- Home

- »

- Petrochemicals

- »

-

Electric Vehicle Fluids Market Size & Share Report, 2030GVR Report cover

![Electric Vehicle Fluids Market Size, Share & Trends Report]()

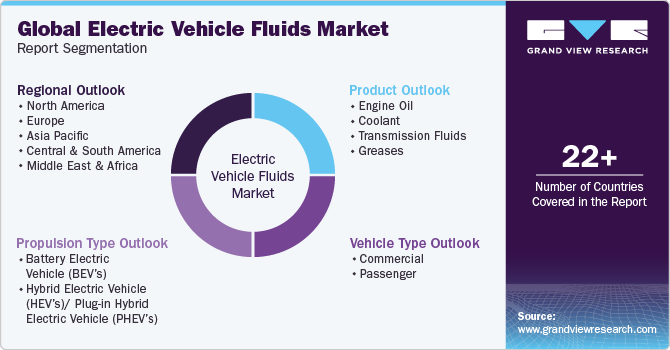

Electric Vehicle Fluids Market Size, Share & Trends Analysis Report By Product, (Engine Oil, Coolant, Transmission Fluids, Greases), By Vehicle Type, By Propulsion Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-257-0

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Electric Vehicle Fluids Market Size & Trends

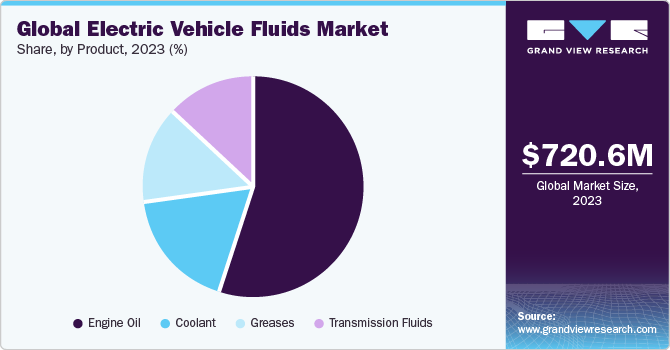

The global electric vehicle fluids market size was estimated at USD 720.6 million in 2023 and is expected to grow at a CAGR of 28.6% from 2024 to 2030. The market is expected to witness substantial growth over the forecast period owing to increasing global demand for e-vehicles, driven by factors, such as environmental concerns, government incentives, and advancements in battery technology. As the EV market expands, there is a growing need for specialized fluids to support the operation of electric drivetrains, cooling systems, and battery packs. Moreover, growing demand and increasing penetration of EVs in developing countries like India are also boosting the demand for e-vehicle fluids in the country.

As per the India Brand Equity Foundation, the e-vehicles industry in India is projected to reach USD 1,318 billion by 2028, which is approximately five times larger than its size in terms of revenue witnessed in the country in 2021. Thus, the industry is expected to grow in the coming years with the growing demand for automobile production. EV fluids are specialized liquids and lubricants designed to support the operation, efficiency, and longevity of EVs’ various components, including electric drivetrains, battery systems, cooling systems, and power electronics. As EV technology continues to advance, the importance of these fluids in ensuring optimal performance and reliability becomes increasingly critical.

The major challenge faced by manufacturers is the diverse fluid requirements for EVs, including coolant fluids, lubricants, transmission fluids, and battery thermal management fluids, each with specific performance criteria and compatibility considerations. Developing and maintaining a comprehensive range of EV fluids that meet these varied requirements can be technically challenging and costly for manufacturers. In addition, the other challenges involved in the market including the lack of standardized specifications and testing protocols for EV fluids can pose challenges for fluid manufacturers and consumers. Without clear industry standards, it can be difficult for manufacturers to develop and market EV fluids effectively, and for consumers to make informed purchasing decisions. Standardization efforts are essential to ensure compatibility, performance, and safety across different EV models and fluid applications.

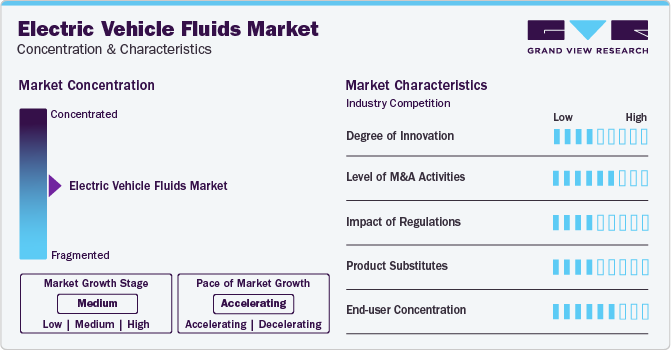

Market Concentration & Characteristics

The global product market is moderately fragmented with many small and large players operating in the industry. This further makes the market more competitive with players focusing more on different strategies including product differentiation, mergers, acquisition, and research & development. For instance, in August 2022: Shell Lubricants introduced heat transfer fluids suitable for Indian climates and geographies for EV motors.

Major multinational corporations, including lubricant manufacturers, specialty chemical companies, and automotive OEMs, often compete in the EV fluids industry, leveraging their extensive resources, research capabilities, and established distribution networks.

While there are numerous smaller and regional players in the market, larger companies with global reach tend to dominate due to their ability to invest in research and development, scale production, and meet stringent quality and performance requirements.

Automotive OEMs, including Tesla, BMW, Volkswagen, and General Motors, are increasingly involved in the development and production of EV fluids, either through in-house manufacturing or strategic partnerships with fluid suppliers.

Propulsion Type Insights

The hybrid electric vehicle (HEVs) segment dominated the market with the highest revenue share of 74.6% in 2023 owing to the rising use of vehicle fluid in them as compared to battery electric vehicles (BEV). One of the main concerns with BEVs is range anxiety, which is the fear of running out of battery charge before reaching a destination or charging point. HEVs alleviate this concern by having a traditional internal combustion engine as a backup power source, providing extended range without the need for frequent recharging. Hybrid EVs combine an internal combustion engine (usually gasoline-powered) with an electric propulsion system.

BEVs are environmentally friendly, producing zero tailpipe emissions, which helps reduce air pollution and mitigate climate change. Moreover, BEVs have lower operating costs compared to hybrid and plug-in hybrid vehicles because electricity is generally cheaper than gasoline or diesel fuel. BEVs have a simpler drivetrain compared to hybrid and plug-in hybrid vehicles, which typically include both an internal combustion engine and an electric motor. This simplicity can lead to greater reliability and easier maintenance.

Vehicle Type Insights

The passenger EV segment dominated the market with the highest revenue share of 65.12% in 2023. The passenger EV market has been experiencing notable trends reflecting both technological advancements and evolving consumer preferences. The passenger EV industry has witnessed a proliferation of models across various vehicle segments. Initially dominated by compact hatchbacks like the Nissan Leaf and Tesla Model, the market now includes electric sedans, SUVs, crossovers, and even electric pickup trucks.

This diversification of EV offerings provides consumers with more choices to meet their preferences and needs. Public transit agencies worldwide are electrifying their bus fleets to reduce greenhouse gas (GHG) emissions and improve air quality in urban areas. E-buses offer quieter operation, lower maintenance costs, and reduced environmental impact compared to conventional diesel buses. Governments are incentivizing the adoption of E- buses through grants, subsidies, and regulatory measures, driving the expansion of electric public transportation.

Product Insights

The engine oil segment dominated the market with the highest revenue share of 55.0% in 2023 owing to the increasing number of vehicles on the road. Engine oil is classified under two main headers, which include viscosity-based (Society of Automotive Engineers) classification and performance-based (European Automobile Manufacturers' Association and American Petroleum Institute) classification. As per SAE International classifications, multi-grade engine oils are classified based on their resistance to temperature.

Coolant fluids play a crucial role in regulating the temperature of electric drivetrains and battery systems, which are prone to heat generation during operation. These fluids circulate through cooling loops to dissipate excess heat and maintain optimal operating temperatures. Coolant fluids in EVs are typically formulated to withstand higher temperatures than those used in traditional internal combustion engine vehicles. They are also designed to be non-conductive to prevent electrical shorts in case of leaks.

In e-vehicles with transmissions, specialized transmission fluids are used to lubricate gears and bearings, ensuring smooth power transmission and reducing frictional losses. These fluids help optimize the efficiency of the transmission system and contribute to overall vehicle performance. Transmission fluids for EVs may have different viscosity and additive formulations compared to those used in conventional vehicles to meet the specific requirements of electric drivetrains.

Regional Insights

The electric vehicle fluids market in North America experienced significant growth driven by several factors including increasing environmental concerns, government incentives, technological advancements, and a shift in consumer preferences toward sustainable transportation. Tesla has been a dominant player in this market, but many traditional automakers have also been investing heavily in EVs, which will further boost the growth of the product market.

U.S. Electric Vehicle Fluids Market Trends

The U.S. electric vehicle fluids market is experiencing significant growth driven by increasing consumer demand for EVs. The electric car sales in the U.S. increased by 60% reaching 1.6 million as compared to the previous year as per IEA (International Energy Agency)

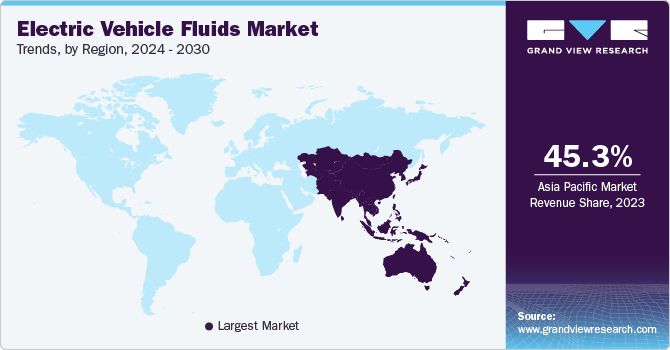

Asia Pacific Electric Vehicle Fluids Market Trends

The electric vehicle fluids market in Asia Pacific accounted for a revenue share of 45.3% in 2023, which is attributed to increased product demand from countries like China and India.The region is expected to witness significant growth with the enhanced demand for EVs and increased government investment in enhancing the production of EVs to reduce carbon emissions.

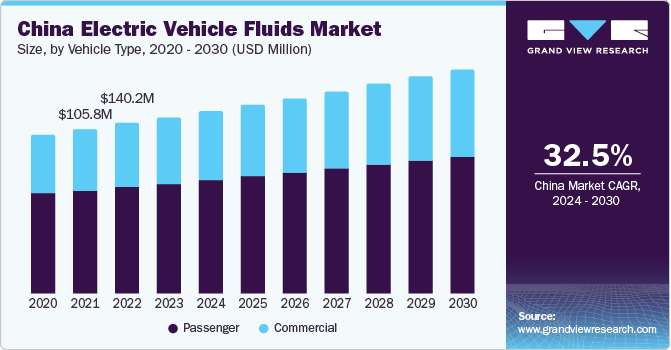

The China electric vehicle fluids market is growing rapidly. According to the China Association of Automobile Manufacturing, the production of New Energy Vehicles in the country witnessed a year-on-year increase of 96.9 percent in December 2022. In 2023, the sales of EVs in the country reached 8.0 million, which was around 33% more than the previous year’s sales as per the International Energy Agency. Thus, the growing EV market is expected to increase the demand for EV fluids in the country.

Europe Electric Vehicle Fluids Market Trends

The electric vehicle fluids market in Europe will witness robust growth in the coming years. The region has set ambitious emission reduction targets in response to the growing concern over climate change. Urban areas are implementing stricter regulations to combat pollution and promote EV adoption. Some of the top auto groups for EV sales in Europe include Volkswagen Group, Stellanis, Tesla, BMW Group, and Geely-Volvo among others. As per the European Commission, around 197,000 plugin vehicles were registered in April in Europe registering a growth of +25% (year over year). EVs are offered various incentives by governments across Europe. These incentives include tax incentives, purchase subsidies, and subsidies for building charging infrastructure.

The Germany electric vehicle fluids market has potential growth opportunities owing to the presence of major players including Ford Motors & General Motors. These companies are in the process of introducing various electric high-performance electric trucks in the market. The trucks feature powerful electric motors, comfortable interiors, and premium features like touch screens and leather seats. For instance, Ford unveiled the new F-150 Raptor R in July 2022, powered by a 5.2-liter V8 engine capable of producing 700 horsepower. The company launched the product due to the rising consumer demand for a Raptor with a V8 engine.

Central & South America Electric Vehicle Fluids Market Trends

The electric vehicle fluids market in Central & South America is expected to grow significantly in the coming years owing to developing charging infrastructure in the region with companies like Audi and WEG SA establishing charging stations across the region. This region comprises emerging countries, such as Brazil and Argentina.

The Brazil electric vehicle fluids market is positioning itself as a key player in the EVs market, with plans for new EV models and manufacturing facilities. Companies like BYD and Stellantis are investing in EV production in Brazil.Brazil's strong ethanol-powered vehicle industry poses a challenge to EV adoption due to the popularity and affordability of flexible-fuel cars powered by ethanol and gasoline. Despite this, the country's vast lithium resources and potential for battery production present opportunities for growth in the EV market.

Middle East & Africa Electric Vehicle Fluids Market Trends

The electric vehicle fluids market in Middle East & Africa is still in its early stages, but it is expected to experience significant growth in the coming years. In the region, electric mobility is still being developed. Although they are the lowest in the world, sales of battery-electric vehicles have generally increased in recent years across the continent.

The South Africa electric vehicle fluids market is one of the developing product markets. According to the Automotive Business Council of South Africa, in 2022, 502 fully electric vehicles were sold in the country, representing a 134% rise over the units sold in 2021, thus, supporting the product market's growth significantly.

Key Electric Vehicle Fluids Company Insights

Some of the key players operating in the market include Exxon Mobil Corp., BP Plc, Shell Plc, FUCHS, TotalEnergies, Petroliam Nasional Berhad (PETRONAS), and Saudi Arabian Oil Co. among others.

-

The market has seen significant activity, with several prominent industry players involved in strategic mergers and acquisitions, expanding regionally, and developing new products. As an example, in 2022, Shell Lubricants introduced heat transfer fluids tailored for EV motors in India, designed to meet specific climatic and geographical needs

-

In addition, in 2022, TotalEnergies Marketing India Pvt. Ltd. (TEMIPL) unveiled a new series of EV Fluids designed for electric and hybrid vehicles, as well as electric bikes, in India

Key Electric Vehicle Fluids Companies:

The following are the leading companies in the electric vehicle fluids market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- BP Plc

- Shell Plc

- FUCHS

- TotalEnergies

- Petroliam Nasional Berhad (PETRONAS)

- Saudi Arabian Oil Co.

- Repsol

- ENEOS Corp.

- Gulf Oil International Ltd.

Recent Developments

-

In January 2023, CRP Automotive unveiled its newest line of Pentosin automotive fluids tailored for several widely used Tesla models currently traversing the roads. This collection comprises two variants of Electrical Drive Fluids (EDF) specifically crafted for Tesla models spanning from 2009 to 2021

-

In 2023: Texaco Lubricants, affiliated with the Chevron brand family, has broadened its product offerings by introducing a fresh lineup of electric fluids (e-fluids) tailored to support the growing EV sector. This endeavor reflects the company's commitment to reducing the carbon intensity of its operations and promoting lower-carbon businesses

Electric Vehicle Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 890.7 million

Revenue forecast in 2030

USD 4,028.7 million

Growth rate

CAGR of 28.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, propulsion type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Exxon Mobil Corp.; BP Plc; Shell Plc; FUCHS; TotalEnergies; Petroliam Nasional Berhad (PETRONAS); Saudi Arabian Oil Co.; Repsol; ENEOS Corp.; Gulf Oil International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Fluids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric vehicle fluids market report based on product, vehicle type, propulsion type, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Engine oil

-

Coolant

-

Transmission Fluids

-

Greases

-

-

Propulsion Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV’s)

-

Hybrid Electric Vehicle (HEV’s)/ Plug-in Hybrid Electric Vehicle (PHEV’s)

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Passenger

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle fluids market size was valued at USD 720.6 million in 2023 and is expected to reach USD 890.7 million in 2024.

b. The global electric vehicle fluids market is expected to grow at a compound annual growth rate (CAGR) of 28.6% from 2024 to 2030 to reach USD 4,028.7 million by 2030.

b. The engine oil segment dominated the market with highest revenue share of 55.0% in 2023 owing to increasing number of vehicles on the road.

b. Some prominent players in the global Electric Vehicle Fluids Market include: ● Exxon Mobil Corporation6.4.2 ● BP p.l.c. ● Shell plc ● FUCHS ● TotalEnergies ● Petroliam Nasional Berhad (PETRONAS) ● Saudi Arabian Oil Co.

b. The market is expected to witness substantial growth over the forecast period owing to increasing global demand for e- vehicles, driven by factors such as environmental concerns, government incentives, and advancements in battery technology. As the EV market expands, there is a growing need for specialized fluids to support the operation of electric drivetrains, cooling systems, and battery packs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."