- Home

- »

- Medical Devices

- »

-

Dental Diagnostic And Surgical Equipment Market Report, 2028GVR Report cover

![Dental Diagnostic And Surgical Equipment Market Size, Share & Trends Report]()

Dental Diagnostic And Surgical Equipment Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Dental Diagnostic Equipment, Dental Surgical Equipment), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-645-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

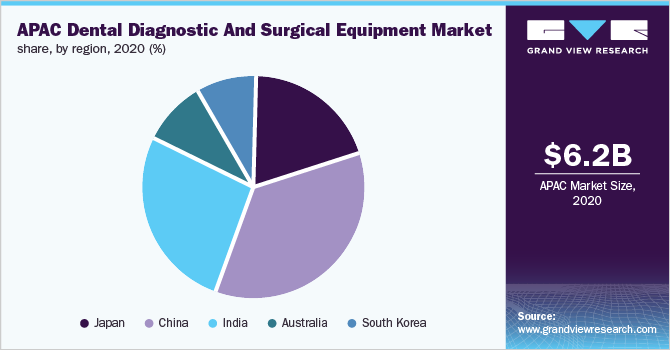

The global dental diagnostic and surgical equipment market size was estimated at USD 6.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2021 to 2028. Rising inclination towards junk food consumption and improper eating habits lead to multiple dental conditions, which, in turn, augment market growth. Rising demand for cosmetic dentistry is another factor considered to be a major driver of the market. Additionally, geriatric and pediatric populations are particularly prone to dental disorders and are positively affecting the market growth. Geriatric patients suffer from various dental conditions such as tooth decay, oral candidiasis, and xerostomia, which is driving the growth of the market for dental diagnostic and surgical equipment. The market is further expected to witness propelling growth during the next seven years due to the continuous development of new technologies and the rising number of qualified dentists. Changing demographics like productivity growth, living standards, savings rates, and investment will result in growth in the market.

The market is likely to be driven by technological advancements such as the introduction of CAD/CAM technology and 3D imaging. CAD technology aids in the creation of better and faster dental prostheses. COVID-19 is identified to have a negative impact on the market. The Irish Dental Association mentioned that about 75.0% of dental practitioners are expecting a financial loss of over 70.0% during the outbreak. From the initial shutdown in March 2020 through today, over a year later, the COVID-19 pandemic has had a significant impact on the dentistry profession. According to our secondary and primary sources, the largest impact of the pandemic on dental practices has been observed in Canada with a significant drop in revenue. However, through digital platforms, the dental equipment market has seen a significant increase in revenue, which is a positive element driving the market for dental diagnostic and surgical equipment.

Dental disorders are among the most common problems across the world. The market for dental diagnostic and surgical equipment is anticipated to develop as the incidence of oral disease rises and substantial shifts in oral care needs occur. Patient preference for painless diagnoses and treatment further promotes the adoption of new technologies and products in this market. Rapid and accurate diagnosis is made possible by technological advancements in the fields of imaging and radiology.

Lately, dental diagnostic devices are getting attention owing to their extensive use within forensic sciences. The rising number of patients with a cavity, carcinoma, tooth erosion, tooth sensitivity, gum disease, and increasing awareness about hygiene among people drive the worldwide market. The increasing geriatric population that is prone to various types of dental infection, poor diet, and rapid development within the medical devices market are fueling the market expansion. However, inadequate reimbursement policies and the high cost of devices may hinder market growth.

Product Insights

The dental surgical equipment segment dominated the market for dental diagnostic and surgical equipment and held the largest revenue share of 51.0% in 2020. Oral surgery is a part of many dental practices where the practice focuses on general dentistry and performs some surgical procedures. Extractions, bone grafts, and implant placements are included as dental surgeries and each of these procedures requires specialized clinical training and surgical equipment particularly designed for the technique. Not all surgical procedures require systems and equipment that can’t be used for other dental procedures; specialized surgical equipment is designed to make surgical procedures safer, more efficient, more comfortable, and ultimately more successful.

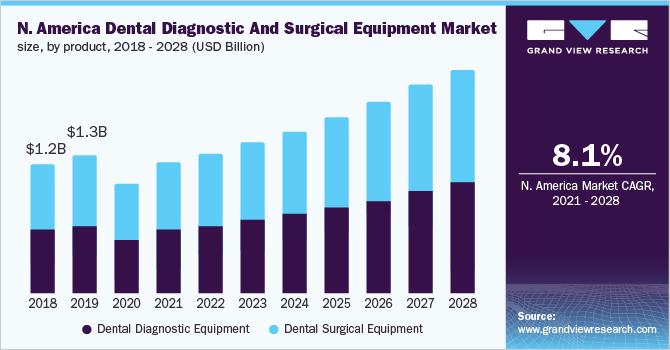

The dental surgical equipment segment is expected to witness a CAGR of over 8.1% over the forecast period. The growth in the number of dentists and dental practices offers immense growth opportunities which can reduce the risk factor of an increase in dental diseases. Moreover, the favorable reimbursements framework acts as one of the key trends for the growth of the segment during the forecast period.

Regional Insights

North America dominated the dental diagnostic and surgical equipment market and accounted for the largest revenue share of over 38.0% in 2020. According to a study conducted by the Canadian Academy of Health Sciences (CAHS) 2014, high costs are a big worry, and Canada's most vulnerable residents have the highest rates of toothache, decay, and disease; nonetheless, they have restricted access to much-needed healthcare amenities. The cost of therapy at hospitals and the majority of surgeon services are paid by publicly financed healthcare systems. According to the Canadian Academy of Health Sciences (CAHS) report 2014, consumers pay for 95% of dental treatment out of pocket or through private dental insurance, and it is delivered in private dentist offices. The remaining 5% is covered by provincial and federal public health insurance, which is designed to support the most vulnerable people.

In Asia Pacific, the market for dental diagnostic and surgical equipment is predicted to grow fast over the forecast period due to infrastructural improvements in dental facilities and clinics, attractive insurance policies, rising population lifestyle changes, and the presence of market growth-oriented regulatory policies.

Key Companies & Market Share Insights

The competitive landscape is strengthened by service quality and expertise in carrying out complicated dental practices. Moreover, the competition between key players will turn intense in the coming years as they are focusing more on geographical expansion, strategic collaborations, and partnerships through mergers and acquisitions. Some of the prominent players in the dental diagnostic and surgical equipment market include:

-

Carestream Health

-

Danaher Corporation

-

KaVo Kerr

-

Biolase Technologies

-

Zolar Dental Laser

-

3M Company

-

Ivoclar Vivadent AG

-

American Medicals

-

Henry Schein

-

Midmark Diagnostic Group

Dental Diagnostic And Surgical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 7.3 billion

Revenue forecast in 2028

USD 12.8 billion

Growth rate

CAGR of 8.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key Companies profiled

Carestream Health; Danaher Corporation; KaVo Kerr; Biolase Technologies; Zolar Dental Laser; 3M Company; Ivoclar Vivadent AG; American Medicals; Henry Schein; Midmark Diagnostic Group

Customization scope

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global dental diagnostic and surgical equipment market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Dental Diagnostic Equipment

-

CAD/CAM Systems

-

Instrument Delivery systems

-

Extra oral Radiology Equipment

-

Intra Oral Radiology Equipment

-

Cone Beam Computed Tomography (CBCT)

-

-

Dental Surgical Equipment

-

Dental Laser

-

Dental handpieces

-

Dental Forceps & Pliers

-

Curettes and Scalers

-

Dental Probes

-

Dental Burs

-

Electrosurgical Equipment

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Dental Diagnostics And Surgical Equipment market size was estimated at USD 6.1 billion in 2020 and is expected to reach USD 7.3 billion in 2021.

b. The global Dental Diagnostics And Surgical Equipment market is expected to grow at a compound annual growth rate of 8.2% from 2021 to 2028 to reach USD 12.7 billion by 2028.

b. North America dominated the Dental Diagnostics And Surgical Equipment market with a share of 38.4% in 2020. This can mainly be attributed to factors like high personal disposable income & expenditure on healthcare, availability of certified professionals, well-built health care infrastructure, and easy access to the services.

b. Some key players operating in the Dental Diagnostics And Surgical Equipment market include American Medicals, 3M Company, Zolar Dental Laser, Danaher Corp, Midmark Diagnostic Group, Planmeca OY, and KaVo Kerr.

b. Key factors that are driving the Dental Diagnostics And Surgical Equipment market growth include Growing consumer awareness, disposable income, geriatric, and pediatric populations that are particularly prone to dental disorders. It is also likely to be driven by technological advancements that aids in the creation of better and faster dental prostheses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.