group of prominent plastic surgeons worldwide, this initiative was officially presented at Palazzo Turati in Milan, emphasizing the industry's shift toward achieving more natural and aesthetically pleasing outcomes in aesthetic breast procedures.

"The demand for aesthetic surgery is rising, but too often shaped by unrealistic expectations," says Prof. Roy De Vita, Plastic Surgeon and Department Dead at the Istituto dei Tumori Regina Elena in Rome. "Many women walk into their first consultation asking for a specific brand or implant shape they saw on Instagram. But implants are medical devices just like orthopedic or cardiac implants, not accessories. You wouldn't choose a heart valve that way."

Source: Johnson & Johnson MedTech, Establishment Labs Holdings Inc., POLYTECH Health & Aesthetics GmbH, Grand View Research

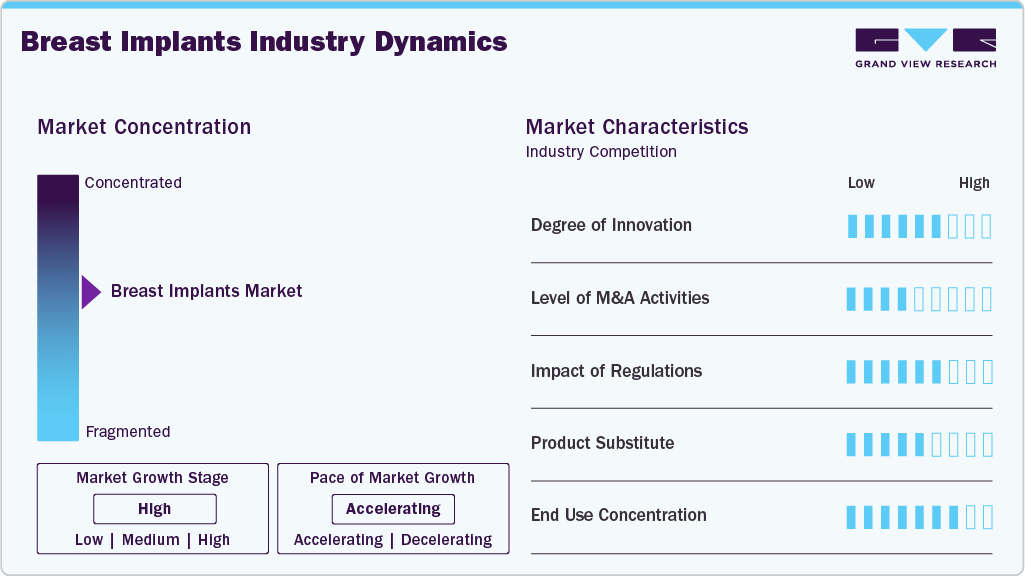

Market Concentration & Characteristics

The breast implants industry demonstrates high innovation, driven by ongoing advancements in materials, implant design, and surgical techniques. Manufacturers are increasingly investing in R&D to develop improved biocompatibility, lighter weight, and more natural anatomical movement, such as ergonomically shaped implants and high-strength cohesive gels. Technologies like 3D imaging for surgical planning, microtextured surfaces to reduce complications, and embedded RFID chips for implant traceability reflect the industry’s push toward personalized and safer solutions.

These innovations enhance aesthetic outcomes, improve patient safety, reduce reoperation rates, and broaden acceptance among patients and surgeons. For instance, in April 2025, POLYTECH Health & Aesthetics GmbH, addressing growing concerns about unnatural-looking breast augmentation results and the increasing rate of revision surgeries, supported the launch of a new expert initiative: the Global Consensus on 'Natural Breast Beauty'. Introduced by a group of prominent plastic surgeons worldwide, this initiative was officially presented at Palazzo Turati in Milan, emphasizing the industry's shift toward achieving more natural and aesthetically pleasing outcomes in aesthetic breast procedures.

Regulations are critical in shaping the breast implants industry by ensuring patient safety, product quality, and market transparency. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set stringent guidelines for clinical trials, manufacturing practices, and post-market surveillance. These regulations have led to the withdrawal of substandard products, enhanced the development of next-generation implants, and prompted companies to adopt more transparent labeling and data tracking systems, such as unique device identifiers (UDIs) and RFID-enabled implants. While compliance may increase time-to-market and costs, it promotes greater patient trust, drives innovation in safer designs, and encourages standardization across regions, ultimately influencing market growth and global adoption.

The breast implants industry has experienced a moderate to a high level of mergers and acquisitions (M&A) in recent years, driven by the need for portfolio diversification, geographical expansion, and technological enhancement. Larger medical device companies often acquire innovative startups or smaller manufacturers specializing in advanced implant designs, surface textures, or integrated safety technologies. These M&A activities aim to streamline R&D pipelines, improve market competitiveness, and meet the rising demand for customized and safe breast augmentation and reconstruction solutions. For instance, in August 2023, Bimini Health Tech expanded its portfolio by acquiring most assets from Ideal Implant, Inc. This acquisition included intellectual property, regulatory approvals, product inventory, and selected manufacturing capabilities. As a result, Bimini’s offerings now encompass a comprehensive suite of aesthetic and reconstructive solutions, including a breast implant product, Acellular Dermal Matrix (ADM), Puregraft fat transfer technology, and the Healeon PRP product line.

“The Ideal Implant technology is unmatched in its safety and technological sophistication and possesses one of the few U.S. FDA Class III Regulatory Approvals for breast implants. Bimini will re-position the technology for the hospital setting, which we believe will unleash profitable growth,” said Bradford Conlan, CEO of Bimini Health Tech. “Adding a breast implant to Bimini’s existing product portfolio is the next foundational step in our strategy to become a global leader in the plastic and reconstructive surgery market.”

In the breast aesthetics and reconstruction space, several product substitutes pose a potential challenge to traditional breast implants. These include autologous fat grafting, external breast prostheses, and tissue flap reconstruction (like TRAM or DIEP flaps). Among these, fat grafting, which involves transferring the patient's fat from one body area to the breasts, is gaining popularity due to its natural feel and minimal risk of foreign body complications. Similarly, external prostheses offer a non-surgical option for breast volume enhancement, especially for post-mastectomy patients. While these alternatives provide certain benefits, such as reduced surgical risks and natural appearance, they may not match implants' volume control, predictability, or longevity, especially in augmentation procedures.

The breast implants industry exhibits a high end-user concentration, with the majority of demand stemming from hospitals, specialized plastic surgery clinics, and ambulatory surgical centers. Among these, private plastic surgery clinics account for a significant share due to the high volume of elective cosmetic augmentation procedures. Hospitals and reconstructive surgery centers are key end-users for post-mastectomy breast reconstruction procedures, driven by the rising incidence of breast cancer. Moreover, ambulatory surgical centers (ASCs) are increasingly preferred for outpatient breast implant surgeries due to their cost-efficiency and shorter recovery time. This concentrated end-user landscape influences manufacturers to target marketing, training, and product development efforts toward high-volume surgical centers and top-performing cosmetic surgeons.

Product Insights

Based on product, silicone implants held the largest share in 2024. The growth is attributed to a greater preference for silicone implants owing to their superior characteristics, such as properties similar to natural breast tissue and biocompatibility. For instance, a gummy implant makes the reconstructed organ look more natural than artificial. This product segment also does not result in disorders associated with the immune system. Due to their soft texture, silicone implants are expected to continue their dominance over the forecast period. Moreover, this feature reduces the risk of hard scar tissue formation around the implantation and wrinkling.

Saline implants are expected to witness significant growth over the forecast period. They are filled with sterile saltwater, which can be safely absorbed by the body in case of rupture, enhancing patient safety perception. Furthermore, saline implants typically require smaller incisions, as they are filled after insertion, making the procedure less invasive and more customizable. Moreover, there is a growing preference for natural and easily detectable implants, especially among patients seeking transparency and a lower risk of hidden rupture.

Shape Insights

Based on shape, round-shaped implants held the largest share in 2024. This growth is due to their round shape, which makes them ideal for breast augmentation. These implants look like compressed spheres, creating huge demand and contributing to market growth. Round-shaped implants are proportional and don't lead to any problems during implant rotation, so surgeons suggest them. Laboratories Arion offers a wide-ranging portfolio comprising round-shaped implants.

Anatomical segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the rising patient preference for natural-looking breast augmentation. Anatomical implants, also known as teardrop-shaped implants, are specifically designed to replicate the natural slope and contour of the breast, offering a more realistic appearance than round implants. This makes them a popular choice among individuals undergoing reconstructive surgeries post-mastectomy or those seeking subtle cosmetic enhancements. As the trend toward personalized and aesthetically natural results gains momentum, demand for anatomical implants is anticipated to grow substantially.

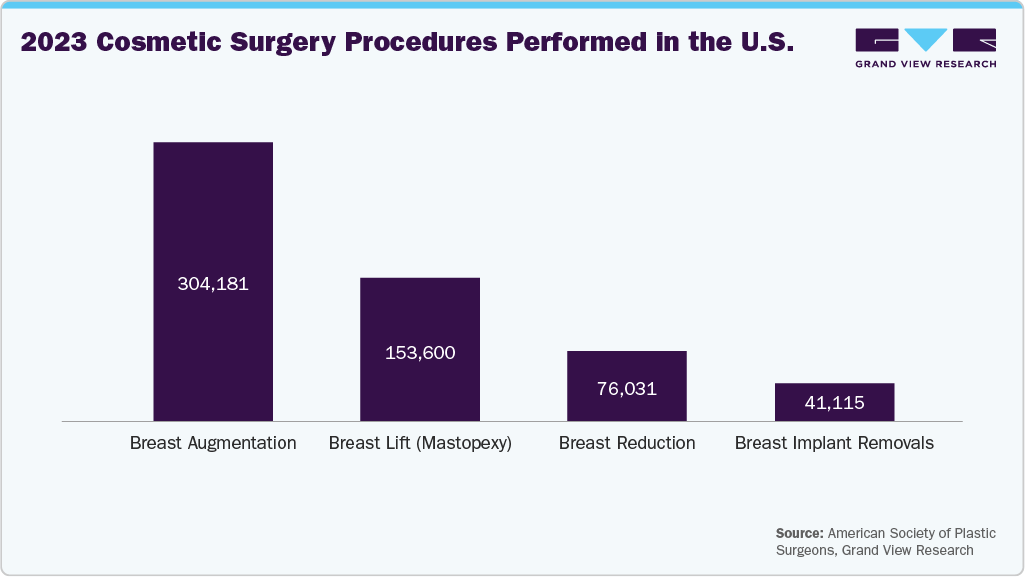

Application Insights

On the basis of application, the cosmetic surgery segment dominated the market in 2024 and is expected to witness the fastest CAGR over the forecast period. This growth is primarily driven by rising aesthetic consciousness, increasing disposable incomes, and broader societal acceptance of cosmetic enhancements. According to the American Society of Plastic Surgeons, breast augmentation remained one of the top cosmetic surgical procedures in the U.S. in 2024, with a surge in demand among women in their 20s and 30s seeking enhancement for body confidence and proportional symmetry. The availability of advanced implant options, such as anatomically shaped, highly cohesive gel, and lighter-weight implants, has further fueled the segment's popularity. In addition, advancements in minimal incision techniques and safer surgical practices continue to attract a broader demographic, reinforcing cosmetic surgery's dominance and future market growth.

End Use Insights

On the basis of end use, hospitals dominated the market in 2024. This growth can be attributed to the increasing number of breast reconstruction surgeries post-mastectomy, as well as a rise in cosmetic augmentation procedures performed in hospital settings. Hospitals offer comprehensive care with access to advanced surgical technologies, skilled plastic surgeons, and post-operative monitoring, making them a preferred choice for both aesthetic and reconstructive breast surgeries. Furthermore, hospitals often collaborate with cancer care centers for breast reconstruction following mastectomy, which has become more common due to rising breast cancer prevalence. The availability of FDA-approved implants, insurance reimbursements in reconstructive cases, and multidisciplinary teams further reinforce hospitals' leading role in the market.

However, cosmetology clinics is projected to witness the fastest growth rate over the forecast period. This can be attributed to the increasing demand for minimally invasive aesthetic procedures and growing public awareness about cosmetic enhancements. These clinics are becoming increasingly popular among individuals seeking breast augmentation for purely aesthetic purposes, as they offer personalized services, shorter waiting times, and cost-effective packages compared to hospitals. Moreover, the rising social acceptance of cosmetic surgery, the influence of social media, and the availability of advanced implant technologies are encouraging more patients, especially younger demographics, to opt for procedures in cosmetology clinics.

Regional Insights

North America dominated the breast implants market with the largest revenue share of 31.17% in 2024. This growth is attributed to the increasing demand for cosmetic procedures, rising awareness of reconstructive surgeries post-mastectomy, and technological advancements in implant materials. The U.S. holds the largest share, owing to many board-certified plastic surgeons, a well-established healthcare infrastructure, and a strong presence of leading manufacturers. In addition, favorable reimbursement policies for breast reconstruction under acts like the Women’s Health and Cancer Rights Act (WHCRA) support procedural volumes. The growing trend toward personalization in cosmetic surgery and FDA approvals for advanced implants, such as Motiva and MemoryGel Enhance, further contribute to regional market expansion.

U.S. Breast Implants Market Trends

The breast implants market in the U.S. is experiencing steady growth, driven by rising demand for aesthetic enhancement procedures and the growing number of breast reconstruction surgeries post-mastectomy. An increasing prevalence of breast cancer has led to a surge in reconstructive surgeries, which are supported by favorable insurance coverage under federal mandates. Furthermore, technological advancements in implant materials, such as cohesive gel implants and lightweight designs, are attracting a broader patient population. The presence of a large base of board-certified plastic surgeons and FDA-approved, high-quality implant options further fuels patient confidence and procedure uptake across the country.

Europe Breast Implants Market Trends

The breast implants market in Europe is witnessing steady growth driven by increasing cosmetic awareness, a growing number of aesthetic procedures, and supportive healthcare infrastructure. Countries like Germany, France, and the UK are leading in procedural volume due to high standards in surgical expertise and access to advanced implant technologies. The region is also shifting toward anatomically shaped and lightweight implants that offer a more natural look and reduced post-operative complications. Moreover, the rise in breast reconstruction surgeries post-mastectomy, driven by cancer awareness programs and public health initiatives, is boosting market demand.

The UK breast implants market is primarily driven by a rising demand for cosmetic enhancement procedures and increasing acceptance of aesthetic surgery among a broader demographic, including older adults. Growing awareness of post-mastectomy breast reconstruction options, supported by the NHS and cancer charities, is further propelling implant adoption. Technological advancements, such as ergonomic and lightweight implants with improved safety profiles, are attracting more patients. The presence of well-regulated clinical standards and a highly skilled workforce in plastic surgery fosters consumer confidence. At the same time, social media influence and celebrity culture continue to normalize cosmetic augmentation, strengthening market growth.

Asia Pacific Breast Implants Market Trends

The breast implants market in Asia Pacific is experiencing the fastest CAGR of 7.99% from 2025 to 2033. This is fueled by increasing disposable incomes, rising awareness of cosmetic procedures, and shifting beauty standards. Countries like China, Japan, South Korea, and India are emerging as key markets, driven by a growing number of medical tourism destinations and a surge in aesthetic consciousness among younger demographics. Minimally invasive procedures and the demand for natural-looking augmentation are also gaining popularity, influencing product innovation in ergonomic and lightweight implants.

China breast implants market is being driven by an increasing disposable income and evolving beauty standards among the younger population. Urbanization and greater exposure to Western aesthetics through social media have led to a growing acceptance of body-enhancement surgeries, including breast augmentation. Moreover, China's rapidly expanding medical aesthetics industry and the availability of advanced surgical techniques are further accelerating market growth. The country's large population and increasing focus on appearance, particularly among millennials and Gen Z women, are expected to continue driving demand for breast implants in the coming years.

Latin America Breast Implants Market Trends

The breast implants market in Latin America is witnessing steady growth driven by increasing demand for cosmetic procedures. Brazil, in particular, remains one of the world leaders in aesthetic surgeries, including breast augmentation. Cultural acceptance of plastic surgery, along with a high emphasis on physical appearance, is contributing to the widespread adoption of breast implants. In addition, the availability of skilled plastic surgeons, cost-effective procedures compared to North America and Europe, and a growing number of medical tourists further support market expansion. Technological advancements and rising awareness of reconstructive breast surgery post-mastectomy are also key factors shaping the regional market trends.

Middle East Africa Breast Implants Market Trends

The breast implants market in the Middle East & Africa is experiencing gradual growth, primarily driven by increasing medical tourism, rising disposable income, and growing acceptance of cosmetic procedures. Countries like the UAE and Saudi Arabia are emerging as key hubs for aesthetic surgeries due to their advanced healthcare infrastructure and skilled plastic surgeons. Moreover, the growing influence of Western beauty standards, particularly among the younger population, is boosting the demand for breast augmentation and reconstruction procedures.

Key Breast Implants Company Insights

The market is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants engage in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the breast implants industry is predicted to grow during the forecast period.

Key Breast Implants Companies:

The following are the leading companies in the breast implants market. These companies collectively hold the largest market share and dictate industry trends.

- ALLERGAN (AbbVie)

- GC Aesthetics

- SEBBIN

- Mentor Worldwide LLC (Johnson & Johnson)

- Sientra Inc. (Tiger Aesthetics Medical, LLC)

- POLYTECH Health & Aesthetics GmbH

- Establishment Labs S.A.

- Shanghai Kangning Medical Supplies Ltd.

- Guangzhou Wanhe Plastic Materials Co., Ltd.

- HansBioMed

- Bimini Health Tech.

Recent Developments

-

In March 2025, BD announced that the first patient had been treated in an Investigational New Drug (IND) clinical trial aimed at supporting its Premarket Approval (PMA) application to the U.S. Food and Drug Administration (FDA). The trial evaluates the use of the GalaFLEX LITE Scaffold to reduce the recurrence of capsular contracture (CC) during breast revision surgery, marking a critical step in advancing breast implant safety and surgical outcomes.

-

In March 2025, POLYTECH Health & Aesthetics announced the launch of its direct subsidiary in the UK, marking a significant strategic investment. This move underscores the company’s commitment to delivering high-quality aesthetic and breast reconstruction solutions while strengthening its presence in one of Europe’s key markets.

-

In May 2025, Johnson & Johnson MedTech announced the U.S. launch of its MENTOR MemoryGel Enhance Breast Implants, addressing a significant need in the continuum of breast cancer care. These implants are specifically designed to support women who have undergone a mastectomy, offering advanced reconstruction options that combine aesthetic appeal with safety and comfort.

-

In September 2024, Establishment Labs Holdings Inc. received approval from the U.S. Food and Drug Administration (FDA) for its Motiva SmoothSilk® Ergonomix and Motiva SmoothSilk Round breast implants. This approval allows their use in both primary and revision breast augmentation procedures, marking a significant milestone in expanding safe and advanced implant options for patients in the U.S.

Breast Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.89 billion

Revenue forecast in 2033

USD 5.16 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, shape, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

ALLERGAN (AbbVie); GC Aesthetics; SEBBIN; Mentor Worldwide LLC (Johnson & Johnson); Sientra Inc. (Tiger Aesthetics Medical, LLC); POLYTECH Health & Aesthetics GmbH; Establishment Labs S.A.; Shanghai Kangning Medical Supplies Ltd.; Guangzhou Wanhe Plastic Materials Co., Ltd.; HansBioMed; Bimini Health Tech.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Implants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global breast implants market report based on product, shape, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone Breast Implants

-

Saline Breast Implants

-

-

Shape Outlook (Revenue, USD Million, 2021 - 2033)

-

Round

-

Anatomical

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Reconstructive Surgery

-

Cosmetic Surgery

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast implants market size was estimated at USD 2.66 billion in 2024 and is expected to reach USD 2.86 billion in 2025.

b. The global breast implants market is expected to grow at a compound annual growth rate of 7.67% from 2025 to 2033 to reach USD 5.16 billion by 2033.

b. North America dominated the breast implant market with a share of 31.17% in 2024. This is attributable to the growing number of reconstruction surgical procedures being conducted in this region.

b. Some key players operating in the breast implants market include ALLERGAN (AbbVie); GC Aesthetics; SEBBIN; Mentor Worldwide LLC (Johnson & Johnson); Sientra Inc. (Tiger Aesthetics Medical, LLC); POLYTECH Health & Aesthetics GmbH; Establishment Labs S.A.; Shanghai Kangning Medical Supplies Ltd.; Guangzhou Wanhe Plastic Materials Co., Ltd.; HansBioMed; Bimini Health Tech.

b. Key factors that are driving the breast implants market growth include the rising number of breast augmentation procedures, the increasing incidence of breast cancer, and growing technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.