- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Decorative Coatings Market Size And Share Report, 2030GVR Report cover

![Decorative Coatings Market Size, Share & Trends Report]()

Decorative Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Primer, Enamel, Emulsion, Others), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-684-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Decorative Coatings Market Size & Trends

The global decorative coatings market size was valued at USD 83.91 billion in 2023 and is expected to expand at a CAGR of 4.8% from 2024 to 2030. The increasing global construction output in emerging economies such as China, India, and others drives market growth. These developmental activities result in increased construction and, consequently, the need for decorative coatingss in residential and commercial buildings. Rising urbanization, especially in developing nations, is resulting in higher rates of demand for shelter and infrastructure development. As urban populations grow, there is a corresponding rise in the market for decorative coatingss that enhance aesthetic appeal while protecting environmental factors.

The decorative coatingss industry can be classified as a subsector of the paints and coatings industry. It is involved in formulating, manufacturing, and selling coatings designed mainly for aesthetic purposes. These coatings are applied to a wide range of surfaces, such as walls and ceilings, furniture, buildings and architectural structures, automobiles, consumer products, and more. The primary objective of decorative coatingss is to enhance the visual appeal of surfaces, transforming them into aesthetically pleasing and functional spaces or products.

With increasing disposable incomes, consumers are more willing to invest in home improvement and decoration projects. This trend is particularly evident in developing regions where improved financial conditions enable households to spend on quality decorative coatingss. There is a growing emphasis on sustainability within the construction sector, leading to increased demand for eco-friendly products that comply with stringent regulatory standards regarding volatile organic compounds (VOCs). Manufacturers are responding by developing low-VOC or VOC-free decorative coatingss. For instance, In the U.S., the Architectural Coating Rule for Volatile Organic Compounds (VOC), published by the Environmental Protection Agency (EPA) under the Clean Air Act, sets limits on the number of VOCs in various categories of architectural coatings to reduce air pollution. Also, coatings must have specific labeling, including VOC content and date of manufacture.

Product Insights

The emulsion dominated the market and accounted for a revenue share of 41.3% in 2023. The factor driving the dominance of emulsion paints is its environmentally friendly characteristics. Emulsion paints are water-based, meaning they contain fewer VOCs than solvent-based alternatives. This aligns with increasing regulatory pressures and consumer demand for sustainable and healthy & safe products. Governments worldwide are implementing stricter regulations on VOC emissions, making water-based emulsions more compliant for manufacturers and consumers.

The primer is expected to grow at a significant CAGR from 2024 to 2030. The growing emphasis on aesthetics in residential and commercial spaces has increased demand for high-quality decorative coatingss. Primers play a crucial role in enhancing the final appearance of topcoats by providing a smooth surface, improving adhesion, and ensuring uniform color application. As consumers seek visually appealing environments, the importance of primers increases.

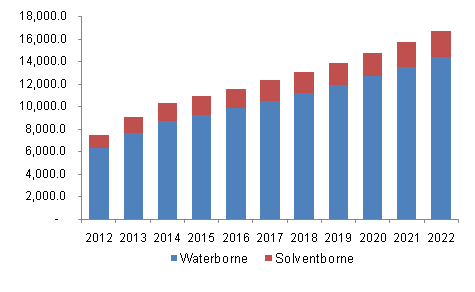

Technology Insights

The water-borne coatings dominated the market and accounted for the largest revenue share in 2023 due to increasing government regulations and growing consumer awareness regarding sustainability & eco-friendliness. Governments worldwide are implementing stricter laws regarding VOC emissions due to their harmful effects on air quality and human health. Water-borne coatings typically contain lower levels of VOCs compared to solvent-based alternatives, making them more compliant with these regulations. In addition, there is a growing consumer awareness regarding sustainability and eco-friendliness. Consumers tend to prefer products with a reduced environmental impact as they become more environmentally conscious.

Powder coating is expected to grow at the fastest CAGR during the forecast period. Powder coatings are used on objects such as doors, windows, facades, and furniture to enhance their surface visually and mechanically. Moreover, powder-coated surfaces exhibit superior durability compared to traditional paint finishes. They are more resistant to chipping, scratching, fading, and wearing than their liquid counterparts. This enhanced performance makes powder coating appealing for products exposed to harsh environments or heavy use, such as automotive parts and outdoor furniture.

Application Insights

The residential segment dominated the market and accounted for the largest revenue share in 2023 due to increasing consumer awareness regarding home aesthetics. Homeowners are more inclined to invest in their living spaces, seeking products that enhance beauty and functionality. The trend towards personalization and unique interior designs has led consumers to explore a variety of decorative coatingss, including paints, wallpapers, and finishes that reflect their styles. In addition, the expansion of the real estate sector, particularly in emerging economies, has significantly contributed to the demand for decorative coatingss.

The commercial segment is expected to grow at the fastest CAGR during the forecast period. The primary driver of growth in the decorative coatings market is rapid urbanization. As more people move into urban areas, there is an increased need for residential and commercial buildings, which drives demand for decorative coatingss. Infrastructure development projects, such as roads, bridges, and public facilities, also require high-quality coatings that enhance aesthetics and provide protection against environmental factors. In commercial spaces, aesthetic appeal is crucial in attracting customers and improving brand image. Businesses increasingly invest in interior and exterior designs that utilize decorative coatingss to create visually appealing environments, increasing the demand for decorative coatingss.

Regional Insights

North America decorative coatings market held a significant revenue share in the global market in 2023 due to increasing construction activities, evolving consumer preferences towards aesthetics and sustainability, technological innovations, urbanization trends, government regulations promoting eco-friendly practices, DIY culture expansion, and heightened health awareness. Government policies promoting energy efficiency and sustainability in construction practices have propelled the growth of sustainable decorative coatingss. According to the World Bank Group, North America has 83% urban population, which propels the demand for decorative coatingss as cities expand with increasing housing developments and urban renewal projects.

U.S. Decorative Coatings Market Trends

The U.S. decorative coatings market held a significant market share in North America in 2023. Increasing environmental concerns have increased the demand for eco-friendly and sustainable decorative coatingss. Consumers are becoming more conscious of the environmental impact of their choices, prompting manufacturers to develop low-VOC and water-based coatings that align with green building standards. This trend caters to consumer preferences and complies with regulatory requirements to reduce environmental footprints. Moreover, Innovations in coating technologies have significantly enhanced product performance characteristics such as durability, washability, and resistance to fading or staining.

Europe Decorative Coatings Market Trends

Europe decorative coatings market held a significant market share in 2023 due to growing awareness about environmental sustainability and human safety. Also, government regulations force manufacturers to make sustainable products. For instance, the European Union (EU) published a directive setting a maximum VOC content limit for paints and vehicle refinishing products. Also, it directs that products must be labeled with their VOC content and comply with the directive’s specifications. Moreover, with increasing disposable incomes across various European nations, consumers are increasingly willing to invest in home improvement projects that include painting and decorating their living spaces.

The UK decorative coatings market held a substantial market share in 2023. The ongoing urbanization trend in the UK is another significant driver for the decorative coatings market. According to the World Bank Group, in 2023, around 85% of the population will live in urban areas in the UK. As more people move into urban areas, there is an increased demand for residential buildings and commercial spaces such as offices and retail outlets. This urban expansion necessitates extensive use of decorative coatingss to meet both functional requirements and aesthetic standards.

Asia Pacific Decorative Coatings Market Trends

The Asia Pacific decorative coatings market dominated the market with the largest revenue share of 38.7% in 2023. The rapid economic growth experienced by many countries in the Asia Pacific region, particularly China and India, has led to increased construction activities. As urban areas expand and populations grow, the demand for residential and commercial buildings is heightened. This surge in construction directly correlates with an increased need for decorative coatingss, essential for aesthetic appeal and protection against environmental factors. Moreover, the ongoing migration from rural areas to cities increases housing demands. New residential developments necessitate various types of coatings for interiors and exteriors.

India decorative coatings market is expected to grow significantly owing to the competitive landscape within India’s decorative coatings market fostering innovation as companies strive to differentiate themselves through product offerings and marketing strategies. Major players invest heavily in research & development (R&D) activities to create advanced formulations that meet evolving consumer needs while maintaining cost-effectiveness.

MEA Decorative Coatings Market Trends

The MEA decorative coatings market is expected to grow significantly from 2024 to 2030. This growth can be attributed to economic, demographic, and technological factors driving demand for decorative coatingss in various applications, including residential, commercial, and industrial sectors. As populations migrate from rural areas to urban centers, there is an increasing demand for housing and infrastructure development. Governments in these regions are investing heavily in construction projects, which include residential buildings, commercial spaces, and public infrastructure. Increasing bilateral pacts between nations for economic development is driving the growth in infrastructure development, leading to the demand for decorative coatingss.

Key Decorative Coatings Company Insights

Some of the key companies in the decorative coatings market are The Sherwin-Williams Company, PPG Industries, Akzo Nobel N.V., BASF SE, Asian Paints and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Asian Paints manufactures, sells, and distributes paints, coatings, and products related to home décor and bath fittings. It offers a wide range of products, including interior and exterior wall paints and wood and metal finishes. Royale Play, Tractor, and Premium Emulsion are some of its prominent offerings in interior coatings.

-

BASF SE specializes in chemicals. The company is grouped into various segments, such as materials, chemicals, surface technologies, industrial solutions, nutrition and care, and agricultural solutions. It develops, produces, and markets a high-quality range of innovative and sustainable automotive OEM and refinish coatings, decorative paints, and surface-applied treatments for metal, plastic, and glass substrates across various industries.

Key Decorative Coatings Companies:

The following are the leading companies in the decorative coatings market. These companies collectively hold the largest market share and dictate industry trends.

- The Sherwin-Williams Company

- PPG Industries

- Akzo Nobel N.V.

- BASF SE

- Jotun

- Asian Paints

- Kansai Paint Co., Ltd.

- RPM International

- Masco Corporation

- Axalta Coating Systems Ltd.

- Nippon Paint (India) Private Limited

Recent Developments

-

In February 2024, Asian Paints' ColourNext launched its "Colour of the Year," named Terra, which focused on themes of soil and sustainability. The company also presented forecast stories that explored concepts like deep Indofuturism and "goblin mode," reflecting contemporary cultural trends. This initiative aimed to inspire consumers and designers in color choices for the upcoming year.

-

In April 2023, Sherwin-Williams signed an agreement to sell its China architectural paint business to Nippon Paint Holdings Co., Ltd. for approximately $1.2 billion. The divestiture allows Sherwin-Williams to focus on its core business and growth opportunities in other markets.

Decorative Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 87.69 billion

Revenue forecast in 2030

USD 116.40 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilo Tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, UAE, Oman, Kuwait and Qatar.

Key companies profiled

The Sherwin-Williams Company; PPG Industries; Akzo Nobel N.V.; BASF SE; Jotun; Asian Paints; Kansai Paint Co.,Ltd.; RPM International; Masco Corporation; Axalta Coating Systems Ltd. and Nippon Paint (India) Private Limited.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decorative Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the decorative coatings report based on product, technology, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Primer

-

Enamel

-

Emulsion

-

Others

-

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Water-borne Coatings

-

Solvent-borne Coatings

-

Powder Coatings

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Infrastructure

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.