- Home

- »

- Clothing, Footwear & Accessories

- »

-

Electric Guitars Market Size, Share & Growth Report, 2030GVR Report cover

![Electric Guitars Market Size, Share & Trends Report]()

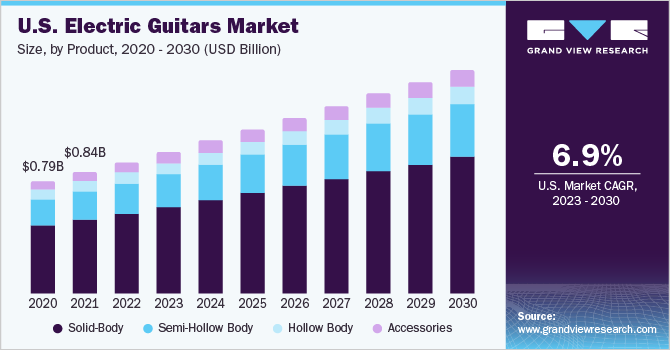

Electric Guitars Market Size, Share & Trends Analysis Report By Product (Solid Body, Semi-hollow Body, Hollow Body, Accessories), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-621-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global electric guitars market size was valued at USD 4.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The increasing music enthusiasm among millennials is projected to be a key factor driving the market. Additionally, the rising number of live concerts, along with the commercialization of music festivals, augments the demand for musical instruments, such as electric guitars. The COVID-19 pandemic has had an adverse impact on the global market owing to the disruptions caused in the supply chain and the imposition of lockdown across several countries in the world.

A surge in product sales was observed toward the end of July 2020 as several consumers started taking up hobbies, which led to the overall growth in the market. Music has become an important aspect of some of the school curricula across the globe. The primary and higher schools are focusing on music education programs and molding their curriculum policies to be friendlier toward music. These factors are expected to boost the product demand in the coming years.

Electric guitars are generally used in metal and rock genres of music. The popularity of these genres has increased, which is one of the major factors driving the market. Another factor driving the market is the rise in the number of musical bands across the globe. Demographic trends show growth in the adolescent population, which tends to take up lots of leisure activities. This, in turn, has led to a rise in the demand for musical instruments, especially electric guitars.

Regions like North America and the Middle East offer immense opportunities for demand fulfillment considering the advent of online retail platforms. Moreover, governments’ willingness to diversify their economies across the globe has led to a huge impetus for commercial music schools and colleges. For instance, in February 2020, the Berklee College of Music was established in Dubai, UAE. Such favorable scenarios bode well for the growth of the market.

With technological advancements and the growth of internet penetration, music education can reach more students around the world. Video conferencing, instant messaging, file sharing, and using digital whiteboards are the medium for the online music education market. Digital music tools like YouTube, Digital sheet music and apps, and cloud-based systems are transforming the music education industry from the traditional music learning process.

The online music and video creation and promotion industry are creating more demand for online music education, which, in turn, is anticipated to drive the market. The demand for online performances and virtual classes to learn a new instrument is expected to grow over the forecast period. This, in turn, has inspired consumers and motivated them to buy a new instrument and learn, especially from the convenience of their houses.

Product Insights

Solid-body electric guitars held the largest revenue share of over 65.0% in 2022. These guitars are prevalent worldwide due to the popularity of rock and metal genres of music. Furthermore, bands widely use solid-body electric guitars for rock music. Consequently, the rise in the number of bands worldwide is expected to boost the demand for solid-body electric guitars in the future. For instance, according to Geography Realm, in May 2021, Finland has 70.6 heavy metal bands per 100,000 people as compared to 53.2 heavy metal bands per 100,000 people in 2012.

Semi-hollow body electric guitars are expected to expand at a lucrative CAGR of 7.2% over the forecast period. Semi-hollow electric guitars are popular as they have the properties of both hollow body and solid-body electric guitars. The rise in the number of bands worldwide is expected to boost the demand for semi-hollow electric guitars in the future..

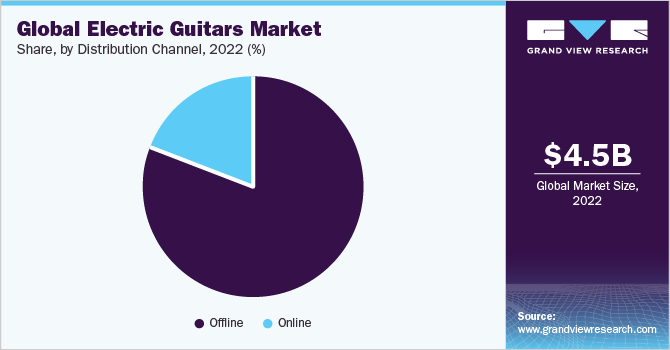

Distribution Channel Insights

The offline channel segment accounted for the largest revenue share of over 70.0% in 2022. After the lockdowns were gradually lifted in various countries across the globe, product sales via offline stores increased. For instance, according to a blog published by Guitar.com, the iconic Guitar Center store on Sunset Boulevard in Hollywood, California saw a triple-digit jump in sales in August 2020 (compared to August 2019), which the company attributed to a rise in amateur musicians and podcasters buying gear to utilize while in lockdown for COVID-19. The offline distribution channels offer significant advantages, such as freedom of selection, low product prices, and high visibility of brands, making them a suitable platform for all types of customers.

The online channel segment is expected to register a lucrative CAGR in the forecast period. This growth is attributed to various factors that include the outbreak of the COVID-19 pandemic and the ease and convenience of product purchasing. According to a blog by Music Strive, 2021, despite having closed factories in March and April 2020, Fender finished the year with a high of USD 700 million, nearly 17% more than what was achieved in 2019. The trend of online purchasing of instruments will continue in the forecast period.

Regional Insights

Asia Pacific held the largest revenue share of over 35.0% in 2022. A strong consumer influence and rapidly evolving consumer tastes on account of the increasing levels of per capita disposable income have been driving the market in the region. The growing interest of people in music and the ability to spend on entertainment and leisure activities have further boosted the demand for electric guitars in the Asia Pacific. Moreover, the increasing number of musical bands conducting music shows and festivals is likely to propel market growth over the forecast period.

North America is expected to register a CAGR of 7.0 % from 2023 to 2030 owing to the increasing number of music concerts and the rising popularity of live-music concepts across the region. Additionally, major electric guitar manufacturers such as Gibson Brands, Inc.; Fender Musical Instruments; Karl Höfner GmbH & Co. KG; Ibanez guitars; Yamaha Corporation; and Michael Kelly Guitar Co. are launching innovative variants to penetrate further into the market and acquire a large customer base in the region, which has been fueling the growth of the market.

Key Companies & Market Share Insights

Players in this market face intense competition as some of them are among the top manufacturers and distributors of musical instruments with a large customer base. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base across the world. The impact of major players on the market is high as most of these players have a global presence and implement various business strategies, such as product launches and developments, mergers & acquisitions, business expansion, partnerships and collaborations, and distribution channel strengthening, to grow further and acquire a larger share in the market:

-

In July 2023, Fender Musical Instruments Corporation (FMIC) announced the launch of a range of new releases from its wholly-owned and licensed brands, including Jackson, Gretsch guitars, EVH, and Charvel. Each of these new models continues to uphold the brands' longstanding reputation for exceptional quality, tone, and technique, catering to the evolving requirements of musicians.

-

In June 2023, PRS Guitars and John Mayer introduced two updates: a new version with a maple fretboard and a fresh color option for the rosewood-equipped model. These updates mark the first color refresh for the rosewood model since its initial launch in January 2022.

Some prominent players in the global electric guitars market include:

-

Gibson Brands, Inc.

-

Fender Musical Instruments Corporation

-

Karl Höfner GmbH & Co. KG

-

Ibanez Guitars

-

Yamaha Corporation

-

The ESP Guitar Company

-

Cort Guitars

-

Michael Kelly Guitar Co.

-

DEAN GUITARS

-

Epiphone

Electric Guitars Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.87 billion

Revenue forecast in 2030

USD 7.62 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Gibson Brands, Inc.; Fender Musical Instruments Corporation; Karl Höfner GmbH & Co. KG; Ibanez Guitars; Yamaha Corporation; The ESP Guitar Company; Cort Guitars; Michael Kelly Guitar Co.; DEAN GUITARS; Epiphone

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Electric Guitars Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global electric guitars market on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Solid-body

-

Semi-hollow body

-

Hollow body

-

Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric guitars market size was estimated at USD 4.49 billion in 2022 and is expected to reach USD 4.87 billion in 2023.

b. The global electric guitars market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 7.62 billion by 2030.

b. The Asia Pacific dominated the electric guitars market with a share of 38.8% in 2022. This is attributable to the rising number of international trade fairs for musical instruments over the years, most notably in China.

b. Some key players operating in the electric guitars market include Gibson Brands, Inc.; Fender Musical Instruments; Karl Höfner GmbH & Co. KG; Ibanez guitars; Yamaha Corporation; and Michael Kelly Guitar Co.

b. Key factors that are driving the electric guitars market growth include the increasing number of music enthusiasts and the rising number of live concerts and music festivals around the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."