- Home

- »

- Healthcare IT

- »

-

Computer Aided Detection Market Size & Share Report, 2033GVR Report cover

![Computer Aided Detection Market Size, Share & Trends Report]()

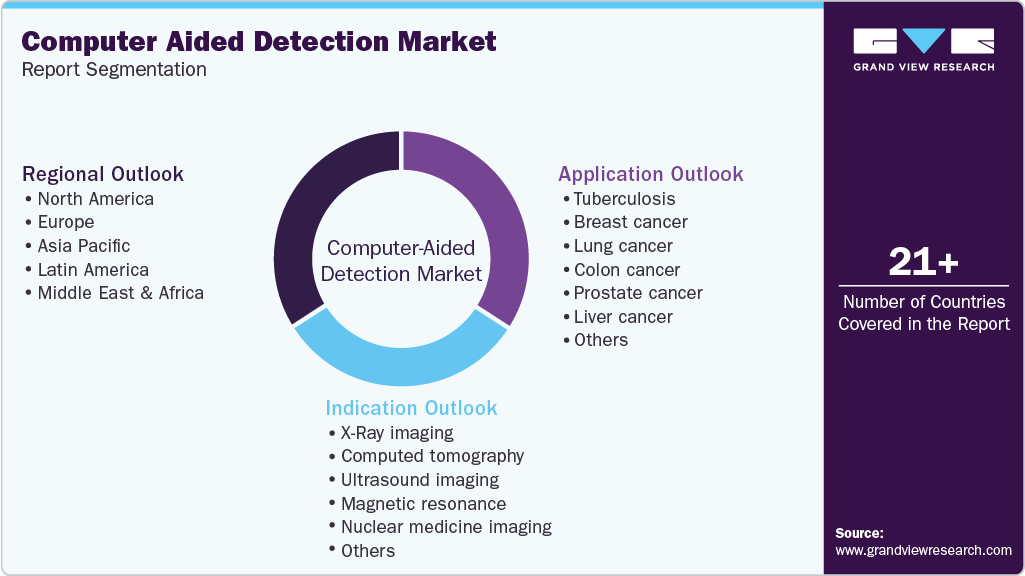

Computer Aided Detection Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Breast Cancer, Lung Cancer, Colon Cancer, Liver Cancer, Neurological Indications), By Indication, By Region, And Segment Forecasts

- Report ID: 978-1-68038-994-4

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Computer-Aided Detection Market Summary

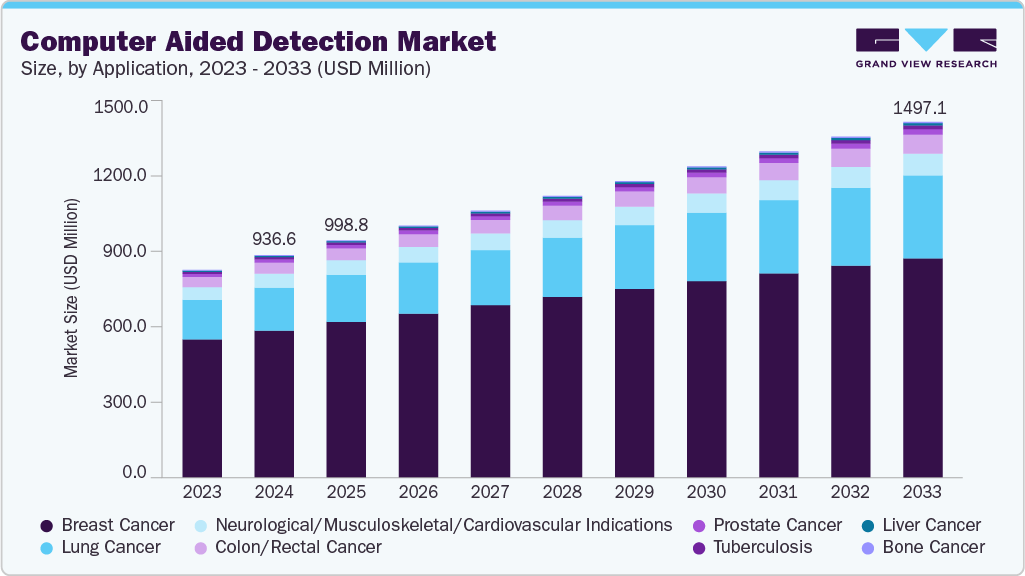

The global computer-aided detection market size was estimated at USD 936.6 million in 2024 projected to reach USD 1,497.1 million by 2033, growing at a CAGR of 5.19% from 2025 to 2033. Increasing cancer prevalence and raising awareness for regular health check-ups are the most significant drivers of the global computer-aided detection (CAD) industry.

Key Market Trends & Insights

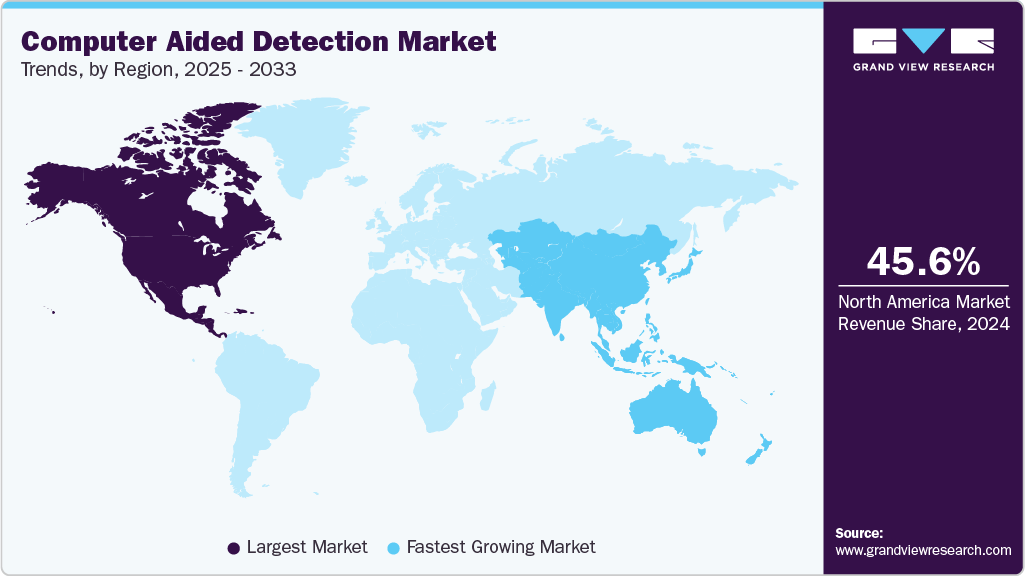

- North America dominated the computer-aided detection with a revenue share of 45.6% in 2024.

- The U.S. computer-aided detection industry is expected to continue growing significantly from 2025 to 2033.

- By product, the breast cancer segment led the market with a revenue share of over 66.13% in 2024.

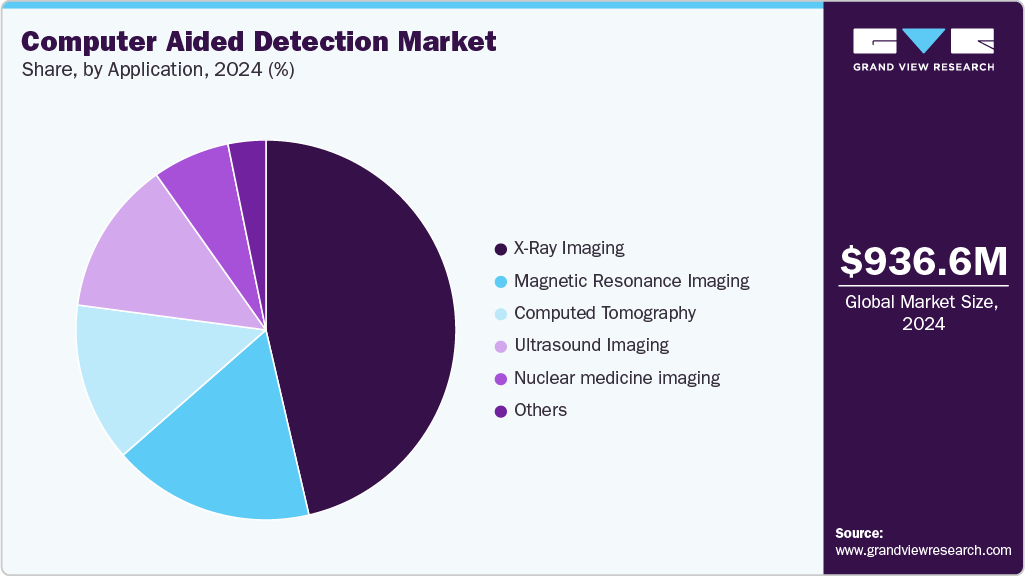

- By indication, X-ray imaging emerged as the leading segment in 2024.

Market Size & Forecast

- 2024 Market Size: USD 936.6 Million

- 2033 Projected Market Size: USD 1,497.1 Million

- CAGR (2025-2033): 5.19%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The deaths due to cancer have led the governments to take various awareness initiatives, along with the key industry contributors, to come up with breakthrough imaging technologies. According to an article published by the American Cancer Society (ACS), 42,250 women deaths from breast cancer were estimated in 2024, with 310,720 new instances of invasive breast cancer. Women aged 70 and over accounted for more than 50% of all breast cancer-related deaths. The applications of CAD in cancer detection and treatment act as a driving force for the market's growth.

Estimated number of new cases and deaths from female ductal carcinoma in situ (DCIS) and invasive breast cancer in the U.S. by age group, 2024

Age

DCIS Cases

Invasive Cases

Deaths

<40

1,360

13,180

990

40-49

8,750

37,650

2,620

50-59

13,760

67,310

6,800

60-69

17,660

89,540

10,010

70-79

11,890

69,130

10,140

80+

3,800

33,910

11,690

All

56,500

310,720

42,250

Source: American Cancer Society, Inc.

Over the last two decades, the diagnostic cancer imaging field has witnessed remarkable evolution and has affected cancer research and clinical management. Tobacco smoking is one of the most common causes of lung cancer and is a leading cause of death in the U.S. Moreover, the number of deaths in women from smoking is expected to increase rapidly over the forecast period. According to ACS, cancer accounted for 1 in 5 deaths in the U.S. Among these, smoking is responsible for 30% of all cancer fatalities and 20% of all cancer cases.

In addition, according to the World Health Organization (WHO) estimates, in 2022, cancer is the leading cause of death worldwide, resulting in approximately 10 million deaths in 2020, or nearly one in six deaths. The enhanced government initiatives to promote cancer awareness and treatment are anticipated to speed up the market's growth. For instance, the U.S. government relaunched the Cancer Moonshot in February 2022, aiming to cut the death rate from cancer by at least 50% over the following 25 years.

AI Integration in Computer-Aided Detection

The integration of artificial intelligence (AI) into computer-aided detection (CAD) systems is transforming medical imaging by enabling faster, more accurate, and data-driven diagnosis. AI algorithms, particularly machine learning and deep learning models, analyze medical images such as X-rays, CT scans, and MRIs to detect abnormalities like tumors, fractures, or lesions that may be difficult to identify manually. By highlighting suspicious regions and providing risk assessments, AI-enhanced CAD acts as a decision-support tool for radiologists, improving diagnostic accuracy and reducing human error.

Leading technology providers are actively integrating AI into their CAD solutions to strengthen competitive advantage, enhance clinical workflow efficiency, and expand their offerings across global healthcare markets. For instance, in September 2025, Olympus launched its OLYSENSE CAD/AI portfolio, a suite of cloud-based, AI-powered applications designed to aid earlier detection and improve clinical outcomes in endoscopy. The portfolio includes specific computer-aided detection (CAD) functionality for colorectal polyps during colonoscopy procedures. This portfolio represents Olympus's first step in creating an intelligent endoscopy ecosystem in the US and Europe.

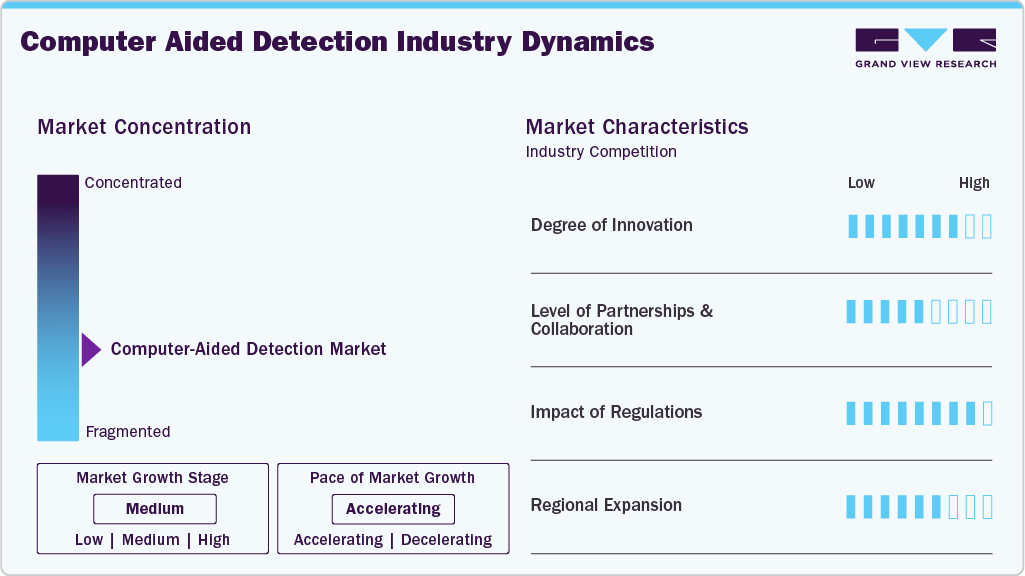

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the computer-aided detection market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation is high in the Computer-Aided Detection (CAD) industry, as AI-powered technologies are transforming medical imaging to enable more precise diagnostics, efficient workflows, and improved patient outcomes. AI-driven CAD solutions streamline image analysis, support early disease detection, and empower healthcare organizations to enhance clinical decision-making while advancing innovation in medical imaging.

The level of partnerships and collaborations in the computer-aided detection industry is significant, as technology providers, healthcare organizations, and global initiatives join forces to expand access, improve diagnostic accuracy, and accelerate innovation. Collaborative efforts are driving the development, validation, and deployment of AI-powered CAD solutions across diverse clinical settings.

For instance, the Stop TB Partnership leads the largest multi-country implementation of AI and ultra-portable X-ray technology, supporting TB detection in rural and low-resource settings. CAD products in this program are now commercially available and have been recommended by the WHO as a triage tool for TB screening since 2021, demonstrating how strategic collaborations can enhance global health outcomes while scaling the adoption of advanced CAD technologies.

Regulations greatly influence the computer-aided detection market, as approval from organizations like the FDA, CE, and WHO guarantees the safety, effectiveness, and reliability of AI-powered diagnostic tools. These regulatory standards foster trust among healthcare providers and help with market access and adoption across different regions. Although strict regulations may delay product launches, they ultimately promote quality, standardization, and broader acceptance of CAD technologies in clinical settings.

Key players in the CAD market are expanding their presence by entering emerging markets and underserved regions. They are leveraging AI-enabled imaging solutions, forming strategic partnerships, and aligning with government-led screening programs to increase adoption.

Case Study: Early Lung Cancer Detection Using Computer-Assisted Diagnosis

Background:

Lung cancer (LC) remains a leading cause of cancer-related mortality, with over 2 million new cases and 1.8 million deaths annually. Early detection significantly improves survival rates, yet most cases are diagnosed at advanced stages due to the lack of early symptoms.Objective:

To evaluate the efficacy of a computer-assisted diagnosis (CAD) algorithm in identifying pulmonary nodules in chest X-rays performed for non-respiratory reasons, potentially leading to early LC detection.Methodology:

A retrospective cohort study was conducted using 20,303 chest X-rays from 2008 that had not been examined by a radiologist. The CAD algorithm, developed using convolutional neural networks (CNNs), sorted these X-rays into four subgroups based on the probability of a pulmonary nodule: ≥98, 66, 33, and 0 percentiles. Radiologists then reviewed 250 images from each subgroup to confirm the presence of pulmonary nodules.Results:

-

High-Probability Group (≥98 percentile): Identified 58 pulmonary nodules, with 39 confirmed by radiologists. In 5 cases, LC was diagnosed with an average delay of 11 months.

- Lower-Probability Groups (66, 33, 0 percentiles): Identified 64 nodules, with fewer confirmed by radiologists. LC was not diagnosed in these groups.

Conclusion:

The CAD algorithm demonstrated a high sensitivity in identifying chest X-rays with potential pulmonary nodules, leading to early LC detection in a subset of cases. Implementing such algorithms in routine clinical practice could facilitate the identification of high-risk patients and enable timely interventions, potentially improving survival rates.Application Insights

The breast cancer segment accounted for the largest revenue share of 66.13% in 2024. The dominance of this segment can be attributed to the rising prevalence of breast cancer. For instance, according to Breastcancer.org, breast cancer is the most prevalent cancer among women in the U.S., accounting for approximately 30% of all new cancer diagnoses annually. In 2024, an estimated 310,720 women are expected to be diagnosed with invasive breast cancer, with 16% of cases occurring in women under 50 years old. However, the lung cancer segment is expected to witness the fastest growth during the forecast period.

Lung cancer is expected to be the fastest-growing segment with a CAGR of 7.34% from 2025 to 2033. According to the National Cancer Institute (NCI), in 2021, lung cancer was responsible for the highest number of cancer cases and deaths worldwide. It is estimated that there are approximately 2 million new cases and 1.8 million deaths attributed to lung cancer. Among both men and women, lung cancer ranks second most frequently diagnosed, following prostate cancer in men and breast cancer in women. The prevalence of lung cancer is escalating globally due to the enhanced availability of tobacco and increased industrialization in developing countries.

Indication Insights

The X-ray imaging segment accounted for the largest share of the computer-aided detection industry in 2024. This growth is attributed to its widespread use in routine screenings, particularly for breast and lung cancers. Advanced CAD systems enhance the accuracy of X-ray interpretations, reducing false positives and improving early detection rates. Moreover, integrating AI algorithms in X-ray imaging enhances diagnostic capabilities, driving adoption among healthcare providers. Furthermore, the Magnetic Resonance Imaging segment is expected to grow at the fastest CAGR during the forecast period.

The magnetic resonance imaging segment is expected to witness the fastest CAGR during the forecast period. This growth of the segment is supported by its high diagnostic accuracy, non-invasive nature, and growing adoption in hospitals and diagnostic centers. In addition, the rising prevalence of chronic and neurological diseases, along with technological advancements such as high-resolution and functional MRI, is contributing to the segment's growth.

Regional Insights

The computer-aided detection (CAD) market in North America held the largest revenue share of 45.6% in 2024, owing to the widespread availability of advanced diagnostic imaging tools (MRI, CT, X-ray, mammography), and many healthcare facilities with PACS and digital imaging systems, which is a precondition for CAD deployment.. In addition, industry and academic partnerships accelerate the development and deployment of AI-powered diagnostic tools. For instance, in April 2025, Leidos invested USD 10 million in a five-year partnership with the University of Pittsburgh’s Computational Pathology and AI Center of Excellence (CPACE) to develop AI-powered tools for faster detection of diseases like heart disease and cancer, aiming to reduce diagnostic turnaround times and enable earlier, more effective care management. Such collaborations strengthen CAD solutions, improving diagnostic efficiency and accelerating market growth.

U.S. Computer-Aided Detection Market Trends

The computer-aided detection industry in the U.S. is expanding as healthcare providers increasingly implement AI-powered systems to improve diagnostic accuracy and workflow efficiency. The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is driving demand for early and precise detection, making CAD tools essential in clinical practice. For instance, according to the National Cancer Institute, in 2025, an estimated 2,041,910 new cases of cancer will be diagnosed in the United States, with 618,120 deaths. CAD tools enable early and precise detection, supporting timely clinical decisions and better patient outcomes.

Europe Computer-Aided Detection Market Trends

The adoption of Computer-Aided Detection in Europe is increasing steadily as healthcare providers seek to enhance diagnostic accuracy and streamline clinical workflows. The high prevalence of cardiovascular diseases is a key factor driving demand for CAD solutions, as according to Eurostat, cardiovascular diseases caused 1.68 million deaths in the EU in 2022, representing 32.7% of all deaths. Computer-Aided Detection systems help identify these conditions at an early stage, facilitating faster interventions and improving treatment outcomes. Ongoing technological advances in image analysis and public funding for digital health initiatives are collectively accelerating CAD adoption across European hospitals and diagnostic centers.

The computer-aided detection market in the UK is driven by the expansion of national screening programs, increasing adoption of AI-enhanced CAD technologies to improve diagnostic accuracy and workflow efficiency, and supportive regulatory frameworks. For instance, in June 2023, the Westminster government launched a national targeted lung cancer screening program, following recommendations from the UK National Screening Committee (UK NSC), which screens adults aged 55-74 with a smoking history using mobile low-dose CT units. CAD systems integrated with these scans help detect lung abnormalities more efficiently, supporting early intervention and improved patient outcomes.

The Germany Computer-Aided Detection (CAD) market’s growth is fueled by increased focus on preventive health and national screening initiatives, strong technological capabilities in medical imaging, and supportive regulatory frameworks from the Federal Institute for Drugs and Medical Devices. For instance, in 2023, the National Heart Alliance (NHA) was established, a collaborative initiative of major German cardiovascular societies under the Federal Ministry of Health, aimed at promoting cardiovascular disease prevention and early detection. This highlights Germany’s dedication to structured national health efforts that directly support CAD adoption and clinical integration.

Asia Pacific Computer-Aided Detection Market Trends

The Asia Pacific computer-aided detection industry is growing due to the rising burden of cancer and cardiovascular diseases across large populations, alongside government-led screening initiatives aimed at early detection. Expanding healthcare infrastructure in countries like India, China, and Southeast Asia is improving access to advanced imaging technologies, while increasing healthcare expenditure and insurance coverage are making CAD systems more affordable.

The computer-aided detection market in Japan is driven by a rapidly aging population, rising incidence of cancers and cardiovascular diseases, and strong government support for advanced diagnostic imaging adoption. Japan’s emphasis on early detection through routine health checkups and cancer screening programs is boosting demand for CAD integration in imaging systems. For instance, in January 2024, the National Cancer Center Japan launched Project CAD, a multicenter clinical trial across 13 Asian centers to evaluate the effectiveness of AI-driven computer-aided detection (CADe) in improving lesion detection during colonoscopy for colorectal cancer screening.

The China computer-aided detection market is growing due to the rising burden of cancer and chronic diseases, government-led national screening initiatives like the Healthy China 2030 program, rapid expansion of healthcare infrastructure in urban and semi-urban areas, and substantial investment in AI-enabled diagnostic technologies. Regulatory support from the National Medical Products Administration (NMPA) further facilitates adoption. At the same time, partnerships between global medical imaging companies and local providers accelerate the deployment of CAD solutions tailored to the country’s healthcare needs.

Latin America Computer-Aided Detection Market

The computer-aided detection industry in Latin America is primarily driven by the limited availability of radiologists, which increases the need for automated diagnostic support, the expansion of private healthcare facilities catering to growing urban populations, and the adoption of telemedicine and cloud-based imaging solutions to reach underserved regions. Government-led initiatives to modernize hospital infrastructure and improve early cancer and chronic disease detection are supporting CAD integration.

Middle East & Africa Computer-Aided Detection Market

The Middle East & Africa computer-aided detection industry’s growth is driven by the rapid expansion of private healthcare networks in urban centers, increasing prevalence of lifestyle-related diseases such as diabetes and cardiovascular disorders, and limited access to experienced radiologists, which fuels demand for automated diagnostic solutions.

Key Computer Aided Detection Company Insights

The market is moderately consolidated, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Computer Aided Detection Companies:

The following are the leading companies in the computer aided detection market. These companies collectively hold the largest market share and dictate industry trends.

- EDDA Technology, Inc.

- FUJIFILM Holdings Corporation

- Hologic, Inc.

- Koninklijke Philips N.V

- Siemens Healthineers AG

- NANO-X IMAGING LTD.

- CANON MEDICAL SYSTEMS CORPORATION

- GE Healthcare

- IBM

- Riverain Technologies

- iCAD, Inc.

- Median Technologies

- Hitachi, Ltd.

- Shimadzu Analytical (India) Pvt. Ltd

- Carestream Health

- Esaote SPA

- Quibim

- Cleerly

- Planmeca

Recent Developments

-

In March 2025, Quibim's QP-Prostate CAD, an AI-based solution for automatic detection and diagnosis of clinically significant prostate cancer lesions, received FDA 510(k) clearance. This technology enhances radiologists' accuracy in prostate MRI interpretation, reduces unnecessary biopsies, and streamlines diagnostic workflows.

“Enhancing lesion detection in medical imaging has long been a critical focus, and it’s been incredibly rewarding to collaborate with our technical experts and healthcare partners to tailor Quibim’s product to meet their exact requirements. With the recent FDA clearance, we’re excited to bring this solution to the US market. The use of pathology data to train and validate our algorithm has been pivotal, and we’re eager to see the real-world impact it will have in the future.”

-David Bazaga, VP of Product at Quibim

-

In March 2025, Planmeca introduced three new CAD/CAM products at IDS 2025, the wireless Planmeca Onyx intraoral scanner, the high-resolution Planmeca Onyx Lab desktop scanner, and the high-precision Planmeca Creo X 3D printer. These products integrate seamlessly with Planmeca’s software and milling units to enhance dental workflows both chairside and in laboratories.

-

In February 2023, ZimVie launched the RealGUIDE CAD and FULL SUITE software modules in Japan, offering a cloud-based integrated digital dentistry platform that streamlines implant planning, guided surgery, and restorative design for efficient and precise dental workflows. The launch also includes the Implant Concierge service, a virtual outsourcing solution for simplified implant treatment planning and surgery.

“The release of our CAD module and its integration with our FULL SUITE marks a turning point for digital dentistry. Our digital platform helps users streamline dental practices and labs of all sizes, which can help contribute to successful patient outcomes and provide the foundation for future digital workflow innovations in the ZimVie dental portfolio.”

- Indraneel Kanaglekar, SVP and President of ZimVie Dental.

Computer Aided Detection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 998.8 million

Revenue forecast in 2033

USD 1,497.1 million

Growth rate

CAGR of 5.19% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

EDDA Technology, Inc.; FUJIFILM Holdings Corporation; Hologic, Inc.; Koninklijke Philips N.V.; Siemens Healthineers AG; NANO-X IMAGING LTD.; CANON MEDICAL SYSTEMS CORPORATION; GE Healthcare; IBM; Riverain Technologies; iCAD, Inc.; Median Technologies; Hitachi, Ltd.; Shimadzu Analytical (India) Pvt. Ltd; Carestream Health; Esaote SPA; Quibim; Cleerly; Planmeca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer-Aided Detection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global computer-aided detection market report based on application, indication, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Tuberculosis

-

Breast cancer

-

Lung cancer

-

Colon cancer

-

Prostate cancer

-

Liver cancer

-

Bone cancer

-

Neurological/Musculoskeletal/Cardiovascular indications

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

X-Ray imaging

-

Computed tomography

-

Ultrasound imaging

-

Magnetic resonance

-

Nuclear medicine imaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.