- Home

- »

- Medical Devices

- »

-

Capsule Endoscopy Market Size, Industry Report, 2033GVR Report cover

![Capsule Endoscopy Market Size, Share & Trends Report]()

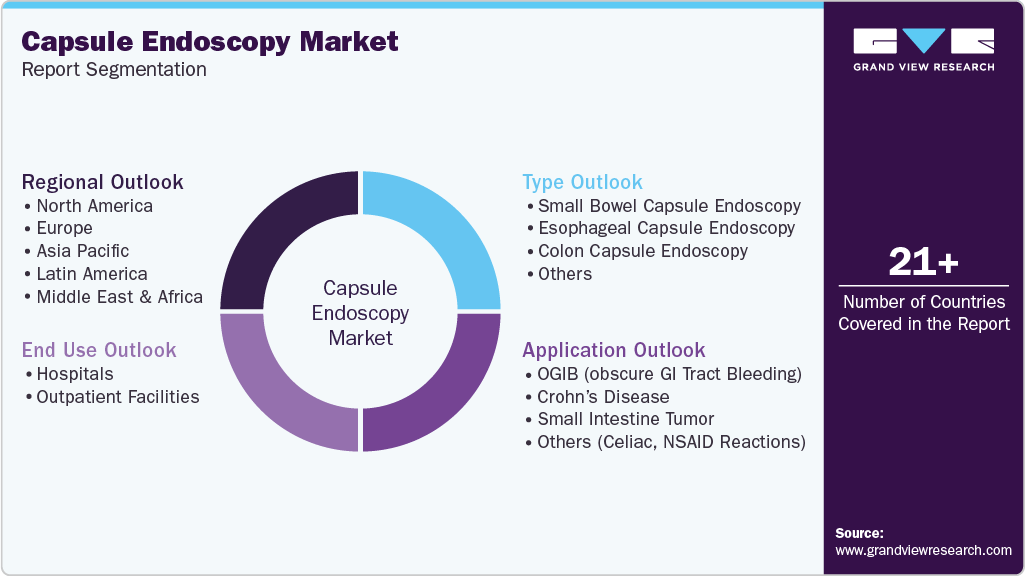

Capsule Endoscopy Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Small Bowel Capsule Endoscopy, Esophageal Capsule Endoscopy), By Application (OGIB (Obscure GI Tract Bleeding), Crohn’s Disease), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-439-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Capsule Endoscopy Market Size & Trends

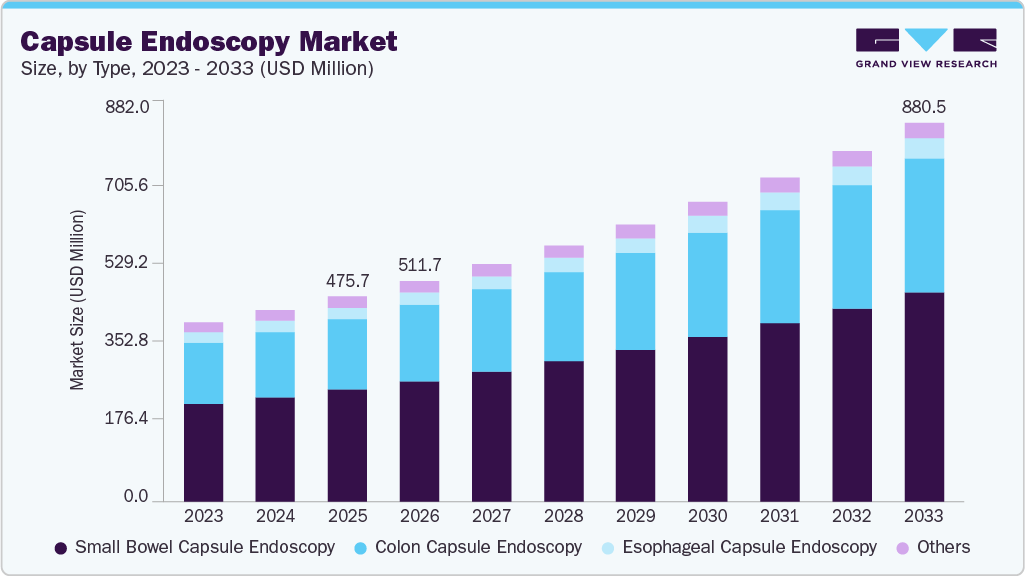

The global capsule endoscopy market size was estimated at USD 475.69 million in 2025 and is projected to reach USD 880.51 million by 2033, growing at a CAGR of 8.06% from 2026 to 2033. The increasing prevalence of Gastrointestinal (GI) diseases & colon cancer, rising demand for minimally invasive diagnostic procedures, and introduction of technologically advanced capsule endoscopes are the major factors driving the market.

Key Market Trends & Insights

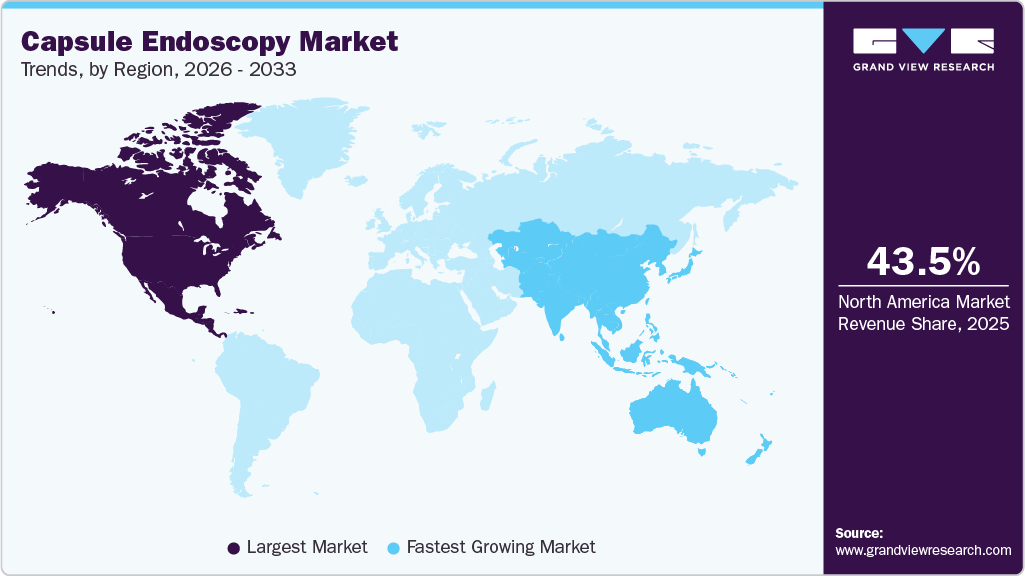

- North America dominated the global capsule endoscopy market with the largest revenue share of 43.55% in 2025.

- The capsule endoscopy market in Mexico is anticipated to register at the fastest CAGR during the forecast period.

- In terms of type segment, the small bowel capsule endoscopy segment accounted for the largest market revenue share in 2025.

- In terms of application segment, the OGIB (obscure GI tract bleeding) segment accounted for the largest market revenue share in 2025.

- In terms of the end use segment, the hospitals segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 475.69 Million

- 2033 Projected Market Size: USD 880.51 Million

- CAGR (2026-2033): 8.06%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

For instance, according to the Canadian Cancer Society, colorectal cancer is expected to be the 4th most commonly diagnosed cancer in Canada in 2024. As per estimates provided by the Canadian Cancer Society, 25,200 Canadians were diagnosed with colorectal cancer, which represented 10% of all new cancer cases in 2024.

As awareness of the clinical benefits of capsule endoscopy, patient convenience, and diagnostic accuracy continues to rise, more hospitals and healthcare providers are incorporating capsule endoscopy into their gastroenterology services. This adoption is driven by the demand for minimally invasive diagnostic procedures, especially for conditions that are difficult to diagnose with traditional endoscopy. Hospitals are increasingly investing in capsule endoscopy technology as it provides detailed imaging of the entire small intestine. The following are the several hospitals that offer capsule endoscopy services,

-

Thomas Jefferson University Hospitals

-

Rush University Medical Center

-

Mayo Foundation for Medical Education and Research [MFMER) Mayo Clinic]

-

Hospital of St. John’s & St. Elizabeth

-

Sydney Norwest Gastroenterology

Capsule endoscopy is a non-invasive diagnostic technology that utilizes a swallowable, wireless capsule equipped with a miniature camera to capture high-resolution images of the gastrointestinal (GI) tract. It is widely adopted for detecting obscure gastrointestinal bleeding (OGIB), Crohn’s disease, small bowel tumors, colorectal cancers, esophageal cancer, and celiac disease, offering a patient-friendly alternative to conventional endoscopy.

Moreover, according to Cancer Council Victoria (Australia), in 2023, a total of 219 individuals in Victoria received a diagnosis of small bowel cancer, comprised of 117 men (53.4%) and 102 women (46.6%). This reflects a diagnosis rate of approximately 3 per 100,000 among men and 2.4 per 100,000 among women. The median age at diagnosis was 67 years for men and 68 years for women. Small bowel cancer accounted for about 0.6% of all newly diagnosed cancers and 0.5% of cancer-related deaths in Victoria that year, ranking as the 34th most frequently diagnosed cancer and the 30th leading cause of cancer mortality in the state.

Technological advancements drive the market's growth. For instance, in January 2025, CapsoVision, recognized for its advancements in capsule endoscopy technology, recently received FDA clearance for pediatric use of its CapsoCam Plus system in patients aged two years and older. This approval marks a significant step forward in expanding access to minimally invasive gastrointestinal diagnostics for younger patients. Offering a swallowable capsule that captures high-quality images without the discomfort of traditional endoscopy, CapsoCam Plus provides a more child-friendly and stress-free option for evaluating small bowel conditions.

Developing training programs and integrating capsule endoscopy into medical, educational, and gastroenterology fellowships fuel the adoption of capsule endoscopy. With the continuous development of advanced capsule technologies, including magnetically controlled capsules and AI-powered automated lesion detection, the need for structured training and certification programs is expected to rise further. This trend enhances diagnostic efficiency and fosters greater confidence among healthcare professionals in utilizing capsule endoscopy for both routine and complex GI investigations, thereby driving market growth. For example, UEG (United European Gastroenterology) offers “A Primer In Capsule Endoscopy,” an online course designed to comprehensively introduce capsule endoscopy, the associated reporting software, and potential complications that may be encountered.

Case Study- Timing of Small-Bowel Capsule Endoscopy and Bleeding-Source Detection (2025)

According to a Springer Nature article published in June 2025, gastroenterology assessed how the timing between a bleeding event and performing small-bowel capsule endoscopy (SBCE) affects the chance of detecting the bleeding source. Researchers examined 562 patients evaluated with SBCE; of these, 131 had overt bleeding episodes and were included in the final analysis.

Key findings:

-

The overall detection rate of bleeding sources via SBCE was around 48-54%, depending on when the SBCE was done relative to the bleeding event (1-7 days, 8-14 days, 15-28 days, or ≥ 29 days).

-

Importantly, for patients whose SBCE found no source of bleeding, the 1-year rebleeding rate was significantly lower (≈ 2%) if SBCE was performed within 14 days of bleeding compared to a 20% rebleeding rate when SBCE was delayed beyond 14 days.

-

The study concludes that timely SBCE (preferably soon after bleeding) may reduce rebleeding risk and improve patient outcomes by enabling earlier detection and intervention.

Market Impact Summary (Based on 2025 Capsule Endoscopy Case Study)

Key Aspect

Market Impact

Timely small-bowel capsule endoscopy significantly improves bleeding-source detection and lowers rebleeding risk.

Drives stronger hospital adoption of capsule endoscopy as a frontline diagnostic tool for gastrointestinal bleeding, thereby increasing demand for advanced systems with rapid workflow capabilities.

Early SBCE (within a short window) improves patient outcomes compared to delayed procedures.

Encourages GI centers to invest in faster-turnaround capsule systems, thereby boosting market growth for solutions that feature streamlined setup, automatic data upload, and AI-assisted triage.

SBCE proves clinically useful even when no active bleeding source is found, influencing treatment decisions and patient monitoring

Strengthens payer and clinician confidence in capsule endoscopy, supporting wider reimbursement acceptance and positioning capsule diagnostics as a standard-of-care tool in GI evaluation.

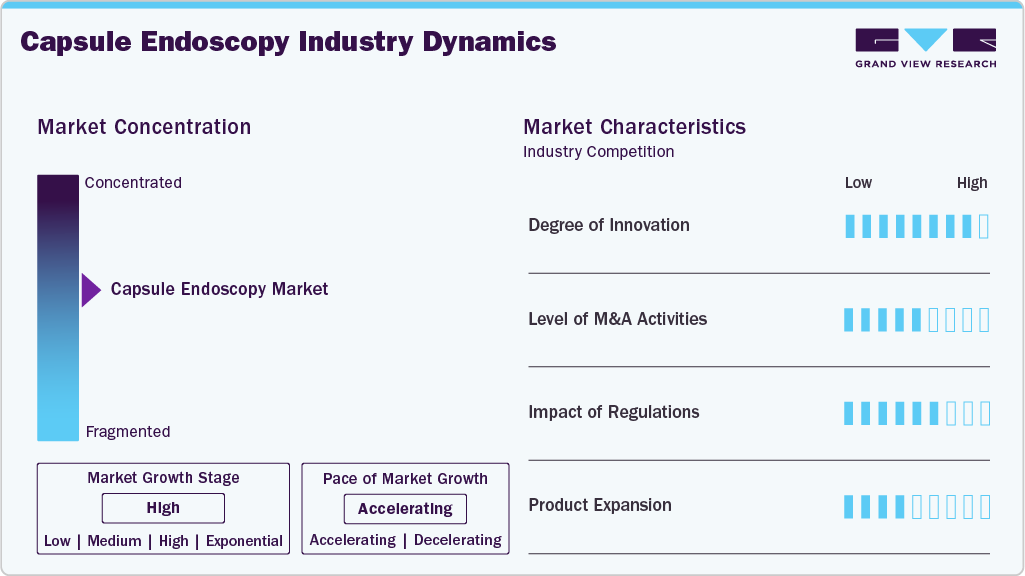

Market Concentration & Characteristics

The global capsule endoscopy industry is characterized by a high degree of innovation, owing to the development of technologically advanced products and innovations that have enhanced diagnostic accuracy, improved patient comfort, and minimized risks associated with traditional endoscopes. For instance, in December 2024, the Asian Institute of Gastroenterology (AIG) Hospital introduced PillBotT, a remote-controlled (robotic) disposable endoscopy capsule developed by Endiatx, a U.S. medical innovator.

The capsule endoscopy industry is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for capsule endoscopes to maintain a competitive edge.

Capsule endoscopes must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards positively impact market growth. The U.S. Food and Drug Administration (FDA) regulates capsule endoscopy as a Class II device. Basic regulatory requirements for the manufacturing and distribution of medical devices in the U.S. are establishing registration, listing of medical devices, Premarket Approval (PMA) process, Investigational Device Exemption (IDE) for clinical research, regulating Quality System (QS), labeling requirements, and Medical Device Reporting.

Several market players are expanding their business By launching new products and getting approvals from regulatory authorities to strengthen their market position and expand their product portfolio. For instance, in May 2024, Medtronic received U.S. FDA clearance for the next-generation PillCam Genius SB capsule endoscopy kit.

Type Insights

The small bowel capsule endoscopy segment led the market with the largest revenue share of 54.67% in 2025. The increasing demand for advanced diagnostic tools for these diseases, which provide efficient and patient-friendly alternatives, is anticipated to drive segment growth in the market, leading to the growing launch of new products. For instance, in December 2024, Medtronic conducted its first patient procedure with the University of Miami Health System (UHealth)HeH by utilizing its next-generation PillCam Genius SB capsule endoscopy kit.

The colon capsule endoscopy segment is anticipated to grow at the fastest CAGR over the forecast period, driven by increasing awareness of colon cancer and a focus on expanding colon screening in several countries worldwide. Furthermore, the rising disposable income, rapid technological advancements in capsule endoscopy, growing demand for minimally invasive surgeries, and implementation of pivotal screening programs for effective cancer diagnosis are key factors promoting market growth. For instance, according to CDC article published in June 2025, there were 147,931 in 2022 newly diagnosed cases of colorectal cancer in the U.S. In the following year, 2023, colorectal cancer accounted for 53,779 deaths nationwide.

Application Insights

The OGIB (obscure GI tract bleeding) segment led the market with the largest revenue share of 45.30% in 2025. The technological advancements and development of artificial intelligence algorithms for image analysis, with companies working on AI-assisted platforms to streamline the interpretation of capsule endoscopy results, are anticipated to drive market growth. For instance, in January 2024, the U.S. FDA approved AnX Robotica’s AI-powered endoscopy tool to enhance the analysis of small bowel capsule endoscopy (SB-CE) images. This technology aims to assist clinicians in detecting suspected small bowel bleeding in adult patients, improving diagnostic accuracy and efficiency.

The small intestine tumor segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing significance of capsule endoscopy in the safe and noninvasive diagnosis of small intestine tumors and related disorders is driving the growth of this segment. Moreover, clinical initiatives have emphasized the role of capsule endoscopy in managing small intestine tumors. For instance, according to the American Cancer Society's estimates, in 2024, approximately 13,920 new cases of small intestine cancer were diagnosed in the U.S.

End Use Insights

The hospitals segment led the market with the largest revenue share of 55.52% in 2025 and is expected to grow at the fastest CAGR during the forecast period. Hospitals have been at the forefront of implementing innovative capsule endoscopy technologies. For instance, in September 2024, AIIMS Nagpur inaugurated a new endoscopy room under its Department of Medical Gastroenterology. This expansion aims to provide advanced diagnostic and therapeutic services to patients in the region. Such developments are likely to drive the segment growth over the forecast period.

The outpatient facilities segment is expected to grow at a significant CAGR during the forecast period. Factors include the increasing preference for daycare and ambulatory surgery centers in colon screenings, which fuels the market growth. In addition, the faster recovery time and minimal discomfort associated with non-invasive endoscopic procedures are expected to accelerate the adoption of capsule endoscopy in outpatient facilities, thereby propelling segment growth over the forecast period.

Regional Insights

North America dominated the global capsule endoscopy market with the largest revenue share of 43.55% in 2025. The high prevalence of several diseases, such as Gastrointestinal (GI) disorders, which include Crohn's disease, gastrointestinal bleeding, celiac disease, ulcerative colitis, colon polyps, or colon cancer, is increasing the need for endoscopic procedures for diagnosis and treatment in North America. For instance, according to data published by the Crohns & Colitis Foundation in November 2024, focusing on pediatric IBD estimated that over 100,000 American youth under age 20 are living with IBD, indicating that the disease burden includes a significant pediatric population.

U.S. Capsule Endoscopy Market Trends

The capsule endoscopy market in the U.S. accounted for the largest market revenue share in North America in 2025. The growing preference for minimally invasive procedures across various medical specialties in the U.S., including gastroenterology, pulmonology, urology, gynecology, and otolaryngology, is driving the demand for endoscopes. Furthermore, many industry players in the U.S. initially pursued approval from the FDA to introduce their products in the country, promoting market growth. For instance, In January 2024, NaviCam SB by AnX Robotica, the FDA cleared this small‑bowel video capsule endoscopy system for use in both adults and children (from age 2 and up), expanding its indication and increasing pediatric access to modern capsule endoscopy.

Europe Capsule Endoscopy Market Trends

The capsule endoscopy market in Europe is expected to grow at a significant CAGR over the forecast period. Factors such as the relatively less stringent medical device approval process in the region are primarily boosting the market. In addition, high disposable income, availability of well-established healthcare infrastructure, presence of developed economies, and availability of skilled professionals are some of the major factors propelling the market growth.

The Germany capsule endoscopy market is expected to grow during the forecast period. The increasing incidence of cancer in Germany is further expected to drive the demand for advanced diagnostic solutions, such as screenings, in the country. According to the Robert Koch Institute (Federal Ministry of Health), around one in eight cancer cases in Germany affects the colon (large intestine) or rectum. In 2022, approximately 29,956 men and 24,654 women were newly diagnosed.

Asia Pacific Capsule Endoscopy Market Trends

The capsule endoscopy market in Asia Pacific is expected to register at the fastest CAGR over the forecast period. The presence of a large number of patient pools with a range of cancer incidences, advanced healthcare systems with a strong focus on innovation and technological advancements, and growing investments by market players to expand their presence in the region are anticipated to propel market growth.

The China capsule endoscopy market is anticipated to register at a considerable CAGR during the forecast period. Improved healthcare facilities and growing healthcare expenditures, along with various initiatives undertaken by private players, are expected to drive market growth. For instance, the Olympus China Medical Training & Education Center (C-TEC) is Olympus China's medical training base, established in three cities: Shanghai, Beijing, and Guangzhou.

Latin America Capsule Endoscopy Market Trends

The capsule endoscopy market in Latin America is anticipated to witness at a considerable CAGR over the forecast period. The growing preference for minimally invasive surgeries over open surgeries, along with increasing awareness about the use of capsule endoscopy for various diagnostic and therapeutic procedures, is expected to drive the market. Moreover, the presence of rapidly developing economies, such as Brazil and Argentina, primarily drives the market growth in Latin America.

The Brazil capsule endoscopy market is anticipated to register significant growth during the forecast period. Favorable government initiatives and high demand for healthcare services drive the country's healthcare sector. Moreover, increasing companies' initiatives to tap opportunities in the Brazilian market, rising incidences of GI conditions, and strengthening distribution networks are a few of the key factors driving the market growth.

Middle East & Africa Capsule Endoscopy Market Trends

The capsule endoscopy market in the Middle East & Africais anticipated to witness at a significant CAGR growth over the forecast period. The MEA capsule endoscopy devices market is gaining immense traction due to the increased number of hospitals and the rising demand for minimally invasive procedures. Moreover, the World Gastroenterology Organisation (WGO) introduced opening endoscopy training centers in Lagos (Nigeria), Nairobi (Kenya), Blantyre (Malawi), and Addis Ababa (Ethiopia).

The South Africa capsule endoscopy market is anticipated to register considerable growth during the forecast period. Increasing healthcare spending and rising demand for advanced healthcare treatments are among the factors anticipated to further boost the market growth during the forecast period. For instance, according to Standard Bank data, South Africa spends around 8% to 9% of its GDP on healthcare.

Key Capsule Endoscopy Company Insights

Key participants in the capsule endoscopy industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Capsule Endoscopy Companies:

The following are the leading companies in the capsule endoscopy market. These companies collectively hold the largest market share and dictate industry trends.

- CapsoVision

- Shangxian Minimal Invasive Inc.

- INTROMEDIC

- Medtronic

- Olympus

- AnX Robotics

- JINSHAN Science & Technology (Group) Co., Ltd.

- Check-Cap

- RF Co., Ltd.

- BioCam

Recent Developments

-

In November 2025, CapsoVision submitted an FDA application for “Breakthrough Device Designation” for a new capsule endoscopy variant aimed at early-stage pancreatic cancer screening, representing the company’s push to expand capsule diagnostics beyond small‑bowel imaging into broader GI oncology screening.

-

In November 2024, Guam Regional Medical City (in collaboration with Guam Memorial Hospital, GI Digital, and USC Keck School of Medicine) launched a lower-cost alternative to conventional colonoscopies for Guam residents using a swallowable, camera-equipped capsule. Recognizing a telemedicine initiative funded by a Telehealth and Distance Learning grant secured by USC Keck, the program will offer capsule endoscopy services to the local population via remote oversight over a two-year period.

-

In March 2023, GIQuIC, the joint clinical registry initiative of the American College of Gastroenterology and the American Society for Gastrointestinal Endoscopy, has partnered with Health Catalyst, a leading healthcare data and analytics company. The collaboration focuses on improving efficiency by reducing manual data entry and enhancing the overall data management process for the national gastroenterology quality registry.

Capsule Endoscopy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 511.71 million

Revenue forecast in 2033

USD 880.51 million

Growth rate

CAGR of 8.06% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

CapsoVision; Shangxian Minimal Invasive Inc.; INTROMEDIC; Medtronic; Olympus; AnX Robotics; JINSHAN Science & Technology (Group) Co., Ltd.; Check-Cap; RF Co., Ltd.; BioCam

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Capsule Endoscopy Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global capsule endoscopy market report based on type, application, end use, and region:

-

Type Outlook (Unit Volume, In Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Small Bowel Capsule Endoscopy

-

Esophageal Capsule Endoscopy

-

Colon Capsule Endoscopy

-

Others

-

-

Application Outlook (Unit Volume, In Thousand Units; Revenue, USD Million, 2021 - 2033)

-

OGIB (obscure GI tract bleeding)

-

Crohn’s disease

-

Small Intestine tumor

-

Others (Celiac, NSAID reactions)

-

-

End Use Outlook (Unit Volume, In Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million) (Unit Volume, In Thousand Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global capsule endoscopy market size was estimated at USD 475.69 million in 2025 and is expected to reach USD 511.71 million in 2026.

b. The global capsule endoscopy market is expected to grow at a compound annual growth rate of 8.06% from 2026 to 2033 to reach USD 880.51 million by 2033.

b. North America dominated the global capsule endoscopy market with the largest revenue share of 43.55% in 2025. This is attributable to a rising prevalence rate of GI disorders & colorectal cancer coupled with advanced healthcare infrastructure, the presence of favorable reimbursement policies, and the increasing adoption of minimally invasive capsule endoscopy by patients.

b. Some key players operating in the capsule endoscopy market include CapsoVision; Shangxian Minimal Invasive Inc.; INTROMEDIC; Medtronic; Olympus; AnX Robotics; JINSHAN Science & Technology (Group) Co., Ltd.; Check-Cap; RF Co., Ltd.; BioCam

b. Key factors that are driving the capsule endoscopy market growth include increasing prevalence of gastrointestinal diseases, colorectal cancer, demand for faster and accurate diagnostics tools, and the presence of supportive government initiatives coupled with rising global geriatric population base.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.