- Home

- »

- Homecare & Decor

- »

-

Ceiling Fans Market Size, Share And Growth Report, 2030GVR Report cover

![Ceiling Fans Market Size, Share & Trends Report]()

Ceiling Fans Market Size, Share & Trends Analysis Report By Product (Standard, Decorative), By Type (Indoor, Outdoor), By Size (Small, Medium, Large), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-608-0

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Ceiling Fans Market Size & Trends

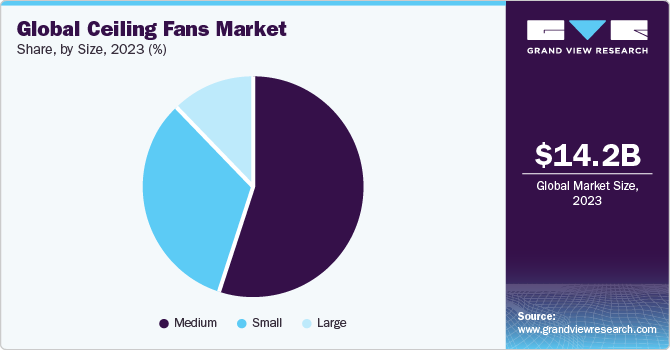

The global ceiling fans market size was valued at USD 14.24 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. This growth is driven by the rising expenditure on home renovation, repair, and improvement. Growing technological advancements in ceiling fan design are also anticipated to contribute to this growth. Additionally, the increasing urbanization and infrastructure development projects in emerging economies are driving the demand for ceiling fans.

The ceiling fan market is shifting towards greater energy efficiency, with current designs focusing on enhancing induction motors to reduce power consumption to approximately 45W for 1200mm sweep fans. However, the adoption of brushless DC (BLDC) motors driven by inverters is gaining traction. BLDC technology could potentially further reduce power consumption to around 35W per fan at full speed, nearly halving energy usage compared to standard fans, which is one of the major improvements in the market.

Ceiling fan designs have witnessed advancements driven by emerging technological innovations. Modern ceiling fans now incorporate cutting-edge technologies that enhance both functionality and aesthetics. The integration of smart features, such as remote-control operation, compatibility with home automation systems, and connectivity to mobile applications, has transformed traditional ceiling fans into intelligent and user-friendly appliances.

The latest offerings of the Hunter Fan Company, one of the market leaders, include the Techne smart fan, which integrates smart operation, easy installation through HunterExpress technology, and efficient airflow powered by SureSpeed innovation. Its compatibility with voice commands, smartphone control, and HomeKit Certification makes it a versatile addition to smart homes. The development of ceiling fans integrated with cutting-edge technologies is expected to drive market growth.

On the downside, the competition from Heating, Ventilation, and Air Conditioning (HVAC) systems is a restraint for the ceiling fans market. HVAC systems offer comprehensive climate control by providing both heating and cooling functionalities, making them versatile solutions for maintaining indoor comfort. As a result, consumers might prioritize investing in HVAC systems, especially in regions with extreme temperature variations, as they offer a year-round solution compared to the seasonal use of ceiling fans.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market is accelerating. The ceiling fans industry has witnessed a high degree of innovation. Companies in the market have focused on including smart features, energy efficiency, and premium design. Crompton received the Red Dot Design Award 2022 for its 'SilentPro Blossom Fans’. This was the company’s flagship product, known for being 2x more silent than ordinary fans. In addition, Crompton ensures power savings through 5-star ratings and the incorporation of BLDC technology to provide innovative and efficient solutions to the residential and commercial sectors.

The impact of regulations is projected to remain moderate. In June 2023, the U.S. Department of Energy (DOE) introduced a proposed rulemaking for new and amended standards for ceiling fans, focusing on energy efficiency. The proposal suggests that standard and hugger ceiling fans with a blade span exceeding 53 inches will likely need to incorporate DC motors to meet the proposed standards. This presents a market opportunity for manufacturers and innovators in the ceiling fan industry to develop and offer advanced DC motor technology in ceiling fans.

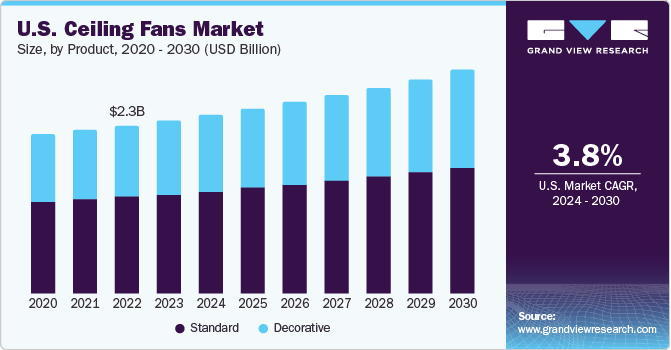

Product Insights

Standard ceiling fan sales accounted for a revenue share of 63.66% in 2023. Standard ceiling fans are more convenient for homeowners who prefer low-maintenance fixtures. In addition, standard ceiling fans typically consume less electricity and offer better cooling and air circulation than ornamental fans. This results in reduced energy costs, a smaller environmental footprint over time, and higher preference among consumers. Moreover, the penetration of standard ceiling fans is high among consumers. Major market players are innovating their products by combining sleek design with advanced functionality to enhance comfort and convenience for residential and outdoor settings.

Decorative ceiling fan sales are projected to grow at a CAGR of 5.5% from 2024 to 2030. Decorative ceiling fans serve as useful appliances and attractive accents in interior design as they combine aesthetic appeal and functionality. Moreover, decorative ceiling fans also come with a built-in light that helps with two distinctive problems: to distribute the air across the room and to illuminate the room with ambient light that serves as a decorative point. As a result, most consumers increasingly prefer decorative ceiling fans.

Type Insights

The indoor ceiling fans segment accounted for a revenue share of 74.66% in 2023. Indoor spaces typically outnumber outdoor areas in residential and commercial areas, leading to a higher demand for indoor cooling solutions. Indoor ceiling fans are used year-round for climate control and air circulation, contributing to consistent demand. Indoor ceiling fans often offer a wider range of designs, styles, and features to cater to diverse indoor décor preferences and functional needs, further driving the market size of this segment.

Outdoor ceiling fan sales are projected to grow at a CAGR of 5.5% from 2024 to 2030. Ceiling fans find versatile outdoor applications, enhancing comfort and ambiance in areas like garages, sunrooms, and outdoor porches. They also aid in air circulation and temperature control during DIY projects or leisure activities in garages. Sunrooms benefit from gentle breezes and ventilation, creating a relaxing environment. Outdoor porches become inviting spaces with added airflow, perfect for gatherings and leisurely moments in nature.

Application Insights

The residential application segment accounted for a revenue share of 69.56% in 2023. Most homeowners use ceiling fans with air conditioning units so that the thermostat can be set at a higher temperature without compromising comfort. According to the U.S. Department of Energy, the thermostat can be set at 78 degrees during the summer, which is the most cost-efficient temperature, while using ceiling fans for enhanced air circulation. This contributes to lower energy consumption and utility bills and is a practical solution to year-round comfort, contributing to sustainable living practices.

Sales of ceiling fans in commercial spaces are projected to grow at a CAGR of 5.8% from 2024 to 2030. Various commercial establishments such as offices, colleges & universities, cafés, retail spaces, and hotels prefer to use energy-efficient ceiling fans to enhance air circulation and create a pleasant environment for employees, customers, guests, and students. Their efficient operation and reduced energy consumption help reduce electricity costs and support sustainability initiatives in commercial buildings. Schools, in particular, benefit highly from the use of energy-efficient ceiling fans as they play an essential role in minimizing electricity expenses by 15% by integrating commercial fans with their existing HVAC systems.

Distribution Channel Insights

Ceiling fan sales via offline channels accounted for a revenue share of 77.84% in 2023. Retailers play a pivotal role by offering specialized guidance and helping customers make suitable choices in ceiling fans. Moreover, their inventory often comprises products that align with consumer preferences within a specific area or locality. Retailers streamline the selection process by presenting popular options, ensuring consumers make well-informed, practical choices that cater to their needs.

The online sales of ceiling fans are projected to grow at a CAGR of 6.1% from 2024 to 2030. The surge in online small electrical appliance retailers is attributed to the widespread internet penetration and the prevalence of internet-enabled devices. These factors have significantly altered consumer spending habits, favoring online channels. The enhanced security measures in online payment systems have instilled confidence among consumers, contributing to the growing market share of online retailers. For instance, Crompton Greaves Consumer Electricals Ltd. has strategically directed investments in 2023 toward improving its visibility and presence on platforms like Google and Amazon.

Size Insights

The medium ceiling fans segment held a revenue share of 54.71% in 2023. Medium ceiling fans provide efficient air circulation by striking a balance between functionality and affordability. They are affordable and practical cooling solutions that cater to a wide range of consumer needs, and their affordable price point makes them available to both businesses and homeowners. Kitchens, bedrooms, living rooms, dining areas, patios, and common spaces are the major spaces where medium-sized ceiling fans are preferred.

Small ceiling fan sales are projected to grow at a CAGR of 5.7% from 2024 to 2030. Small ceiling fans effectively circulate air without taking up too much space in homes with low ceilings. They provide a small-space solution that blends in perfectly with smaller spaces like bathrooms, kitchens, and bedrooms. Residential spaces such as laundry rooms, hallways, walk-in closets, home offices, nurseries, and compact living areas majorly use small ceiling fans. By circulating air during both the hot summers and the cold winters, they offer year-round comfort. Moreover, small ceiling fans are generally easier to install compared to larger models, making them suitable for DIY installation projects.

Regional Insights

The ceiling fans market in North America held a share of 20.38% of the global revenue in 2023. In North America, ceiling fans are extensively utilized due to the prevailing atmosphere. Consumers in the region often opt for various types such as decorative and standard fans. For instance, in living rooms, decorative fans are favored as they illuminate the ambiance and enhance the room's appeal as a sitting area. Ceiling fans play a crucial role in promoting energy efficiency in North America.

U.S. Ceiling Fans Market Trends

The ceiling fans market in the U.S. is expected to grow at a CAGR of 3.8% from 2024 to 2030. Within the U.S., rules and regulations controlling manufacturing and installation apply to the this market. These rules, which address issues like electrical wiring, support structures, blade clearance, and adherence to local and federal building codes, guarantee that safety and quality requirements are satisfied. In terms of the test standard for ceiling fan energy efficiency ratings, most countries outside of the United States use the IEC 60879-based test protocol, whereas the United States of America (USA) has its own test protocol.

Asia Pacific Ceiling Fans Market Trends

The ceiling fans market in Asia Pacific held a revenue share of 44.85% in 2023. One of the key factors driving the demand for ceiling fans in Asia Pacific is the growing impact of climate change and the need for energy-efficient home appliances to mitigate these effects. According to the Asian Development Bank, Asia is projected to become the world's top energy-consuming region by 2025, heightening its vulnerability to energy security and climate change hazards unless steps are taken to curtail energy usage.

Key Ceiling Fans Company Insights

The global ceiling fans market is fragmented. Key companies are actively innovating and undergoing partnerships to gain a competitive advantage. Manufacturers are focused on innovation in motor technology, energy efficiency, and design aesthetics that play a key role in differentiating products within the market. Manufacturers are adopting direct and indirect distribution strategies, some of which are direct to end-user, direct to OEM, direct to systems integrator/contractor, and via distributors.

Key Ceiling Fans Companies:

The following are the leading companies in the ceiling fans market. These companies collectively hold the largest market share and dictate industry trends.

- Crompton Greaves Consumer Electricals Limited

- Craftmade

- Minka Lighting LLC

- Hunter Fan Company

- Monte Carlo Fan Company

- Big Ass Fans

- Ajanta Electricals

- Fanimation

- Mega Home Appliances

- Kichler Lighting LLC

Recent Developments

-

In October 2023, Hunter Fan Company launched a collaborative collection with HGTV host Jasmine Roth, comprising seven lighting and one ceiling fan collection. Roth, known for her expertise in home renovation and design, served as a brand ambassador for Hunter Lighting in 2022, as a part of this collaboration. The collection, named Jasmine Roth + Hunter, offers diverse styles from modern to vintage and includes standout pieces like the Fernando chandelier. The collaboration aims to differentiate Hunter in the ceiling fan and lighting industry through innovative design and attention to detail. The collection is the fourth major product launch from Hunter Fan Company in 2023 and is available through various retailers.

-

In October 2023, the company unveiled four new Ceiling Fans Decor models designed for optimal performance and comfort, showcasing sophisticated and on-trend designs. These fans are equipped with a Weather+ rating, addressing the impact of specific environmental elements, such as saltwater spray and UV rays, on the fan finish and blades.

-

In September 2023, the company introduced its TrueLight technology, featured in products that produce and emit a radiant, evenly dispersed glow achieved through enhanced brightness, efficiency, and coverage. This technology is incorporated into seven collections of indoor Hunter ceiling fans with lights.

-

In July 2023, the company unveiled its Hunter Express technology across three new ceiling fan collections. This innovation aimed to streamline the installation process for ceiling fans, featuring tool-free blades, plug-and-play wiring, Quick Connect light kits, and pre-assembled bodies. These engineered components enable customers to install ceiling fans effortlessly and rapidly in their homes within minutes.

Ceiling Fans Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.86 billion

Revenue forecast in 2030

USD 19.92 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, size, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa. Saudi Arabia

Key companies profiled

Crompton Greaves Consumer Electricals Limited; Craftmade; Minka Lighting LLC; Hunter Fan Company; Monte Carlo Fan Company; Big Ass Fans; Ajanta Electricals; Fanimation; Mega Home Appliances; Kichler Lighting LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceiling Fans Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ceiling fans market report based on product, type, size, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standard

-

Decorative

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global ceiling fans market size was estimated at USD 14.24 billion in 2023 and is expected to reach USD 14.86 billion in 2024.

b. The global ceiling fans market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 19.92 billion by 2030.

b. In 2023, the Asia Pacific ceiling fans market accounted for 44.85% of global revenue, driven by the region's increasing demand for energy-efficient appliances amid climate change concerns and projections of becoming the world's leading energy-consuming region by 2025.

b. Some of the key players in the market include Crompton Greaves Consumer Electricals Limited, Craftmade, Minka Lighting LLC, Hunter Fan Company, Monte Carlo Fan Company, Big Ass Fans, Ajanta Electricals, Fanimation, Mega Home Appliances, Kichler Lighting LLC.

b. Key factors that are driving the ceiling fans market growth include the increasing demand for energy-efficient cooling solutions, rapid urbanization driving infrastructure development, and continuous innovation in fan design and technology to meet evolving consumer preferences for comfort and sustainability.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."