- Home

- »

- Automotive & Transportation

- »

-

Europe Yacht Market Size & Share, Industry Report, 2030GVR Report cover

![Europe Yacht Market Size, Share & Trends Report]()

Europe Yacht Market Size, Share & Trends Analysis Report By Type (Super Yacht, Flybridge Yacht), By Length (Upto 20m, 20m to 50m), By Propulsion (Motor Yacht, Sailing Yacht), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-237-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2022

- Industry: Technology

Europe Yacht Market Size & Trends

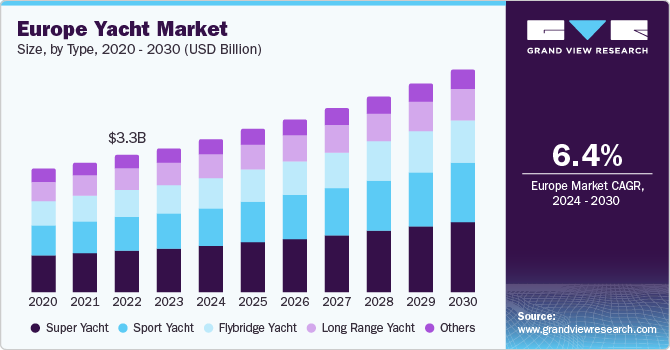

The Europe yacht market size was valued at USD 3.33 billion in 2023 and it is projected to grow at a CAGR of 6.4% from 2024 to 2030. The increasing preference of travellers for luxury marine tourism and personalized services is the primary factor driving the market growth. Owing to the increase in yachting tourism post-pandemic, the demand for yachts has gradually increased over the last few years. The growing population of high & ultra-high-net-worth individuals and increasing spending on recreational activities are expected to drive market growth over the projected period.

In 2023, the Europe market accounted for approximately 35.5% share of the global yacht market. The market growth is anticipated to show an upward curve in Europe over the forecast period. The increasing number of High-Net-Worth Individuals (HNWI) and growing preference for technologically advanced yachts are the primary factors driving the growth of the sales of new yachts in the region. The anticipated surge in demand across Europe is expected to be fueled by the cutting-edge interiors and premium amenities delivered by European OEM manufacturers. These manufacturers are consistently investing in research and development, aiming to elevate the travel experience through distinctive onboard luxury accommodations.

Recreational spending has witnessed an increase among the Europeans in recent years. According to the European Boating Industry, approximately 48 million European citizens participate in recreational boating activities regularly, with the vessels used being either chartered or owned by the participants. A rise in this number is expected to drive the adoption of yachts in the near future. Among different age groups, millennials and Gen Z spend most of their leisure time traveling compared to boomers and Gen X. The growing spending on traveling among the younger generation is likely to boost market growth. Yachting tourism has become a part of the general marine tourism sector and is expected to witness an increase in recreational spending in the near future. Yachting tourism covers catering, accommodation, entertainment, and other leisure activities in coastal areas and islands.

Yacht is still considered to be a super luxurious product, therefore, owning a yacht is still considered to be a luxury. Due to the high costs of ownership and subsequent additional costs in annual maintenance, which are also extraordinarily high, the market growth is hindered by these factors.

Market Concentration & Characteristics

The stage of growth is medium and the pace of growth is accelerating for the Europe yacht industry. The highly competitive market is prompting the key market players to pursue various strategies to increase their market penetration and cement their foothold in the market by differentiating themselves in terms of the type and quality of services they offer, including personalized craftsmanship, innovative design, and exceptional attention to detail. In addition, these firms are focusing on research and development (R&D) to drive innovation in the boating industry. The market players are also pursuing strategic partnerships and expansions to enhance credibility and broaden market access.

The degree of innovation in the industry is high. In recent years, the industry has experienced notable technological advancements, resulting in streamlined operations for yachts. Yacht manufacturers are actively investing in specialized yacht development, incorporating sustainable power sources, eco-friendly propulsion systems, and recyclable materials. Moreover, the adoption of 3D printing in yacht production has surged, enabling the creation of bespoke components for decks and hulls. This technology not only facilitates customization but also drives cost savings through minimized material wastage. In addition, artificial intelligence (AI) is expected to enable the introduction of autonomous systems across yachts, improving navigation, saving fuel, and enhancing safety.

Yachts can significantly impact the environment based on factors such as carbon emissions, fuel consumption, and pollutant releases in the water. The implementation of European Commission environmental regulations has had a significant impact on the Europe yacht industry. Yacht manufacturers are required to adhere to stringent emissions standards and environmental sustainability practices, influencing their production processes. Compliance with these regulations has necessitated adjustments in manufacturing techniques and supply chain practices to minimize environmental impact.

Despite the considerable total cost of ownership linked with owning a personal yacht, marine travel and tourism endeavors have remained largely resilient due to the accessibility of yacht rentals. Enhanced maritime security systems, connectivity options, tracking capabilities, and rising disposable incomes continue to propel market growth. Moreover, advancements in telematics and IoT platforms are poised to enhance the industry's prospects in the foreseeable future.

Type Insights

The super yacht segment dominated the market with the largest revenue share of more than 31% in 2023. The high popularity among the end-users is anticipated to bode well for segment growth. Superyachts are motor or sailing yachts with amenities such as a gym, multiple pools, dining areas, and bars. Superyachts have become a preferred choice for wealthy individuals due to the increasing use of hybrid diesel-electric propulsion and various technological advancements in these yachts and the extensive superyacht customization options offered by market players are driving the segment growth.

The sport yacht segment is anticipated to witness the fastest CAGR of 7.8% over the forecast period in the market. Sport yachts are widely used for marine tourism, sports tournaments, and other recreational activities such as cruising, fishing, and water sports. The growing demand for recreational games and increasing demand for outdoor recreational activities are expected to contribute to the segment growth. New model launches in the category are expected to boost the segment growth. Furthermore, increasing demand for recreational tournaments and a growing affinity for outdoor recreational activities are expected to drive the segment growth.

Length Insights

The 20 to 50-meter segment dominated the market with a revenue share of over 56% in 2023. It is expected to continue to dominate the segment over the forecast period. The growth of the segment can be attributed to benefits that include cheap maintenance costs and light wind sailing capabilities, which guarantee flying in a favorable wind direction and help save fuel costs. Users are also favoring this length size because of advantages like reduced moorage expenses and shallow drafts for water anchorages. Benefits such as better space compared to less than 20-meter yachts and lower costs compared to larger yachts are driving the segment growth.

The up to 20-meter segment is anticipated to register a significant CAGR over the forecast period. The segment growth can be attributed to factors such as these yachts are often easy to trailer and launch, which makes them convenient for exploring different bodies of water. Furthermore, in Europe, the emerging trend of using renewable energy such as solar energy and wind energy in sea vessels is most likely to play an important role in reducing fuel usage and emissions from ships. A yacht of this length of size operating on renewable energy is generally compact and lightweight as it requires less energy to sail. The ease of maintenance of these yachts is further driving the segment growth.

Propulsion Insights

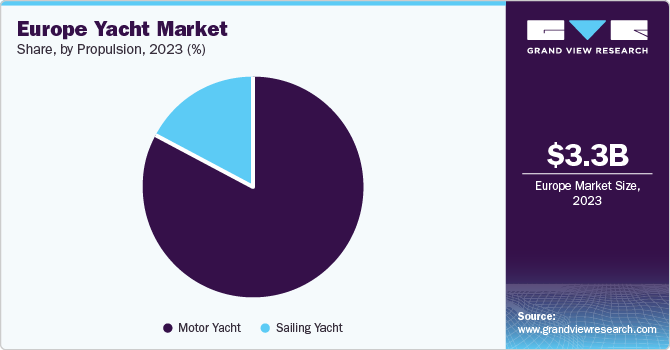

In terms of propulsion, the motor yacht segment dominated the market with the largest revenue share of more than 83% in 2023. The high share of this segment can be attributed to the benefits such as motor yachts offer a luxurious ride as they are physically less demanding since they do not require handling sails. Motor yachts have become an attractive option for buyers as they offer high speeds for long-distance travel. The growing popularity of leisure activities is further anticipated to drive the growth of the motor yacht segment. These yachts are highly preferred by the people for the advanced systems and equipment installed in the motor yachts. Ease of cruising, higher speeds, and lower dependency on the wind are driving the segment growth. The segment is also anticipated to witness the fastest CAGR over the forecast period.

The sailing yachts use sails as a propulsion system and therefore depend upon the speed of the wind for movement. The need for traditional sailing experience and new features in sailing yachts are likely to drive the segment growth. The sailing vessels have a superior and traditional design, deck space, and onboard facilities but are rarely used for long distances. Sailing yachts are preferred by people looking to travel across the water only powered by the wind, the original yachting form.

Country Insights

Europe accounted for the largest market share with a revenue contribution of over 35% in 2023 in the global market. The predominant market share is due to the surge in yacht sales within the region. The demand in the region is chiefly fueled by factors such as the rising number of High Net Worth Individuals (HNWI) and the increasing popularity of water-based sports and fishing activities. Over the forthcoming years, coastal and marine tourism is projected to witness a substantial growth in passenger traffic, driven by the region's natural advantages and recent supportive policies. This growth is expected to catalyze investments in coastal areas and various recreational pursuits, spanning from fishing, sail training adventures, white-water rafting, kayaking, and one-day boating excursions, to activities like scuba diving, free diving, and snorkeling. The proliferation of trade shows organized by manufacturers and recreational boating events is further bolstering market growth in the region.

UK Yacht Market Trends

The yacht market in the UK held the largest market share of more than 23% in the Europe region. The growth of the market in the UK is fueled by many key factors. These include the increase in disposable income among individuals, increased interest in leisure activities such as sailing and yachting, and the country's strategic positioning as a hub for maritime trade and tourism. In addition, the latest advances in technology and the availability of sustainable materials are further propelling the industry's expansion within the UK.

France Yacht Market Trends

The France yacht market is anticipated to witness a significant CAGR of 5.4% over the forecast period. The market is poised for growth due to several influential factors. These include a wealthy clientele base, both domestically and internationally, drawn to the country's renowned luxury lifestyle and maritime heritage. In addition, the government actively promotes nautical tourism through marketing campaigns and investment in coastal amenities to attract yacht enthusiasts and tourists, stimulating economic growth in coastal regions.

Germany Yacht Market Trends

The yacht market in Germany is anticipated to show a significant CAGR of 5.2%. Numerous growth factors, such as a thriving economy, a rise in outdoor leisure activities like sailing and boating, and a solid manufacturing base renowned for high-quality workmanship and technological innovation, are responsible for the market growth. The vast network of waterways and coastal areas in Germany also contributes to the industry's growth by offering plenty of options for yacht ownership and water-based recreational activities.

Croatia Yacht Market Trends

Croatia's stunning Adriatic coastline, with its numerous islands and clear blue waters, makes it an attractive destination for yacht owners and enthusiasts.The growth of Croatia's tourism industry has increased the demand for yacht charters and marina services. Croatia's regulatory environment, including tax incentives for yacht owners and favorable maritime laws, has encouraged yacht ownership and chartering activities in the country.

Greece Yacht Market Trends

Greece's reputation as a symbol of luxury living and leisure attracts affluent individuals seeking exclusive experiences, including yacht ownership, luxury yacht charters, and bespoke cruising itineraries along the Greek coastline and islands. Moreover, favorable regulations, including tax incentives and simplified procedures for yacht registration and operation, have attracted yacht owners and investors to Greece, stimulating market growth.

Italy Yacht Market Trends

Italy's popularity as a top tourist destination drives demand for yacht charters, cruises, and luxury experiences along its coastline and islands, further fueling growth in the yacht market. Continued investments in marinas, yacht clubs, and harbor facilities enhance Italy's appeal as a yachting destination and support the growth of the yacht industry.

Turkey Yacht Market Trends

Turkey offers competitive pricing for yacht construction, maintenance, and services compared to other Mediterranean countries, making it an attractive destination for yacht buyers and investors. Turkey's strategic location between Europe and Asia, with access to the Mediterranean, Aegean, and Black Seas, makes it a key hub for yacht manufacturing, sales, and tourism. The Turkish government has implemented supportive policies and incentives to promote the growth of the yacht industry

Key Europe Yacht Company Insights

Some of the key companies in the Europe yacht industry are Azimut Benetti S.p.A.; Damen Shipyards Group; Heesen Group; and The San Lorenzo S.p.A, among others.

-

AZIMUT HOLDING SPA manufactures yachts and mega yachts. AZIMUT HOLDING SPA operates through various brands. Such as AZIMUT, Benetti, Lusben, and Yachtique. The company offers a wide range of yachts, operates shipyards of megayachts, refit shipyards, and provides customers with a range of services to yacht owners. The Yachtique brand provides customized yacht interior design and makeover, private jet interior designs, and villa and residential interior designs, including onboard decoration services.

-

Damen Shipyards Group is a defense, shipbuilding, and engineering conglomerate that manufactures ships for applications such as harbor and terminal, defense and security, public transport, offshore construction, shipping, fishing, dredging, aquaculture, and recreation. The company also provides ship repair maintenance services, conversion services, chartering services, and financing & brokerage services. Damen Shipyards Group’s geographical footprint spans the Netherlands, Poland, Romania, Sweden, France, Ukraine, Turkey, South Africa, Brazil, the UAE, Qatar, Russia, China, Cuba, Curacao, Indonesia, Vietnam, Singapore, and Australia.

Princess Yachts Limited and Heesen Group are some of the emerging companies in the Europe yacht industry.

-

Princess Yachts Limited is a designer and manufacturer of yachts. The company specializes in luxury motor yachts, superyachts, flybridge yachts, sports yachts, motor yachts, and openbridge yachts. The company’s portfolio of yachts can be segmented into yacht models such as X class, Y class, F class, S class, V class, and R class.

-

Heesen Yachts Sales B.V. specializes in custom-built superyachts. The company holds expertise in all-aluminum yacht design, engineering, and construction. Heesen Yachts Sales B.V. has built yachts under several projects, such as Project X Venture, Project Ceres, Project Saturnus, Project Avanti, and Project Kometa

Key Europe Yacht Companies:

- Azimut Benetti S.p.A.

- Damen Shipyards Group

- Heesen Group

- The San Lorenzo S.p.A

- Sunseeker International

- Ferretti S.p.A.

- Amel Yachts

- Princess Yachts Limited

- Bavaria Yachts

- Groupe Beneteau

Recent Developments

-

In March 2024, Sanlorenzo closes the Simpson Marine acquisition. The Italian company Sanlorenzo Group has announced the closing of the acquisition of 95 percent of the share capital of Simpson Marine Limited from Mike Simpson, for an equity consideration of US$10 million, plus an earn-out up to US$7 million calculated on the net profit for the 2023 fiscal year.

-

In March 2024, Sirena Yachts Opens a New Superyacht Shipyard in Yalova. Steady growth in both sales volumes and model sizes has led Sirena Yachts to expand its yacht production facilities in Turkey. Leasing waterside building halls in the shipbuilding center of Yalova, near Istanbul, has added an extra 150,000 square meters of construction space to Sirena's estate and boosted the workforce to 1,200. The intention is to concentrate production of Sirena's Steel 42 superyacht in Yalova.

Europe Yacht Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.54 billion

Revenue forecast in 2030

USD 5.14 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, company share analysis, competitive landscape, growth factors, and trends

Segments covered

Type, length, propulsion, country

Regional scope

Europe

Country scope

U.K.; Germany; France; Croatia; Greece; Italy; Turkey

Key companies profiled

Azimut Benetti S.p.A.; Damen Shipyards Group; Heesen Group; The San Lorenzo S.p.A; Sunseeker International; Ferretti S.p.A.; Amel Yachts; Princess Yachts Limited; Bavaria Yachts; Groupe Beneteau

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Yacht Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe yacht market report based on type, length, propulsion, and country:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Super Yacht

-

Flybridge Yacht

-

Sport Yacht

-

Long Range Yacht

-

Others

-

-

Length Outlook (Revenue, USD Million, 2017 - 2030)

-

Upto 20 m

-

20 to 50 m

-

Above 50 m

-

-

Propulsion Outlook (Revenue, USD Million, 2017 - 2030)

-

Motor Yacht

-

Sailing Yacht

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.K.

-

Germany

-

France

-

Croatia

-

Greece

-

Italy

-

Turkey

-

Frequently Asked Questions About This Report

b. The Europe yacht market was estimated at USD 3.33 billion in 2023 and is expected to reach USD 3.54 billion in 2024.

b. The Europe yacht market is expected to progress at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 5.14 billion in 2030.

b. The super yacht segment accounted for the largest revenue share of more than 30% in 2023 in the Europe yacht market. It will maintain its dominance over the forecast period owing to its high popularity among the end-users.

b. The key players operating in the Europe yacht market include Azimut Benetti S.p.A.; Damen Shipyards Group; Heesen Group; and The San Lorenzo S.p.A, among others

b. Key factors driving the Europe yacht market include the increasing preference of travelers for luxury marine tourism and personalized services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."