- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Global Fructose Market Size, Share, Trend Report, 2020-2027GVR Report cover

![Fructose Market Size, Share & Trends Report]()

Fructose Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Fructose Syrups, High Fructose Corn Syrup), By Application (Beverages, Processed Foods), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-1-68038-841-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global fructose market size was valued at USD 4.34 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2020 to 2027. Growing demand for low-sugar, low-fat, and processed low-calorie food products is expected to drive industry growth. Fructose is a monosaccharide with a chemical formula similar to glucose but different molecular structure. It is naturally available in fruits, vegetables, honey, and some plants. Fructose is used in food & beverages for enhancing their quality, taste, and texture. Furthermore, the low Glycemic Index (GI) associated with the product as compared to table sugar is likely to propel its demand. The U.S. is expected to exhibit significant growth on account of rising consumer awareness about following a healthy diet.

The consumers are looking for a replacement for white sugar in their daily diet to achieve fitness, which will help the growth of the fructose industry over the projected period. However, the consumers are opting the organic products, which will impact the market growth to some extent. Fructose is derived from various raw materials, such as sugarcane, beet, and maize. The use of the product has been prevalent in the food & beverage industry on account of its low cost and high relative sweetness.

Factors like fluctuation in raw material prices and an increase in production costs are likely to be key challenges for the industry players. An increase in the manufacturing cost can directly impact the price of the final product. For instance, in September 2019, Tate & Lyle announced a price increase for its products falling under the North American food and beverage solutions business owing to the rise in manufacturing costs.

Furthermore, Cargill, Inc. reported in its 2019 annual report that the revenue for its starch & sweeteners products decreased on account of the increase in energy and raw material costs in Europe. As per the research, high fructose corn syrup can increase the risk of high blood pressure, diabetes, heart disease, weight gain, cancer, fatty liver & liver stress, increased cholesterol levels, leaky gut syndrome, and higher mercury intake. Therefore, the consumers are shifting their preference towards alternatives, such as coconut sugar, raw honey, and stevia, which is expected to hamper the industry growth.

Product Insights

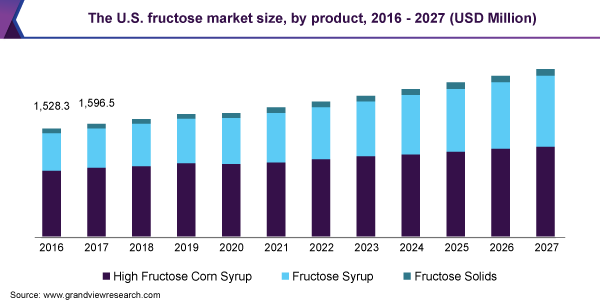

High fructose corn syrup dominated the market in 2019 with a revenue share of 62.0%. These products gained popularity on account of their versatility and ability to enhance texture, color, quality, and flavor of various foods and beverages. Also, manufacturers prefer high fructose corn syrup considering its liquid state, which provides ease in the manufacturing process and costs lesser than other caloric sweeteners. For instance, the usage of sugar instead of high fructose corn syrup in soft drinks increases the sweetener cost two times.

The fructose syrups segment is estimated to register the fastest CAGR of 5.4% from 2020 to 2027. The high growth rate is backed by the ability of fructose syrups to blend with other ingredients. Fructose solids are primarily derived from corn starch and are used in dry-mix beverages, flavored water, low-calorie products, carbonated products, energy drinks, baked goods, chocolate milk, fruit packs, and breakfast cereals. Fructose solids help in maintaining the desired moistness and tender textures of bakery products for a longer time.

Application Insights

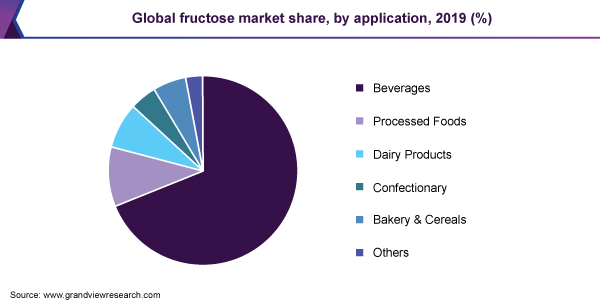

Beverage application dominated the market and accounted for more than a 69% share of the overall market revenue in 2019. The product is used as a caloric sweetener in beverages, such as soda, soft drinks, juices, coffee creamer, and energy & sports drinks. The growing consumption of soft drinks in developing countries is positively influencing the market growth.

Some of the companies using fructose are PepsiCo. The Coca-Cola Company, Tropicana Products, Inc., Jones Soda Co., Darigold, A&W Concentrate Company, Kraft Foods, Inc., etc. The food processing application segment is estimated to register the fastest CAGR from 2020 to 2027 on account of the rising technological advancements and innovations along with the high demand for processed food products. The rising popularity of packaged meals, snacks, and desserts is expected to propel the fructose demand in the food and beverage applications.

Regional Insights

North America led the global market in 2019 with a revenue share of over 44%. The popularity of packaged beverages in the region, such as juices, sports drinks, and carbonated soft drinks, has supported industry growth. However, consumers in this region are gradually shifting towards organic products, which is likely to have a negative impact on product demand.

The demand for the product in Europe is expected to grow at the lowest rate on account of the rising geriatric population, which is susceptible to chronic diseases. Moreover, the consumers in the region are becoming health conscious, which limits the consumption of sweet foods and beverages, thus affecting the growth of the market.

Asia Pacific is expected to be the fastest-growing regional market from 2020 to 2027 due to the rapidly expanding beverage industry in China and India. In addition, the rising population coupled with a shift in consumer lifestyle, which demands food products, such as packaged juices, candies, and chocolates, is likely to drive industry growth.

Key Companies & Market Share Insights

The industry is highly fragmented and competitive with the presence of a significant number of large- and medium-sized companies that offer similar products. Key players are vertically integrated into the value chain. Industry players are now targeting small- and medium-scale end users to tap the local markets. They are also trying to establish themselves in the developing markets wherein the food & beverage, dairy, and bakery industries are witnessing significant growth. These strategies are aiding the companies to gain access to local markets and present them with new growth opportunities. Some prominent players in the global fructose market include:

-

ADM

-

Cargill, Incorporated

-

DuPont

-

Galam

-

Ingredion, Inc.

-

Shijiazhuang Huaxu Pharmaceutical Co., Ltd

-

Tate & Lyle

Fructose Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.37 billion

Market volume in 2020

8,640.5 Kilotons

Revenue forecast in 2027

USD 6.01 billion

Volume forecast in 2027

10,823.9 Kilotons

Growth Rate

CAGR of 4.1% from 2020 to 2027 (Revenue-based)

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico; Germany; U.K., France, Italy, Spain; China; India, Japan, Australia; Brazil, Argentina, and South Africa

Key companies profiled

ADM; Cargill, Inc.; DuPont; Galam; Ingredion, Inc.; Shijiazhuang Huaxu Pharmaceutical Co., Ltd.; Tate & Lyle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global fructose market report on the basis of product, application, and region:

-

Product Outlook (Volume; Kilotons; Revenue, USD Million, 2016 - 2027)

-

High Fructose Corn Syrup

-

Fructose Syrups

-

Fructose Solids

-

-

Application Outlook (Volume; Kilotons; Revenue, USD Million, 2016 - 2027)

-

Beverages

-

Processed Foods

-

Dairy Products

-

Confectionary

-

Bakery & Cereals

-

Others

-

-

Regional Outlook (Volume; Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fructose market size was estimated at USD 4.34 billion in 2019 and is expected to reach USD 4.37 billion in 2020.

b. The fructose market is expected to grow at a compound annual growth rate of 4.1% from 2020 to 2027 to reach USD 6.01 billion by 2027.

b. High fructose corn syrup product type dominated the fructose market with a share of 62.01% in 2019, owing to its versatility and ease in the manufacturing process and costs less than other caloric sweeteners.

b. Some of the key players operating in the fructose market include ADM, Cargill, Incorporated, DuPont, Galam, Ingredion, Shijiazhuang Huaxu Pharmaceutical Co., Ltd, Tate & Lyle.

b. The key factors that are driving the fructose market include a growing trend for sugar, fat, and calorie reduction, coupled with increased demand from the food & beverage industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.