- Home

- »

- Next Generation Technologies

- »

-

Engineering Services Outsourcing Market Size Report, 2030GVR Report cover

![Engineering Services Outsourcing Market Size, Share & Trends Report]()

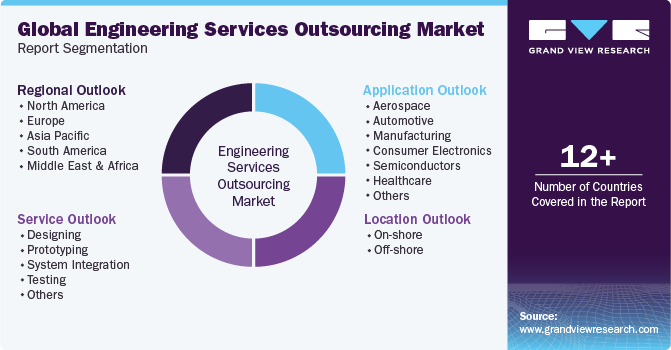

Engineering Services Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Designing, Prototyping, System Integration, Testing), By Location, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-236-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Engineering Services Outsourcing Market Summary

The global engineering services outsourcing market size was estimated at USD 2.57 billion in 2024 and is projected to reach USD 9.41 billion by 2030, growing at a CAGR of 23.4% from 2025 to 2030. The growth of the market can be attributed to several factors, including the increasing complexity of engineering projects that necessitate specialized expertise and advanced technological capabilities.

Key Market Trends & Insights

- North America engineering services outsourcing industry is expected to grow at the fastest CAGR of over 16% from 2025 to 2030.

- Europe engineering services outsourcing industry is expected to grow at a CAGR of over 25% from 2025 to 2030.

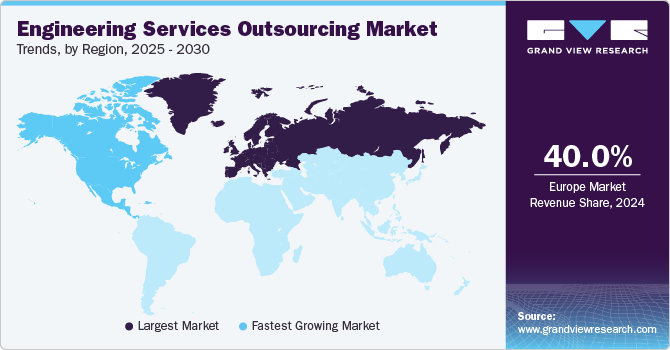

- Asia Pacific engineering services outsourcing industry dominated the market with a share of over 40% in 2024.

- Based on service, the testing segment accounted for the largest market share of over 31% in 2024.

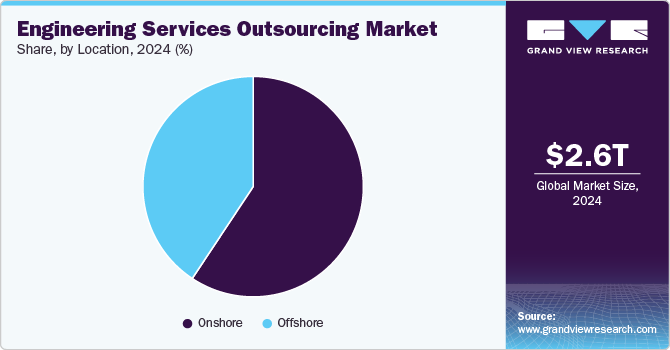

- In terms of location, the on-shore segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.57 Billion

- 2030 Projected Market Size: USD 9.41 Billion

- CAGR (2025-2030): 23.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, the demand for cost reduction and operational efficiency drives businesses to seek external partners who can provide high-quality engineering services at competitive prices is driving the engineering services outsourcing industry growth.

Cost reduction and efficiency gains are significant drivers fueling the growth of the Engineering Services Outsourcing (ESO) market. One of the primary reasons for this growth is the ability of ESO to reduce operational costs. By outsourcing engineering services, companies can leverage labor cost arbitrage, particularly by partnering with providers in regions such as India, the Philippines, or Eastern Europe, where engineering talent is available at lower costs. Additionally, ESO eliminates the need for companies to invest in costly infrastructure such as advanced software, tools, and research facilities. This reduction in overhead allows organizations to reallocate budgets to other strategic areas, thereby propelling engineering services outsourcing industry expansion.

Additionally, the growing adoption of Artificial Intelligence (AI), the Internet of Things (IoT), and Digital Twins. These technologies have transformed traditional engineering processes, enabling more accurate simulations, predictive maintenance, and real-time monitoring. ESO providers are often at the forefront of these innovations, investing heavily in advanced software and tools. For instance, Digital Twin technology allows companies to create virtual replicas of physical systems, enabling them to optimize performance and identify potential issues before deployment. By outsourcing these capabilities, businesses gain access to state-of-the-art tools without incurring the high costs of in-house development.

The adoption of Industry 4.0 technologies is significantly driving the growth of the Engineering Services Outsourcing (ESO) market. Industry 4.0, often referred to as the Fourth Industrial Revolution, incorporates advanced technologies such as automation, artificial intelligence (AI), the Internet of Things (IoT), digital twins, and big data analytics into industrial processes. This shift is transforming the engineering landscape, creating a surge in demand for specialized expertise that ESO providers are uniquely positioned to deliver, thereby driving engineering services outsourcing industry growth.

Automation and robotics are central to Industry 4.0, enabling businesses to increase productivity and reduce costs. The design, development, and deployment of robotic systems require specialized engineering services, from mechanical design to software programming and integration. ESO providers have the necessary expertise to deliver end-to-end solutions for automation projects, allowing companies to implement robotic systems more quickly and efficiently. This growing demand for robotics-related engineering services is further fueling the expansion of the engineering services outsourcing industry.

Service Insights

The testing segment accounted for the largest market share of over 31% in 2024. This dominance is driven by the increasing complexity of automotive systems and components, particularly with the rise of electric vehicles (EVs) and autonomous driving technologies. As Original Equipment Manufacturers (OEMs) seek to ensure safety and compliance with stringent regulations, there is a growing demand for comprehensive testing services. This includes simulation, validation, and verification processes that can efficiently handle advanced technologies. The need for rapid prototyping and the ability to bring products to market faster also contribute to the segment's dominance, as companies look to outsource these specialized tasks to reduce costs and enhance operational efficiency.

The designing segment is expected to witness the fastest CAGR of over 25% from 2025 to 2030. This rapid growth can be attributed to the rapid evolution of automotive technologies and consumer preferences. As automakers increasingly focus on innovation, they require advanced design capabilities that incorporate the latest trends in connectivity, sustainability, and user experience. The shift towards modular vehicle architectures and platform sharing allows for more flexible design processes, enabling quicker adaptations to market demands. Additionally, the integration of artificial intelligence (AI) and machine learning in design processes enhances creativity and efficiency, driving further growth in this segment.

Location Insights

The on-shore segment accounted for the largest market share in 2024. The on-shore segment benefits from the increasing emphasis on quality control, intellectual property protection, and regulatory compliance. Companies are recognizing the advantages of keeping engineering services closer to their operational bases to facilitate better communication and collaboration among teams. This trend is particularly relevant in regions with high labor costs where businesses are willing to invest in local expertise to ensure high-quality outcomes. Additionally, the rising consumer demand for locally produced goods fosters a preference for on-shore outsourcing as companies seek to enhance their brand image and meet sustainability goals.

The off-shore segment is expected to witness the fastest CAGR from 2025 to 2030, as manufacturers continue to leverage cost advantages associated with outsourcing engineering services to countries with lower labor costs. This strategy allows OEMs to focus on core competencies while accessing specialized skills and technologies that may not be available domestically. The growing trend of digital transformation within the automotive industry also supports off-shoring efforts, as companies can utilize advanced digital tools and platforms for seamless collaboration across borders. Furthermore, the increasing complexity of automotive systems necessitates a diverse skill set that off-shore providers can offer at competitive prices.

Application Insights

The manufacturing segment accounted for the largest market share in 2024, driven by the ongoing push for efficiency and scalability in production processes. As automakers strive to reduce production costs while maintaining high-quality standards, there is a growing reliance on outsourced manufacturing services that can provide specialized expertise and advanced technologies. Additionally, the shift towards electrification and sustainable manufacturing practices is prompting manufacturers to seek partners who can support these initiatives through innovative solutions. The need for rapid adaptation to changing market conditions further fuels demand for flexible manufacturing options.

The healthcare segment is expected to register the fastest CAGR from 2025 to 2030, owing to the increasing integration of advanced technologies such as IoT, AI, and big data analytics in medical devices and healthcare systems. As healthcare providers look to enhance patient outcomes through personalized medicine and improved diagnostics, there is a rising demand for engineering services that can support the development of sophisticated medical devices. Additionally, regulatory pressures and the need for compliance with stringent safety standards drive healthcare organizations to outsource specialized engineering services that ensure quality and reliability in their products.

Regional Insights

North America engineering services outsourcing industry is expected to grow at the fastest CAGR of over 16% from 2025 to 2030, primarily driven by the need for cost reduction, access to specialized skills, and the pressure to innovate quickly. Companies in the region are increasingly outsourcing engineering functions to improve efficiency, reduce overhead costs, and focus on their core competencies. The availability of a skilled workforce in emerging economies and the rise of digital transformation are also significant factors contributing to this trend.

U.S. Engineering Services Outsourcing Market Trends

The U.S. engineering services outsourcing industry is expected to grow at a CAGR of over 15% from 2025 to 2030, driven by the early adoption of energy optimization services and a trend towards outsourcing non-core energy management operations. The market is projected to grow significantly, with investments in upgrading aging power infrastructure and advancements in smart grid technologies enhancing demand for energy optimization solutions.

Europe Engineering Services Outsourcing Market Trends

Europe engineering services outsourcing industry is expected to grow at a CAGR of over 25% from 2025 to 2030. In Europe, the market largely driven by the region’s need to maintain competitiveness in the global market. Outsourcing helps European firms access advanced technologies, lower labor costs, and tap into specialized expertise that may not be readily available in-house. Additionally, economic pressures and regulatory complexities in various European countries encourage businesses to seek external partners for engineering support to streamline operations and remain flexible.

The UK engineering services outsourcing market is expected to grow at a significant rate in the coming years. This expansion is characterized by a strong push towards sustainability and renewable energy integration. Government policies aimed at reducing carbon footprints and promoting green technologies are driving investments in energy optimization services. The increasing demand for digitization in energy management systems is also fostering growth in this sector.

The engineering services outsourcing market in Germany is characterized by its leadership in renewable energy adoption and stringent environmental regulations. The country has made significant investments in wind and solar power, which necessitate advanced energy management solutions to optimize performance and reliability. As a result, there is a growing demand for ESO services that can integrate these renewable sources into existing grids while ensuring efficiency and sustainability.

Asia Pacific Engineering Services Outsourcing Market Trends

Asia Pacific engineering services outsourcing industry dominated the market with a share of over 40% in 2024, fueled by its rapid economic growth, an abundance of highly skilled labor, and a favorable business environment for global companies. With lower labor costs and a growing pool of qualified engineers, countries such as India and China have become attractive destinations for outsourcing engineering tasks. Furthermore, the increasing demand for digital and technological innovation in industries such as manufacturing, automotive, and IT drives the need for more outsourced engineering expertise in this region.

Japan's engineering services outsourcing market is gaining traction owing to the increasing demand for high-quality engineering services, particularly in the automotive and healthcare sectors. Companies are increasingly outsourcing specialized engineering tasks to leverage global expertise while managing costs effectively.

Engineering services outsourcing market in China is witnessing rapid growth driven by the country's massive investments in renewable energy infrastructure and technology. As one of the largest consumers of energy globally, China is focusing on optimizing its energy consumption through advanced engineering services. The government's initiatives to reduce reliance on coal and increase the share of renewables are creating significant opportunities for ESO providers. The market is anticipated to grow as China continues to implement smart grid technologies and enhance its overall energy efficiency.

Key Engineering Services Outsourcing Company Insights

Some of the key players operating in the market are Tata Consultancy Services (TCS) and ALTEN Group.

-

ALTEN Group is a global technology consulting and engineering services company that specializes in providing innovative solutions across various industries, including aeronautics, automotive, telecommunications, and life sciences. The company focuses on delivering comprehensive services that encompass the entire product development cycle, from design and engineering to IT solutions. The company's commitment to innovation and sustainable practices makes it a trusted partner for organizations looking to enhance their operational efficiency and competitiveness in a rapidly evolving market.

-

Tata Consultancy Services (TCS) is a global IT services, consulting, and business solutions organization providing a comprehensive range of services, including application development, business process outsourcing, and digital transformation solutions. With a strong focus on innovation and sustainability, TCS leverages advanced technologies to help clients across various sectors enhance their operational efficiency and drive growth. The company operates in numerous countries worldwide, serving some of the largest enterprises and contributing significantly to the global IT landscape.

HCL Technologies Limited and Emerson Electric Co some of the emerging participants in the engineering services outsourcing market.

-

HCL Technologies Limited is a global IT services and consulting company that specializes in a wide range of services, including IT and business services, engineering and R&D services, and products and platforms, catering to diverse industries such as finance, healthcare, and telecommunications. The company has established a strong presence in over 60 countries, focusing on innovation and client-centric solutions to drive digital transformation and operational efficiency for its clients. The company is known for its commitment to research and development, evidenced by its extensive portfolio of patents and numerous innovation labs worldwide.

-

Emerson Electric Co. is a global technology and engineering company that was established as a manufacturer of electric motors and fans. The company delivers automation solutions, providing innovative products and services across various sectors, including industrial, commercial, and residential markets. The company specializes in measurement and analytical instrumentation, process control systems, and fluid control technologies, among others.

Key Engineering Services Outsourcing Companies:

The following are the leading companies in the engineering services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- AKKA Technologies (Akkodis)

- Alten Group

- Capgemini Engineering

- Entelect

- HCL Technologies Limited

- Emerson Electric Co

- Infosys Limited

- Tata Elxsi

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Wipro Limited

Recent Developments

-

In December 2024, ALTEN Group announced the completion of its acquisition of the Worldgrid business unit from Atos SE. Worldgrid specializes in providing consulting and engineering services to energy and utility companies, primarily operating in France, Germany, and Spain.

-

In December 2024, HCLTechnologies announced the acquisition of assets from HPE's Communications Technology Group. This acquisition will expand HCL's portfolio of service offerings, including Business Support Systems (BSS) and network applications while integrating advanced technologies like AI and IoT into its services.

-

In March 2024, Tata Consultancy Services (TCS) announced a multimillion-dollar strategic partnership with Ramboll, a global architecture and engineering consultancy based in Denmark, to transform its IT infrastructure over the next seven years. This collaboration aims to modernize Ramboll's IT operating model, enhancing business growth while optimizing costs and reducing its carbon footprint.

Engineering Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,287.04 billion

Revenue forecast in 2030

USD 9.41 billion

Growth rate

CAGR of 23.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, location, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

AKKA Technologies (Akkodis); Alten Group; Capgemini Engineering; Entelect; HCL Technologies Limited; Infosys Limited; Tata Elxsi; Tata Consultancy Services Limited; Tech Mahindra Limited; Wipro Limited

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Engineering Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the engineering services outsourcing market report based on service, location, application, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Designing

-

Prototyping

-

System Integration

-

Testing

-

Others

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

On-shore

-

Off-shore

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Manufacturing

-

Consumer Electronics

-

Semiconductors

-

Healthcare

-

Telecom

-

Energy & Utilities

-

Construction & Infrastructure

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global engineering services outsourcing market size was valued at USD 2,575.03 million in 2024 and is expected to reach USD 3,287.04 million by 2025.

b. Key factors that are the rising demand for incorporating the most delinquent technologies in the product offerings, and the increasing need to trim the product lifecycles and trim costs are also anticipated to contribute to the ESO market's growth. The growing alliance among Engineering Service Providers (ESP) and Original Equipment Manufacturers (OEM) is predicted to appear to be one of the direct factors propelled by the increase in the acceptance of engineering services outsourcing (ESO).

b. Some key players operating in the engineering services outsourcing market include Tata Consultancy Services Limited, Tata Elxsi, ALTEN Group, AKKA and Capgemini Engineering.

b. The global engineering services outsourcing market is expected to grow at a compound annual growth rate of 23.4% from 2025 to 2030 to reach USD 9,412.07 billion by 2030

b. The testing segment dominated the market in 2024 of over 31%, driven by the increasing complexity of automotive systems and components, particularly with the rise of electric vehicles (EVs) and autonomous driving technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.