- Home

- »

- Advanced Interior Materials

- »

-

Compound Semiconductor Materials Market Size Report, 2027GVR Report cover

![Compound Semiconductor Materials Market Size, Share & Trends Report]()

Compound Semiconductor Materials Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Group IV-IV, Group III-V, Group II-VI), By Application (Electronics & Consumer Goods, Telecommunication), And Segment Forecasts

- Report ID: GVR-4-68038-823-7

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Compound Semiconductor Materials Market Summary

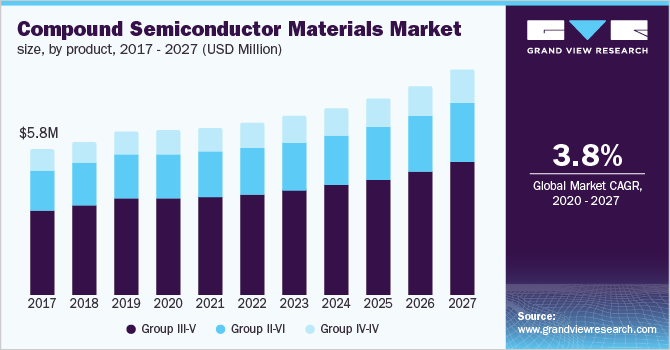

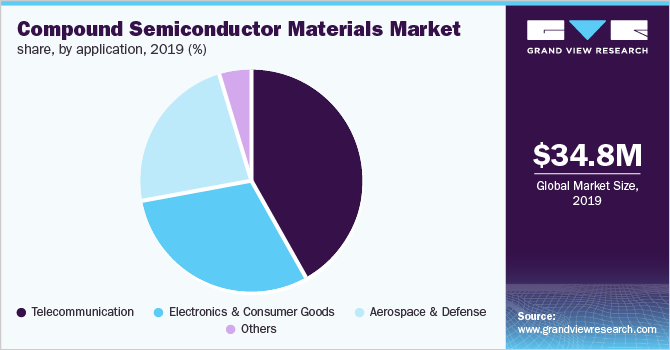

The global compound semiconductor materials market size was valued at USD 34.8 million in 2019 and is projected to reach USD 46.9 million by 2027, growing at a CAGR of 3.8% from 2020 to 2027. Growing product use in various electronic applications, including electronic film coatings, electronic wafer, and integrated circuits, is expected to drive the market.

Key Market Trends & Insights

- The Asia Pacific dominated the market and accounted for over 51.0% share of the global revenue in 2019.

- The market in Europe is estimated to reach USD 9.7 million by 2027.

- By product, the Group III-V segment led the market and accounted for more than 52.0% share of the global revenue in 2019.

- By application, the telecommunication segment led the market and accounted for more than 41.0% share of the global revenue in 2019.

Market Size & Forecast

- 2019 Market Size: USD 34.8 Million

- 2027 Projected Market Size: USD 46.9 Million

- CAGR (2020-2027): 3.8%

- Asia Pacific: Largest market in 2019

Growing industrialization has led to an increase in data transactions, thereby boosting the global semiconductor market growth. Compound semiconductor materials are used in scientific applications, such as rocket coatings and jumpsuit coatings, owing to their high radiation resistance. This trend is likely to complement the market growth over the forecast period.China is expected to dominate the global market in the forthcoming years owing to the presence of a huge semiconductor hub in the country. This can be attributed to low manufacturing costs, which reduce the overall operational cost and increases profits. The country's growth in the electronics manufacturing sector is expected to drive the product demand over the forecast period. The market faces an internal threat of substitution from silicon carbide materials owing to their low production cost as compared to other compound semiconductor materials, thereby resulting in a growing preference for silicon carbide materials in order to reduce the overall cost of the end product.

In July 2019, Japan’s Ministry of Economy, Trade, and Industry (METI) announced that it will restrict the exports of fluorinated polyimides, photoresists, and hydrogen fluoride, which are essential for manufacturing semiconductors and smartphone displays to dismantle the existing global semiconductor value chain. This move severely impacted South Korea’s semiconductor production.

Nanotechnology is widely used in the production of compound semiconductor materials with extremely large surface area to volume ratio, resulting in materials with more surface area depending on properties, which are used for the fabrication and construction of electronic devices. The technology is widely used for the manufacturing of semiconductor devices for automobiles and smartphones.

Compound Semiconductor Materials Market Trends

The increasing usage of compound semiconductors in Light Emitting Diodes (LEDs) is a key factor in the growth of the compound semiconductor industry. LEDs are replacing other types of conventional lighting such as halogen bulbs. The demand for fluorescent and incandescent lights for commercial and domestic purposes is massive.

Moreover, LEDs are widely used in the automotive industry as they offer brighter illumination compared to traditional lighting. The increasing usage of LED lighting is anticipated to benefit the compound semiconductor industry. According to the International Energy Agency (IEA), almost 50% of the buildings were covered with LEDs globally in 2021.

Demand for compound semiconductors in data centers is propelling the market growth. Data centers widely use transceivers to transmit or receive signals. The use of compound semiconductors in transceivers enhances their speed. Rising demand for high-speed transceivers is likely to propel market demand in the coming years.

Low average material cost for silicon conductors as compared to the cost of compound semiconductors is likely to act as a restraint for the market demand. However, rising demand for the market in the defense sector for ease of operability in radio frequency devices is likely to create opportunities for portfolios and investments. In 2021, the United States government spent USD 801 billion for military and defense activities, which constituted about 38% of the military spending globally.

Product Insights

Group III-V compound semiconductor materials led the market and accounted for more than 52.0% share of the global revenue in 2019 on account of its wide use in transistors, LEDs, lasers, and solar cells for 5G, IoT, and smart vehicles. Their higher power efficiency and unique optical properties give them an edge over silicon-based semiconductors.

The growth in the optoelectronics industry is anticipated to propel the demand for Group II-VI compound semiconductors over the forecast period. Group II-VI compound semiconductor materials exhibit large band gaps, and hence are popular in optoelectronics for short-wavelength applications.

Group IV-IV is anticipated to register the fastest CAGR of 4.4% over the forecast period on account of the growing demand for SiC semiconductors. SiC offers various additional benefits over silicon such as 10 times the breakdown electric field strength, a wider range of p- and n-type control needed for device construction, higher tolerance for voltages, the capability of operating at higher temperatures, and three times the bandgap.

The growth in the electric vehicles (EVs) market is expected to be a key driver for SiC as more EV manufacturers are using SiC Schottky barrier diodes or MOSFETs in DC-DC converters. Other end-use industries where SiC semiconductors are increasingly being used include military systems, sensor systems, solar power inverters and other power supplies, and wind turbines.

Application Insights

Telecommunication led the market and accounted for more than 41.0% share of the global revenue in 2019 owing to the high demand for semiconductors for mobiles and wireless communication. GaAs substrates are used in power amplifiers and switches for smartphones. Their use is further increasing in wireless communication on account of their high speed and efficiency over silicon semiconductors.

These materials are widely used in the aerospace and defense industry for a wide range of applications, including power suppliers for space and aircraft, solid-state relays and contractors, and VLF transmitters. Growing defense spending and increasing usage of electronic content in fighter planes, tanks, and armored carriers are anticipated to augment the market growth.

The electronics and consumer goods application segment is expected to register the fastest CAGR of 4.6% over the forecast period owing to extensive demand for semiconductors for electronic appliances. Gallium arsenide, aluminum phosphate, and silicon carbide are some of the commonly used products for these applications.

The product demand is extensively increasing in various end-use applications, including electric vehicles and healthcare. In the transportation industry, motor drives include electric vehicles, forklift trucks, and locomotives, whereas non-motor drives include vehicle electronic ignition, vehicle voltage regulation, and traffic signal control.

Regional Insights

The Asia Pacific dominated the market and accounted for over 51.0% share of the global revenue in 2019 on account of a surge in demand from the consumer electronics manufacturing industry, coupled with high product penetration. Rapid urbanization and rising disposable income in the region are expected to further contribute to the expansion of consumer electronics, thereby complimenting the market growth.

The market in North America is expected to be driven by growth in demand from the end-use industries in the U.S., Canada, and Mexico. Foreign manufacturers are compelled to increase their target market by coming in close proximity to the region, which is leading to capacity expansion and acquisitions.

The market in Europe is estimated to reach USD 9.7 million by 2027. The automotive sector in the region is expected to be a key end-use market for the product. Emerging technologies such as the introduction of Artificial Intelligence, electrification of vehicles, and digitalization are the key growth drivers in the region.

Growing infrastructure development in Central and South America due to rising industrial growth is anticipated to boost the growth of the electronics industry, which is projected to fuel the product demand. Increasing investments and favorable government policies are expected to have a positive impact on market growth over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented due to the presence of technology-driven companies focusing on differentiating from a product offering standpoint. Companies are also focused on acquiring core competencies related to varied service offerings by various methods, including mergers & acquisitions, strategic alliances, and vertical integration across the value chain. Capacity expansion and acquisitions are the strategies adopted by the key players to cater to the increasing demand in the regional markets. The adoption of compound semiconductor power devices in automotive, electronics, and renewable energy systems has increased prominently over the last few years and is anticipated to gain additional momentum in the upcoming years.

Recent Developments

-

In May 2022, JX Nippon Mining & Metals USA Inc. received financial support from the Japan Bank for International Cooperation for the construction of a new facility in Arizona, USA

-

In April 2022, Shin-Etsu Chemical Co. Ltd. Announced the development of a novel thermal interface silicone rubber sheet, called the “TC-BGI Series”, for use in electric car components, in line with the advancements in high voltage gadget technology

-

In May 2022, IQE plc and Porotech entered a strategic partnership. The aim of this partnership is to scale, develop and commercialize unique wafer technology invented by Porotech, known as “PoroGaN”

-

In October 2021, IQE entered into a strategic partnership with GlobalFoundries. The focus of this long-term partnership is to design gallium nitride on silicon technologies, to be utilized in the areas of wireless and mobile infrastructure

Some of the prominent players in the compound semiconductor materials market include:

-

SK siltron Co., Ltd.

-

Sumitomo Electric Industries, Ltd.

-

JX Nippon Mining & Metals

-

FURUKAWA CO., LTD.

-

Shin-Etsu Chemical Co., Ltd.

-

SHOWA DENKO K.K.

-

Xiamen Powerway Advanced Material Co.

-

Freiberger Compound Materials GmbH

-

WIN Semiconductors Corp

-

IQE PLC

Compound Semiconductor Materials Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 35.7 million

Revenue forecast in 2027

USD 46.9 million

Growth Rate

CAGR of 3.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; South Korea; Taiwan; Brazil

Key companies profiled

Sumitomo Electric Industries, Ltd.; JX Nippon Mining & Metals; FURUKAWA CO., LTD.; Shin-Etsu Chemical Co., Ltd.; SHOWA DENKO K.K.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compound Semiconductor Materials Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global compound semiconductor materials market report on the basis of product, application, and region.

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Group IV-IV

-

Group III-V

-

Group II-VI

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Electronics & Consumer Goods

-

Aerospace & Defense

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global compound semiconductor materials market size was estimated at USD 34.8 million in 2019 and is expected to reach USD 35.7 million in 2020.

b. The compound semiconductor materials market is expected to grow at a compound annual growth rate of 3.8% from 2020 to 2027 to reach USD 46.9 million by 2027.

b. Group III-V compound semiconductor materials dominated the market and accounted for more than 52.0% share of the global revenue in 2019, on account of its wide use in transistors, LEDs, lasers, and solar cells for 5G, IoT, and smart vehicles.

b. Some of the key players operating in the compound semiconductor materials market include SK siltron Co., Ltd., Sumitomo Electric Industries, Ltd., JX Nippon Mining & Metals, FURUKAWA CO., LTD., Shin-Etsu Chemical Co., Ltd., SHOWA DENKO K.K., Xiamen Powerway Advanced Material Co., Freiberger Compound Materials GmbH, WIN Semiconductors Corp, and IQE PLC.

b. The key factors that are driving the compound semiconductor materials market include growing product demand for the production of semiconductors, coupled with increasing product penetration and rising technological innovations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.