- Home

- »

- Medical Devices

- »

-

Dental X-ray Market Size, Share And Trends Report, 2030GVR Report cover

![Dental X-ray Market Size, Share & Trends Report]()

Dental X-ray Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Analog, Digital), By Type (Intraoral, Extraoral), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-228-0

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental X-ray Market Summary

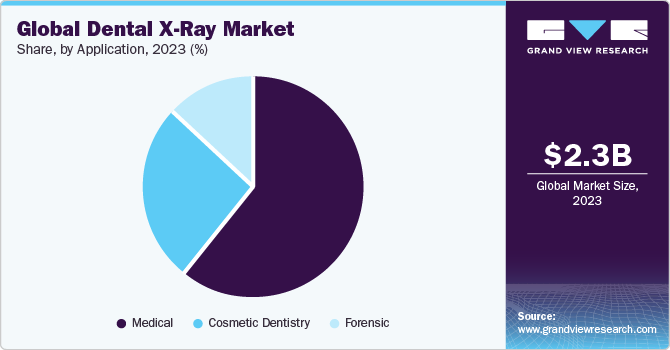

The global dental X-ray market was estimated at USD 2.31 billion in 2023 and is projected to reach USD 4.17 billion by 2030, growing at a CAGR of 8.9% from 2024 to 2030. Dental X-rays are medical images of a person’s teeth and the surrounding structures that are used to evaluate oral health.

Key Market Trends & Insights

- North America dominated the market in 2023 with a 38.0% revenue share.

- The U.S. held the largest market share in North America in 2023.

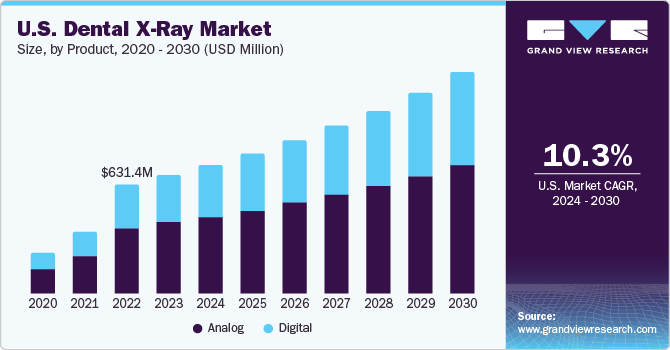

- By product, the analog segment held the largest revenue share of 59.3% in 2023.

- By type, the intraoral segment accounted for the largest revenue share in 2023.

- By end use, the dental hospitals & clinics segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.31 billion

- 2030 Projected Market Size: USD 4.17 billion

- CAGR (2024-2030): 8.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

It involves the use of low levels of radiation to capture images. An increase in the preference of people for better aesthetic and oral care and a rise in the burden of teeth disorders has led to an increase in the frequency of dental X-ray procedures, which is, in turn, boosting the market growth. The rapid adoption of cosmetic dentistry, increasing disorders of teeth, the introduction of innovative imaging solutions, and the rising geriatric population are the key factors propelling the market growth. The dental digital X-ray market has been experiencing many technological advancements, one such path-breaking innovation is the cone-beam Computed Tomography System (CBCT). CBCT has provisions for fast, accurate, and 3-D imaging of patients to examine dental disorders. This system has successfully surmounted the pitfalls of the conventional 2-D X-ray imaging aiding precision studies and effective diagnostics of dental diseases.

The COVID-19 pandemic has exerted its impact across various markets, including the dental industry, owing to government-imposed lockdowns as a precautionary measure. The supply chain for dental X-Ray has not been immune to these effects, experiencing disruptions. The broader medical device industry has also faced substantial challenges and disturbances in its supply chain due to the ongoing pandemic. The outbreak of coronavirus has impacted the market negatively as there was a decline in the number of dental treatments after the second quarter of 2020. However, this is estimated to be a temporary effect and during the forecast period, the demand for X-rays is likely to increase post-pandemic. An increase in awareness of oral care and rising problems related to teeth will drive the market growth.

According to the U.S. Centers for Disease Control and Prevention (CDC), report published in 2019, around 84.9% of children aged between 2 and 17 years, nearly 64.0% of adults from 18 to 64 years of age, and nearly 65.6% of adults aged 65 and above have had at least one visit to a dentist. The routine checkups mainly include crowns, root canals, maxillofacial procedures, bonding treatments, and dental fillings. Thus, regular dental checkups are anticipated to fuel the growth of the global market.

Market Concentration & Characteristics

Emerging technologies such as cone-beam computed tomography (CBCT) and the increasing adoption of digital X-ray systems underscore the dynamic and innovative nature of this market. Several market players such as Catalent Inc., Dentsply Sirona, and Biolase, Inc, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations significantly impact the market by ensuring stringent compliance standards for product safety, quality, and documentation. While promoting patient welfare, these regulations also necessitate rigorous tracking, reporting, and adherence to good clinical practice (GCP). Potential substitutes in this market include emerging imaging technologies such as intraoral scanners, 3D optical imaging, and artificial intelligence-based diagnostic tools, challenging traditional X-ray methods. Regional expansion involves establishing strategic distribution hubs and partnerships to efficiently navigate diverse regulatory landscapes.

Product Insights

Based on the product, the analog segment led the market in 2023 with the largest revenue share of 59.3%. However, the market share of analog is expected to decline in the next few years. The slow growth can be attributed to the need for multiple x-rays for an image of decent quality, which causes repeated exposure to radiation. This exposure exceeds the digital systems. Apart from the risk of high radiation exposure, the system entails increased consumption of time & chemicals, and developing the x-rays requires trained staff.

The digital segment is expected to register the fastest CAGR during the forecast period. This is due to the technological advancements, digital innovation, and expansion of companies. This segment is estimated to retain its position in the market owing to the speeding adoption of digital sensors. The increasing adoption rates of digital sensors are credited to factors such as lower operating time and excellent quality imaging.

Type Insights

Based on the type, the intraoral segment accounted for the largest revenue share in 2023. Intraoral radiology equipment provides detailed images, allowing dentists to spot cavities and monitor the general health of teeth & jawbones. Intraoral x-ray imaging is the most widely used diagnostic method in the field of dentistry. Intraoral imaging is utilized for an assortment of procedures, such as diagnosing caries & checking endodontic file location. Intraoral x-ray equipment is expected to show high growth due to the exceptional spatial and contrast resolution offered by these devices.

The extraoral segment is anticipated to register the fastest CAGR over the forecast period as they enable control over radiation exposure in comparison to intraoral methods. They are most commonly used in the identification of larger disorders, such as temporomandibular joint disorders or wedged teeth. To date, Dentsply Sirona has installed around 100,000 extraoral imaging units globally.

Application Insights

In terms of application, the medical segment dominated the market in 2023.Dental radiography is essential for dentists in evaluating the severity of conditions such as cavities, tumors, and fractures, aiding in the assessment of tooth decay levels and identification of other oral issues like cysts or abscesses. The market is categorized into medicals, cosmetic industry, and forensic applications, showcasing its diverse uses. Serving as a valuable diagnostic and treatment planning tool, dental radiography provides a comprehensive view of various oral conditions, including cavities, tumors, and fractures, ensuring effective care.

The cosmetic dentistry segment has been anticipated to show lucrative CAGR over the forecast period. Growing global concerns about dental esthetics have led to a significant uptick in the demand for cosmetic procedures, with an observed doubling in recent years. This surge is driving the need for imaging systems, particularly in cosmetic dentistry, where intraoral and extraoral radiographs play a vital role. These radiographs are routinely taken before dental procedures like whitening, teeth contouring, or cavity filling. In cosmetic dentistry, intraoral x-rays are indispensable for assessing dental roots, a crucial step before embarking on any cosmetic operation. Radiographs are particularly valuable in preparing inlay or Onlay restorations, aiding in the evaluation of critical criteria such as periodontal support, extent of decay, and proximity of the tooth to the nerve.

End use Insights

Based on the end-use, the dental hospitals & clinics segment dominated the market in 2023 due to their central role in providing comprehensive healthcare products, including diagnostic and preventive dental care. X-rays play a crucial role in the diagnostic process, aiding dentists and healthcare professionals in identifying dental issues such as cavities, infections, and structural problems. The centralized nature of hospitals and clinics allows for the integration of dental X-ray products into overall patient care, facilitating coordinated and efficient healthcare delivery, thereby contributing to the overall segment growth.

The dental diagnostics centers segment is anticipated to witness a lucrative CAGR during the forecast period. Dental diagnostic centers are at the forefront of the end-use segment due to their specialized focus on providing comprehensive and advanced diagnostic products in the field of dentistry. These centers are specifically designed to cater to the diagnostic needs of patients, offering a range of imaging products, including X-rays, panoramic radiography, and cone-beam computed tomography (CBCT). Their dedicated approach allows for a heightened level of expertise, ensuring accurate and detailed imaging for both routine examinations and complex cases drives the overall segment growth.

Regional Insights

North America dominated the market with a revenue share of 38.0% in 2023,due to the presence of well-established healthcare infrastructure and growing healthcare spending in developed countries, like the U.S. Moreover, favorable healthcare reimbursements and an increase in government initiatives in this region boost the market penetration of these systems.

The U.S. held the largest market share in North America in 2023. The country is characterized by a high prevalence of dental clinics, private practices, and advanced diagnostic centers, equipped with state-of-the-art X-ray technology. The innovative landscape, coupled with a well-established regulatory framework, positions the U.S. as a leader in adopting and advancing dental X-ray technologies, contributing significantly to its dominance in the North American market.

The Asia Pacific is anticipated to witness the fastest CAGR during the forecast period. This is due to the rising awareness in the developing countries of the region regarding various oral problems, thus facilitating rapid diagnosis and treatment. The geriatric population in China is also another major factor driving the market. Moreover, India and China are currently the largest tobacco-producing and consuming countries having the lowest smoking awareness. The government in the developing countries like India, and China are taking extensive efforts to improve the healthcare infrastructure owing to which the adoption of innovative solutions for diagnostics and therapeutics increased.

China accounted for the largest share of the market in the Asia Pacific region in 2023. China's dominance in the dental X-rays market within the Asia Pacific region can be attributed to its rapidly growing healthcare infrastructure, increasing awareness of oral health, and substantial investments in advanced diagnostic technologies.

Key Dental X-ray Company Insights

Some of the key players operating in the market include Dentsply Sirona, and Biolase, Inc

-

Dentsply Sirona offers a range of dental X-ray products, including intraoral and extraoral imaging systems, digital X-ray sensors, and imaging software

-

Biolase, Inc. is a global leader in dental lasers and medical devices that provide biological treatments to reduce pain and improve patient safety

Zimmer Bioment Holdings and A-Dec Company are some of the emerging players in the global market.

-

Zimmer Biomet Holdings offers a range of dental products and solutions, including dental implants, components, biomaterials, and digital dentistry solutions

-

A-Dec, offers a variety of dental X-ray films for different purposes including Intraoral X-rays, extraoral X-rays as well as panoramic X-rays

Key Dental X-ray Companies:

The following are the leading companies in the dental X-ray market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these dental X-ray companies are analyzed to map the supply network.

- Planmeca OY

- Dentsply Sirona

- Danaher Corporation

- Institute Straumann

- Zimmer Bioment Holdings

- 3M Company

- Align Technology Inc,

- A-Dec

- Biolase Inc

Recent Developments

-

In October 2023, Denti.AI has officially announced the significant achievement of securing FDA 510(k) clearance for Denti.AI Detect. This groundbreaking AI-powered imaging solution enhances disease detection capabilities in intra- and extraoral radiography, along with providing charting automation

-

In June 2023, LunaLite Dental, has unveiled its latest breakthrough in dental care, the LunaLite automated laser-guided dental x-ray positioner. This cutting-edge device is set to revolutionize the x-ray process, providing improved efficiency and comfort for both dental professionals and patients

-

In February 2022, Overjet has successfully obtained a U.S. patent for its artificial intelligence (AI) technology, which is designed to measure anatomical structures and quantify disease on dental X-rays. This accomplishment reflects the recognition and protection of Overjet's innovative approach in the field of AI-driven dental imaging

Dental X-ray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.50 billion

Revenue forecast in 2030

USD 4.17 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; Planmeca OY; Danaher Corporation; Institute Straumann; Zimmer Bioment Holdings; 3M Company; A-Dec; Align Technology Inc; Biolase Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental X-Ray Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global dental X-ray market report based on product, type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intraoral

-

Extraoral

-

-

Application Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cosmetic Dentistry

-

Forensic

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Hospitals & Clinics

-

Dental Diagnostic Centers

-

Dental Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global dental X-ray market size was estimated at USD 2.31 billion in 2023 and is expected to reach USD 2.50 billion in 2024.

b. The global dental X-ray market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 4.17 billion by 2030.

b. North America dominated the dental X-ray market with a share of 38.0% in 2023. This is attributable to the presence of well-established healthcare infrastructure, growing healthcare spending favorable healthcare reimbursements, and an increase in government initiatives in this region.

b. Some key players operating in the dental X-ray market include Dentsply Sirona Inc.; Planmeca OY; Carestream Dental, LLC; Danaher; LED Medical Diagnostics, Inc.; Cefla S.C.; Vatech Co., Ltd.; Yoshida Dental Mfg. Co. Ltd.

b. Key factors that are driving the dental X-ray market growth include the increasing incidence of dental diseases, the growing geriatric population, the rise in technological advancements in dental imaging methodologies, and the rising demand for cosmetic dentistry services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.