- Home

- »

- Healthcare IT

- »

-

Healthcare Electronic Data Interchange Market Report, 2030GVR Report cover

![Healthcare Electronic Data Interchange Market Size, Share & Trends Report]()

Healthcare Electronic Data Interchange Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Services, Solutions), By Delivery Mode, By End-use (Healthcare Payers, Healthcare Providers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-549-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Electronic Data Interchange Market Summary

The global healthcare electronic data interchange market size was valued at USD 4.41 billion in 2022 and is projected to reach USD 9.18 billion by 2030, growing at a CAGR of 9.6% from 2023 to 2030. Rising need to curb healthcare costs coupled with technological advancements in electronic data interchange is expected to facilitate market growth.

Key Market Trends & Insights

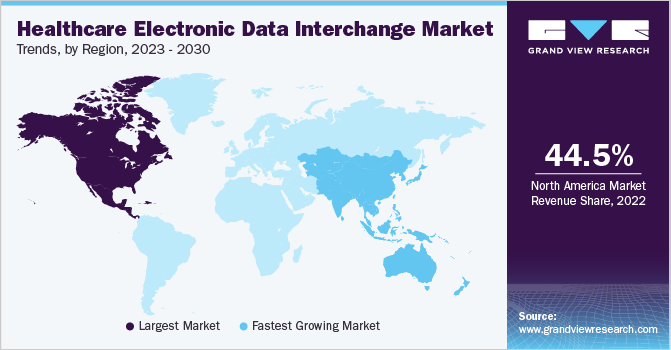

- North America dominated the market with the largest revenue share of 44.5% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 9.9% during the forecast period from 2023 to 2030.

- By component, the services segment dominated the market with the largest revenue share in 2022.

- Based on delivery mode, the web and cloud-based EDI segment dominated the market with the largest revenue share of 46.6% in 2022.

- Based on end-use, the healthcare payers segment dominated the market with the largest revenue share of 36.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.41 Billion

- 2030 Projected Market Size: USD 9.18 Billion

- CAGR (2023-2030): 9.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Additionally, a surge in the number of end-users coupled with increasing adoption of EDI is expected to support the market growth during the forecast period. Healthcare EDI helps in the automation of business processes from claims submission and payment, insurance eligibility checks, and data reporting. According to the Maryland Healthcare Commission, claim submissions are considered to be the most common electronic transaction in health care.

Electronic data interchange helps in keeping healthcare costs at an affordable level, improving the quality of healthcare delivery and its supporting process, and making accurate, fast, reliable, secure, and detailed information. The use of paper form can be cumbersome, incompetent, and costlier when it needs to distribute, retrieve, consolidate, and look for data. Electronic data interchange helps in minimizing these kinds of time-consuming processes and streamlines the claim management processes.

Technologically advanced electronic data interchange services/solutions such as web-based EDI help to address issues regarding confidentiality, authentication, and data integrity. Developments in the American National Standards Institute (ANSI) X12 EDI formatting standard have made electronic data interchange useful for Business-to-Business (B2B) transactions. The emergence of Extensible Markup Language (XML) and web-based standards in electronic data interchange is pacing the growth of this industry.

Various methods or delivery modes are used to deliver electronic data interchange services/solutions such as web and cloud-based EDI, EDI Value Added Network (VAN), Direct (point-to-point) EDI, Mobile EDI, Applicability Statement version 2 (AS2), File Transfer Protocol over Virtual Private Network (FTP/VPN), Secure File Transfer Protocol (SFTP) or File Transfer Protocol Secure (FTPS).

Moreover, an increasing number of end-users are expected to propel the demand for electronic data interchange services/solutions over the market period. The end-users include payers, providers, pharmaceutical & medical device industries, and others. A surge in the number of hospitals in the UK, France, Germany, and Denmark, which are adopting cost curtailing strategies through the use of electronic data interchange coupled with increased tie-ups with their vendors or suppliers is expected to support the growth of this space during the forecast period. Pharmaceutical industries and medical device manufacturers are also adopting electronic data interchange services owing to growing competitiveness, pricing pressure, and lower profit margins, resulting in market growth.

Component Insights

The components segment is bifurcated into services and solutions. The services segment dominated the market with the largest revenue share in 2022 owing to the rising rate of outsourcing electronic data interchange services by healthcare organizations and increasing demand for scalability and integrity of EDI solutions.

The solutions segment is expected to grow at the fastest CAGR over the forecast period from 2023 to 2030 owing to the growing demand for electronic data interchange solutions such as e-invoicing, EDIFACT manifests, and others, as it reduces administrative costs, accelerates information processing, ensures data accuracy, eliminates certain business transactions, streamlines business procedures, and strengthens customer or vendor relations.

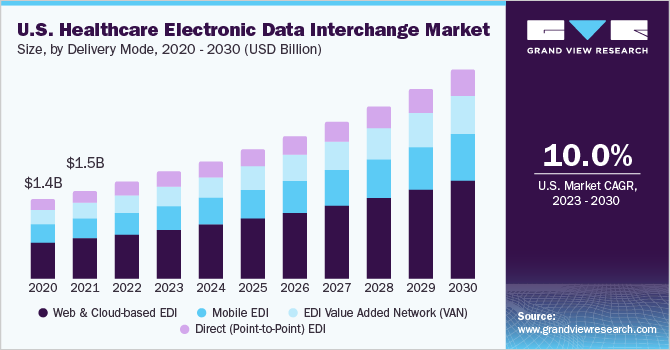

Delivery Mode Insights

The delivery modes analyzed in this study include EDI VAN, direct EDI, and mobile EDI. The web and cloud-based EDI segment dominated the market with the largest revenue share of 46.6% in 2022 owing to growing demand from small and medium-sized healthcare providers for its affordable solutions coupled with improved flexibility and scalability.

The mobile EDI segment is expected to grow at the fastest CAGR of 10.4% over the forecast period owing to technological advancements in the healthcare industry and the increasing acceptance of mobile solutions among healthcare providers.

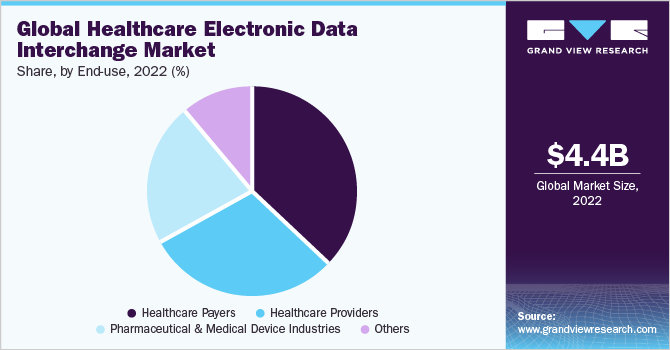

End-use Insights

Based on end-use, the global healthcare electronic data interchange market is segmented into payers, providers, pharmaceutical & medical device industries, and others. The healthcare payers segment dominated the market with the largest revenue share of 36.9% in 2022 owing to growing demand from insurance plans, and healthcare payer organizations for the evaluation of insurance claims before their payment settlement, prevention and detection of fraudulent claims, and disease risk assessment.

On the other hand, the healthcare providers segment is expected to grow at the fastest CAGR of 10.1% over the forecast period from 2023 to 2030 owing to the rising adoption of EDI for operational intelligence, performance management, and financial management by physicians and clinicians, hospitals, clinics, and medical assessment centers.

Regional Insights

North America dominated the market with the largest revenue share of 44.5% in 2022 owing to the higher adoption of Healthcare Information Technology (HCIT), and the presence of major market players such as McKesson Corporation, Optum, Inc.; The SSI Group, LLC; etc. Factors such as the rising demand for electronic data interchange services/solutions among pharmaceutical companies and medical device manufacturers to tackle growing competitiveness, pricing pressure, and lower profit margins is expected to boost the growth of the market in the region.

Asia Pacific is expected to grow at the fastest CAGR of 9.9% during the forecast period from 2023 to 2030. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities. The presence of policy reforms, economic development, and the growing IT industry is expected to drive the market in the Asia Pacific region. Additionally, rising patient volume, increasing the need to manage a large volume of patient data, and implementation of HCIT programs in India, Japan, and Australia are expected to help the growth of this vertical.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. Factors such as investment in research & development, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. For instance, in May 2022, NextGen Healthcare, Inc., a provider of innovative, cloud-based healthcare IT solutions, announced the launch of NextGen Health Data Hub Insights, a modern and expandable data warehouse and custom analytics solution. The platform is designed to make data access, analytics, and report generation easier for health information exchanges (HIEs) and healthcare providers.

Similarly, in October 2021, Cerne announced the launch of Cerner RevElateTM, the company's next-generation patient accounting tool, with new and expanded features to the Cerner revenue cycle management portfolio.

In addition, in October 2019, Epicor Software Corporation announced the acquisition of 1 EDI Source, Inc., a company specializing in business visibility software and electronic data interchange (EDI) solutions. This strengthened Epicor’s Business Services lineup and supported its objective to become the cloud vendor of choice in target markets. Some of the prominent key industry players operating in the global healthcare electronic data interchange market include:

-

OSP

-

MCKESSON CORPORATION

-

NXGN Management, LLC

-

Optum, Inc.

-

SSI Group LLC

-

Cleo

-

Oracle

-

Epicor Software Corporation

-

Effective Data

-

DataTrans Solutions

Healthcare Electronic Data Interchange Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.83 billion

Revenue forecast 2030

USD 9.18 billion

Growth Rate

CAGR of 9.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, delivery mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

OSP; MCKESSON CORPORATION; NXGN Management, LLC; Optum, Inc.; SSI Group LLC; Cleo; Oracle; Epicor Software Corporation; Effective Data; DataTrans Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

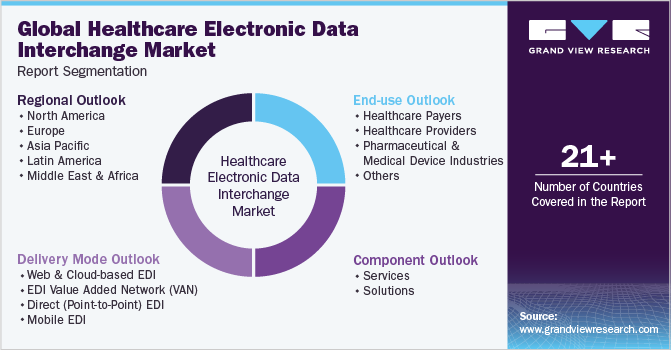

Global Healthcare Electronic Data Interchange Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare electronic data interchange market on the basis of component, delivery mode, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

Solutions

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web and Cloud-based EDI

-

EDI Value Added Network (VAN)

-

Direct (Point-to-Point) EDI

-

Mobile EDI

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Payers

-

Healthcare Providers

-

Pharmaceutical & Medical Device Industries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare electronic data interchange market size was estimated at USD 4.41 billion in 2022 and is expected to reach USD 4.83 billion in 2023.

b. The global healthcare electronic data interchange market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 9.18 billion by 2030.

b. North America held the dominant share in the market in 2022, owing to the higher adoption of Healthcare Information Technology (HCIT), and the presence of major market players such as McKesson Corporation, Optum, Inc.; The SSI Group, LLC; etc.

b. Some key players operating in the healthcare electronic data interchange market include OSP; McKesson Corporation; NXGN Management, LLC; Optum, Inc.; SSI Group LLC; Cleo; Cerner Corporation; 1 EDI Source (Epicor Software Corporation); Effective Data; and DataTrans Solutions.

b. Key factors that are driving the healthcare electronic data interchange market growth include the rising need to curb healthcare costs, technological advancements in EDI and surge in number of end-users coupled with increasing adoption of EDI.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.