- Home

- »

- Next Generation Technologies

- »

-

Smart Home Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Home Market Size, Share & Trends Report]()

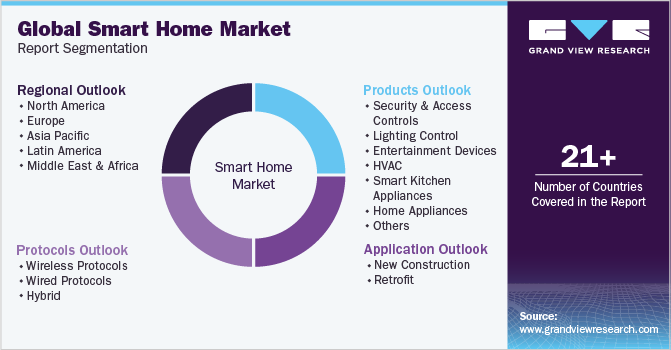

Smart Home Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Security & Access Controls, Lighting Control), By Protocols (Wired Protocols, Hybrid), By Application (New Construction, Retrofit), By Region, And Segment Forecasts

- Report ID: 978-1-68038-041-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Home Market Summary

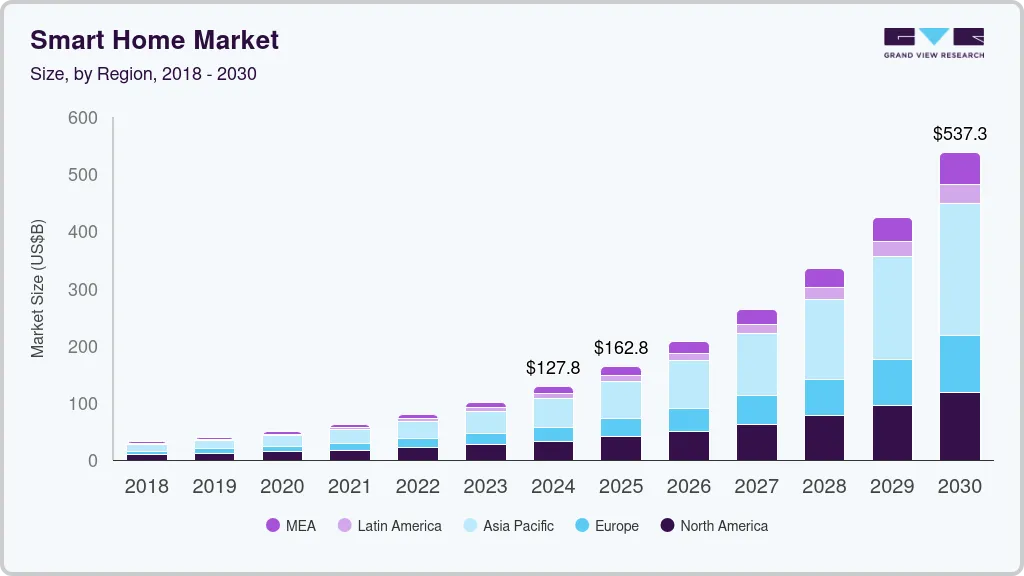

The global smart home market size was valued at USD 127.80 billion in 2024 and is projected to reach USD 537.27 billion by 2030, growing at a CAGR of 27.0% from 2025 to 2030. The market is witnessing a surge in AI-powered devices, enhancing automation and user experience across products like cameras, smart lighting, streaming devices, and appliances.

Key Market Trends & Insights

- North America smart home market held a significant share of over 25% in 2024.

- The U.S. smart home market dominated the North america and held the highest share of 72% in 2024.

- By product, the security & access control segment held the largest share of over 29% in 2024.

- By protocol, the hybrid protocols segment accounted for the largest market share in 2024.

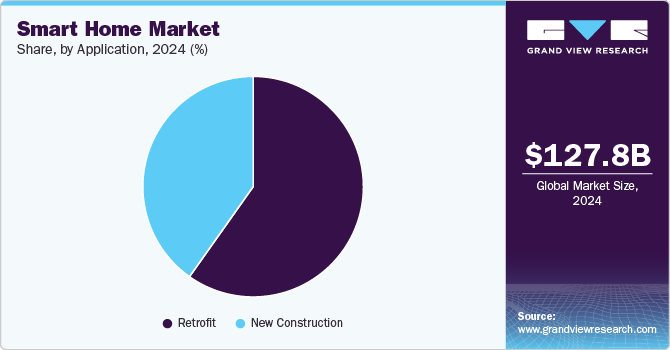

- By application, the retrofit segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 127.80 Billion

- 2030 Projected Market Size: USD 537.27 Billion

- CAGR (2025-2030): 27.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing adoption of AI-driven digital assistants is making smart home technology more intuitive and hands-free, influencing consumer preferences. Additionally, the widespread availability of smartphones and high-speed internet is accelerating the demand for connected smart home solutions, enabling seamless control and integration.The rapid advancement of Internet of Things (IoT) technology has significantly contributed to smart home industry expansion. IoT enables devices to communicate with each other, creating a seamless and integrated home environment. This connectivity allows for improved device performance, increased energy efficiency, and greater user control. As more devices become IoT-enabled, the potential for creating fully connected, intelligent homes is growing significantly and making it easier for consumers to manage various aspects of their homes from anywhere in the world. With better integration, these devices are becoming increasingly appealing to a broader audience thereby fueling smart home industry growth.

Additionally, the increasing consumer focus on energy efficiency and sustainability is a key trend in the smart home industry. As environmental concerns rise globally, more homeowners are looking for ways to reduce their energy consumption and minimize their carbon footprint. Smart home solutions, like smart thermostats, lighting systems, and energy-efficient appliances, allow consumers to better monitor and optimize their energy usage. This not only results in lower utility bills but also aligns with a growing desire for eco-friendly living, encouraging widespread adoption of energy-efficient smart home products.

Furthermore, the integration of voice assistants and artificial intelligence (AI) into smart home ecosystems is revolutionizing the market. Devices such as Amazon Alexa, Google Assistant, and Apple Siri allow users to interact with their smart home systems through voice commands, enhancing the ease of use and accessibility of these technologies. AI-powered devices learn from user preferences and optimize home environments automatically, improving convenience and energy management. This trend is fostering an even more intuitive user experience, where the home adapts to its occupants' needs and preferences, driving further smart home industry expansion.

Moreover, the increasing demand for home security and safety solutions is driving the smart home industry growth. With growing concerns about burglary, property damage, and personal safety, consumers are turning to smart security devices such as smart cameras, doorbell cameras, motion sensors, and smart locks. These devices provide homeowners with real-time alerts and remote monitoring capabilities, enhancing security. This growing demand for smart security solutions is expected to contribute significantly in the coming years.

Product Insights

The security & access control segment dominated the market with the largest share of over 29% in 2024, owing to rising concerns over safety, theft, and break-ins, prompting consumers to adopt smart home security systems. These solutions include smart cameras, doorbell cameras, motion sensors, smart locks, and alarm systems, offering enhanced monitoring, control, and peace of mind. With the growing adoption of connected devices, the trend toward remote security monitoring and automation continues to rise. Additionally, advancements in facial recognition, AI-driven surveillance, and integration with home automation systems are enhancing the effectiveness of smart security solutions.

The home healthcare segment is expected to witness the highest CAGR of over 32% from 2025 to 2030, which is driven by the aging population and increasing health awareness. As people prefer to age in place, there is a growing demand for smart home technologies that can assist with health monitoring, emergency alerts, and daily care tasks. Devices such as fall detection sensors, remote health monitoring, and smart medication reminders are gaining popularity. Additionally, the growing advancements in telemedicine, wearables, and AI-driven health monitoring tools are making healthcare more accessible and convenient in the home environment.

Protocols Insights

The hybrid protocols segment accounted for the largest market share in 2024, driven by its ability to combine the strengths of both wired and wireless technologies. This approach allows for enhanced connectivity and flexibility, as hybrid protocols can operate without interfering with existing Wi-Fi networks and can utilize power lines for communication, eliminating the need for additional routers. As a result, hybrid systems are gaining popularity among consumers who seek reliable and efficient smart home solutions.

The wireless protocols segment is expected to witness the highest CAGR from 2025 to 2030, driven by the increasing integration of Internet of Things (IoT) devices with advanced technologies like artificial intelligence (AI) and machine learning, enabling seamless connectivity and automation. This segment benefits from rising consumer demand for energy-efficient solutions, enhanced security systems, and personalized home automation experiences. The affordability of smart devices and advancements like voice-controlled virtual assistants further boost adoption. Additionally, the proliferation of Wi-Fi 6 technology ensures reliable connectivity for multiple devices, while growing awareness of sustainability and convenience continues to propel the hybrid segment's growth.

Application Insights

The retrofit segment accounted for the largest market share in 2024, driven by the growing demand for upgrading existing homes with smart technologies. Many homeowners are opting to retrofit their homes with smart thermostats, lighting, security systems, and home automation devices without undergoing significant renovations. This segment benefits from lower installation costs and easy integration with existing infrastructure. The trend of affordability and increased availability of retrofit products makes it appealing to a wide range of consumers who wish to modernize their homes without starting from scratch.

The new construction segment is expected to witness the highest CAGR from 2025 to 2030, driven by the increasing incorporation of smart technologies in newly built homes. As the demand for smart homes rises, developers and builders are integrating advanced home automation, energy-efficient systems, and connected devices directly into the construction process. The growing trend of “smart homes from the ground up” is spurred by the increasing awareness of energy efficiency, security, and convenience among homebuyers. Additionally, building codes and standards are evolving to incorporate smart technologies, making it more feasible for builders to include these systems in new constructions.

Regional Insights

North America smart home market held a significant share of over 25% in 2024, driven by increasing consumer demand for convenience, energy efficiency, and security. As the adoption of Internet of Things (IoT) devices grows, consumers are seeking integrated smart home systems that offer seamless control over lighting, heating, cooling, security, and entertainment. The region’s high disposable income, along with widespread internet penetration, also contributes to the rapid expansion of smart homes, particularly in urban areas. Moreover, government incentives and initiatives promoting energy efficiency and sustainability are further fueling market growth.

U.S. Smart Home Market Trends

The smart home market in the U.S. accounted for the highest share of 72% in 2024. Consumers are increasingly adopting smart devices such as thermostats, cameras, and smart speakers for better home management and convenience. Additionally, growing concerns around home security and energy conservation are pushing the adoption of interconnected smart home devices. The rise of home automation systems that allow remote control via smartphones and integration with AI technologies is further driving demand.

Europe Smart Home Market Trends

The smart home market in Europe is expected to grow at a CAGR of over 26% from 2025 to 2030, as consumers increasingly demand convenience, security, and energy efficiency. There is a noticeable trend toward integrating multiple smart devices into comprehensive ecosystems, allowing for seamless automation of lighting, heating, security, and entertainment systems. As in other regions, sustainability and energy savings are top priorities, with consumers seeking smart thermostats, energy management tools, and eco-friendly appliances.

The UK smart home market is expected to grow at a significant rate in the coming years, propelled by a growing focus on energy efficiency, sustainability, and home security. The UK’s commitment to reducing carbon emissions is further accelerating the demand for smart home products with energy-saving capabilities.

The smart home market in Germany is driven by a strong emphasis on automation and energy efficiency. German consumers are particularly drawn to products that provide both convenience and environmental benefits, such as smart lighting, heating systems, and solar-powered devices. The market is also influenced by the country’s commitment to sustainability and its focus on reducing carbon emissions, with government incentives encouraging the adoption of energy-efficient technologies.

Asia Pacific Smart Home Market Trends

The smart home market in Asia Pacific is expected to grow at the highest CAGR of over 28% from 2025 to 2030, driven by the increasing adoption of connected devices, improved internet infrastructure, and the rising demand for convenience, security, and energy efficiency. Consumers in APAC are increasingly seeking integrated smart home ecosystems that offer automation across lighting, HVAC, security systems, and appliances. The market is also influenced by the growing interest in smart homes as part of the broader trend of digitalization and urbanization, with both affluent urban populations and emerging middle-class consumers embracing connected living.

Japan smart home market is gaining traction, driven by a strong demand for advanced technology and innovation, with a particular focus on home security and energy efficiency. The market is also seeing a rise in demand for elderly care solutions, as Japan has one of the world's fastest-aging populations. Smart home systems that support health monitoring, fall detection, and remote caregiving are becoming increasingly popular. Additionally, the government’s push for energy-efficient technologies is driving the adoption of smart appliances and devices, such as smart thermostats and energy management systems, as part of efforts to reduce carbon emissions.

The smart home market in China is rapidly expanding and is propelled by the country’s technological advancements, a growing middle class, and government initiatives supporting smart cities. The adoption of AI-powered devices, voice assistants, and IoT-enabled products is gaining momentum as consumers seek greater convenience and efficiency. Chinese tech giants such as Alibaba and Tencent are heavily investing in smart home ecosystems, and the integration of 5G technology is expected to further accelerate the market’s growth by enabling faster, more reliable connections. The trend of smart home integration is also being driven by urbanization and the increasing interest in home automation for security, energy savings, and enhanced user experiences.

Key Smart Home Company Insights

Some of the key players operating in the market include Siemens AG and Schneider Electric SE, among others

-

Siemens AG is known for its technological leadership in automation, electrification, and digitalization. The company offers a broad portfolio of smart home and building automation products, focusing on energy management, smart grids, and IoT-integrated solutions. Siemens provides cutting-edge solutions for smart homes, including home automation systems, smart thermostats, lighting control, and security features. Their technologies aim to improve energy efficiency, security, and convenience for both residential and commercial spaces.

-

Schneider Electric SE is a global player in energy management and automation. The company offers a wide range of products and services aimed at enhancing energy efficiency, sustainability, and smart home experience. Schneider Electric’s smart home solutions include connected devices for lighting, heating, security, and energy monitoring, all designed to integrate seamlessly with home automation systems. By leveraging IoT technologies and data-driven insights, Schneider Electric helps consumers optimize energy usage, reduce costs, and enhance comfort, positioning itself as a prominent player in the smart home market.

Assa Abloy AB and Philips Lighting B.V. are some of the emerging market participants in the Smart Home market.

-

Assa Abloy AB is a global player in access solutions, specializing in products and services related to locks, doors, and entrance automation. The company offers a wide range of smart home solutions, including electronic locks, keyless entry systems, and smart security products. With operations in over 70 countries, Assa Abloy focuses on providing innovative and secure solutions for residential, commercial, and institutional sectors. The company’s smart home technologies enhance home security, offering convenience, control, and automation through advanced digital locking systems and connected devices.

-

Philips Lighting B.V., now known as Signify, is a global provider of lighting solutions, with a strong focus on smart lighting products for residential, commercial, and industrial applications. The company is at the forefront of the smart home lighting market, offering a wide range of connected, energy-efficient lighting products. The company's innovative solutions include smart bulbs, light control systems, and IoT-enabled lighting that can be controlled via smartphones or voice assistants.

Key Smart Home Companies:

The following are the leading companies in the smart home market. These companies collectively hold the largest market share and dictate industry trends.

- LG Electronics, Inc.

- Siemens AG

- Amazon.com, Inc.

- Google Nest (Google LLC)

- Samsung Electronics Co., Ltd.

- Schneider Electric SE

- Legrand S.A.

- Robert Bosch GmbH

- Assa Abloy AB

- Sony Group Corp.

- ABB, Ltd.

- Philips Lighting B.V.

- Honeywell International, Inc.

Recent Developments

-

In February 2025, Amazon.com, Inc. unveiled Alexa+, its upgraded AI-powered virtual assistant. Alexa+ integrates generative AI capabilities, powered by Amazon Bedrock models like Nova and Anthropic’s Claude AI, enabling more natural conversations, improved contextual understanding, and multi-command handling. It offers personalized experiences by remembering user preferences and acting as an autonomous "agent" for tasks like reservations and repairs.

-

In September 2024, Schneider Electric SE launched an AI-powered energy management feature on its Wiser Home app, designed to optimize energy consumption for water heaters and EV chargers. This feature, developed in-house, uses AI to learn from user habits, weather forecasts, and tariff data to manage energy loads and reduce bills automatically.

-

In August 2024, LG Electronics unveiled a new chapter in connected home living at IFA 2024 with the ThinQ AI Home Hub. This hub acts as a central control point for managing and monitoring all compatible smart appliances within the home, enhancing convenience and connectivity. Featuring advanced AI capabilities, the ThinQ AI Home Hub learns user preferences to provide personalized services and streamline daily routines, marking a significant step in LG's vision for intelligent and integrated home environments.

Smart Home Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 162.78 billion

Revenue forecast in 2030

USD 537.27 billion

Growth rate

CAGR of 27.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, protocols, application, region

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Benelux, Nordic Countries, Russia, China, Australia, Japan, India, South Korea, Indonesia, Thailand, Brazil, Mexico, Argentina, South Africa, U.A.E., Saudi Arabia, Egypt, Nigeria.

Key companies profiled

LG Electronics, Inc.; Siemens AG; Amazon.com, Inc.; Google Nest (Google LLC); Samsung Electronics Co., Ltd.; Schneider Electric SE; Legrand S.A.; Robert Bosch GmbH; Assa Abloy AB; Sony Group Corp.; ABB Ltd.; Philips Lighting B.V.; and Honeywell International, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Smart Home Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart home market report based on product, protocols, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Access Controls

-

Security Cameras

-

Video Door Phones

-

Smart Locks

-

Remote Monitoring Software & Services

-

Others

-

-

Lighting Control

-

Smart Lights

-

Relays & Switches

-

Occupancy Sensors

-

Dimmers

-

Other Products

-

-

Entertainment Devices

-

Smart Displays/TV

-

Streaming Devices

-

Sound bars and Speakers

-

-

HVAC

-

Smart Thermostats

-

Sensors

-

Smart Vents

-

Others

-

-

Smart Kitchen Appliances

-

Refrigerators

-

Dish Washers

-

Cooktops

-

Microwave/Ovens

-

-

Home Appliances

-

Smart Washing Machines

-

Smart Water Heaters

-

Smart Vacuum Cleaners

-

-

Smart Furniture

-

Home Healthcare

-

Other Devices

-

-

Protocols Outlook (Revenue, USD Million, 2018 - 2030)

-

Wireless Protocols

-

ZigBee

-

Wi-Fi

-

Bluetooth

-

Z Wave

-

Others

-

-

Wired Protocols

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofit

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic Countries

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Egypt

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global smart home market size was estimated at USD 127.80 billion in 2024 and is expected to reach USD 162.78 billion in 2025.

b. The global smart home market is expected to grow at a compound annual growth rate of 27.07% from 2025 to 2030 to reach USD 537.28 billion by 2030.

b. North America dominated the smart home market with a share of over 25% in 2024. This is attributable to the increasing adoption of smart devices in the residential vertical to improve the standard of living.

b. Some key players operating in the smart home market include LG, Electronics, Inc., Siemens AG, Amazon .com, Google Nest (Google LLC), Samsung Electronics Co.,Ltd., Schneider Electric SE, Legrand S.A., Robert Bosch GmbH, Assa Abloy AB, Sony Group Corporation, ABB Ltd., Philips Lighting B.V., Honeywell International, Inc.

b. Key factors that are driving the market growth include the growing need for smart security & surveillance systems, and increasing demand for low carbon emission-oriented and energy-saving solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.