- Home

- »

- Consumer F&B

- »

-

Cold And Flu Supplements Market Size & Share Report 2030GVR Report cover

![Cold And Flu Supplements Market Size, Share & Trends Report]()

Cold And Flu Supplements Market Size, Share & Trends Analysis Report By Product (Herbal Extracts, Natural Molecules), By Distribution Channel (Pharmacies & Drug Stores, Online), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-249-5

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global cold and flu supplements market size was estimated at USD 15.28 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030. The global demand for cold and flu supplements has been increasing due to shifts in lifestyle and the easier availability of supplements both in physical stores and online. In addition, the growing awareness among consumers regarding the healing properties of various natural ingredients is contributing to the demand for cold and flu supplements and over-the-counter (OTC) medications. Furthermore, the rising purchasing power of consumers worldwide is expected to result in higher expenditure on immune health products, including cold and flu supplements.

According to data from the World Health Organization (WHO), the annual death toll from the flu ranges from 290,000 to 650,000 individuals. As a result, there has been an increased demand for cold and flu supplements among consumers, driven by their desire to strengthen their immune systems and prevent such illnesses. The primary purpose of consuming cold and flu supplements is to enhance individual immunity, and the market for these products is expected to grow steadily due to the rising consumer awareness regarding their benefits. The market for products or supplements with natural and immunity-boosting claims presents a noteworthy opportunity, as it aligns with consumer preferences.

Cold and flu supplements are available in various forms. Among these, forms, such as tablets and capsules, are the most popular choices. The industry's growth is propelled by brand extensions and continuous product innovations. The COVID-19 outbreak in 2020 significantly amplified the sales of preventive products like vitamins and minerals worldwide, with a notable surge in demand for vitamin C. Various governments have implemented free annual flu immunization programs for the rising elderly population, which could potentially restrain the industry's growth in the future. Nevertheless, manufacturers' increased investments in product development are expected to drive the sales of cold and flu supplements in the upcoming years.

Furthermore, the market growth will be driven by rising consumer awareness about seasonal diseases and their growing healthcare expenditures. In June 2020, Rapid Nutrition, a natural healthcare company, received an Innovation Connections grant from the Australian government. The grant aims to support the company in advancing and bringing to market its novel treatment for alleviating cold and flu symptoms. As part of this initiative, Rapid Nutrition will collaborate with a prestigious Australian university to conduct extensive clinical trials. Moreover, the company has already subjected its product to independent testing at two laboratories and has filed an innovation patent to protect the unique formula.

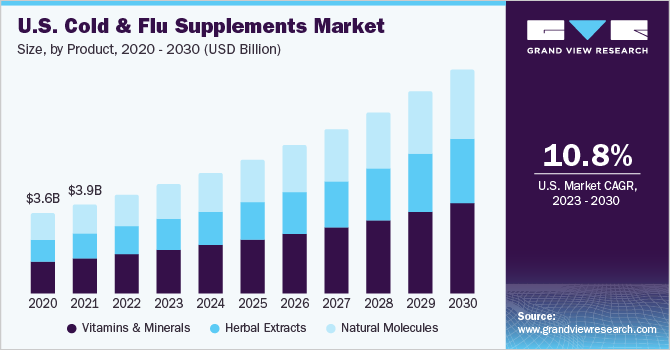

Product Insights

The vitamins and mineral segment accounted for the largest share of 40.1% in 2022. Vitamins and minerals play a crucial role in supporting the immune system and overall health. As a result, they are frequently incorporated into cold and flu supplements to boost immunity and aid in recovery. The market for vitamin and mineral-based cold and flu supplements has witnessed steady growth, driven by consumer awareness of the importance of these nutrients in maintaining optimal health. The herbal extract segment is anticipated to grow at the fastest CAGR of 12.2% over the forecast period from 2023 to 2030. Herbal extracts have long been used in traditional medicine to treat various ailments, including colds and the flu. These extracts are derived from different parts of plants, such as leaves, roots, and flowers, and contain a range of bioactive compounds with potential health benefits.

The market for herbal extract-based cold and flu supplements has experienced significant growth due to the increasing consumer preference for natural and plant-based remedies. The market for natural molecule-based cold and flu supplements has been witnessing a CAGR of 10.7% over the forecast period. These supplements, derived from natural compounds and ingredients, offer a more holistic approach to combating cold and infection symptoms, compared to traditional pharmaceutical options. The growth of the market can be attributed to increasing consumer preference for natural and organic products, growing awareness of the potential side effects of conventional medications, and the rising demand for preventive healthcare solutions.

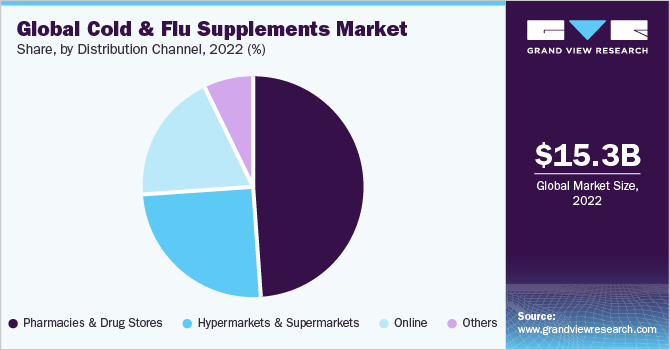

Distribution Channel Insights

The pharmacies & drug store segment accounted for the major share of 48.5% in 2022. The primary reason for increased sales through this channel is that pharmacies and drugstores have trained pharmacists who can provide expert guidance and advice to consumers seeking cold and flu supplements. These professionals can offer recommendations based on individual needs, existing medications, and potential drug interactions. The availability of knowledgeable staff instills confidence in consumers and encourages them to purchase supplements from these trusted healthcare providers. Furthermore, pharmacies and drugstores are widely recognized as reliable sources of healthcare products.

Consumers perceive these channels as credible sources for cold and flu supplements due to their specialization in pharmaceuticals and wellness products. The trust associated with pharmacies and drugstores motivates consumers to choose these channels for their healthcare needs, including the purchase of the supplement. The online channel segment is expected to grow at the fastest CAGR of 12.9% over the forecast period. Online channels offer unmatched convenience and accessibility for consumers. They allow individuals to explore a diverse selection of cold and flu supplements from the comfort of their homes or on the go, with just a few clicks. Online platforms offer 24/7 availability, allowing consumers to purchase supplements at their preferred time and location. This convenience has significantly contributed to the increased sale of cold and flu supplements through online channels in recent years.

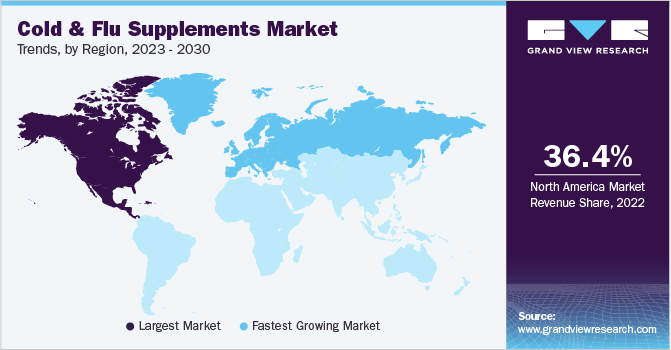

Regional Insights

North America held a major share of over 36.4% of the global market in 2022. North Americans are increasingly embracing health consciousness, resulting in a heightened focus on maintaining a healthy diet and lifestyle. This shift has led to a surge in the popularity of health supplements, with ingredients, such as vitamin C, vitamin D, and zinc, being widely incorporated. These supplements are formulated with precise nutrients and dosages to address various health concerns, including immunity, respiratory health, and cognitive function. This trend exemplifies the growing consumer demand for products that promote overall well-being and cater to specific health requirements. The market in Europe is anticipated to grow with the fastest CAGR of 13.0% over the forecast period.

The high demand for cold and flu supplements in Europe can be attributed to various factors, including cultural differences in approaching and managing flu and cold symptoms. According to the STADA Health Report 2021 by STADA Arzneimittel AG, a Germany-based company, 34% of Europeans strengthen their immune systems by consuming probiotics, vitamins, and minerals. This can help them fight off infections. These dietary supplements are popular in Serbia (59%) as well as Poland (52%) and the Czech Republic (50%). The prevalence of cold weather increases susceptibility to respiratory infections, driving the need for immune-boosting supplements. In addition, changing parental preferences toward preventive healthcare and a proactive approach to illness management contribute to the growing demand for these supplements.

The market in Asia Pacific is anticipated to grow at a CAGR of 12.2% over the forecast period. The demand for these supplements is growing in the Asia Pacific region due to factors like high population density, urbanization, and increased virus exposure. Traditional medicine practices also contribute to this demand, with herbal remedies playing a significant role. In the Asia Pacific region, several companies produce cold and flu supplements. Eu Yan Sang International Ltd., a reputable traditional Chinese medicine-focused business in Singapore, has more than 210 retail locations across China, Hong Kong, Macau, Malaysia, and Singapore.

Key Companies & Market Share Insights

Market players are focusing on developing innovative cold and flu supplements. They are formulating products with unique ingredient combinations, improved delivery formats, and enhanced efficacy to provide consumers with differentiated options. Some of the initiatives include:

-

In May 2023, Himalaya Wellness, a subsidiary of Himalaya Global Holdings Ltd., launched the Ashwagandha+ supplement line and expanded its Hello line with three new products. Among them, the Ashwagandha+ Immune supplement combines ashwagandha, zinc, elderberry, and vitamin C to support healthy immune function throughout the year. These ingredients are recognized for their beneficial properties in supporting a healthy immune system, particularly during flu and cold seasons

-

In March 2023, Nordic Naturals entered into a partnership with 2,500 Walmart stores to extend the availability of its omega-3 supplements to a considerably broader customer base. With Walmart's extensive retail presence throughout the U.S., this collaboration presents a substantial opportunity for Nordic Naturals to reach and connect with a broader consumer demographic

-

In May 2022, Nature's Way Products, LLC. announced a significant expansion of its Gummy facility in Green Bay, Wisconsin, just two years after its opening. The expansion will add 116,000 square feet to the existing 80,000 square feet, incorporating manufacturing, packaging, and warehouse capacity. The project was scheduled to commence in early summer and is expected to be completed by late Q3 of 2023

Some of the prominent players in the global cold and flu supplements market include:

-

Wakunaga of America, Co. Ltd.

-

Neurobiologix, Inc.

-

KLAIRE LABS

-

Nordic Naturals

-

Himalaya Global Holdings Ltd.

-

Nature's Way Products, LLC

-

NU SKIN

-

Flora Inc.

-

Pfizer Inc.

-

Amway

-

NOW Foods

-

Nature's Sunshine Products, Inc.

-

The Vitamin Shoppe

Cold And Flu Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.97 billion

Revenue forecast in 2030

USD 36.61 billion

Growth rate

CAGR of 11.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Wakunaga of America, Co. Ltd.; Neurobiologix, Inc.; KLAIRE LABS; Nordic Natural; Himalaya Global Holdings Ltd.; Nature's Way Products, LLC; NU SKIN; Flora Inc.; Pfizer Inc.; Amway; NOW Foods; Nature's Sunshine Products, Inc.; The Vitamin Shoppe

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

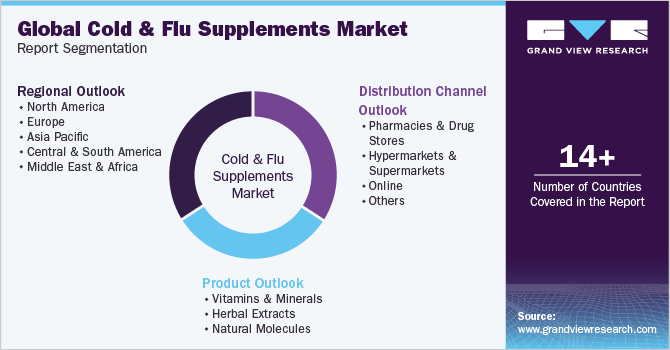

Global Cold And Flu Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the cold and flu supplements market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Vitamins & Minerals

-

Herbal Extracts

-

Natural Molecules

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Pharmacies & Drug Stores

-

Hypermarkets & Supermarkets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold and flu supplements market size was estimated at USD 15.28 billion in 2022 and is expected to reach USD 16.97 billion in 2023.

b. The global cold and flu supplements market is expected to grow at a compounded growth rate of 11.5% from 2023 to 2030 to reach USD 36.61 billion by 2030.

b. Vitamins and minerals dominated the global cold and flu supplements market with a share of 40.1% in 2022. Vitamins and minerals play a crucial role in supporting the immune system and overall health. As a result, they are frequently incorporated into cold and flu supplements to boost immunity and aid in recovery.

b. Some key players operating in the cold and flu supplements market include Wakunaga of America, Co. Ltd, Neurobiologix, Inc., KLAIRE LABS, Nordic Natural, Himalaya Global Holdings Ltd., Nature's Way Products, LLC, NU SKIN, Flora Inc., Pfizer Inc., Amway, NOW Foods, Nature's Sunshine Products, Inc., The Vitamin Shoppe.

b. Key factors that are driving the cold and flu supplements market growth include increasing consumer awareness about health and well-being has encouraged consumers to take a proactive approach toward managing their health, including preventing and treating cold and flu symptom

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."