- Home

- »

- Clinical Diagnostics

- »

-

Human Papilloma Virus Testing Market, Industry Report, 2033GVR Report cover

![Human Papilloma Virus Testing Market Size, Share & Trends Report]()

Human Papilloma Virus Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Cervical Cancer Screening, Vaginal Cancer Screening), By Product, By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-549-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Papilloma Virus Testing Market Summary

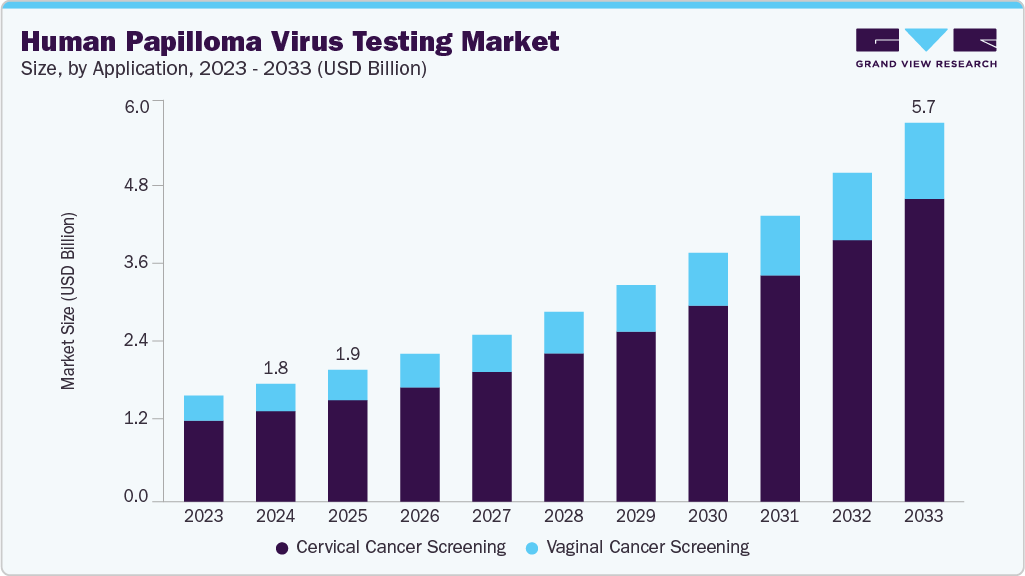

The human papilloma virus testing market size was estimated at USD 1.76 billion in 2024 and is projected to reach USD 5.67 billion by 2033, growing at a CAGR of 14.14% from 2025 to 2033. The market is fueled by rising HPV-related cancer cases, with human papilloma virus (HPV) causing over 95% of cervical cancers.

Key Market Trends & Insights

- By product, the Consumables segment held the highest market share of 65.34% in 2024.

- Based on technology, the PCR segment held the highest market share of 39.48% in 2024.

- By application, the cervical cancer screening segment dominated the market with the largest revenue share of 76.7% in 2024.

- By end use, the hospitals & clinics segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.76 Billion

- 2033 Projected Market Size: USD 5.67 Billion

- CAGR (2025-2033): 14.14%

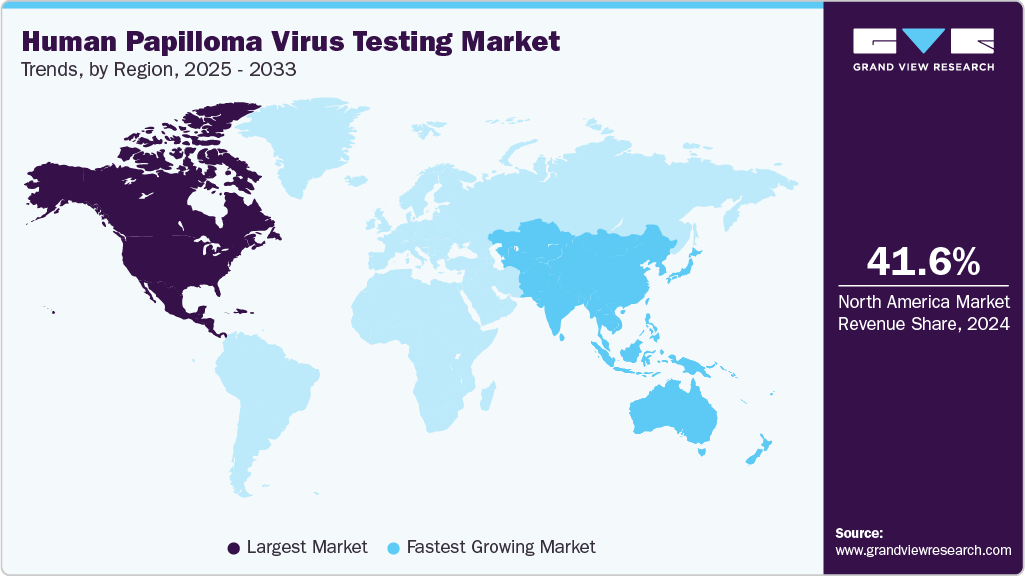

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Countries like Australia have replaced Pap smears with HPV DNA testing for higher sensitivity. Self-sampling kits, such as those from BD and Hologic, are expanding access in underserved areas. WHO’s elimination strategy and NGO-backed programs in Africa and Asia drive adoption. Advances in molecular diagnostics, bundled women’s health panels, and improved lab infrastructure make testing more accessible and cost-effective globally. Cervical cancer is the fourth most common cancer among women worldwide and the second leading cause of female cancer-related mortality.

In November 2020, the World Health Organization launched its Global Strategy to Eliminate Cervical Cancer, setting the 90-70-90 targets for 2030-vaccinate 90% of girls by age 15, screen 70% of women at ages 35 and 45, and treat 90% of women with identified disease. This initiative came against alarming statistics: in 2022, only 18% of countries had reached the recommended screening coverage of over 70%, and global coverage still stood at about 20%. HPV is the causative agent in 99.8% of cervical cancer cases, with genotypes 16 and 18 alone responsible for 70% of cases. Nineteen high-risk genotypes account for 90% of all HPV-related cancers. Given the asymptomatic nature of most HPV infections, molecular testing has become essential for early detection. Since 2017, countries such as Australia and the Netherlands have transitioned from Pap smears to primary HPV DNA testing, citing higher sensitivity and longer screening intervals.

In India, where one in five women with cervical cancer resides and 25% of global deaths occur, the government is moving aggressively toward mass screening. In April 2025, the Union Minister convened a joint meeting of the Department of Biotechnology, BIRAC, AIIMS, ICMR, IARC, and industry partners to review indigenously developed RT-PCR HPV test kits. Developed by repurposing COVID-19 PCR infrastructure, these kits focus on the most common cancer-causing genotypes and aim to deliver affordable, scalable screening. Calling the launch “a milestone in preventive healthcare”, Union Minister added, “it becomes a national responsibility to safeguard our youth and offer them timely prevention.”

The private sector is also driving innovation. At the July 2024 AOGIN conference in Seoul, Seegene Inc. presented its Allplex HPV HR Detection and Allplex HPV28 Detection assays, offering comprehensive genotyping of high- and low-risk HPV types using quantitative PCR, alongside its fully automated STARlet-AIOS workflow system. The company’s Executive Vice-President and Chief Global Sales and Marketing Officer noted, “We expect our HPV products to be adopted in cervical cancer screening programs in more countries, helping to realize a world free from all diseases.”

In November 2023, Abbott received U.S. FDA approval for its Alinity m HR HPV assay, designed for both primary screening and co-testing, with extended genotyping to improve patient risk stratification. Vice President of Abbott’s molecular business, remarked, “HPV testing is a powerful tool for detecting infections that can lead to certain cancers and illustrates the power of molecular diagnostics in infectious disease.”

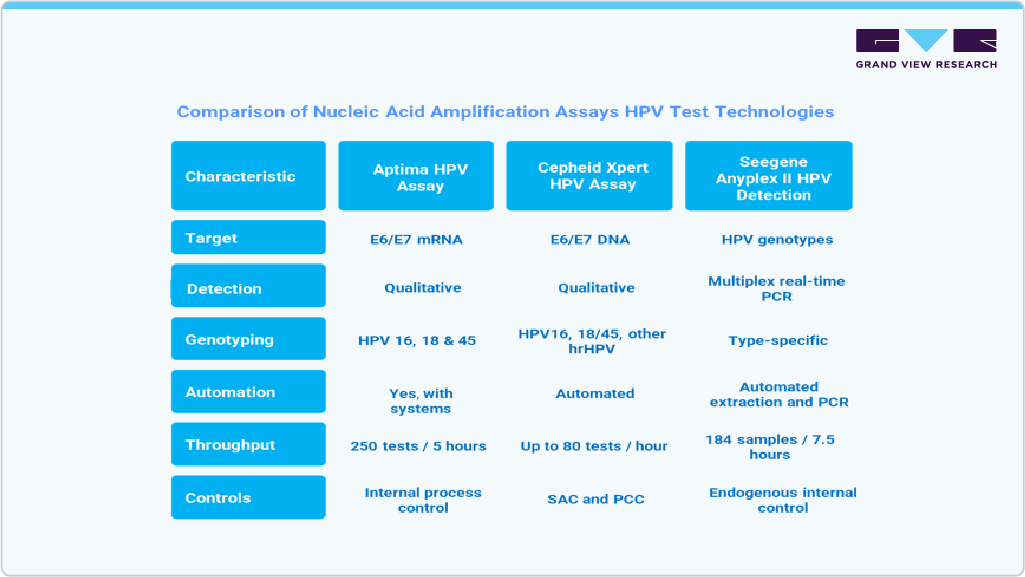

Moreover, Nucleic Acid Amplification Assays (NAATs) have become the gold standard for HPV detection due to their high analytical sensitivity, ability to detect low viral loads, and suitability for screening and diagnostic applications. Unlike traditional cytology, which relies on microscopic examination of cells, NAATs identify HPV-specific nucleic acid sequences, enabling earlier and more accurate detection of high-risk infections that may lead to cervical cancer. The most widely adopted NAAT platforms target the E6/E7 oncogenes-markers of viral activity strongly associated with oncogenic transformation-offering improved clinical specificity over assays targeting structural genes like L1.

Several advanced NAAT platforms have been developed and deployed in national screening programs, particularly in high-income countries such as Australia, which has integrated molecular HPV testing as the primary screening method since 2017. These platforms differ in their target (DNA vs mRNA), throughput, automation, and genotyping capabilities, allowing healthcare systems to select the technology best suited to their infrastructure and population needs.

These developments underscore a market undergoing rapid transformation, driven by global elimination goals, public-private collaboration, indigenous low-cost solutions for emerging markets, and advanced automation in molecular diagnostics. With increasing adoption of self-sampling and integration of HPV testing into comprehensive women’s health panels, the global HPV testing market is poised for robust growth, particularly in Asia-Pacific, Latin America, and the Middle East, where large underserved populations and expanding diagnostic infrastructure create strong demand momentum.

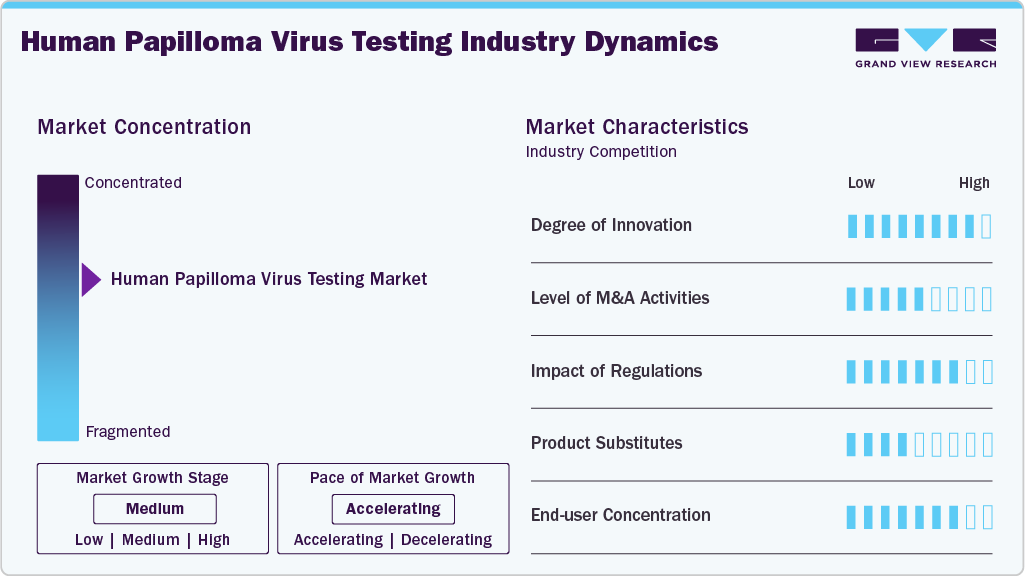

Market Concentration & Characteristics

The degree of innovation in HPV NAATs is high, reflecting significant advancements in molecular diagnostics that have transformed cervical cancer screening. Platforms such as the Aptima HPV Assay introduced E6/E7 mRNA detection, improving specificity by targeting actively replicating virus rather than latent infections. Cepheid’s Xpert HPV brought true “near-patient” testing with rapid, cartridge-based E6/E7 DNA amplification on scalable GeneXpert modules, enabling on-demand results in under an hour. Seegene’s Anyplex II leverages proprietary TOCE™ technology to simultaneously genotype 14 to 28 HPV types with semi-quantitative viral load estimation in a single reaction. These innovations enhance accuracy, throughput, and clinical utility, supporting large-scale population screening and rapid diagnostic workflows.

In December 2024, H.U. Group Holdings, Inc. completed the acquisition of the HPV self-test service business of Hatch Healthcare K.K. The deal strengthens H.U. Group’s position in the growing self-sampling segment of HPV screening, aligning with global trends toward increasing accessibility and patient-driven testing. Self-test HPV services have been gaining momentum as a means to improve participation rates, especially in populations with historically low screening uptake. This acquisition enables H.U. Group to expand its molecular diagnostics portfolio, capture new market share in preventive women’s health, and leverage existing lab infrastructure to scale HPV self-collection solutions.

Regulatory frameworks play a critical role in shaping market access, adoption timelines, and competitive dynamics in HPV testing. In the U.S., the FDA’s approval process for HPV assays-such as Abbott’s Alinity m HR HPV assay (approved on November 2, 2023)-ensures compliance with stringent analytical and clinical validation requirements before commercial deployment. In the EU, CE-IVD marking under the In Vitro Diagnostic Regulation (IVDR), which came into effect in May 2022, mandates enhanced clinical evidence and post-market surveillance, impacting legacy and new assays. WHO’s 2030 elimination strategy and national screening guidelines further drive standardization, while in markets like India, government-backed validation of indigenous RT-PCR HPV kits in April 2025 demonstrates how local regulatory initiatives can accelerate cost-effective screening adoption in low- and middle-income countries. These evolving requirements incentivize innovation and extend development timelines, influencing product launch strategies globally.

Product expansion in the HPV testing market is increasingly focused on broadening assay menus, improving workflow efficiency, and enhancing patient access through innovative delivery models. Hologic has expanded its Panther System test menu beyond the Aptima HPV assay to include multiple women’s health and STI tests, enabling high-throughput, consolidated screening from a single platform. Roche has built on its cobas HPV test by integrating extended genotyping for more precise risk stratification, which is now offered alongside its CINtec PLUS Cytology for triage. Emerging players are introducing multiplex PCR panels that combine HPV detection with screening for other oncogenic viruses, while regional manufacturers in the Asia-Pacific are launching cost-optimized, portable HPV DNA platforms to reach rural clinics. This diversification strengthens competitive positioning and supports broader adoption in both developed and resource-limited healthcare settings.

Regional expansion strategies in the HPV testing market are driven by rising screening mandates, improved laboratory infrastructure, and targeted partnerships. BD (Becton, Dickinson and Company) has extended its BD Onclarity HPV assay into Latin America through collaborations with public health programs in Brazil and Mexico, aligning with government-led cervical cancer prevention initiatives. Qiagen has expanded its careHPV test distribution in sub-Saharan Africa and Southeast Asia via NGO and government procurement channels, focusing on low-resource settings. In the Middle East, private labs in the UAE and Saudi Arabia are adopting advanced genotyping assays from global suppliers to meet growing demand for preventive women’s health services. Such geographic diversification allows companies to capture high-growth markets, adapt pricing models to local economies, and contribute to the WHO’s 2030 screening coverage goals.

Application Insights

The cervical cancer screening segment dominated the market with the largest revenue share of 76.7% in 2024 due to the high prevalence of HPV-related cervical cancer worldwide. Early detection through HPV testing is essential for preventing the progression of cervical cancer, driving widespread adoption of screening programs. The availability of advanced, noninvasive testing methods, such as HPV DNA tests and liquid-based cytology, has contributed to the segment growth. In addition, increasing awareness of cervical cancer prevention and government initiatives supporting regular screenings further boost demand for HPV testing in cervical cancer detection.

The vaginal cancer screening segment is anticipated to grow at a significant CAGR of 12.28% from 2025 to 2033, owing to the increasing recognition of HPV's role in vaginal cancer development. Rising awareness of HPV-related cancers and improving diagnostic technologies fuel the demand for effective screening methods. Early detection of HPV infections linked to vaginal cancer allows for timely treatment and prevention, reducing cancer risk. The expansion of healthcare infrastructure, particularly in developing regions, and the push for routine screenings are expected to further accelerate the growth of this segment.

Technology Insights

The PCR segment held the largest revenue share in 2024 due to its high sensitivity and accuracy in detecting HPV DNA. Polymerase Chain Reaction (PCR) allows for the identification of specific viral strains, including high-risk types linked to cervical and other cancers. The technology’s ability to detect low viral loads and provide precise results at early stages of infection has made it the preferred method for HPV testing. Moreover, PCR’s scalability, ease of automation, and ability to test in diverse settings have further fueled its dominance in the human papilloma virus (HPV) testing industry.

The immunodiagnostics segment is projected to grow at a significant CAGR during the forecast period, propelled by the increasing demand for accurate, reliable, and cost-effective diagnostic solutions. Immunodiagnostic tests, which detect HPV-specific antibodies or antigens, offer advantages such as high sensitivity and faster results. The growing emphasis on preventive healthcare and early detection of HPV-related cancers fuels market growth. In addition, advancements in immunodiagnostic technologies and expanding testing infrastructure in emerging markets are expected to contribute significantly to segment expansion.

End Use Insights

The hospitals & clinics segment held the largest market share in 2024, owing to their central role in providing comprehensive healthcare services. These facilities offer reliable diagnostic testing and follow-up care, making them a primary choice for patients seeking HPV screening. The availability of advanced diagnostic equipment, skilled healthcare professionals, and integrated care systems in hospitals and clinics further contributes to their dominance in the market. Moreover, the increasing number of individuals seeking HPV testing in these settings, driven by awareness campaigns, supports their leading position in the market.

The laboratories segment is expected to experience a significant growth rate during the forecast period, fueled by the increasing demand for accurate, efficient, and reliable testing methods. Advancements in molecular diagnostics and the rising awareness of HPV-related health risks drive this growth. Laboratories are adopting cutting-edge technologies such as PCR and next-generation sequencing, which enhance the sensitivity and specificity of HPV detection. Furthermore, the growing prevalence of HPV infections and government initiatives promoting HPV testing contribute to the segment’s market potential.

Product Insights

The consumables segment accounted for the largest revenue share in 2024, attributed to the increasing demand for efficient and cost-effective diagnostic solutions. These consumables, such as test kits, reagents, and cartridges, are essential for accurate HPV detection and screening, which is crucial for the prevention of cervical cancer. The growing adoption of HPV testing in routine healthcare and expanding testing programs worldwide have further boosted the segment’s growth. Furthermore, consumables' convenience and ease of use have contributed to their widespread adoption in clinical settings.

The services segment is expected to grow at the fastest CAGR during the forecast period, propelled by the increasing need for specialized testing and counseling services. Healthcare providers expand their offerings to include comprehensive HPV testing solutions, often involving laboratory services, result analysis, and patient education. The rising awareness about HPV-related cancers, along with government initiatives promoting regular screenings, fuels the demand for these services. Moreover, advancements in molecular diagnostics and personalized treatment options are expected to enhance the value and scope of services in HPV testing.

Regional Insights

North America human papilloma virus testing market dominated the global market with the largest revenue share of 41.6% in 2024. The integration of HPV testing into routine checkups and the increase in preventive healthcare drive significant market growth. Routine screenings for HPV, especially in women, are becoming a standard part of preventive care, helping detect potential risks early. The rising focus on proactive healthcare and disease prevention, along with improved guidelines for cervical cancer screening, boosts the demand for HPV testing. Moreover, healthcare providers increasingly emphasize regular testing to identify high-risk strains, further expanding the market size.

U.S. HPV Testing Market Trends

The human papilloma virus testing market in the U.S. held the largest share in 2024. The growing demand for home testing kits is expanding the U.S. market by providing individuals with convenient and private options for screening. These at-home kits offer users greater flexibility, leading to increased adoption. In addition, expanding HPV vaccination programs encourages more people to engage in preventive healthcare, further driving the market. Widespread vaccination efforts reduce the incidence of HPV-related cancers. Still, regular testing remains crucial for ensuring continued growth in demand for HPV diagnostic solutions nationwide.

Europe Human Papilloma Virus Testing Market Trends

The HPV testing market in Europe is anticipated to witness significant expansion over the forecast period, owing to increasing screening initiatives and the rising incidence of cervical cancer. Government-led programs and greater public awareness encourage regular screening, leading to higher demand for HPV tests. The rising number of cervical cancer cases across Europe underscores the importance of early detection, further boosting the market. These efforts foster widespread adoption of HPV testing as a preventive measure, helping reduce cancer risks and driving the overall human papilloma virus (HPV) testing industry expansion in the region.

Asia Pacific Human Papilloma Virus Testing Market Trends

The HPV testing market in the Asia Pacific is set to be the fastest-growing region with a CAGR of 15.5% from 2025 to 2033. This growth can be attributed to the growing focus on women’s health and expanding healthcare access. An increase in awareness of HPV-related cancers and the importance of early detection encourages more women to seek regular screening. Governments and healthcare organizations are investing in awareness campaigns, improving healthcare infrastructure, and making HPV testing more accessible. This heightened emphasis on preventive care and the availability of affordable testing options are set to fuel the demand for HPV testing across the region, driving market growth.

China HPV testing market is projected to grow at the fastest CAGR during the forecast period, driven by the adoption of co-testing and technological advancements. The combination of Pap smear and HPV DNA testing, known as co-testing, is gaining popularity due to its enhanced accuracy in detecting cervical abnormalities and HPV infections. In addition, innovations such as self-collection kits and advanced molecular diagnostic technologies make HPV testing more accessible and efficient. These developments are improving the reliability of results and encouraging more people to undergo regular screening, expanding market size and adoption rates.

Key Human Papilloma Virus Testing Company Insights

Some key companies in the human papilloma virus testing industry include Abbott, bioMerieux, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, and Siemens Healthineers AG.

-

Abbott offers innovative healthcare solutions, including diagnostic tools, medical devices, nutrition products, and branded generic medicines. The company focuses on improving health and enhancing lives through cutting-edge technology and scientifically backed solutions worldwide.

-

bioMérieux specializes in diagnostic solutions, offering a range of products and services for clinical microbiology, molecular biology, and immunoassays. Its solutions help detect infectious diseases, ensuring faster, more accurate diagnoses and better patient outcomes globally.

Key Human Papilloma Virus Testing Companies:

The following are the leading companies in the HPV testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Biomedical Diagnostics

- bioMerieux

- Bio-Rad Laboratories, Inc.

- Fujirebio

- Oncolab

- Hologic, Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

Recent Developments

-

The FDA approval of Teal Wand, the first at-home cervical cancer screening test, marks a significant strategic milestone in women’s health. Targeting women aged 25-65, the test enables self-sampling at home with lab analysis and online results in under a week. Validated in a study of 600+ women, it demonstrated equivalent accuracy to clinician-collected samples, addressing barriers to clinic-based Pap smears. With a launch planned in California in June 2025, Teal Wand aims to expand screening access, improve early detection, and capture untapped market segments. This positions the company as an innovation leader while unlocking new revenue streams in preventive diagnostics.

-

In May 2024, Roche received FDA approval for one of the first HPV self-collection solutions in the U.S. This approval is expected to enhance access to screening and support efforts to eliminate cervical cancer. This solution allows for early detection of HPV, helping identify women at risk and enabling timely treatment to prevent cervical cancer development.

-

In February 2025, in collaboration with Roche Diagnostics, Metropolis Healthcare launched a self-sampling HPV DNA test for cervical cancer screening across India. The test, recognized by the WHO, detects 14 high-risk HPV types and aims to improve access and early detection, particularly in underserved areas.

Human Papilloma Virus (HPV) Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2033

USD 5.67 billion

Growth rate

CAGR of 14.14% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Biomedical Diagnostics; bioMerieux; Bio-Rad Laboratories, Inc.; Fujirebio; Oncolab; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd; Siemens Healthineers AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Papilloma Virus Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global human papilloma virus (HPV) testing market report based on application, product, technology, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cervical Cancer Screening

-

Vaginal Cancer Screening

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR

-

Immunodiagnostics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.