- Home

- »

- Electronic Devices

- »

-

Home Audio Equipment Market Size, Industry Report, 2030GVR Report cover

![Home Audio Equipment Market Size, Share & Trends Report]()

Home Audio Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Technology (Wired, Wireless), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: 978-1-68038-325-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Audio Equipment Market Summary

The global home audio equipment market size was estimated at USD 32.69 billion in 2023 and is projected to reach USD 69.34 billion by 2030, growing at a CAGR of 11.5% from 2024 to 2030. The steadily growing demand for quality home audio equipment and high-performance home theater experiences among consumers is anticipated to be a major growth driver.

Key Market Trends & Insights

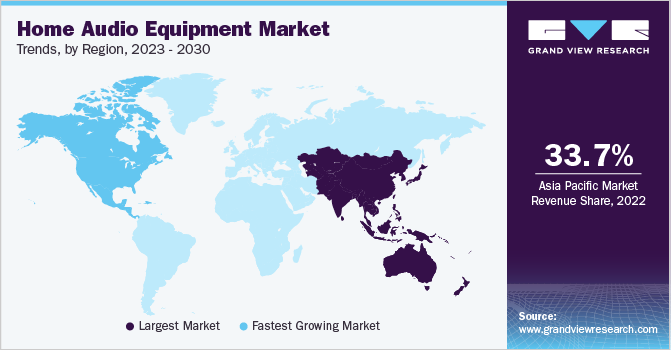

- The Asia Pacific held the largest market share of 35.5% in 2023.

- India accounted for a substantial share of the regional market in 2023.

- Based on type, the home audio speakers and systems segment held the largest market share of 34.8% in 2023.

- Based on technology, the wireless segment held the largest market share in 2023.

- By distribution channel, the online segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.69 Billion

- 2030 Projected Market Size: USD 69.34 Billion

- CAGR (2024-2030): 11.5%

- Asia Pacific: Largest market in 2023

A steady increase in the disposable income levels of consumers has enabled this purchasing trend in recent years. Furthermore, initiatives by television manufacturers to highlight the enhanced audience experience offered by external audio solutions are expected to boost market expansion.

Companies in the consumer electronics market have increasingly introduced AI-integrated devices, marking them as another major enabler for industry growth. For instance, in April 2023, Sensory announced the integration of ChatGPT and other Artificial Intelligence (AI) into its consumer devices to drive conversational voice responses. Such initiatives are expected to supplement sales of devices such as home audio equipment in the coming years.

The market growth can further be attributed to the implementation of various digital technologies in consumer electronic devices and substantial investments from manufacturers who emphasize providing a premium experience to customers. Globally, the miniaturization of electronic items is rapidly gaining popularity. Electronic products that are portable and lightweight are witnessing heavy demand among consumers, leading to the expansion of the global home audio equipment electronics market. Additionally, new products with improved features are being introduced due to increasing R&D and innovation investments by leading companies. For instance, Samsung Electronics announced an investment of USD 15 billion by 2028 for its new research & development facility in Giheung, South Korea. The facility will focus on next-generation devices, along with new technology development.

Rising consumer awareness regarding power usage and its impacts on the environment is driving the development of energy-efficient consumer electronic products, supplementing market expansion. The emergence of hi-fi wireless sound bars with ambi-sound technology has gained prominence as they are less expensive and make surround sound simpler. The emergence of home-theater-in-a-box (HTIB) systems with Dolby’s Atmos technology with 7.1 channel surround sound is expected to revolutionize the audio equipment industry. Manufacturers of home entertainment devices are channeling their efforts to offer connected home entertainment products via smart technologies such as home assistance and smart speakers to enhance the entertainment experience of viewers. These devices are proven to augment the audio experience of movies and TV shows via voice control automation.

Governments across global economies are focusing on funding the manufacturing of consumer electronics in their countries, thus encouraging manufacturers to invest in their countries. The Indian Government launched the National Policy on Electronics 2018, which intends to reach a turnover of USD 400 billion with the help of domestic manufacturing of consumer electronics by 2025. The policy is anticipated to boost the adoption of technologies such as the Internet of Things (IoT), AI, and machine learning in the country. Such initiatives are expected to enable substantial market expansion during the forecast period.

Premium device manufacturers such as Samsung Electronics and Apple Inc. have a product line of high-end electronic devices, which are expected to experience a rise in demand over the forecast period, especially in developed countries such as Canada, the UK, Germany, and the U.S. However, these models are considered expensive in markets where consumers are price-sensitive and prefer an affordable model with similar features. As a result, brands are focusing on expanding their product line in different price ranges so that a greater consumer share can be achieved.

Type Insights

Based on type, the home audio speakers and systems segment held the largest market share of 34.8% in 2023. Home audio speakers and systems have substantially advanced in terms of innovations over the years. With the introduction of smart devices and voice-controlled assistants such as Google Home and Amazon Echo, audio systems have gained voice control and smart home connectivity. Users can utilize voice commands to control their audio systems, listen to music from streaming sites, and interact with various smart gadgets in their homes. Moreover, high-resolution audio formats, including Free Lossless Audio Codec (FLAC) and Master Quality Authenticated (MQA), have gained popularity as they provide enhanced sound quality than traditional compacted formats. These factors would further supplement segment expansion during the forecast period.

The home theater in-a-box (HTiB) segment is anticipated to grow at the fastest CAGR during the forecast period. This growth can be attributed to the ease of use of this equipment for consumers. HTiB’s setup requires a basic understanding of technology to install and operate, with manufacturers offering detailed guidance and colored interconnections to facilitate easier installation. This simplicity of setup generally attracts people who are tech-savvy or prefer a plug-and-play system. HTiB serves a diverse group of customers who prefer an organized home theater experience. It offers enhanced functionality and technology, with high-definition audio decoding, wireless connection options, HDMI connectivity, and support for various media formats. These developments have improved the audiovisual experience offered by HTiB, increasing the appeal of this equipment among consumers.

Technology Insights

Based on technology, the wireless segment held the largest market share in 2023. Wireless audio systems often offer multi-room functionality, permitting users to play synchronized audio in multiple rooms or establish different audio zones. Consumers can stream audio to multiple house sections via wireless speakers linked to a centralized system or networked devices, thereby controlling audio playback from a single gadget or application. Developments in wireless audio technologies have resulted in improved sound quality. Wireless high-quality audio codecs such as audio processing technology (aptX), Lossless Digital Audio Codec (LDAC), and Advanced Audio Coding (AAC) offer enhanced audio performance and lower latency, resulting in a more engaging listening experience. These factors are expected to supplement segment growth from 2024 to 2030.

The wired segment is anticipated to expand at a significant CAGR during the forecast period. Wired connections are compatible with a wide variety of audio equipment and types. They are used to connect audio amplifiers, turntables, CD players, or other audio equipment to offer adaptability and flexibility between devices and manufacturers. This adaptability has enabled consumers to create personalized home audio settings based on their preferences and needs. High bandwidth audio files and lossless audio codecs are supported over wired connections, which enables transmission of high-resolution audio recordings, such as FLAC and WAV, without degradation. However, this segment is expected to account for a comparatively smaller share in the coming years, as wireless home audio systems provide better flexibility and ease regarding location and setup when compared to wired systems.

Distribution Channel Insights

The online segment held the largest market revenue share in 2023. Home audio items are available for purchase through online marketplaces and e-commerce sites such as Amazon.com, Flipkart, eBay, and Best Buy. These platforms offer a comprehensive range of products, customer reviews, and ratings, allowing consumers to investigate and compare numerous options. They frequently offer these products at affordable prices and discounts, appealing to the buyer’s conscience. For instance, specialized online electronics merchants such as Best Buy, Crutchfield, and B&H Photo & Electronic Corp. are skilled in launching and selling in-home audio equipment. Thus, pricing and convenience benefits for consumers are expected to supplement segment growth during the forecast period.

The offline segment is expected to grow at a significant CAGR during the forecast period. A sizeable number of consumers still prefer purchasing at brick-and-mortar retail businesses that specialize in electronics, home appliances, or audio equipment. These retail stores typically have sections or departments dedicated to home audio products such as speakers, receivers, headphones, amplifiers, and soundbars. These retail stores provide a wide variety of audio equipment, from entry-level to high-end models, of different brands and prices. Customers can have the advantage of looking at several models, evaluating features, and getting help from sales experts before purchasing. As a result, physical channels are expected to contribute substantially to this market in the coming years.

Regional Insights

The Asia Pacific held the largest market share of 35.5% in 2023. With the growing demand for wireless speakers, Bluetooth technology has become highly popular in the regional market as it is compatible with a wide range of mobile devices, including iPhones and Android smartphones. Moreover, the release of Bluetooth 5.0 has enabled a new function that allows users to listen to audio on two linked devices at the same time, and audio can be played on two separate speakers in two distinct rooms. Such features are projected to fuel the expansion of this industry in the region over the forecast period.

India accounted for a substantial share of the regional market in 2023. This is owing to increased disposable income and spending capacity of middle-class consumers in the economy. Growing consumer preference for high-quality audio devices has led to heightened demand for premium product brands such as Sony, Bose, and Harman. Additionally, a thriving film and music culture in the country acts as a growth catalyst for the audio devices market. Indians celebrate various festivals throughout the year, and playing folk songs and music is an inevitable part of such celebrations, which has acted as a major growth driver for the home audio equipment market.

North America Home Audio Equipment Market Trends

North America is anticipated to register a notable CAGR over the forecast period. Advances in digital audio technology and shifting consumer preferences from conventional to modern audio systems are expected to drive regional market growth. Furthermore, the growing demand for portable home audio equipment that can support USB drives and access high-quality audio content from the internet also bodes well for market advancement. Manufacturers and suppliers of home audio equipment have been developing more user-friendly and less visually intrusive audio systems as part of the efforts to strengthen their regional market penetration.

U.S. Home Audio Equipment Market Trends

The U.S. is home to prominent audio equipment manufacturing brands such as Bose, Harman, and Dolby. These manufacturers have frequently introduced premium-quality audio devices for consumers. The presence of prominent retailers such as Amazon and Best Buy has also enabled efficient market reach for innovative products. Major sales such as Black Friday and Amazon Prime Day witness a significant volume of sales of electronic devices, including home audio equipment. Furthermore, the growing trend of installing AI-based interactive devices has led to a surge in demand for smart home audio devices.

Europe Home Audio Equipment Market Trends

Europe held a considerable share of the global market in 2023. This is attributed to a strong affinity for music and home entertainment by the diverse regional consumer base. Consumer willingness to invest in premium products, coupled with high disposable income, contributes to the region’s strong share. Additionally, the growing popularity of smart homes and wireless audio technologies has fueled market demand as consumers increasingly seek seamless and connected audio experiences. A strong distribution network, robust retail infrastructure, and presence of various e-commerce platforms enable market penetration and accessibility for high-tech audio devices.

The UK has a pioneering role in the development of high-quality audio devices. For instance, Dolby, a prominent name in audio technology, originates from London. The urban population in the country encompasses a diverse audience from all over the world with different interests in music. This population is a major consumer of electronics and audio devices. Moreover, with significant advancements in connected technology, the demand for IoT-enabled connected audio systems is expected to advance over the forecast period.

Latin America Home Audio Equipment Market Trends

Latin America is anticipated to register the fastest CAGR during the forecast period. Increasing consumer preference for high-end audio products due to rising disposable incomes and regional urbanization drive regional market growth. Additionally, advancements in technology, including the integration of wireless systems and smart features, enhance home audio devices' appeal, making them more attractive to consumers. Finally, the proliferation of high-speed internet services is facilitating the adoption of these technologies, further stimulating market demand.

Key Home Audio Equipment Company Insights

Some key companies involved in the home audio equipment market include Bose Corporation, HARMAN International, and SAMSUNG, among others.

-

Bose Corporation is a U.S.-based manufacturer of audio devices. The company is well known for its premium-quality audio product offerings. In the home audio segment, the company offers soundbars, smart speakers, amplifiers, and other supplementary audio products. Bose offers both wired and wireless home audio speakers with Wi-Fi and Bluetooth connectivity options. In May 2024, the company launched its SoundLink Max Portable Speaker featuring several technological upgrades.

-

HARMAN International is a U.S.-based audio equipment manufacturing company. The company has been operating as a subsidiary of Samsung since 2017. HARMAN offers premium quality sound systems for luxury cars under its brand Bang & Olufsen. The company offers a wide variety of audio products, such as Bluetooth speakers, voice-activated speakers, headphones, home multi-room systems, and soundbars under its brands JBL, AKG, Infinity, and Harman Kardon.

Key Home Audio Equipment Companies:

The following are the leading companies in the home audio equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Akai (inMusic, Inc.)

- Audio Partnership Plc

- Bose Corporation

- Dolby Laboratories, Inc.

- XPERI INC

- HARMAN International

- Intex Technologies

- JVCKENWOOD Corporation

- LG Electronics

- Nakamichi Corporation

- Nice North America

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- SHARP CORPORATION

- Vistron (Dong Guan) Audio Equipment Co., Ltd.

- SAMSUNG

Recent Developments

-

In July 2024, JBL, a leading brand of HARMAN, announced the launch of JBL Modern Audio AV Receivers and Stage 2 Loudspeakers to provide a premium home theater experience. The product offers easy installation and connectivity options for consumers and can be conveniently upgraded. The AV receivers are available in four different models, while the loudspeakers offer five options for buyers to choose from.

-

In May 2024, Dolby Laboratories and VIZIO announced their partnership for the integration of the Dolby Atmos technology in VIZIO’s complete range of soundbars launched in 2024. This development comes on the back of the introduction of Dolby Vision to the entire 4K TV range of VIZIO, which would ensure a more complete visual and aural experience for audiences.

Home Audio Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.16 billion

Revenue Forecast in 2030

USD 69.34 billion

Growth rate

CAGR of 11.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, technology, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Akai (inMusic, Inc.); Audio Partnership Plc; Bose Corporation; Dolby Laboratories, Inc.; XPERI INC.; HARMAN International; Intex Technologies; JVCKENWOOD Corporation; LG Electronics; Nakamichi Corporation; Nice North America; Panasonic Holdings Corporation; Koninklijke Philips N.V.; SHARP CORPORATION; Vistron (Dong Guan) Audio Equipment Co., Ltd.; SAMSUNG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Audio Equipment Market Report Segmentation

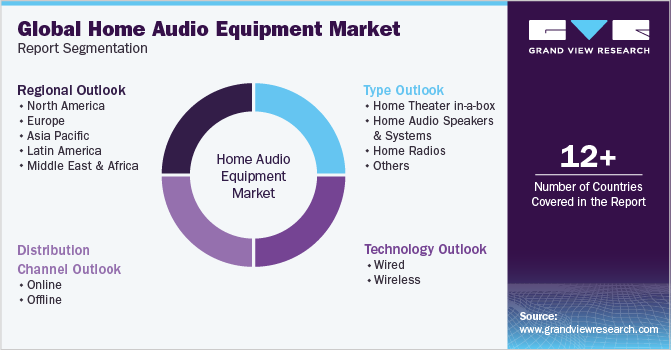

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home audio equipment market report based on type, technology, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Theater in-a-box

-

Home Audio Speakers and Systems

-

Home Radios

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.