- Home

- »

- Clinical Diagnostics

- »

-

Immunoprotein Diagnostic Testing Market Size Report, 2030GVR Report cover

![Immunoprotein Diagnostic Testing Market Size, Share & Trends Report]()

Immunoprotein Diagnostic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Test (Immunoglobulin Diagnostic Tests), By Technology, By Application, By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-501-4

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global immunoprotein diagnostic testing market size was estimated at USD 9.54 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The market is experiencing significant growth due to the increasing prevalence of chronic and infectious diseases, advancements in diagnostic technologies, and rising awareness of early disease detection. Immunoprotein tests, which detect specific proteins in the blood or other bodily fluids, play a crucial role in diagnosing and monitoring a wide range of conditions, including autoimmune disorders, cancer, cardiovascular diseases, and infections.

With increasing prevalence of chronic diseases, key players are focusing on product development. For instance, In April 2024, Virax Biolabs introduced ImmuneSelect, a suite of immune profiling solutions within their ViraxImmune T-Cell diagnostic platform. Designed for research purposes, ImmuneSelect evaluates T-Cell-driven immunity to aid in understanding and early characterization of symptoms associated with post-viral syndromes, including Long COVID.

The rising global burden of chronic diseases such as diabetes, rheumatoid arthritis, and cardiovascular disorders, is one of the key driving factors for industry growth. Similarly, the increasing incidence of infectious diseases, including emerging pathogens, has fueled the demand for accurate and rapid diagnostic solutions. Immunoprotein tests are favored for their ability to provide reliable results with high sensitivity and specificity.

Technological advancements in assay platforms, such as the development of automated, multiplex, and Point-Of-Care (POC) diagnostic systems, have further fueled market expansion. These innovations improve testing efficiency, reduce turnaround times, and enhance accessibility, particularly in remote and resource-limited settings. The integration of artificial intelligence (AI) and machine learning in immunoprotein diagnostics is also driving precision and personalized healthcare, contributing to the market's growth.

Market Concentration & Characteristics

The degree of innovation has been significant, driven by advancements in technology, clinical applications, and patient needs. The development of portable, easy-to-use immunoprotein testing devices has enabled on-site diagnostics, improving patient outcomes by providing quicker results, especially in remote or underserved areas. POCT devices are becoming more sensitive and specific, expanding their applications

Many companies in the immunoprotein diagnostic testing market form strategic alliances to combine their expertise in research, technology, and commercialization. For instance, diagnostics companies often partner with biotech firms to leverage novel biomarker discoveries or with technology companies to integrate advanced data analytics and artificial intelligence into their platforms.

Regulatory bodies often mandate robust clinical validation for new biomarkers used in immunoprotein diagnostics. While this ensures reliability, it can also extend the time and cost of bringing innovative products to market.

Continuous research activities are being done for identifying novel biomarkers for diseases such as cancer, autoimmune disorders, and infectious diseases. Companies are developing new immunoprotein assays to detect these biomarkers, addressing unmet clinical needs. Expansion into multiplex testing platforms allows the simultaneous detection of multiple immunoproteins, improving diagnostic efficiency and enabling comprehensive disease profiling.

Regional expansion in the market is a critical strategy for companies aiming to increase their market presence, tap into emerging opportunities, and address diverse healthcare needs globally. The focus on regional expansion is driven by factors such as varying disease prevalence, economic development, healthcare infrastructure, and regulatory environments.

Test insights

The immunoglobulin diagnostic tests segment accounted for the largest revenue share of the market of 27.1% in 2024. These tests dominate the immunoprotein diagnostic testing market due to their critical role in diagnosing a wide range of conditions, including immune deficiencies, autoimmune disorders, and infectious diseases. These tests measure immunoglobulin levels, such as IgG, IgA, IgM, and IgE, providing valuable insights into immune system function. Their widespread application in monitoring chronic conditions, identifying allergies, and supporting vaccine efficacy studies further drives demand. Additionally, advancements in assay technologies, such as automated and multiplex platforms, enhance test accuracy and efficiency. The growing prevalence of immune-related disorders and the increasing emphasis on personalized medicine solidify their dominance in the market.

The C-Reactive Protein (CRP) diagnostic tests segment is likely to grow at a CAGR of 8.3% over the forecast period. CRP tests are used to assess inflammation in conditions such as infections, autoimmune disorders such as rheumatoid arthritis and lupus along with cardiovascular diseases. With the increasing prevalence of the abovementioned diseases, the demand for CRP tests is anticipated to grow over the forecast period.

Application Insights

The infectious disease testing segment accounted for the largest revenue share of the market of 24.2% in 2024. Infectious disease testing is in high demand due to the increasing prevalence of infectious diseases, the need for early and accurate diagnosis, and the critical role these tests play in managing public health. The rise of chronic infections such as HIV, tuberculosis, and hepatitis, along with COVID-19 pandemic, has driven the need for reliable diagnostic tools. Early detection is crucial for effective treatment and preventing the spread of these diseases. The COVID-19 pandemic further highlighted the importance of rapid and widespread testing, leading to increased investments in diagnostic technologies.

The oncology testing segment is likely to grow at a CAGR of 8.1% over the forecast period. Oncology testing is in high demand within the immunoprotein diagnostic testing industry due to the increasing incidence of cancer globally and the growing emphasis on early detection, personalized treatment, and monitoring of therapeutic efficacy. According to the World Health Organization, in 2022, there were over 20 million new cancer cases which are likely to cross 35 million by 2050 with an increase of 77% compared to 2022. Immunoproteins, such as tumor markers, play a crucial role in identifying specific proteins associated with different cancer types, enabling early diagnosis and improving patient outcomes.

As cancer remains one of the leading causes of death worldwide, there is a growing need for accurate, reliable, and minimally invasive diagnostic tools. Immunoprotein tests, including those for biomarkers like prostate-specific antigen (PSA) for prostate cancer and CA 125 for ovarian cancer, are essential for identifying cancers at early stages when treatment is more effective. Furthermore, the shift toward personalized medicine in oncology, where treatments are tailored based on individual biomarker profiles, has significantly increased the demand for immunoprotein tests. These tests also aid in monitoring disease progression, assessing treatment response, and detecting potential relapses.

Technology Insights

The enzyme-based immunoassay segment accounted for the largest revenue share of the market of 25.0% in 2024. These assays, such as ELISA (Enzyme-Linked Immunosorbent Assay), are widely used for detecting and quantifying proteins, antibodies, and other biomarkers, making them essential in diagnosing a range of conditions, including autoimmune diseases, infectious diseases, and cancers. The growing prevalence of these diseases and the need for early, non-invasive diagnostic methods have fueled the demand for enzyme-based immunoassays.

In addition, enzyme-based immunoassays offer several advantages, such as high throughput, ease of automation, and compatibility with various sample types, including blood, serum, and urine. The ability to detect low levels of biomarkers with high specificity makes these assays ideal for monitoring disease progression, treatment efficacy, and detecting relapses, particularly in chronic conditions like cancer and autoimmune disorders.

The chemiluminescence assay segment is likely to grow at a CAGR of 9.3% over the forecast period. These assays utilize light emission resulting from a chemical reaction, providing a much stronger and more detectable signal compared to traditional colorimetric assays. This allows for precise measurements even in small sample volumes, which is crucial for diagnosing conditions that require early detection of biomarkers at low concentrations, such as cancer, autoimmune disorders, and infectious diseases. Furthermore, the non-radioactive nature of CLAs makes them safer and more suitable for routine clinical use compared to older methods that relied on radioactive substances. The ability to automate chemiluminescence assays further boosts their demand, as it enables high-throughput testing, reduces human error, and improves overall efficiency in clinical laboratories.

Distribution Channel Insights

The retail sales segment accounted for the largest share of the market of 54.1% in 2024. This growth can be attributed to the increased accessibility and convenience for patients. Retail sales make immunoprotein diagnostic tests easily available to individuals, allowing them to access these tests with ease. Furthermore, retail outlets provide patients with the ability to take charge of their health by offering convenient testing options. These sales channels also play a significant role in educating the public about the importance of diagnostic testing, which further contributes to the expansion of the market.

The direct tender segment is likely to grow at a CAGR of 8.1% over the forecast period. Direct tender offers a simplified procurement process for healthcare facilities and institutions that require large volumes of diagnostic tests. This arrangement often leads to cost savings for buyers through bulk purchasing and negotiated pricing, making it a highly attractive option for healthcare providers. In addition, direct tender agreements provide the flexibility to customize products and services to meet the specific needs of healthcare providers, ensuring that they receive the most suitable solutions for their operations.

End-use Insights

The hospitals and clinics segment accounted for the largest revenue share of the market of 44.7% in 2024. Hospitals and clinics serve a large number of patients daily, driving a high demand for diagnostic testing services. With specialized departments and advanced medical equipment, hospitals are well-equipped to deliver accurate and timely immunoprotein diagnostic testing. The shift from centralized to decentralized testing has further fueled market growth, as it allows for quicker, on-site results and improved patient care. Additionally, advancements in healthcare technology have played a significant role in expanding the market, enabling more efficient, precise, and accessible diagnostic solutions. These factors combined have contributed to the growing demand for immunoprotein diagnostic testing services.

The diagnostic laboratories segment is likely to grow at a CAGR of 8.5% over the forecast period. These laboratories are equipped with state-of-the-art technology and staffed by skilled professionals who ensure high accuracy and reliability in test results. Diagnostic labs offer a wide range of tests, including immunoprotein diagnostics, which are essential for diagnosing various conditions such as autoimmune diseases, infections, and cancer. Additionally, diagnostic laboratories provide centralized testing, allowing for standardized procedures and quality control, which enhances the consistency and trustworthiness of results. They are also able to handle complex and specialized tests that may not be feasible in smaller healthcare settings. The increasing demand for precise and timely diagnostics, coupled with the growing focus on personalized medicine, has further supported the dominance of segment in the market.

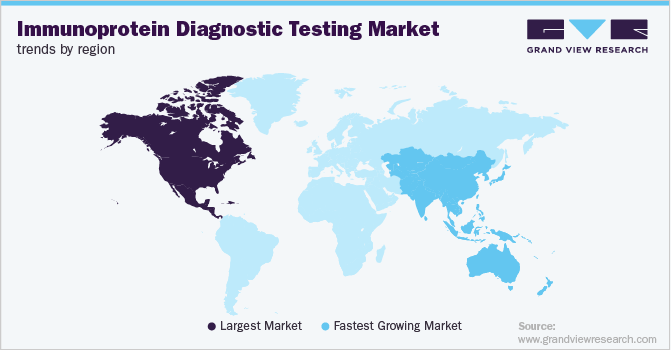

Regional Insights

North America immunoprotein diagnostic testing industry dominated and accounted for a 45.32% share in 2024. The market dominance can be attributed to technological advancements, the high prevalence of chronic diseases, and growing investments in research and development. The region benefits from a well-established healthcare infrastructure, which includes advanced medical facilities, skilled healthcare professionals, and strong regulatory frameworks. These factors ensure easy access to immunoprotein diagnostic testing services for patients, further supporting the growth and dominance of the market.

U.S. Immunoprotein Diagnostic Testing Market Trends

The U.S. immunoprotein diagnostic testing industry is projected to grow significantly during the forecast period. The rising prevalence of chronic diseases, such as cancer, cardiovascular diseases, and autoimmune disorders, in the U.S. is driving the demand for immunoprotein diagnostic testing to support early detection and ongoing monitoring of these conditions. Additionally, the U.S. benefits from stringent regulatory standards enforced by agencies like the U.S. Food and Drug Administration (FDA), which ensures the quality, safety, and reliability of diagnostic tests. These regulations enhance consumer trust and confidence in the market, further promoting the growth of immunoprotein diagnostic testing services in the country.

Europe Immunoprotein Diagnostic Testing Market Trends

The immunoprotein diagnostic testing industry in Europe is likely to emerge as a lucrative region. The regional market growth is driven by the rising prevalence of chronic diseases. Advancements in diagnostic technologies, including enzyme-based immunoassays and chemiluminescence assays, are enhancing the accuracy and speed of test results, contributing to increased adoption in clinical settings. Additionally, the growing focus on personalized medicine, where treatments are tailored based on individual biomarker profiles, is fueling demand for immunoprotein tests.

The UK immunoprotein diagnostic testing market is projected to grow during the forecast period. The UK's strong healthcare infrastructure, including the National Health Service (NHS), provides widespread access to these diagnostic services, further boosting demand. Additionally, the growing emphasis on personalized medicine, where treatments are tailored based on specific biomarkers, is driving the need for more advanced diagnostic tests. The UK’s stringent regulatory standards ensure the quality and safety of these tests, enhancing consumer trust and contributing to the market’s expansion.

The immunoprotein diagnostic testing market in France is expected to show steady growth over the forecast period. The France market is growing on account of rising prevalence of chronic diseases such as breast cancer, prostate cancer, colorectal cancer, rheumatoid arthritis and lupus.

Germany immunoprotein diagnostic testing market is projected to expand during the forecast period. Advances in diagnostic technologies, including enzyme-linked immunosorbent assays (ELISA) and chemiluminescence assays, are improving the accuracy, speed, and sensitivity of tests, enabling early detection and better monitoring of these conditions. Germany's advanced healthcare infrastructure, supported by both public and private healthcare systems, ensures wide access to these diagnostic services, contributing to the market's expansion.

Asia Pacific Immunoprotein Diagnostic Testing Market Trends

The immunoprotein diagnostic testing industry in Asia Pacific is expected to experience the highest growth rate of 8.7% CAGR during the forecast period. The growing demand for personalized medicine, which tailors treatment based on individual biomarker profiles, is further driving the need for these diagnostic tests. APAC's diverse healthcare landscape, with varying levels of healthcare infrastructure across countries, is also a factor in the market growth. While countries like Japan, South Korea, and Australia have advanced healthcare systems, emerging markets such as China and India are witnessing increased access to diagnostic services due to improvements in healthcare infrastructure and rising health awareness.

China immunoprotein diagnostic testing market is projected to expand throughout the forecast period. China’s expanding healthcare infrastructure, along with government initiatives to improve healthcare access and promote early disease detection, is further boosting the market.

The immunoprotein diagnostic testing market in Japan is anticipated to grow during the forecast period. Japan’s investment in research and development, particularly in biotechnology and diagnostics, supports the continuous innovation and growth of the immunoprotein diagnostic testing market.

Latin America Immunoprotein Diagnostic Testing Market Trends

The Latin America immunoprotein diagnostic testing industry is expected to experience significant growth throughout the forecast period. The region's expanding healthcare infrastructure, along with government initiatives aimed at improving access to healthcare services, is contributing to market growth. However, challenges such as economic disparities and varying healthcare standards across countries may impact the accessibility and availability of advanced diagnostic tests in certain areas.

The immunoprotein diagnostic testing market in Brazil is likely to grow over the forecast period. Brazil's expanding healthcare infrastructure, supported by both public and private sectors, is improving access to diagnostic services, especially in urban areas. Technological advancements in diagnostic tools, such as enzyme-linked immunoassays (ELISA) and chemiluminescence assays, are enhancing the accuracy, speed, and efficiency of immunoprotein tests, making them more accessible to patients.

Middle East And Africa Immunoprotein Diagnostic Testing Market Trends

The Middle East and Africa immunoprotein diagnostic testing market is expected to grow due to several driving factors. The rising prevalence of chronic diseases, including cancer, cardiovascular diseases, and autoimmune disorders, is creating a significant demand for diagnostic tests to aid in early detection and monitoring of these conditions. Technological advancements in immunoprotein diagnostic tools, such as enzyme-linked immunoassays (ELISA) and chemiluminescence assays, are improving the accuracy and efficiency of tests, making them more accessible in the region.

The immunoprotein diagnostic testing industry in Saudi Arabia is anticipated to experience lucrative growth during the forecast period. The Saudi government’s Vision 2030 initiative, which aims to diversify the economy and improve healthcare services, is also contributing to the expansion of the healthcare sector, including diagnostic testing services. Increased health awareness, particularly among the growing middle-class population, is encouraging more individuals to seek early detection and preventive healthcare services. Additionally, regulatory bodies in Saudi Arabia, such as the Saudi Food and Drug Authority (SFDA), ensure that diagnostic tests meet high standards of safety and quality, fostering consumer trust and confidence in the market.

Key Immunoprotein Diagnostic Testing Company Insights

Key players are focusing on technological innovations, such as the development of enzyme-based immunoassays, chemiluminescence assays, and multiplex immunoassays, to enhance the accuracy, speed, and efficiency of diagnostic tests. Various independent researchers and academic research institutions are actively involved in product development. For instance, in February 2024, a group of researchers designed a test which involves paper-based multiplexed vertical flow assay for detection of COVID-19. It offers rapid results in under 20 minutes and employs machine learning algorithms for data analysis, enhancing its diagnostic accuracy. Such developments are likely to bring new innovative products in the market.

Key Immunoprotein Diagnostic Testing Companies:

The following are the leading companies in the immunoprotein diagnostic testing market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Aurora Biomed Inc.

- Tecan Trading AG

- Promega Corporation

- Charles River Laboratories

- Creative Biolabs.

Recent Developments

-

In April 2024, Virax Biolabs introduced ImmuneSelect, a suite of immune profiling solutions within their ViraxImmune T-Cell diagnostic platform. Designed for research purposes, ImmuneSelect evaluates T-Cell-driven immunity to aid in understanding and early characterization of symptoms associated with post-viral syndromes, including Long COVID.

-

In July 2023, Quest Diagnostics, one of the major players in the diagnostic testing market, launched its first diagnostic test in the open market related to Alzheimer's disease. The AD-Detect Test for Alzheimer's Disease test made available through an online platform offers an examination of brain protein and shares an assessment measuring potential risks associated with the disease.

-

In July 2023, Siemens Healthineers, a German organization operating in the healthcare technology and automation industry, launched one of its latest innovations, Atellica CI Analyzer. The new addition to Siemens’ diverse portfolio, dealing with immunoassay and clinical chemistry testing has attained clearance from the U.S. FDA and is distributed among multiple regional markets now.

Immunoprotein Diagnostic Testing Market Report Scope

Attribute

Details

Market size value in 2025

USD 10.26 billion

Revenue forecast in 2030

USD 14.86 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, application, technology, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Agilent Technologies, Inc.; Danaher Corporation; Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Aurora Biomed Inc.; Tecan Trading AG; Promega Corporation; Charles River Laboratories; Creative Biolabs.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Immunoprotein Diagnostics Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global immunoprotein diagnostic testing market report based on the test, application, technology, end-use, distribution channel, and region.

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Complement System Proteins Diagnostic Tests

-

Free Light Chain Diagnostic Tests

-

Haptoglobin Diagnostic Tests

-

Immunoglobulin Diagnostic Tests

-

Prealbumin Diagnostic Tests

-

C-Reactive Protein (CRP) Diagnostic Tests

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease Testing

-

Oncology Testing

-

Endocrine Testing

-

Toxicology Testing

-

Allergy Testing

-

Autoimmune Disease Testing

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radioimmunoassay

-

Enzyme Based Immunoassay

-

Chemiluminescence Assay

-

Immunofluorescence Assay

-

Immunoturbidity Assay

-

Immunoprotein Electrophoresis

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Tender

-

Retail Sales

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunoprotein diagnostic testing market size was estimated at USD 9.54 billion in 2024 and is expected to reach USD 10.26 billion in 2025.

b. The global immunoprotein diagnostic testing market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 14.86 billion by 2030.

b. North America dominated the immunoprotein diagnostic testing market with a share of 45.32% in 2024. This is attributable to well-established healthcare infrastructure in the U.S. and high incidence of cancer among the U.S. population.

b. Some key players operating in the immunoprotein diagnostic testing market include Abbott Laboratories; Bio-Rad Laboratories, Inc.; DiaSorin S.p.A; Enzo Biochem, Inc.; F. Hoffmann-La Roche AG; Thermo Fisher Scientific, Inc.; bioMérieux SA; Abcam Plc.; Siemens Healthineers; Beckman Coulter; and Ortho Clinical Diagnostics.

b. Key factors that are driving the market growth include increase in prevalence of chronic diseases such as such as infectious diseases, cancer, cardiovascular disease, obesity, type 2 diabetes, and rheumatoid arthritis and technological advancements in immunoprotein diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.