- Home

- »

- Green Building Materials

- »

-

Global Glass Curtain Wall Market Size Report, 2020-2027GVR Report cover

![Glass Curtain Wall Market Size, Share & Trends Report]()

Glass Curtain Wall Market Size, Share & Trends Analysis Report By System Type (Unitized, Stick), By End Use (Commercial, Public, Residential), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-906-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

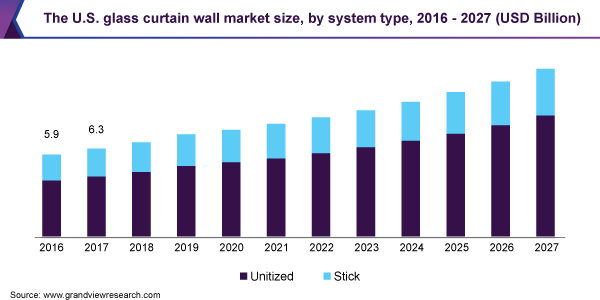

The global glass curtain wall market size was valued at USD 46.1 billion in 2019 and is expected to grow at a compounded annual growth rate (CAGR) of 7.0% from 2020 to 2027. Rising focus on improving the energy efficiency of the building structures coupled with growing investment in the development of green buildings are projected to drive the market. The glass curtain wall systems are a symbol of modern architecture, dating back to the 1930’s construction era. Rising the adoption of aluminum as a lightweight and structurally strong alternative to iron has put a significant impact on the development and adoption of glass curtain wall systems as an integral element of the building structure. The unitized glass curtain wall emerged as the largest system type segment in the U.S. in 2019. Increasing investment in the construction of large commercial buildings and rising demand for residential structures with sleek modern architectural looks are some of the factors driving the segment growth within the market for glass curtain walls in the U.S.

Improvements in various technical aspects had a far-reaching impact on the wider application of glass curtain wall systems across the world. Development of composite structural elements and improvements in the glass making process has enabled the production of lightweight glass curtain walls, thereby reducing the installation time.

Various governmental bodies and corporate offices across the world are adopting and promoting various ‘Green Building’ standards. For instance, the Government of India has set an ambitious target of having 10.0 billion square feet of green building floor space by 2022. This, in turn, is expected to drive the demand for various green building materials including the glass curtain walls.

Glass curtain walls offer a sleek and modern look to the building structures. The majority of glass curtain walls are installed on the newly constructed buildings. However, the product is witnessing growing adoption in redevelopment and reconstruction of older building structures. Thus, rising investment in building redevelopment activities is expected to boost the market growth.

System Type Insights

The unitized system led the market for glass curtain walls and accounted for more than 65.0% share of the global revenue in 2019. The demand for unitized system is driven by its easy to install properly and its suitability to the high rise building structures. Unlike other systems, it generates considerably less amount of waste and is highly suitable to buildings requiring high volumes of cladding.

The unitized system is fabricated at an off-site location in a controlled environment, thereby ensuring the quality of the final product. The glass panels are then transported and assembled at the construction site. However, the system requires specialized cranes for installation, thus limiting its use to the high volume projects.

The stick system is expected to grow at a steady pace over the forecast period owing to its durability and suitability for low volume construction. In addition, the system is compatible with a wide range of building structures and glass types. Furthermore, the stick system type is being used to renovate existing old building structures into modern ones.

The stick system segment accounted for USD 16.1 billion in revenue in 2019 and is expected to witness a revenue-based CAGR of 5.9% over the forecast period. The high installation cost and longer installation time associated with this system type are expected to have a negative impact on segment growth over the forecast period.

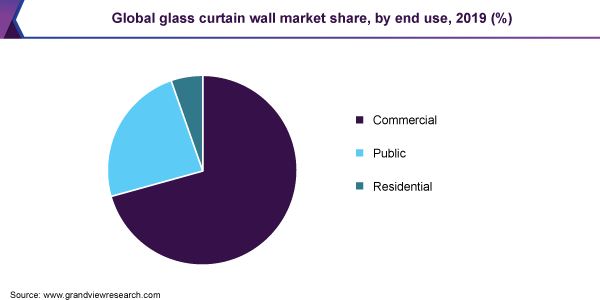

End-use Insights

The commercial end-use segment led the market for glass curtain walls and accounted for more than 70.0% of the global revenue share in 2019, owing to the growing emphasis on the construction of energy-efficient office spaces and commercial structures. Furthermore, increasing spending on the restoration of old office buildings is expected to boost demand for glass curtain walls over the forecast period.

The commercial segment also includes hotels, resorts, hospitals, and shopping malls. These establishments incur significant expenditure on electricity consumption. Furthermore, excess electricity use leads to a significant rise in operational costs, thereby, affecting the overall profit margins. As a result, the sector is focusing on reducing its electricity consumption by adopting green building standards.

The residential segment is anticipated to progress at a revenue-based CAGR of 7.6% in the glass curtain wall market over the forecast period. Multifamily residential complexes are progressively adopting a variety of sustainable measures such as installing energy-efficient lighting, HVAC systems, in order to save the energy expenditure. Thus, the segment is expected to boost the demand for glass curtain walls in the future.

The public segment includes stadiums, public buildings, and various transportation facilities such as airports, bus terminals, and train stations. These venues are progressively adopting green building codes in order to generate energy savings and comply with various regulatory standards. Thus, the use of glass curtain walls at such places has a huge potential to save a substantial amount of energy.

Regional Insights

Asia Pacific dominated the market for glass curtain walls and accounted for over 35.0% share of global revenue in 2019, owing to high product utilization in the construction of retail and office spaces in the emerging economies of India, Philippines, China, Indonesia, and Vietnam. Moreover, growing regulatory support for the construction of green buildings in the region is expected to drive the demand for glass curtain walls in the region.

In the U.S., the market for glass curtain walls is expected to ascend at a revenue-based CAGR of 6.4% over the forecast period on account of a positive outlook for office and commercial construction sector in the U.S. and Mexico. In addition, the growing adoption of ‘Green Building’ standards is expected to drive the demand for glass curtain walls in North America.

The office construction industry in the U.S. has exhibited continuous growth over the past five years on account of rising requirements for office space by companies. Currently, around 95.8 million square feet of office space is under construction in the U.S. Thus, ongoing construction projects such as the redevelopment of St. John’s Terminal and Hudson yards are anticipated to boost the market growth.

In the Middle East and Africa, the market for glass curtain walls is anticipated to witness the highest CAGR of 8.1% in terms of volume over the upcoming period. The emergence of Dubai as a major financial and business hub and the rapid growth of commercial construction in Saudi Arabia and Qatar are anticipated to be the primary factors driving the market in the region.

Key Companies & Market Share Insights

Major market players are engaged in implementing various marketing strategies such as strategic collaborations with the installation contractors and expansion of product portfolio. For instance, Kawneer, a manufacturer, has developed an installation certification scheme for installation contractors to train them in better installation practices and minimize the risk of defects. A large number of manufacturers are present at the global level. However, small and medium level players at the regional level are also competing for market share. Some of the market players offer installation and post-installation services. Brand recognition and brand loyalty are some of the factors playing an important role in increasing the market share of the company. Some of the prominent players in the glass curtain wall market include:

-

Kawneer

-

Asahi Glass

-

Nippon Sheet Glass

-

Schott AG

-

China Glass Holdings Limited

-

Vitro

-

Apogee Enterprises Inc.

Glass Curtain Wall Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 48.5 billion

Revenue forecast in 2027

USD 79.0 billion

Growth Rate

CAGR of 7.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in thousand square meters, revenue in USD billion and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

The U.S.; Canada; Mexico; Germany; The U.K.; France; Italy; South Korea; China; India; Japan; Brazil; UAE; Saudi Arabia

Key companies profiled

Kawneer; Asahi Glass; Nippon Sheet Glass; Schott AG; China Glass Holdings Limited; Vitro; Apogee Enterprises Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global glass curtain wall market report on the basis of system type, end-use, and region:

-

System Type Outlook (Volume, Thousand Square Meters; Revenue, USD Billion, 2016 - 2027)

-

Unitized

-

Stick

-

-

End-use Outlook (Volume, Thousand Square Meters; Revenue, USD Billion, 2016 - 2027)

-

Commercial

-

Public

-

Residential

-

-

Regional Outlook (Volume, Thousand Square Meters; Revenue, USD Billion, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global glass curtain wall market size was estimated at USD 46.1 billion in 2019 and is expected to reach USD 48.5 billion in 2020.

b. The glass curtain wall market is expected to grow at a compound annual growth rate of 7% from 2020 to 2027 to reach USD 79 billion by 2027.

b. The unitized system dominated the glass curtain wall market with a share of 56.4% in 2019, owing to its suitability for installation on large-sized buildings and faster installation time.

b. Some of the key players operating in the glass curtain wall market include Kawneer, Asahi Glass, Nippon Sheet Glass, Schott AG, China Glass Holdings Limited, Vitro, and Apogee Enterprises Inc.

b. The key factors that are driving the glass curtain wall market include growing demand for commercial spaces such as offices, malls, among others, and the rising adoption of green building standards across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."