- Home

- »

- Next Generation Technologies

- »

-

Computer Aided Engineering Market, Industry Report, 2033GVR Report cover

![Computer Aided Engineering Market Size, Share & Trends Report]()

Computer Aided Engineering Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud-based), By End Use (Automotive, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-802-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Computer Aided Engineering Market Summary

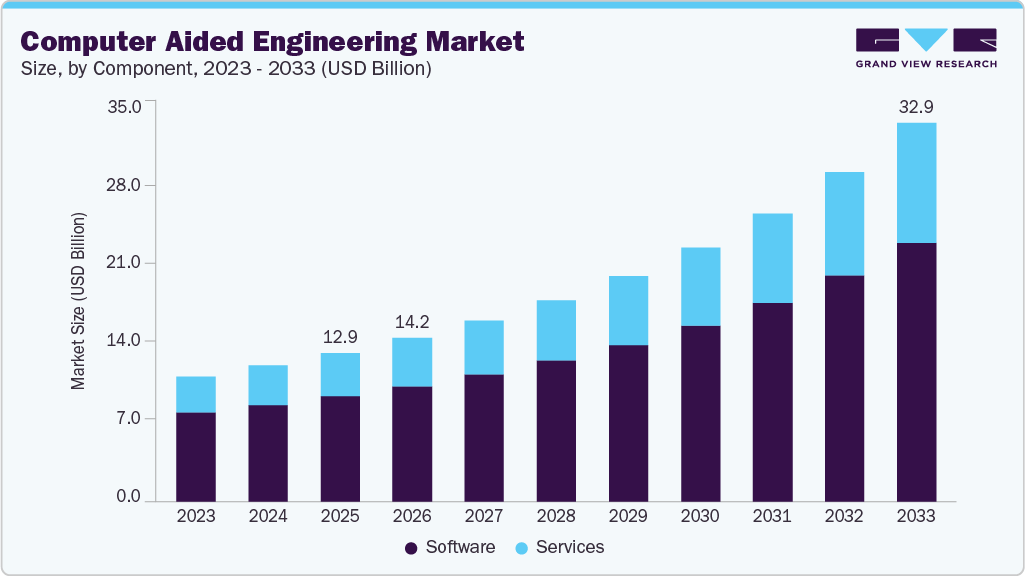

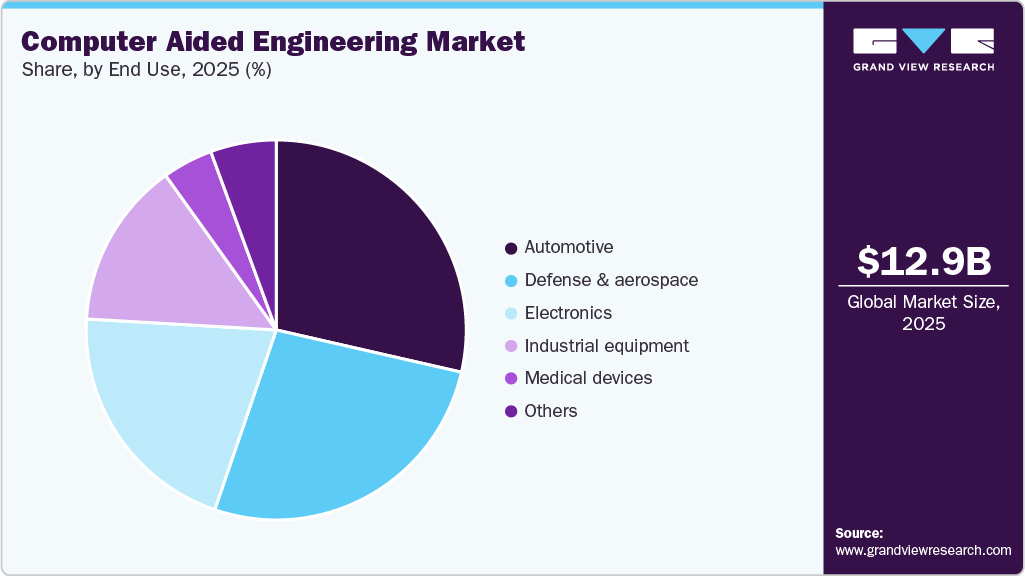

The global computer aided engineering market size was estimated at USD 12.90 billion in 2025 and is projected to reach USD 32.87 billion by 2033, growing at a CAGR of 12.8% from 2026 to 2033, driven by the rising need for sophisticated simulation capabilities and design optimization in sectors including automotive, aerospace, and electronics. The rapid integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing into computer-aided engineering (CAE) solutions is accelerating growth across the CAE industry.

Key Market Trends & Insights

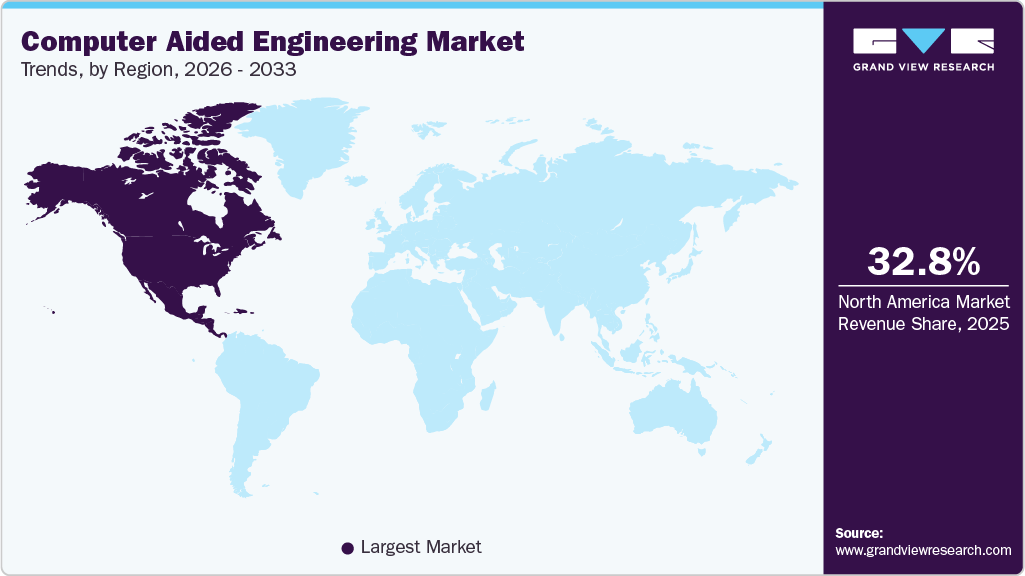

- North America computer aided engineering market dominated the global industry with the largest revenue share of 32.8% in 2025.

- The computer aided engineering industry in the U.S. is expected to grow significantly over the forecast period.

- By component, software led the market and held the largest revenue share of 70.9% in 2025.

- By deployment, the on-premise segment held the dominant position in the market and accounted for the largest revenue share in 2025.

- By end use, the defense & aerospace segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 12.90 Billion

- 2033 Projected Market Size: USD 32.87 Billion

- CAGR (2026-2033): 12.8%

- North America: Largest market in 2025

AI and ML enhance product development by enabling predictive analytics, automated design optimization, and data-driven decision-making, thereby reducing manual errors and shortening development cycles. Cloud-enabled CAE platforms further support global collaboration, provide on-demand access to high-performance computing, and eliminate the need for significant capital investments in local infrastructure. As a result, access to sophisticated simulation tools is expanding beyond large enterprises to include a growing number of small and medium-sized businesses.Rising emphasis on sustainability and resource efficiency is also strengthening market momentum. Organizations across sectors are required to design environmentally responsible products, minimize material consumption, and improve overall energy performance. CAE software enables engineers to model and test materials, structures, and systems under diverse operating conditions, facilitating the development of lighter, more durable, and energy-efficient solutions. Regulatory requirements related to emissions, product safety, and reliability further encourage broader CAE adoption to ensure compliance. For instance, in March 2025, NVIDIA announced that CAE applications from Ansys, Altair, Cadence, Siemens, and Synopsys can achieve up to 50× faster performance on the NVIDIA Blackwell platform, enabling industries such as automotive and aerospace to accelerate development timelines and enhance design accuracy while reducing costs.

The growing use of digital twins and IoT-driven engineering workflows is adding another dimension to CAE demand. By leveraging real-time operational data and creating virtual counterparts of physical assets, engineers can continuously evaluate performance, anticipate failures, and refine system designs more effectively. As industries increasingly embrace connected products and smart manufacturing ecosystems, the integration of IoT data with CAE tools becomes essential for advanced simulations, predictive maintenance, and system-wide optimization. Together, these technological advancements and evolving industry requirements are solidifying CAE’s role as a foundational element of modern engineering innovation worldwide.

Component Insights

The software segment dominated the market and accounted for a revenue share of 70.9% in 2025, driven by the increasing complexity of modern engineering designs and the expanding requirement for high-fidelity simulation tools. Organizations in automotive, aerospace, electronics, and industrial machinery are turning to advanced CAE platforms to analyze intricate physical behaviors, including fluid flow, structural response, and thermal dynamics. The push to minimize prototyping expenses, shorten development timelines, and enhance product reliability is reinforcing the adoption of these technologies, positioning CAE as an essential component of contemporary engineering processes. Within software, the segment is further categorized into Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), multibody dynamics, and optimization and simulation solutions.

The services segment is anticipated to grow at the highest CAGR during the forecast period due to the rising trend of outsourced CAE and engineering analysis services. Organizations, particularly in automotive, aerospace, and heavy machinery sectors, are leveraging external CAE service providers to manage peak workloads, handle large-scale simulations, or access expertise in niche areas such as computational fluid dynamics (CFD), finite element analysis (FEA), and thermal analysis. This outsourcing model reduces infrastructure costs and allows companies to focus on core product development while maintaining high simulation accuracy. Based on software, the segment is further bifurcated into Development Service, and Training, Support & Maintenance.

Deployment Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2025, driven by organizations’ need for high security and data control. Industries such as defense, aerospace, and automotive often deal with sensitive designs and proprietary intellectual property, making on-premise CAE solutions attractive. Hosting software and simulation data locally ensures that critical design information remains within the organization’s firewall, reducing the risk of cyber threats and compliance violations while maintaining full control over access and usage.

The cloud-based segment is expected to grow at a significant CAGR during the forecast period due to the enhanced collaboration and remote accessibility offered by cloud platforms. Engineering teams often operate across multiple locations or time zones, and cloud-based CAE solutions allow seamless sharing of simulation data, real-time collaboration on projects, and centralized storage of design models. This reduces delays, ensures version control, and facilitates faster decision-making, making cloud adoption increasingly attractive to global organizations.

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share in 2025, driven by the increasing demand for lightweight and fuel-efficient vehicles. Automakers are under pressure to reduce vehicle weight to improve fuel economy and meet stringent emission regulations. CAE tools enable engineers to simulate material performance, structural integrity, and crashworthiness, allowing them to design lighter yet safer vehicles without extensive physical prototyping, thereby accelerating development timelines and reducing costs

The defense and aerospace segment is expected to grow at a significant CAGR over the forecast period owing to the growing emphasis on lightweight materials and fuel efficiency. Aerospace and defense organizations are investing heavily in composite materials, alloys, and novel structural designs to improve performance and reduce fuel consumption. CAE software allows engineers to simulate the behavior of these materials under operational stresses, optimize designs for weight reduction, and maintain structural safety, which is critical in both commercial and military aviation.

Regional Insights

North America computer aided engineering market dominated the global market with the largest revenue share of 32.8% in 2025 due to the rapid adoption of high-performance computing (HPC) and simulation-driven design in engineering and manufacturing sectors. Companies leverage advanced simulation tools to accelerate product development, reduce prototyping costs, and improve design accuracy, particularly in aerospace, automotive, and defense industries.

U.S. Computer Aided Engineering Market Trends

The computer aided engineering market in the U.S. is expected to grow significantly at a CAGR of 11.4% from 2026 to 2033, due to the integration of AI and machine learning into CAE software, enabling predictive modeling, optimization, and automated design testing. This allows engineers to simulate complex scenarios faster, reducing time-to-market for innovative products.

Europe Computer Aided Engineering Market Trends

The computer aided engineering market in Europe is anticipated to register considerable growth from 2026 to 2033 due to stringent environmental and safety regulations, particularly in the automotive and aerospace sectors, driving the adoption of simulation software for emission reduction, crash analysis, and energy-efficient design.

The UK computer aided engineering market is expected to grow rapidly in the coming years as supported by government-backed R&D incentives and smart manufacturing initiatives, which encourage industries to implement CAE solutions for digital twin creation, product optimization, and Industry 4.0 adoption.

The computer aided engineering market in Germany held a substantial market share in 2025 due to the automotive industry’s focus on electric vehicle (EV) and autonomous vehicle development, requiring sophisticated simulation for battery design, thermal management, and autonomous system validation.

Asia Pacific Computer Aided Engineering Market Trends

The computer aided engineering market in Asia Pacific held a significant share in the global market in 2025, due to rapid industrialization and infrastructure development, prompting manufacturers to adopt CAE tools to improve design quality, reduce production costs, and accelerate project timelines across electronics, machinery, and construction sectors.

The Japan computer aided engineering market is expected to grow rapidly in the coming years, owing to the precision engineering and robotics innovation, where CAE tools are essential for designing high-precision machinery, automation systems, and advanced consumer electronics with minimal trial-and-error.

The computer aided engineering market in China held a substantial market share in 2025, due to government-supported technological modernization and Made in China 2025 initiatives, pushing domestic manufacturers to implement CAE for advanced manufacturing, product quality improvement, and competitiveness in global markets.

Key Computer Aided Engineering Company Insights

Key players operating in the computer aided engineering market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Computer Aided Engineering Companies:

The following are the leading companies in the computer aided engineering market. These companies collectively hold the largest market share and dictate industry trends.

- Altair Engineering

- ANSYS, Inc.

- Autodesk, Inc.

- Bentley Systems, Inc.

- Dassault Systemes

- ESI Group

- Exa Corporation

- Hexagon AB

- Keysight Technologies

- Siemens

Recent Developments

-

In April 2025, ANSYS, Inc. announced expansion of its collaboration with TSMC, a Taiwan-based semiconductor manufacturing company, to advance next-generation semiconductor design, introducing upgraded AI-enabled workflows for radio-frequency (RF) design migration and photonic integrated circuits (PICs). The company confirmed new tool certifications that support TSMC’s latest process technologies, including the newly introduced N3C node built on the existing N3P design foundation. Together, Ansys and TSMC aim to strengthen 3D-IC multiphysics optimization and accelerate development cycles for AI and high-performance computing (HPC) chips, supporting faster market deployment of advanced semiconductor solutions.

-

In February 2025, Dassault Systèmes and Volkswagen Group announced a long-term partnership to modernize Volkswagen’s digital vehicle-development environment through the deployment of the 3DEXPERIENCE platform. The platform will serve as a unified foundation for product design and engineering, incorporating advanced simulation capabilities through integrated tools such as SIMULIA for finite element analysis, computational fluid dynamics, and multiphysics modeling. This collaboration is intended to enhance development efficiency, improve cross-functional workflows, and support the creation of next-generation vehicles across the Volkswagen portfolio.

-

In September 2024, Bentley Systems, Inc. acquired 3D geospatial company Cesium, aiming to strengthen its iTwin platform and advance digital twin development for infrastructure projects. The integration of Cesium’s 3D geospatial technology and Cesium ion SaaS platform with iTwin’s engineering models will enable a unified solution that combines geospatial, engineering, IoT, subsurface, reality, and enterprise data, offering developers a more comprehensive and data-rich platform for designing, monitoring, and managing complex infrastructure systems.

Computer Aided Engineering Market Report Scope

Report Attribute

Details

Market size in 2026

USD 14.19 billion

Revenue forecast in 2033

USD 32.87 billion

Growth rate

CAGR of 12.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

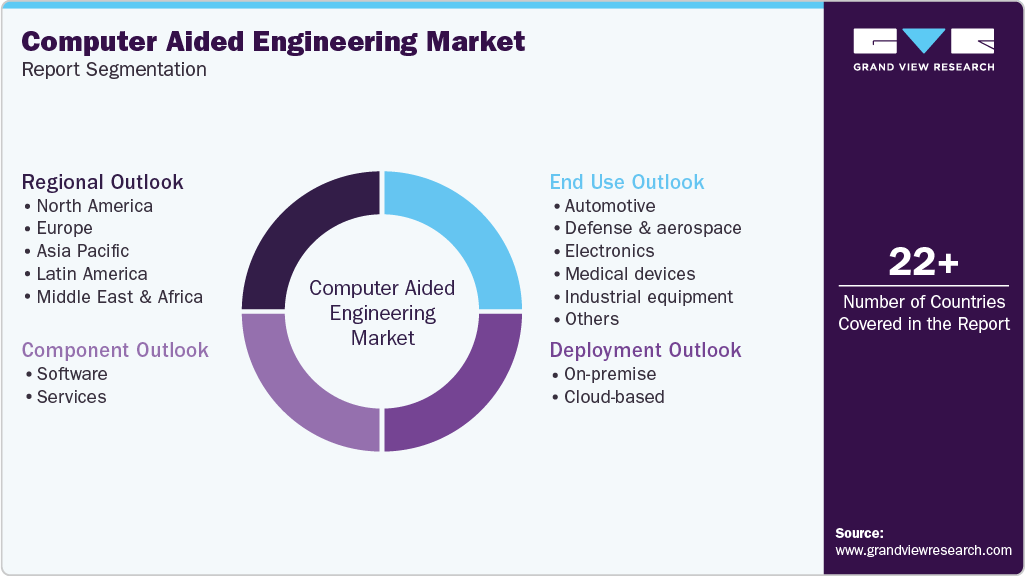

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Altair Engineering; ANSYS, Inc.; Autodesk, Inc.; Bentley Systems, Inc.; Dassault Systemes; ESI Group;

Exa Corporation; Hexagon AB; Keysight Technologies, Siemens

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Aided Engineering Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global computer aided engineering market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Finite Element Analysis (FEA)

-

Computational Fluid Dynamics (CFD)

-

Multibody dynamics

-

Optimization & simulation

-

-

Services

-

Development Service

-

Training, Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud-based

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Defense & aerospace

-

Electronics

-

Medical devices

-

Industrial equipment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computer-aided engineering market size was estimated at USD 12.90 billion in 2025 and is expected to reach USD 14.19 billion in 2026.

b. The global computer-aided engineering market is expected to grow at a compound annual growth rate of 12.8% from 2026 to 2033 to reach USD 32.87 billion by 2033.

b. The Finite Element Analysis segment dominated the global computer-aided engineering market and accounted for a market share of more than 50.0%.

b. The automotive end-use industry led the global computer-aided engineering market with a share of 28.6%, driven by the increasing demand for lightweight and fuel-efficient vehicles. Automakers are under pressure to reduce vehicle weight to improve fuel economy and meet stringent emission regulations .

b. The on-premise segment dominated the global computer-aided engineering market and accounted for a market share exceeding 85.0%, driven by organizations’ need for high security and data control. Industries such as defense, aerospace, and automotive often deal with sensitive designs and proprietary intellectual property, making on-premise CAE solutions attractive.

b. North America dominated the global market with the largest revenue share of 32.8% in 2025 due to the rapid adoption of high-performance computing (HPC) and simulation-driven design in the engineering and manufacturing sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.