- Home

- »

- Healthcare IT

- »

-

Cardiovascular Information System Market Size Report, 2030GVR Report cover

![Cardiovascular Information System Market Size, Share & Trends Report]()

Cardiovascular Information System Market (2023 - 2030) Size, Share & Trends Analysis Report By Mode Of Operation (Web-based, Cloud-based, On-site), By System (CVIS, CPACS), By Region, And Segment Forecasts

- Report ID: 978-1-68038-986-9

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global cardiovascular information system market size was valued at USD 1.1 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. The increasing number of challenges associated with cardiovascular care, including managing large amounts of data, data retrieval, and maintaining patient history records, is creating the need for advanced systems, such as Electronic Health Record (EHR), which would facilitate data analysis. The swift growth of the global cardiovascular devices industry is mainly attributed to the escalating global count of patients suffering from cardiovascular diseases and disorders, coupled with the rising demand for productive data management tools in cardiac care departments.

A cardiovascular information system uses a software-based system to gather clinical data. These systems are created to satisfy the needs of clinical researchers, physicians, nurses, and chemists. They offer several features that support managing clinical workflow and data integration. These features of the cardiovascular information system make it ideal for usage. The introduction of technologically advanced products and the rising trend of telemedicine are expected to boost market growth. CVIS enables cardiac surgeons and hospital administrators to work more efficiently than with traditional data management techniques.

The system's utility is further maximized when combined with other technologies, such as Cardiology Picture Archiving and Communication System (CPACS). The market is projected to experience rapid growth owing to factors such as high adoption rates and growing awareness of the availability of these systems.

Moreover, the increasing prevalence of cardiovascular diseases due to fast-paced lifestyles and stress-related concerns is also expected to increase the demand for cardiovascular information systems. Globally, deaths from cardiovascular diseases make up the majority of all fatalities. According to a World Health Organization (WHO) report published in 2019, 17.9 million deaths, or 32% of all fatalities worldwide, were attributed to cardiovascular diseases. In 85% of these cases, a heart attack or stroke was the cause of death.

Heart attacks and strokes account for more than four out of every five CVD deaths, and one-third of these fatalities happen in adults below the age of 70 years. Cardiovascular problems must be identified at the earliest to start treatment and medication, which increases demand for cardiovascular information systems. These systems increase the productivity and efficiency of software and patient records. They are more efficient than traditional methods of storing and processing cardiac data of patients, and thus their demand is greater.

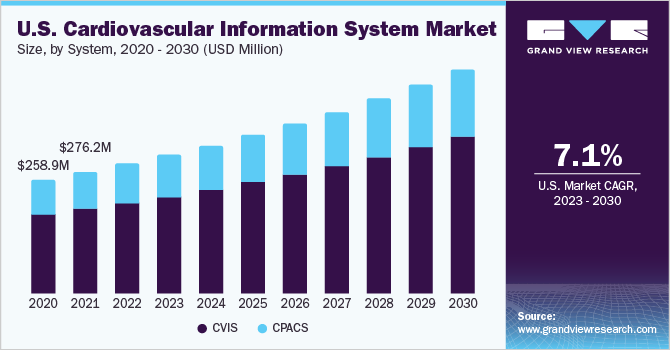

System Insights

The CVIS segment accounted for the largest revenue share in 2022 and is expected to expand at the fastest CAGR over the forecast period. CVIS systems facilitate effective data analysis, enabling physicians to make accurate therapeutic decisions quicker than CPACS systems. Thus, the adoption of CVIS has been observed to be higher than CPACS, adding to its significant growth. Based on the system type, the market is segmented into cardiovascular information system (CVIS), and cardiology picture archiving and communication system (CPACS).

Cardiology Picture Archiving and Communication System (CPACS) was the previous name for CVIS, which changed over time to take on its current name. The cardio-first information storage system, or CVIS, stores all the vital information present in patient photos, medical records, x-rays, and laboratory test results. A cardiologist can easily access and assess patient cardiac treatment data using systems such as CVIS. When CVIS and EMR are connected, cardiologists can greatly improve patient outcomes.

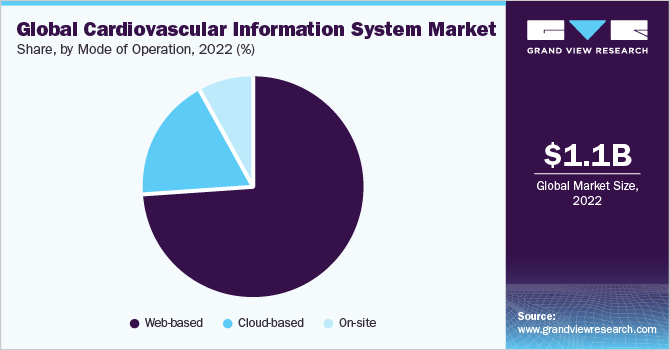

Mode Of Operation Insights

The web-based segment accounted for the dominant revenue share of 74.4% in the cardiovascular information system market in 2022. There is no requirement for local program installation in web-based operations, and this deployment method has the benefit of easy accessibility. Healthcare workers operating remotely or in multiple places may conveniently log in and use the CVIS platform with their credentials. The data is often kept on safe servers to ensure data protection and backup.

A high rate of awareness and relatively cheaper costs are some of the prime factors resulting in the wide-scale adoption of the web-based mode of operation for cardiovascular information systems globally. The market development in this mode of operation is driven by improved interoperability, easy access to images and information from anywhere, and increased convenience.

Based on the mode of operation, cardiovascular information systems are classified into web-based, cloud-based, and on-site segments. The cloud-based segment is anticipated to expand at the fastest CAGR of 10.1% over the forecast period due to its cost-effectiveness and convenience. Cloud-based cardiovascular information systems can allow healthcare professionals to access patient information anytime and anywhere, and their strong demand is expected to boost segmental growth.

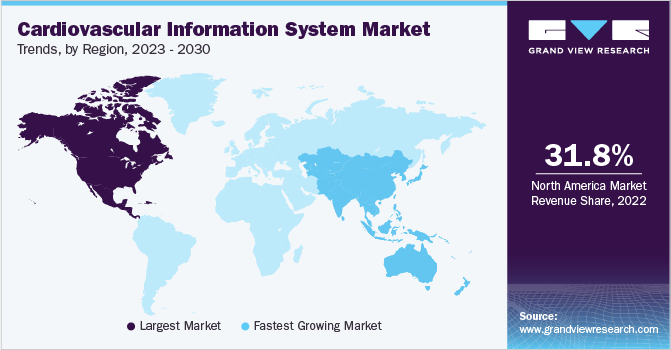

Regional Insights

North America dominated the market and accounted for the largest revenue share of 31.8% in 2022. According to the Centers for Disease Control and Prevention, heart disease is the primary cause of mortality for both men and women of most racial and ethnic groups in the U.S. Cardiovascular disease claims one life in the U.S. every 33 seconds. In the United States, heart disease claimed the lives of almost 695,000 people in 2021, accounting for 1 out of every 5 deaths.

According to the National Library of Medicine, heart failure rates vary within North America due to variations in economic development, genetic predisposition, cultural practices, and trends in risk factors and treatment. The industrialized nations of the U.S. and Canada have a common culture, geographic location, and modern economic and infrastructural systems. Nutritional inadequacies and infectious diseases give way to degenerative illnesses, including cardiovascular diseases, cancer, overweight/obesity, and diabetes, as the epidemiology of rural to industrial areas changes in these countries. This has led to an increase in the prevalence of heart failure in these nations, particularly when general life expectancy rises.

On the other hand, the Asia Pacific region is expected to expand at the fastest CAGR of 10.2% during the forecast period. The region has witnessed a significant increase in healthcare expenditure, leading to greater investments in research and development activities related to cardiovascular diseases due to a sharp increase in number of patients. This has helped develop new and innovative products and technologies, which has boosted regional market growth.

The presence of fast-developing economies such as India and China, where healthcare infrastructure is rapidly improving, is expected to boost the development of the Asia Pacific region over the forecast period. In addition, the increasing prevalence of cardiovascular diseases in this region is expected to further add to the growth of this market due to the mounting burden of patient data records.

Key Companies & Market Share Insights

Major market players invest in research and development projects to improve existing technologies. Developing CVIS systems in combination with other systems is a priority among most companies. The sophisticated hardware requirements of these new systems continue to pose a big challenge. Hence, developing systems compatible with commonly available hardware is a priority for companies. Also, the high costs of these products and services hinder their adoption in developing countries. As a result, players are outsourcing the development of these systems to companies based in developing economies at a cheaper cost, thereby reducing the overall manufacturing costs.

Companies are also opting for strategic partnerships for mutual benefits. For instance, in February 2023, an independent cardiovascular practitioner in the U.S., Cardiovascular Institute of the South (CIS), partnered with the New York City-based private equity company, Lee Equity Partners, to establish Cardiovascular Logistics, a nationwide platform for cardiovascular care. Similarly, in February 2021, Intelerad announced its acquisition of LUMEDX Corporation, a cardiology information systems vendor, on the back of the acquisition of Digisonics, Inc., to expand its cardiovascular expertise by providing enterprise imaging. Some of the major participants in the global cardiovascular information system market:

-

Philips Healthcare

-

GE Healthcare

-

Cisco Systems

-

Fujifilm Medical Systems, Inc.

-

Siemens Healthcare GmbH

-

Cerner Corporation

-

LUMEDX Corporation

-

Digisonics, Inc.

-

Honeywell Life Care Solutions

Cardiovascular Information System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.18 billion

Revenue forecast in 2030

USD 2.20 billion

Growth Rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of operation, system, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Philips Healthcare; GE Healthcare; Cisco Systems; Fujifilm Medical Systems, Inc.; Siemens Healthcare GmbH; Cerner Corporation; LUMEDX Corporation; Digisonics, Inc.; Honeywell Life Care Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

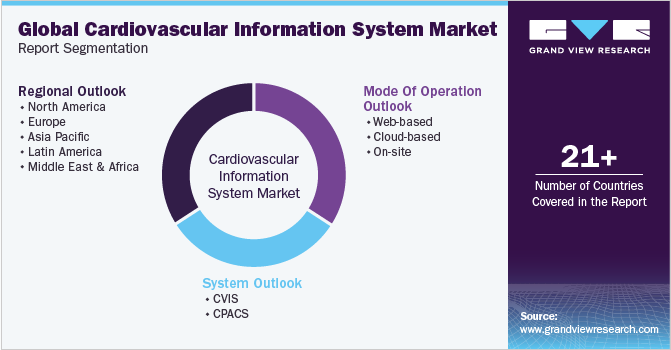

Global Cardiovascular Information System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cardiovascular information system market report based on mode of operation, system, and region:

-

Mode Of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-site

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

CVIS

-

CPACS

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular information system market size was estimated at USD 1.0 billion in 2022 and is expected to reach USD 1.18 billion in 2023.

b. The global cardiovascular information system market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 2.2 billion by 2030.

b. North America dominated the cardiovascular information system market with a share of 31.8% in 2022. This is attributable to the presence of well-established healthcare infrastructure, the surging prevalence of cardiovascular diseases, and other conditions (that affect the functioning of the heart’s muscle or valve) in the region.

b. Some key players operating in the cardiovascular information system market include Philips Healthcare, GE Healthcare, McKesson Corporation, Siemens Healthcare GmbH, Merge Healthcare, Inc., Agfa Healthcare N.V., Cerner Corporation, Fujifilm Medical Systems, Inc., Lumedx Corporation, and Digisonics, Inc.

b. Increasing number of challenges associated with cardiovascular care including the management of large amount of data, data retrieval, and the maintenance of patient history records is creating the need for advanced systems are boosting the growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.