- Home

- »

- Renewable Chemicals

- »

-

Furandicarboxylic Acid Market Size & Share Report, 2030GVR Report cover

![Furandicarboxylic Acid Market Size, Share & Trend Report]()

Furandicarboxylic Acid Market Size, Share & Trend Analysis Report By Application (PET, Polyamides, Polycarbonates, Plasticizers, Polyester Polyols), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-043-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Furandicarboxylic Acid Market Size & Trends

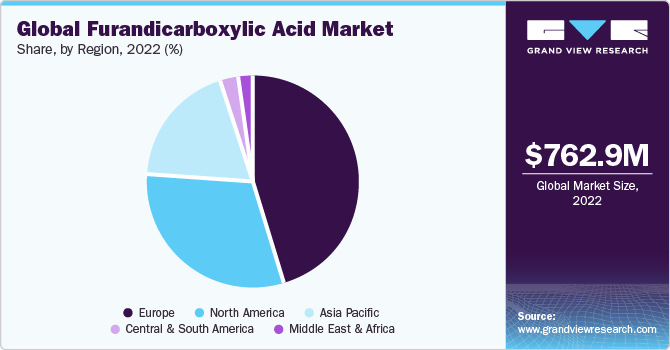

The global furandicarboxylic acid market size was valued at USD 762.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 34.0% from 2023 to 2030. Furandicarboxylic acid (FDCA) is an oxidized furan derivative and is a highly stable compound. Owing to its potential of being used as a substitute to a wide variety of petrochemicals such as adipic acid and terephthalic acid, there has been extensive R&D over the past decade. The product was classified by the US Department of Energy as one of 12 priority chemicals for establishing the “green” chemistry industry of the future. Earlier, it was not commercialized in industrial volumes as the production process was not economically viable. The key concern for the economic production of FDCA is the instability of the intermediate, which is needed for the production of FDCA - 5-hydroxymethylfurfural (HMF).

The synthesis of 2,5-Furandicarboxylic acid (FDCA) offers greater ease compared to the synthesis of HMF (5-Hydroxymethylfurfural). The challenges associated with HMF synthesis include the requirement of expensive catalysts, high-pressure conditions, HMF decomposition into levulinic and formic acid, and the complexities of separating DMSO (Dimethyl sulfoxide) as a solvent, along with concerns regarding the toxicity of byproducts. Currently, FDCA is primarily supplied for scientific purposes, and the supply is tailored to meet specific client requirements.

The anticipated cost-effective production of furandicarboxylic acid (FDCA) is projected to drive significant demand for bio-based FDCA in the market. This bio-based alternative holds great potential for replacing numerous petroleum-based chemicals and bio-based intermediates like levulinic acid and succinic acid. The inherent properties of FDCA contribute to the production of superior end products while minimizing the generation of by-products.

A substantial supply of feedstock is required to meet the demands of mass-producing furandicarboxylic acid (FDCA), making raw material suppliers a crucial component of the market. Notably, Cargill, Incorporated, a major player in the industry, stands out as one of the largest suppliers of bio-based raw materials, including sugar. In a strategic collaboration, Avantium has partnered with Cargill to secure a reliable supply of starch-based feedstock for their pilot plant operations.

Furandicarboxylic acid (FDCA) holds significant importance as a renewable feedstock for polyester production and is expected to emerge as a potential substitute for purified terephthalic acid (PTA). This is primarily attributed to its low production cost and biodegradable nature. The relatively simplified conversion process of FDCA into plastics, in comparison to the traditional polyester production using PTA, is expected to drive its demand in the market. These favorable factors position FDCA as a promising alternative in the industry, aligning with the growing emphasis on sustainability and environmentally friendly solutions.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 46.0% in 2022 and is expected to grow at the fastest CAGR of 35.3% during the forecast period. This significant growth is attributed to the increasing consumer awareness about environmental issues, which led to the rising demand for sustainable packaging solutions. FDCA is used in the production of bio-based polymers like PEF, which offers superior barrier properties and can be an eco-friendly substitute for traditional packaging materials. Furthermore, continuous advancements in technology and process optimization have made the production of FDCA more efficient and cost-effective. This has further bolstered FDCA market growth by making it a viable and competitive option compared to conventional chemicals.

Application Insights

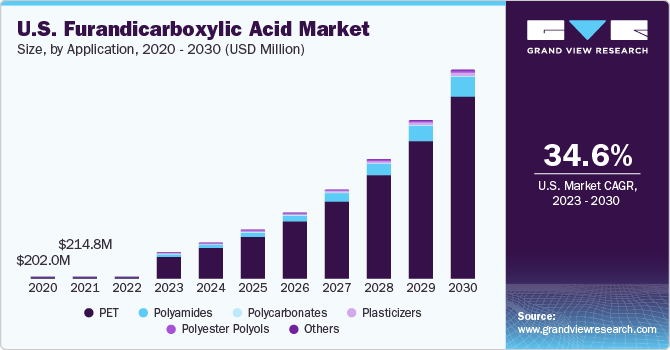

The PET segment held the largest revenue share of 85.8% in 2022 and is expected to grow at the fastest CAGR of 34.2% over the forecast period. This positive outlook is attributed to the usage of PET in the food and packaging industry. In addition, increasing interest in the development of bio-based PET is expected to benefit the market.

The adoption of 2,5-furandicarboxylate (PEF) as a renewable alternative to terephthalic acid, along with the use of renewable ethylene glycol (EG), enables the production of 100% renewable polyester. This innovative material finds promising applications in film and bottle manufacturing due to its exceptional barrier properties. Additionally, the polyamide segment is expected to grow at the second-fastest CAGR of 34.1% over the forecast period. Furthermore, FDCA esters hold significant potential as substitute plasticizers, particularly for phthalate-based ones, addressing the demand for safer alternatives in various industries.

Key Companies & Market Share Insights

Key players in the furandicarboxylic acid (FDCA) market are implementing diverse strategies, including product introductions, mergers and acquisitions, joint ventures, and geographic expansion, to enhance their market presence and stimulate growth. For instance, in December 2021, Avantium successfully secured USD 100 million in financing for the construction of a furandicarboxylic acid (FDCA) plant in Delfzijl, the Netherlands. This funding helped Avantium to proceed with its plans to establish the facility, which is anticipated to play a crucial role in the production of FDCA.

Key Furandicarboxylic Acid Companies:

- Avantium

- Synbias Pharma

- V & V Pharma Industries

- Carbone Scientific

- Tokyo Chemical Industry Co., Ltd.

- Chemsky (shanghai) International Co., Ltd

Recent Development

-

In December 2021, Avantium successfully secured USD 100 million in financing for the construction of a furandicarboxylic acid (FDCA) plant in Delfzijl, the Netherlands. This funding helped Avantium to proceed with its plans to establish the facility, which is anticipated to play a crucial role in the production of FDCA.

Furandicarboxylic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8,614.9 million

Revenue forecast in 2030

USD 66,904.3 million

Growth rate

CAGR of 34.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in Tons, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Germany; France; Italy; China; Japan

Key companies profiled

Avantium; Synbias Pharma; V & V Pharma Industries; Carbone Scientific; Tokyo Chemical Industry Co., Ltd.; Chemsky (shanghai) International Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Furandicarboxylic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global furandicarboxylic acid (FDCA) market based on application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

PET

-

Polyamides

-

Polycarbonates

-

Plasticizers

-

Polyester Polyols

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global furandicarboxylic acid market size was estimated at USD 762.9 million in 2022 and is expected to reach USD 8,614.9 million in 2023.

b. The global furandicarboxylic acid market is expected to grow at a compound annual growth rate of 34.0% from 2023 to 2030 to reach USD 66,904.3 million by 2030.

b. PET segment dominated the furandicarboxylic acid market with a share of 85.8% in 2022. This is attributable to the application of PET in the food and packaging industry.

b. Some key players operating in the furandicarboxylic acid market include Synbias, V&V Pharma Industries, Tokyo Chemical Industry, Carbone Scientific, Chemsky, and others.

b. Key factors that are driving the market growth include its potential of being used as a substitute to a wide variety of petrochemicals such as adipic acid and terephthalic acid.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."