- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Market Size & Share, Industry Report, 2030GVR Report cover

![Electric Vehicle Market Size, Share & Trends Report]()

Electric Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By Propulsion Type, By Drive Type, By Vehicle Speed, By Vehicle Class, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-259-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Market Summary

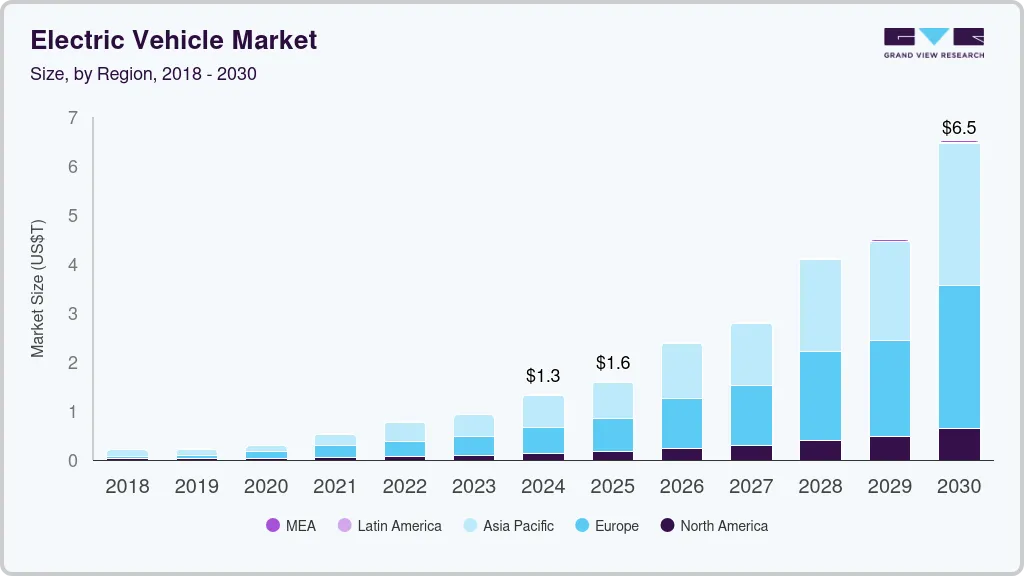

The global electric vehicle market size was estimated at USD 1,328.08 billion in 2024 and is projected to reach USD 6,523.97 billion by 2030, growing at a CAGR of 32.5% from 2025 to 2030. Government policies and incentives worldwide are accelerating the adoption of Electric Vehicles (EVs).

Key Market Trends & Insights

- The North America electric vehicle market is expected to grow at a moderate CAGR during the forecast period.

- The U.S. electric vehicle market is expected to grow at the fastest CAGR during the forecast period

- By propulsion, the battery electric vehicle segment dominated the market in 2024.

- By drive type, the front-wheel drive segment dominated the market in 2024.

- By vehicle speed, the 100MPH-125MPH segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,328.08 Billion

- 2030 Projected Market Size: USD 6,523.97 Billion

- CAGR (2025-2030): 32.5%

- Asia Pacific: Largest market in 2024

Many countries are implementing stringent emission regulations and providing subsidies, tax benefits, and other incentives to both consumers and manufacturers, encouraging the shift from internal combustion engine vehicles to electric alternatives. Besides, advancements in battery technology are significantly enhancing the range, performance, and affordability of EVs. Innovations such as solid-state batteries and improvements in lithium-ion batteries are reducing costs and increasing energy density, making EVs more appealing to consumers.

The expansion of the transportation and logistics sectors significantly drives the rising demand for EVs. As global trade and e-commerce continue to surge, there is an increased need for efficient and sustainable transportation solutions. Electric vehicles offer a promising alternative to traditional internal combustion engines, as they produce lower emissions and reduce operational costs. This shift is particularly evident in urban areas where delivery services are increasing, and the need to mitigate air pollution is critical. Consequently, logistics companies are increasingly integrating electric vans and trucks into their fleets, driven by both regulatory pressures and the economic benefits of lower fuel and maintenance expenses. For instance, in May 2024, Amazon deployed heavy-duty electric trucks across Southern California for freight operations. The introduction of the 50 heavy-duty electric trucks in the region is a step towards decarbonization through first, middle, and last-mile delivery.

Technological advancements and infrastructure development are propelling the adoption of EVs in transportation and logistics. According to the U.S. Department of Energy, more than 10,000 EV charging stations were installed across the U.S. The installation of the EV charging station has bolstered the sales of battery and plug-in electric vehicles. Besides, governments worldwide are also investing in EV charging infrastructure and providing incentives for EV adoption, which further supports this transition. As consumer awareness of environmental issues grows, there is an increase in demand for eco-friendly delivery options, prompting companies to prioritize EVs in their operations. This combination of economic, regulatory, and societal factors is accelerating the shift towards electric vehicles, highlighting their crucial role in the future of transportation and logistics.

Advancements in battery technology, alongside affordable pricing, and enhanced performance, are propelling the rapid expansion of electric vehicles in the market. Innovations in battery chemistry, like lithium-ion and solid-state batteries, have boosted energy density and decreased charging durations, rendering EVs more feasible and enticing to consumers. Furthermore, the diminishing costs of batteries, attributable to economies of scale and refined manufacturing techniques, have bolstered the affordability and competitiveness of EVs against traditional internal combustion engine vehicles. Augmented performance capabilities, such as extended driving ranges, swifter acceleration, and smoother rides, further increase the adoption of EVs. These dynamics, combined with sustainability concerns and supportive governmental measures, are accelerating the uptake of electric vehicles, marking a transformative upheaval in the automotive sector.

Moreover, replacing conventional fuel school buses and public transportation buses with electric counterparts offers significant environmental and economic benefits. Electric buses produce zero tailpipe emissions, reducing air pollution and greenhouse gas emissions, which are major contributors to climate change and urban air quality issues. Although the initial investment in electric buses and charging infrastructure can be high, the total cost of ownership over the lifespan is often lower. Further, electric buses have fewer moving parts, leading to reduced maintenance costs and increased reliability.

Furthermore, major players in the EV market are enhancing their electric vehicles by integrating Wi-Fi, communication systems, and Advanced Driver Assistance Systems (ADAS) to elevate the travel experience and ensure passenger safety. For instance, in April 2023, Scania AB introduced an electric bus in Mexico equipped with ten batteries totaling 330 kWh, providing a range of 300 km. It also features a 2-speed transmission for efficient battery management, regenerative braking, a power output of 230 kW, and 1,800 Nm of torque.

Vehicle Type Insights

The passenger cars segment accounted for the largest share of 89.0% in 2024. The trajectory of electric passenger cars is poised for significant expansion, with projections indicating a substantial surge in their adoption across major markets. According to the International Energy Agency (IEA), in 2024, around 10 million electric cars are anticipated to be sold in China alone, constituting around 45% of the nation's total car sales. Besides, in the U.S., electric vehicles will account for approximately one out of every nine cars sold. Similarly, in Europe, despite prevailing challenges such as a subdued outlook for passenger car sales and the gradual reduction of subsidies in certain countries, electric cars are still expected to make up approximately one-fourth of all cars sold. This data underscores a remarkable shift towards electric mobility, driven by both consumer demand and policy initiatives aimed at decarbonizing transportation.

The trucks segment is expected to grow at a notable CAGR during the forecast period due to regulatory pressures, technological advancements, and the increasing demand for sustainable transportation solutions.Governments worldwide are enforcing stricter emissions standards and offering financial incentives to encourage the adoption of electric trucks, making them more appealing to fleet operators. Advancements in battery technology are enhancing electric trucks' range and efficiency, while charging infrastructure improvements are reducing operational downtime. In addition, the long-term cost benefits of electric trucks, such as lower maintenance and fuel expenses, are driving their adoption in logistics, freight, and delivery sectors.

Propulsion Type Insights

The Battery Electric Vehicle (BEV) segment dominated the market in 2024. The surge in BEV adoption can be attributed to the growing environmental awareness among consumers, which has fueled interest in cleaner transportation options, with BEVs offering a greener alternative to traditional internal combustion engine vehicles. Besides, the adoption of electric buses in urban public transport fleets is rapidly increasing worldwide. To meet this growing demand, key market players are launching new BEVs. For instance, in May 2024, Isuzu Motors Limited, an automotive manufacturer, introduced a BEV flat-floor route bus named ERGA EV in Japan. The ERGA EV aims to lead the way in next-generation bus technology in Japan, significantly contributing to the push for carbon neutrality (CN) in public transportation.

The Fuel Cell Electric Vehicles (FCEVs) segment is anticipated to grow at the fastest CAGR during the forecast period.FCEVs use hydrogen to generate electricity for propulsion, thus gaining traction as a viable alternative to traditional internal combustion engine vehicles and battery electric vehicles. This surge is primarily due to their potential for zero emissions, longer driving ranges, and shorter refueling times compared to other counterparts.

Drive Type Insights

The Front-wheel Drive (FWD) segment dominated the market in 2024. FWD is increasingly being adopted due to its cost-effectiveness in manufacturing. FWD vehicles require fewer components compared to rear-wheel drive systems, which reduces production costs. This cost advantage allows car manufacturers to offer more competitively priced vehicles to consumers. Additionally, FWD electric cars are typically lighter, which enhances fuel efficiency and lowers overall operating costs for drivers. These economic benefits make FWD an attractive option for both manufacturers and consumers.

The All-wheel Drive (AWD) segment is anticipated to grow at the highest CAGR during the forecast period.The adoption of AWD is due to its performance in various driving conditions. Consumers prioritize safety, and AWD offers improved traction and stability, especially in adverse weather conditions like rain and snow. Besides, the rise in popularity of SUVs and crossovers has fueled demand for AWD systems. These vehicles are often marketed for their versatility, and AWD is a key component that supports off-road capability and better handling on rough terrains. Moreover, advancements in technology have made AWD systems more efficient, reducing the impact on fuel economy compared to older models. Consumers can enjoy the benefits of AWD without significant sacrifices in fuel efficiency, making it a practical choice for a wider range of drivers.

Vehicle Speed Insights

The 100MPH-125MPH segment dominated the market in 2024. The growing demand for electric cars, high-speed electric two-wheelers, and electric three-wheelers is contributing to the growth of the 100MPH-125MPH segment. As consumers seek vehicles that offer not only sustainability but also performance, electric cars capable of achieving speeds between 100MPH and 125MPH are becoming more attractive. These vehicles provide a balance of efficiency and performance, making them suitable for both urban commutes and longer highway journeys. Additionally, advancements in battery technology and charging infrastructure have alleviated previous concerns about range and charging times, further bolstering the adoption of high-speed electric cars.

The less than 100 MPH segment is anticipated to grow at the fastest CAGR during the forecast period.The rising popularity of high-speed electric two-wheelers and three-wheelers is expected to fuel the growth of the below 100MPH segment. Urbanization and the need for efficient, eco-friendly transportation solutions have led to a surge in demand for electric scooters and motorcycles that can navigate through congested city streets swiftly while also offering the capability for higher speeds on open roads. Similarly, the segment growth attributed to electric three-wheelers, which serve as crucial last-mile delivery vehicles and passenger transport solutions in many regions, along with enhanced performance and speed capabilities. The integration of these vehicles into the logistics and transportation sectors underscores their importance in meeting the growing demand for faster, more reliable, and sustainable urban mobility solutions.

Vehicle Class Insights

The low-price electric vehicle segment dominated the market in 2024. This high market share is due to a rising consumer preference for more affordable EVs, driven by the growing awareness of environmental concerns, government incentives, and advancements in EV technology that have made electric cars more accessible to a broader audience. The affordability of these vehicles has played a crucial role in their widespread adoption, particularly in emerging markets and among budget-conscious consumers who are looking for cost-effective alternatives to traditional gasoline-powered cars.

The mid-price electric vehicle segment is expected to register a moderate CAGR over the forecast period. The segment caters to consumers who seek a balance between affordability, performance, and sustainability. Positioned between entry-level and high-end EVs, mid-priced electric vehicles offer advanced features, longer ranges, and improved battery performance at a more accessible price point. With the increasing availability of charging infrastructure and government incentives, the mid-price EV class is expected to witness sustained growth as it becomes a mainstream choice for those seeking an eco-friendly, budget-conscious vehicle option.

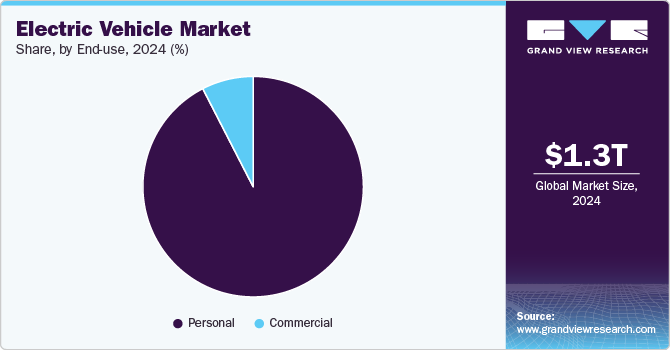

End-use Insights

The personal segment dominated the market in 2024. Personal electric vehicles, being emission-free, offer a cleaner alternative to traditional gas-powered vehicles, appealing to environmentally conscious consumers. Government incentives and policies have played a crucial role in promoting the adoption of PEVs. Many countries have implemented subsidies, tax breaks, and other incentives to encourage consumers to switch to EVs. These incentives not only make PEVs more affordable but also help alleviate concerns about charging infrastructure. With governments worldwide setting ambitious targets to reduce carbon emissions, the push for PEVs is expected to continue, further driving their adoption in the coming years.

The commercial segment is anticipated to grow at a significant CAGR during the forecast period.One significant trend is the increasing adoption of electric vans and trucks by delivery and logistics companies. This movement is primarily fueled by the desire to reduce operating costs and environmental impact. Companies are finding that electric vehicles offer a viable solution to both economic and sustainability concerns, with advancements in battery technology extending their range and durability, which is driving the demand for EVs.

Regional Insights

The North America electric vehicle market is expected to grow at a moderate CAGR during the forecast period. The North America EV market’s growth is driven by the rising demand for electric vehicles in countries like the U.S. Additionally, various new initiatives are being launched by automotive manufacturers, policymakers, non-profit organizations, and charging network companies. One such initiative is the creation of "Veloz," a new non-profit organization dedicated to attracting investments, fostering innovation, marketing, and promoting the growth of EVs in North America.

U.S. Electric Vehicle Market Trends

The U.S. electric vehicle market is expected to grow at the fastest CAGR during the forecast period due to incentives offered by federal and state as well as growing environmental awareness among consumers. The introduction of more affordable EV models and improvements in battery technology, which have extended vehicle range and reduced charging times, have further accelerated this trend. Major automakers are expanding their EV portfolios, and new entrants are injecting fresh competition which is propelling the growth of the U.S. EV market.

Europe Electric Vehicle Market Trends

Europe electric vehicle market is expected to register a notable CAGR from 2025 to 2030. With shifting consumer preferences and companies recognizing the long-term cost savings and environmental benefits they are opting for EVs. The presence of well-established and renowned EV manufacturers in Europe is further bolstering market growth. Companies such as Volkswagen and BMW are leading the way with their extensive range of electric models and significant investments in electric vehicle technology. This strong industrial base is not only driving sales but also fostering innovation and competition in the market, contributing to the robust expansion of the electric vehicle sector in Europe.

The Germany electric vehicle market held a substantial market share in 2024. The German automotive industry, traditionally dominated by internal combustion engine (ICE) vehicles, is undergoing a rapid transformation. Major German automakers such as Volkswagen, BMW, and Mercedes-Benz have significantly ramped up their EV production, with ambitious targets to electrify their fleets. Innovations in battery technology, such as improved energy density and faster charging capabilities, have enhanced the appeal of EVs. Moreover, the introduction of a variety of EV models across different segments, from compact cars to luxury SUVs, has broadened the market appeal, thereby driving the growth of the Germany EV market.

Electric vehicle market in the UK is expected to grow rapidly during the forecast period owing to the increasing consumer demand, government incentives, and advancements in technology. Sales of EVs have surged, with BEVs and plug-in hybrid electric vehicles (PHEVs) becoming more prevalent on British roads. This growth is supported by the UK's commitment to phasing out the sale of new petrol and diesel cars by 2030, with a complete shift to zero-emission vehicles by 2035.

Asia Pacific Electric Vehicle Market Trends

The Asia Pacific electric vehicle industry was identified as a lucrative region in 2024. The EV market in Asia Pacific is witnessing growth due to the rapid pace of infrastructure development across the region. Countries such as China, Japan, and South Korea are leading the charge, with significant investments in EV infrastructure and manufacturing. China's aggressive push towards electrification, supported by subsidies and stringent emission regulations, has positioned it as a global leader in EV sales and production. Japan and South Korea are also key players, focusing on innovation and technology development, particularly in battery efficiency and charging infrastructure. The region is witnessing a surge in consumer adoption of EVs, influenced by rising fuel prices and the desire for sustainable transportation options.

The China electric vehicle market held a substantial market share in 2024. Increased participation from traditional automotive companies such as Geely and Great Wall Motors, which are expanding their EV portfolios, is contributing to EV market growth. Besides, international players, such as Tesla, are also intensifying their presence in China, drawn by the lucrative market potential. This competitive landscape is fostering innovation and driving down costs, making EVs increasingly accessible to the average consumer. In summary, the Chinese electric vehicle market is characterized by robust growth, driven by favorable policies, technological advancements, and a dynamic competitive environment, positioning China as a global leader in the transition to sustainable mobility.

Electric vehicle market in India is expected to witness growth over the forecast period. The expansion of charging networks and improvements in EV range and performance are reducing consumer apprehensions which is driving the electric vehicle in India. Major automotive manufacturers are increasingly collaborating with tech companies to enhance EV capabilities, integrating features such as autonomous driving and smart connectivity. As a result, the India EV market is set to continue its upward trajectory, contributing significantly to the global shift towards greener mobility solutions.

Japan electric vehicle market is expected to grow at a moderate growth rate during the forecast period. Technological innovations in battery technology, such as advancements in lithium-ion batteries and the development of solid-state batteries, are propelling the growth of the Japan EV market. These improvements are leading to greater vehicle range, faster charging times, and overall cost reductions, making EVs more attractive to consumers.

Key Electric Vehicle Company Insights

Some of the key companies in the electric vehicle industry include AB Volvo, Volkswagen Group, BYD Company Ltd. and others. Organizations are focusing on integrating advanced technologies into their EV offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, business expansions, partnerships, collaborations, and agreements, among others.

-

AB Volvo is a manufacturing company known for its wide range of commercial vehicles, including trucks, buses, and construction equipment. The company operates through various segments, such as Volvo Trucks, Volvo Construction Equipment, and Volvo Buses, providing innovative and reliable transportation solutions globally. With a strong commitment to reducing its carbon footprint, Volvo has been at the forefront of developing electric and autonomous vehicles.

-

Volkswagen Group has firmly positioned itself as one of the major firms in the electric vehicle (EV) market. With a strategic commitment to sustainable mobility, the group has introduced the ID. Series, including the ID.3 and ID.4 models, as part of its ambitious plan to become a leading player in the EV market. The company's substantial investments in battery technology, manufacturing infrastructure, and charging networks underscore its dedication to electrification. Additionally, Volkswagen's diverse portfolio of brands, including Audi, Porsche, and Škoda, is expanding its range of electric vehicles, aiming to deliver cutting-edge technology and innovative solutions to meet the growing demand for eco-friendly transportation.

Key Electric Vehicle Companies:

The following are the leading companies in the electric vehicle (EV) market. These companies collectively hold the largest market share and dictate industry trends.

- AB Volvo

- BYD Company Ltd.

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Kawasaki Motors Corp., U.S.A

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- Renault Group

- Tesla, Inc.

- Toyota Motor Corporation

- Volkswagen Group

- Zero Motorcycle

Recent Developments

-

In May 2024, Lohia Auto, an electric vehicle manufacturer, unveiled the 'Humsafar IAQ,' a three-wheeler tailored for short-distance commutes and last-mile connectivity. With a range of 185 km per charge, it can attain a maximum speed of 48 kmph and accommodate one driver plus four passengers. The model is equipped with a swappable 7.6 kW and optional fixed 10.7 kW battery, along with an IP67-rated motor and 4.5R10, 8 PR Sheet Metal Rim.

-

In April 2024, NexGen Energia, an e-mobility company headquartered in Noida, India introduced a cost-effective electric two-wheeler. This unveiling signifies a significant stride towards enhancing the accessibility and affordability of EVs.

-

In November 2023, Alexander Dennis, a subsidiary of NFI Group Inc., a prominent global bus manufacturer introduced its latest lineup of battery-electric buses tailored for the UK and Ireland. The debut includes the Enviro100EV small bus and Enviro400EV double-decker, showcasing significant advancements in performance. These models mark a notable shift towards zero-emission transportation and are integral components of a broader range of next-generation electric buses.

-

In August 2023, ElectraMeccanica, a compact Solo electric vehicle manufacturer announced plans to merge with Tevva, a UK-based truck manufacturer, aiming to bolster their collective presence in the electric truck market. This strategic move presents Tevva with avenues to expand across the UK, Europe, and venture into the U.S. market, leveraging ElectraMeccanica's manufacturing facility in Arizona, The U.S., to scale up truck production.

Electric Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,595.75 billion

Revenue forecast in 2030

USD 6,523.97 billion

Growth rate

CAGR of 32.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion/trillion, volume in units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, propulsion type, drive type, vehicle speed, vehicle class, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AB Volvo; BYD Company Ltd.; Ford Motor Company; General Motors; Honda Motor Co., Ltd.; Kawasaki Motors Corp. U.S.A; Mercedes-Benz Group AG; Mitsubishi Motors Corporation; Nissan Motor Co., Ltd.; Renault Group; Tesla Inc.; Toyota Motor Corporation; Volkswagen Group; Zero Motorcycle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle market report based on Vehicle type, propulsion type, drive type, vehicle speed, vehicle class, end-use, and region.

-

Vehicle Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Scooters

-

Motorcycles

-

Three-Wheelers

-

Passenger Cars

-

Buses

-

Trucks

-

-

Propulsion Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric vehicle (PHEV)

-

Fuel Cell Electric Vehicle (FCEV)

-

-

Drive Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Front-wheel Drive (FWD)

-

Rear-wheel Drive (RWD)

-

All-wheel Drive (AWD)

-

-

Vehicle Speed Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Less Than 100 MPH

-

100MPH to 125MPH

-

Above 125 MPH

-

-

Vehicle Class Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Low Priced

-

Mid-Price

-

High Price

-

-

End Use Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle market size was estimated at USD 1,328.08 billion in 2024 and is expected to reach USD 1,595.75 billion in 2024.

b. The global electric vehicles market is expected to grow at a compound annual growth rate of 32.5% from 2025 to 2030 to reach USD 6,523.97 billion by 2030.

b. BEV segment held the largest market share in 2024. The surge in battery electric vehicle (BEV) adoption can be attributed to growing environmental awareness among consumers, which has fueled interest in cleaner transportation options, with BEVs offering a greener alternative to traditional internal combustion engine vehicles.

b. Some key players operating in the electric vehicle market include AB Volvo, BYD Company Ltd., Ford Motor Company, General Motors, Honda Motor Co., Ltd., Kawasaki Motors Corp., U.S.A, KTM Sportmotorcycle GmbH, Mercedes-Benz Group AG, MITSUBISHI MOTORS CORPORATION, Nissan Motor Co., Ltd, Renault Group, Tesla, TOYOTA MOTOR CORPORATION, Volkswagen Group, Zero Motorcycle.

b. Key factors that are driving the market growth include stringent vehicle emission regulations and the government support for both manufacturing and buying electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.