Industry Insights

The global insect growth regulators market size was estimated at USD 723.3 million in 2016. Globally increasing consumption of environment-friendly pesticides is expected to be a key factor driving market growth. The IGRs are manmade chemicals that impede the reproductive cycle of the insect and ultimately lead to its death. They mimic the hormones present inside the insect’s body and disrupt its growth at the molting stage.

They are also referred to as birth control for pests. IGRs are also effective against pests that have developed resistance against insecticide. They are non-polluting, bio-degradable, and non-persistent. They are also non-toxic to humans as well as to the beneficial microbes present in the soil. IGRs aid in achieving economies of scale as they are economical and are effective in very minute quantity also.

IGRs are materials which exhibit a very high degree of efficiency. This has resulted in rising demand from various industries including agriculture, residential, and commercial. Rise in integrated pest management and organic farming practices in emerging economies including India and China has played a major role in augmenting the demand in the last few years. This trend is expected to continue over the forecast period.

Increasing use of pesticides is leading to a harmful impact on arable land. Synthetic-based pesticides contaminate the soil and groundwater and have a harmful impact on beneficial bacteria as well as plants. Repetitive usage of these pesticides has led pests to develop a resistance to them, thereby having no effect on the life cycle of the pests. Thus, IGRs serve as an effective mimic hormone interrupting the reproductive cycle of pests.

IGRs are witnessing a huge demand owing to the rising popularity of organic farming. Crop protection products used in organic farming degrade rapidly and have minimal impact on the environment as they are mainly derived from natural sources. Insect growth regulators, botanical extracts derived from plants, synthetic pheromone medications, and several other biological pesticides are commonly used in organic farming. These products have a minimal impact on beneficial pests and on the environment.

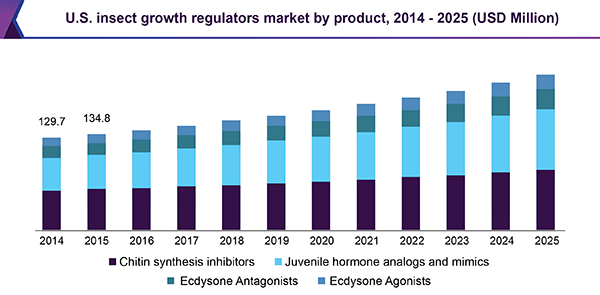

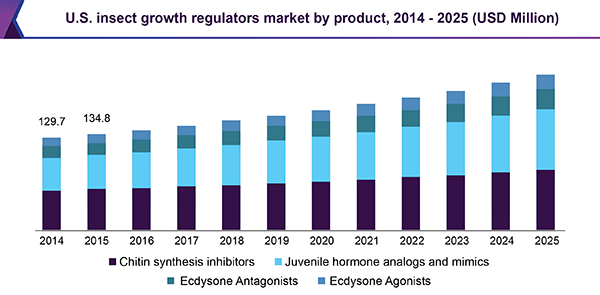

Product Insights

Chitin synthesis inhibitors were estimated as the largest product segment in 2016, accounting for over 40% of the global revenue share. Chitin synthesis inhibitors act in two different ways which include inhibiting process of chitin and exoskeleton formation. Lufenuron, noviflumuron and diflubenzuron are commonly used chitin synthesis inhibitors. Buprofezin keeps levels of 20 hydroxyecdysone from reducing during initial stages of molting process. Exposure to cyromazine leads to emergence of abnormally hard cuticles on the pest’s body, which leads to disrupting the molting cycle.

Juvenile hormone agonists are expected to attain the fastest growth rate during the forecast period in the global insect growth regulators market. They are widely used across indoor and outdoor in commercial pest control and are expected to witness adoption during the analysis period. Their process of action is lower as compared to that of other insect growth regulators and has no knockdown effects. Juvenile hormone agonists are scarcely used in pets and on livestock. Methoprene is used on pets while pyriproxyfen is scarcely used on pets and livestock.

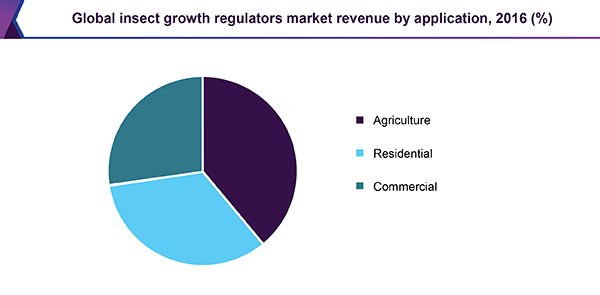

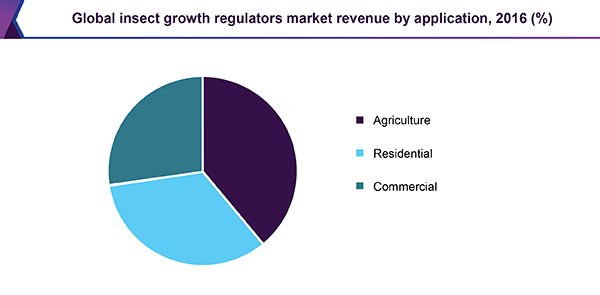

Application Insights

The global demand has seen a paradigm shift due to rising awareness among consumers. Agriculture emerged as the largest application segment and accounted for over 34% of the total market revenue in 2016.

Form Insights

Liquid was estimated as the largest market in 2016. They are in the form of lliquid concentrate, and are needed to be diluted before the application procedure. Liquid IGRs can also be used as a stand-alone product in case of severe infestations. Though these are staining and leave an odor after application. They are extensively used owing to their cheaper costs and high performance over severe incidences of infestations.

Aerosol is anticipated to witness the fastest growth over the forecast period. Aerosol insect growth regulators are easier to use as compared to other forms such as liquid or bait. They are available in convenient canister packaging enabling easier application. It also allows easier application in areas which are hard to reach such as cracks, small openings, crevices, and joints. An aerosol can be used for spot treatment, fogging as well as surface application. The canister packaging prevents wastage of IGRs, however, it may pose risk of inflammability and explosivity. Also, they are expensive as compared to other forms of insect growth regulators.

Regional Insights

North America dominates the overall market followed by Europe. The demand in North America is majorly contributed by high concerns towards health leading to higher adoption of safer alternatives to pesticides that are eco-friendly. Moreover, innovative packaging, as well as product innovations coupled with high standards of living, are also supplementing the product demand.

Asia Pacific is anticipated to witness the fastest growth over the forecast period. Rising awareness regarding professional pest control services, improving standard of living, expanding middle income class population, and rising health awareness is contributing towards demand. Several research and development activities conducted in the region will contribute to growing interest in IGRs in the farming community and result in improving demand for the global market.

Insect Growth Regulators Market Share Insight

Key players include Bayer AG, Central Life Science, OHP, Inc., Syngenta AG, Dow AgroSciences LLC, Helm Agro US, Inc., Nufarm Limited, Russell IPM, Valent USA LLC, McLaughlin Gormley King Company (MGK), Sumitomo Chemical Company Limited,and Control Solutions, Inc. Companies have engaged in adopting several strategic initiatives including, product launches, collaborations and agreements in order to strengthen their presence.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Historical data

|

2014 - 2016

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Revenue in USD Million and CAGR from 2017 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

|

|

Country scope

|

U.S., Italy, France, China, Australia, Brazil

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments covered in the report

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global insect growth regulators market on the basis of product, form, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Form Outlook (Revenue, USD Million, 2014 - 2025)

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Agriculture

-

Residential

-

Commercial

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

Europe

-

Asia Pacific

-

Central & South America

- Middle East & Africa