- Home

- »

- Organic Chemicals

- »

-

Flavors And Fragrances Market Size, Industry Report, 2033GVR Report cover

![Flavors And Fragrances Market Size, Share & Trends Report]()

Flavors And Fragrances Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Natural, Aroma Chemicals), By Application (Flavors, Fragrances), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-697-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavors And Fragrances Market Summary

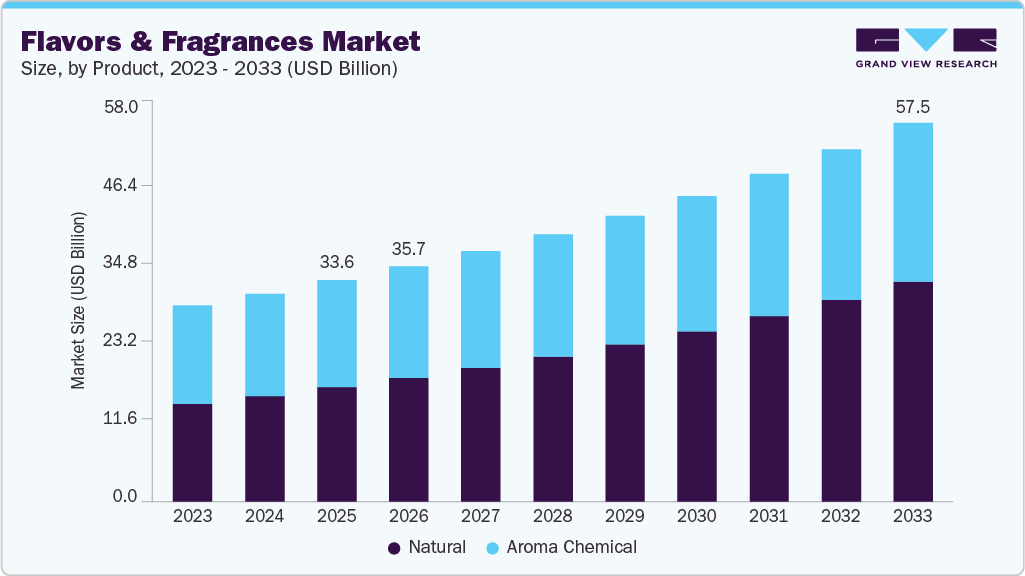

The global flavors and fragrances market size was estimated at USD 32,265.6 million in 2024 and is projected to reach USD 52,388.2 million by 2033, expanding at a CAGR of 5.5% from 2025 to 2033. The market is primarily driven by the rising demand for processed and convenience foods, coupled with the growing consumption of personal care and cosmetic products across emerging and developed economies.

Key Market Trends & Insights

- Asia Pacific dominated the flavors and fragrances market with the largest revenue share of 32.6% in 2024.

- The market in China is expected to grow at the highest CAGR of 8.1% from 2025 to 2033.

- By product, the natural segment is expected to grow at the highest CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By product, the natural segment held the largest revenue share of 75.0% in 2024 in terms of value.

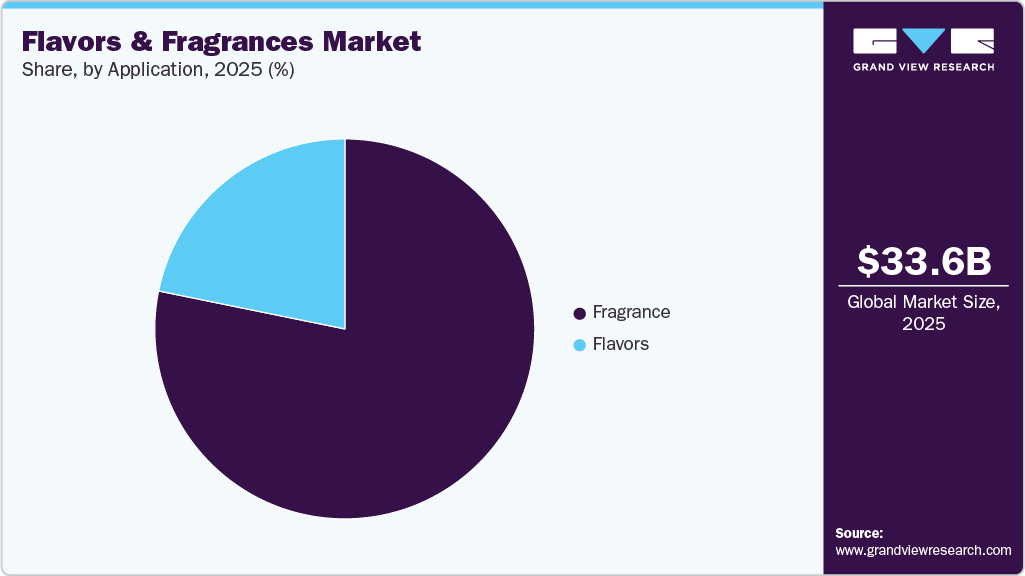

- By application, the fragrances segment held the largest revenue share of 52.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 32,265.6 Million

- 2033 Projected Market Size: USD 52,388.2 Million

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

Increasing consumer preference for natural and clean-label ingredients is accelerating the adoption of essential oils, oleoresins, and bio-based aroma chemicals. The market is benefitting from rapid urbanization, evolving lifestyle patterns, and the expanding wellness and aromatherapy segments. The market presents significant growth opportunities driven by the rising demand for natural, organic, and sustainable ingredients, particularly in food, beverage, and personal care applications. Advancements in biotechnology and fermentation-based production are enabling the development of high-purity aroma compounds with reduced environmental impact. Emerging markets in Asia Pacific, Latin America, and the Middle East offer untapped potential due to expanding middle-class populations, increasing disposable incomes, and evolving consumer preferences.

Despite strong growth prospects, the market faces key challenges including raw material price volatility, particularly for natural extracts, which can disrupt supply chains and increase production costs. Strict regulatory frameworks and compliance requirements across regions, especially regarding labeling, allergens, and synthetic ingredients, pose constraints on product formulation and market entry. Furthermore, intense competition among global and regional players is pressuring margins, while the growing demand for transparency and traceability requires investment in sourcing and quality control systems.

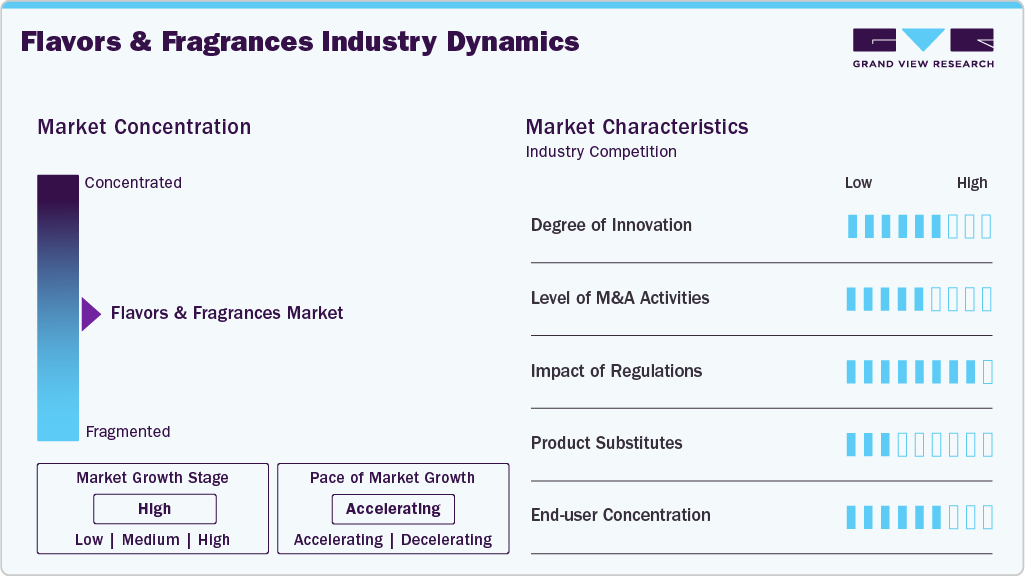

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Sensient Technologies Corp., BASF SE, Mane SA, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

The leading players in the market are adopting a range of strategic initiatives focused on innovation, sustainability, and regional expansion to strengthen their market share. Companies are heavily investing in R&D to develop novel, clean-label, and functional ingredients aligned with evolving consumer preferences. Strategic mergers and acquisitions are being pursued to enhance product portfolios, strengthen global distribution networks, and enter high-growth emerging markets. In addition, firms are leveraging biotechnological advancements to produce cost-efficient and eco-friendly aroma compounds, while also establishing long-term partnerships with raw material suppliers to ensure quality and traceability.

Product Insights

The natural segment held the largest revenue share of 74.6% in 2024, primarily due to a pronounced consumer shift toward clean-label, plant-based, and sustainable ingredients across food, beverage, personal care, and aromatherapy applications. Increasing health and environmental awareness, along with regulatory pressures against synthetic additives, has prompted manufacturers to reformulate products using natural inputs. Essential oils and oleoresins, derived from botanical sources, are favored for their multifunctional properties, including aroma, flavor enhancement, and therapeutic benefits. Moreover, the rising demand for premium and wellness-oriented products, particularly in developed markets, has further accelerated the adoption of high-value natural ingredients, reinforcing the dominance of this segment.

Within the natural category, essential oils, such as orange, lemon, lavender, peppermint, and eucalyptus, are extensively used in fragrances, functional beverages, and aromatherapy, owing to their distinct aromatic profiles and holistic benefits. Simultaneously, oleoresins such as paprika, turmeric, and black pepper are gaining traction in savory food formulations and nutraceuticals for their robust flavor and bioactive properties. The segment also includes other natural extracts that cater to niche and artisanal product lines. On the other hand, the aroma chemicals segment, while smaller in share, remains vital for offering stability, consistency, and cost efficiency in large-scale production. It encompasses esters, alcohols, aldehydes, phenols, and terpenes, each contributing to specific olfactory or flavor profiles.

Application Insights

The fragrances segment accounted for the largest revenue share of 52.2% in 2024, driven by robust demand across the personal care, home care, and wellness industries. The growth is largely attributed to rising consumer spending on cosmetics, toiletries, and household products, particularly in emerging markets experiencing rapid urbanization and lifestyle shifts. Fine fragrances, soaps, and detergents continue to see strong demand due to evolving grooming habits and heightened hygiene awareness. In addition, the increasing popularity of wellness products and aromatherapy solutions, often featuring natural essential oils, has significantly boosted the use of fragrances in both mass-market and premium product lines.

The flavors segment, while slightly smaller in revenue share, remains a critical growth area driven by the expanding processed food and beverage industry. Within this category, beverages lead the application outlook due to the popularity of flavored waters, functional drinks, and non-alcoholic beverages. Dairy, bakery, and convenience foods are also key contributors, supported by the rise in snacking trends, on-the-go consumption, and flavored dairy innovations such as yogurts and cheeses. In addition, animal feed flavoring, a niche but growing area, is gaining traction as producers aim to enhance palatability and nutritional appeal for livestock. Flavor houses are increasingly focusing on natural and region-specific profiles to cater to diverse consumer palates, and technological advancements in encapsulation and flavor-release mechanisms enabling longer shelf life and improved sensory performance across food categories.

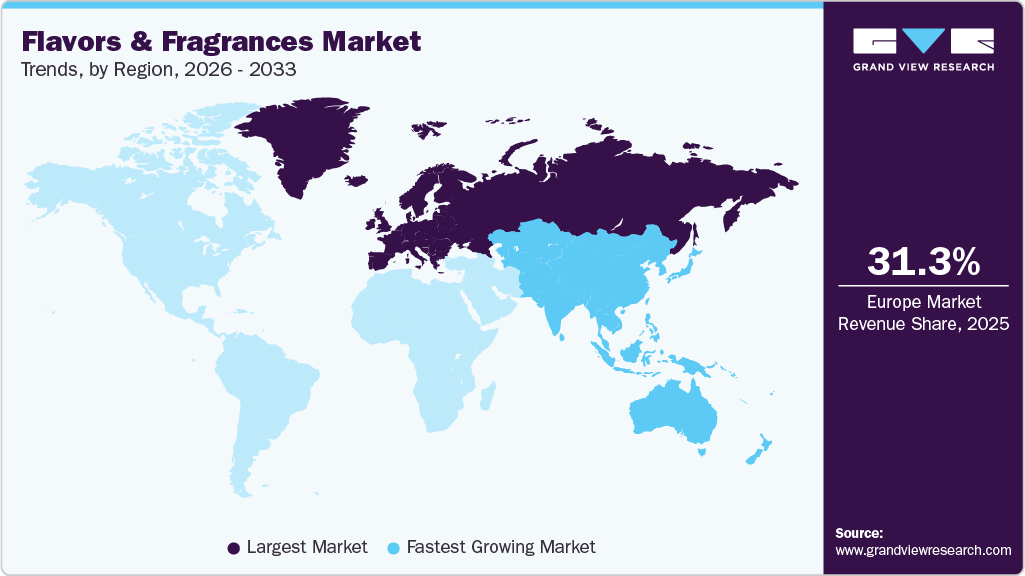

Regional Insights

Asia Pacific held the largest share of the market in 2024, accounting for 32.6% of the total revenue. This dominance is fueled by rapid industrialization, a booming middle-class population, and increasing demand for processed foods, personal care, and home care products. Growing urbanization, evolving dietary patterns, and the rising popularity of natural and traditional ingredients further support market growth. The region also benefits from abundant raw material availability and expanding manufacturing bases, making it a strategic hub for both production and consumption.

China Flavors & Fragrances Market Trends

China remained a key contributor to Asia Pacific’s market leadership, driven by strong domestic demand across food, beverage, cosmetics, and household care sectors. The country’s growing focus on product premiumization, natural formulations, and wellness-related offerings is prompting manufacturers to invest in advanced flavor and fragrance solutions. Government initiatives supporting local manufacturing, coupled with the rise of e-commerce and international brand penetration, are further enhancing market potential in China.

North America Flavors And Fragrances Market Trends

North America accounted for 21.7% of the global market in 2024, backed by a mature and innovation-driven food and personal care industry. High consumer awareness regarding product quality, clean-label claims, and sustainability has pushed companies to offer sophisticated and health-conscious formulations. The region is also a hub for R&D and the early adoption of biotechnology for producing sustainable aroma chemicals. Demand for natural flavors and functional fragrances continues to shape product development across multiple sectors.

U.S. Flavors & Fragrances Market Trends

The U.S. remained the dominant market within North America, characterized by its strong consumer base, well-established retail infrastructure, and trend-led product innovation. The country is witnessing a growing appetite for organic and artisanal food and beverage offerings, as well as premium personal care products with botanical scents. Strategic investments in green chemistry, supply chain transparency, and wellness-driven formulations are key factors influencing market dynamics in the U.S.

Europe Flavors And Fragrances Market Trends

Europe represented 20.8% of the market in 2024, supported by a well-regulated environment and demand for high-quality, sustainable products. Consumers in the region prioritize safety, transparency, and traceability, making natural and bio-based ingredients increasingly popular. The market is also benefiting from strong growth in luxury fragrances, organic personal care, and specialty foods, especially in Western Europe. Innovation and compliance with EU regulations remain central to regional competitiveness.

Germany led the European market owing to its strong food processing and cosmetics industries, along with a growing emphasis on sustainability and clean-label formulations. Demand for customized flavors and premium fragrances is rising, especially among health-conscious and environmentally aware consumers. The country also serves as a manufacturing and innovation hub, with several leading global players and niche natural product brands operating in the region.

Latin America Flavors And Fragrances Market Trends

Latin America held a 15.4% market share in 2024, driven by increasing urbanization, changing dietary habits, and rising consumer interest in personal grooming and wellness. Brazil and Mexico are major contributors, with growing demand for affordable yet sensory-rich food and personal care products. Regional manufacturers are increasingly incorporating locally sourced natural ingredients to appeal to traditional preferences while aligning with global sustainability trends.

Middle East & Africa Flavors and Fragrances Market Trends

The Middle East & Africa accounted for 9.6% of the market in 2024, showing steady growth supported by rising disposable incomes, lifestyle modernization, and a youthful population. Demand for premium and culturally relevant fragrances, along with the growing penetration of flavored food and beverage products, is driving regional expansion. While import dependency remains high, local production capabilities are gradually strengthening, creating new opportunities for both international and regional players.

Key Flavors And Fragrances Company Insights

Key players, such as Sensient Technologies Corp., BASF SE, Mane SA, Takasgo International Corporation, are dominating the market.

-

BASF SE is a leading global player in the Flavors and Fragrances market, known for its extensive portfolio of aroma ingredients, functional raw materials, and sustainable solutions catering to personal care, home care, and food industries. Leveraging its strong R&D capabilities and advanced chemical expertise, BASF offers a wide range of high-performance aroma chemicals, including esters, alcohols, and aldehydes, that enhance the olfactory and sensory profiles of consumer products. The company is actively investing in green chemistry and biotechnology to expand its range of bio-based and biodegradable ingredients in response to growing consumer demand for clean-label and eco-friendly formulations. With a strategic focus on innovation, regulatory compliance, and supply chain integration, BASF continues to strengthen its global footprint through partnerships, capacity expansions, and localized product development tailored to emerging market needs.

Key Flavors And Fragrances Companies:

The following are the leading companies in the flavors and fragrances market. These companies collectively hold the largest market share and dictate industry trends.

- Sensient Technologies Corp.

- BASF SE

- Mane SA

- Takasgo International Corporation

- Givaudan

- Alpha Aromatics

- Ozone Naturals

- Elevance Renewable Sciences, Inc.

- Firmenich SA

- Symrise AG

Recent Developments

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In January 2023 Symrise AG invested in Ignite Venture Studio. It is B2C startup ventures in the personal care sector. Symrise has invested in Ignite Venture Studio to drive product innovations in fragrance and cosmetic ingredients.

-

In December 2022, Symrise had partnered with Norwest Ingredients for comprehensive sustainability assessment of peppermint and spearmint raw materials.

-

In December 2022, Mane Group has opened two new facilities in India. The first site is located at MANE KANCOR Angamaly, Kerala; the second is at MANE KANCOR Byadgi, Karnataka.

Flavors And Fragrances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34,137.0 million

Revenue forecast in 2033

USD 52,388.2 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Southeast Asia; Saudi Arabia; African Continent; Brazil; Colombia

Key companies profiled

Sensient Technologies Corp.; BASF SE; Mane SA; Takasago International Corp.; Givaudan; Alpha Aromatics; Ozone Naturals; Elevance Renewable Sciences, Inc.; Firmenich SA; Symrise AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavors And Fragrances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global flavors and fragrances market report based on application, technology, resin and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Essential Oils

-

Orange Essential Oils

-

Corn mint Essential Oils

-

Eucalyptus Essential Oils

-

Pepper Mint Essential Oils

-

Lemon Essential Oils

-

Citronella Essential Oils

-

Patchouli Essential Oils

-

Clove Essential Oils

-

Ylang Ylang/Canaga Essential Oils

-

Lavender Essential Oils

-

-

Oleoresins

-

Paprika Oleoresins

-

Black Pepper Oleoresins

-

Turmeric Oleoresins

-

Ginger Oleoresins

-

-

Others

-

-

Aroma Chemical

-

Esters

-

Alcohol

-

Aldehydes

-

Phenol

-

Terpenes

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Products

-

Beverages

-

Animal Feed

-

Others

-

-

Fragrance

-

Fine Fragrance

-

Cosmetics and Toiletries

-

Soaps and Detergents

-

Aromatherapy

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Portugal

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Middle East & Africa

-

Saudi Arabia

-

African Continent

-

-

Latin America

-

Brazil

-

Colombia

-

-

Frequently Asked Questions About This Report

b. The global flavors and fragrances market size was estimated at USD 32,265.6 million in 2024 and is expected to reach USD 34,137.0 million in 2025.

b. The flavors and fragrances market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 52,388.2 million by 2033.

b. The natural segment held the largest revenue share of 75.0% in 2024 due to rising consumer demand for clean-label, plant-based, and sustainable ingredients across food, beverage, and personal care applications. This shift was further supported by regulatory pressures on synthetic additives and the growing popularity of wellness-focused and premium products.

b. Some of the key players operating in the flavors and fragrances market include Sensient Technologies Corp., BASF SE, Mane SA, Takasago International Corp., Givaudan, Alpha Aromatics, Ozone Naturals, Elevance Renewable Sciences, Inc., Firmenich SA, and Symrise AG.

b. The flavors and fragrances market is driven by rising demand for natural and clean-label ingredients, growing consumption of processed foods and beverages, and increased spending on personal care and home care products. The evolving consumer preferences toward wellness and sensory-driven experiences are fueling innovation across both flavor and fragrance applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.