- Home

- »

- Power Generation & Storage

- »

-

Lead Acid Battery Market Size, Share, Industry Report, 2033GVR Report cover

![Lead Acid Battery Market Size, Share & Trends Report]()

Lead Acid Battery Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (SLI, Stationary, Motive), By Construction Method (Flooded, VRLA), By Application (UPS, Telecom, Electric Bikes), By Region, And Segment Forecasts

- Report ID: 978-1-68038-778-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lead Acid Battery Market Summary

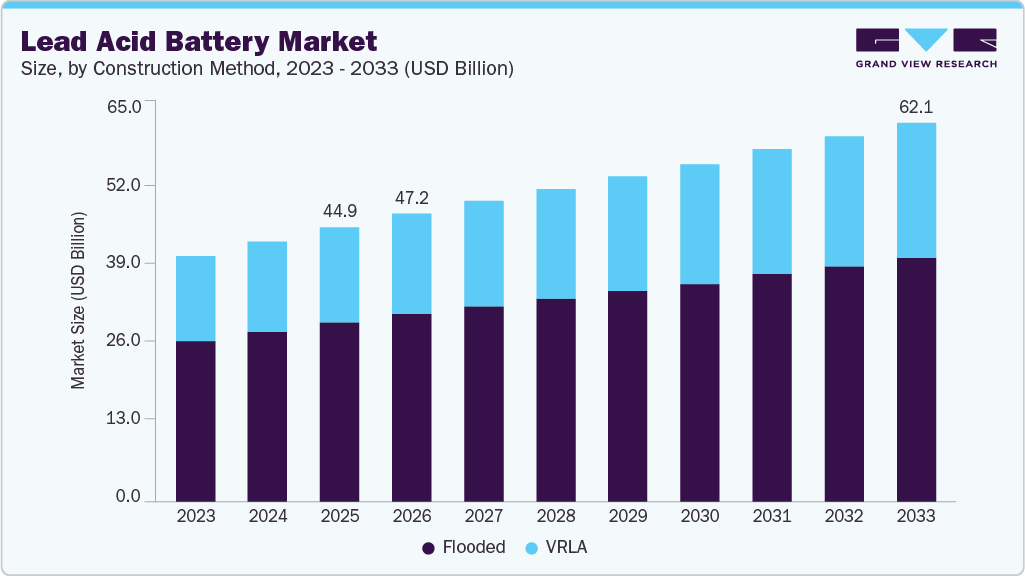

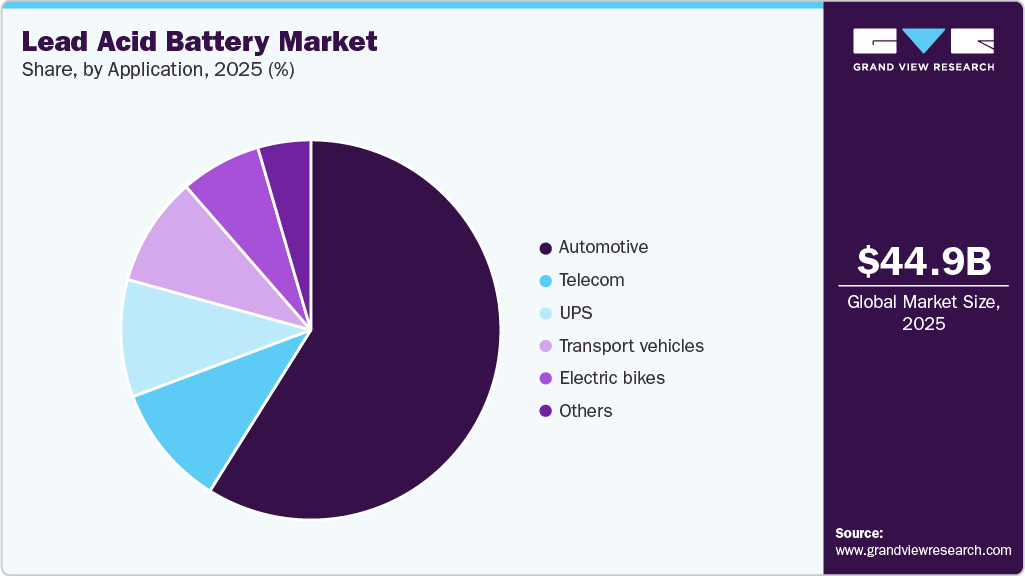

The global lead acid battery market size was estimated at approximately USD 44.91 billion in 2025 and is projected to reach USD 62.09 billion by 2033, at a CAGR of 4.0% from 2026 to 2033. The growing emphasis on reliable and cost-effective energy storage solutions is driving the steady expansion of the lead acid battery industry, supported by the accelerating adoption of these batteries across automotive, industrial, and stationary backup applications.

Key Market Trends & Insights

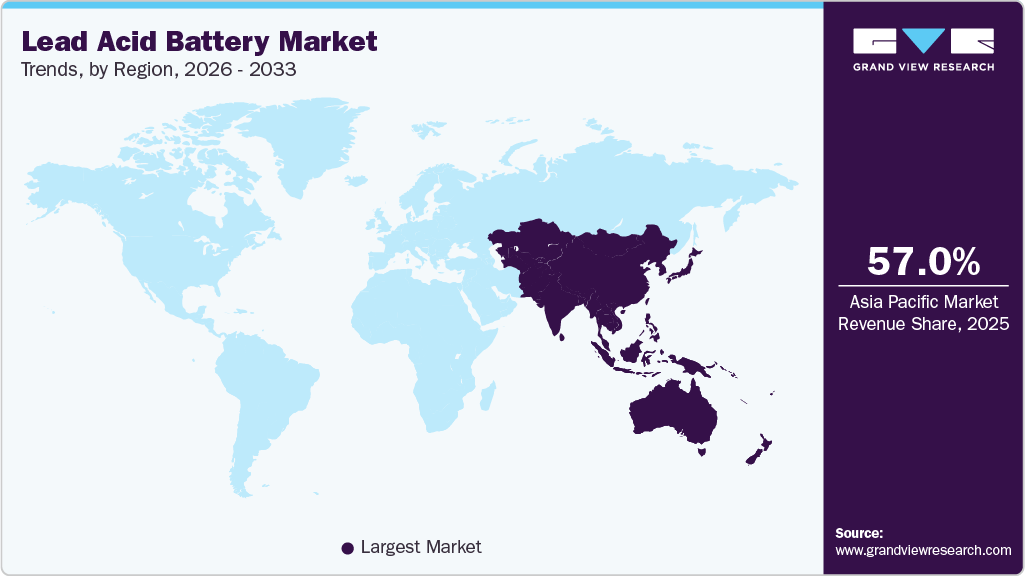

- The Asia Pacific lead acid battery industry held the largest share of over 57.0% of the global market in 2025.

- By construction method, the flooded lead acid batteries held the largest market share of over 65.0% in 2025.

- Based on application, the automotive segment held the largest market share in 2025.

- Based on product, the SLI segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 44.91 Billion

- 2033 Projected Market Size: USD 62.09 Billion

- CAGR (2026-2033): 4.0%

- Asia Pacific: Largest market in 2025

The sector continues to benefit from a strong replacement cycle, extensive manufacturing networks, and one of the most mature recycling ecosystems globally.Sustainability is emerging as a key differentiator for the lead acid battery industry, largely due to its highly efficient recycling ecosystem, which enables the recovery and reuse of most battery components. This established circular value chain reduces waste generation, lowers dependence on newly mined lead, and helps manufacturers maintain competitive production costs. As global policies increasingly emphasize responsible materials management and low-emission manufacturing, lead-acid batteries continue to align well with compliance requirements in both mature and developing markets. Their proven recyclability, combined with a relatively low environmental footprint throughout the product's lifecycle, strengthens their position as a stable and sustainable energy storage solution across the automotive, industrial, and backup power sectors.

On the technology front, continuous product enhancements are improving the operational capabilities of lead acid batteries and expanding their applicability. Modern variants, such as enhanced flooded batteries (EFB) and absorbent glass mat (AGM) batteries, are engineered to deliver quicker recharge cycles, higher endurance, and improved performance under deep-discharge conditions, making them suitable for start-stop vehicles, telecom networks, and critical power systems. Advances in plate design, grid alloys, separators, and electrolyte formulation are further increasing reliability and service life. In addition, ongoing improvements in VRLA technologies are helping the industry address performance challenges in high-temperature environments and heavy-duty industrial settings.

Drivers, Opportunities & Restraints

A key driver for the global lead acid battery industry is the growing need for reliable backup power as industries worldwide expand digital infrastructure and telecom networks. During 2024-2025, multiple regions across Asia, Africa, and Latin America accelerated telecom tower deployments to support 4G densification and early-stage 5G rollouts, resulting in higher consumption of VRLA batteries for uninterrupted power support. Global automotive demand further strengthened the market as rising vehicle parc across emerging and developed economies sustained the replacement cycle for SLI batteries. In addition, major international manufacturers reported improved recycling efficiencies in 2024, tightening the global circular economy loop and lowering raw material dependence, which reinforced the cost competitiveness of lead acid technology across price-sensitive markets.

A major opportunity for the global market in 2025 arises from the increasing adoption of advanced lead acid technologies, including AGM, EFB, and lead-carbon systems, in renewable energy-linked storage and hybrid solar installations. Recent microgrid and community solar initiatives launched across Southeast Asia, Latin America, and parts of Africa in 2024 increasingly incorporated advanced VRLA and lead-carbon batteries due to their better cycling performance and resilience under partial-state-of-charge conditions. The rapid global expansion of data centers, particularly in India, the Middle East, Western Europe, and the United States, is also creating significant new opportunities, as large-scale UPS systems continue to rely on lead acid batteries for their proven reliability, safety profiles, and cost advantages.

Despite global momentum, the lead acid battery industry faces notable restraints. The rapid adoption of lithium-ion technology across electric vehicles, grid-scale energy storage, and portable electronics is reshaping technological expectations and eroding the share of lead acid in high-energy-density applications. In 2025, several automotive OEMs, including leading manufacturers in Europe, China, Japan, and South Korea, announced expanded EV production capacities, shifting long-term demand away from conventional SLI batteries. Meticulously, tightening global regulations on lead handling, emissions, and recycling compliance in regions such as the EU, North America, and East Asia have increased operational and environmental management costs. These challenges collectively restrict the market’s expansion into advanced applications that demand superior energy density, lighter weight, and longer cycle life.

Construction Method Insights

Flooded lead-acid batteries continue to dominate the global construction method landscape due to their cost efficiency, broad manufacturing base, and large-scale adoption across automotive SLI and industrial applications. Their robust design, ease of maintenance, and long-standing technological maturity make them the preferred choice in developing markets where affordability heavily influences procurement decisions. The segment benefits from strong replacement demand and widespread use in conventional vehicles, backup power, and material-handling equipment. In countries across Asia, Africa, and Latin America, the rapid expansion of the vehicle parc and grid reliability challenges further reinforce the strong market presence of flooded batteries.

VRLA technologies, including AGM and GEL types, are growing at a faster pace due to their maintenance-free design, sealed construction, and superior performance in mission-critical environments. The increasing deployment of telecom towers, UPS systems, data centers, and start-stop vehicles is strengthening the outlook for this segment, particularly in regions that are investing heavily in digital infrastructure. While VRLA batteries offer better deep-cycle characteristics and operational flexibility, their higher price compared with flooded alternatives limits immediate penetration in cost-sensitive markets. Nevertheless, rising adoption in renewable-energy-linked storage and industrial automation is expected to accelerate future share gains.

Product Insights

SLI batteries held the largest share of the global product segmentation due to their universal requirement in internal combustion engine vehicles and the strong replacement cycle associated with global vehicle parc growth. As automobiles require dependable starting power, SLI batteries remain indispensable, with millions of units replaced annually across both mature and emerging automotive markets. The continued expansion of the used-vehicle fleet, especially in Asia and Africa, ensures that cyclical demand remains steady. Even with the rise of electrification, SLI batteries remain relevant in hybrid vehicles and auxiliary electrical systems, supporting their dominant position.

The stationary segment is experiencing robust growth driven by expansion in data centers, telecom infrastructure, commercial buildings, and industrial UPS systems. This segment benefits from the reliability and cost-effectiveness of lead-acid technology in environments where the total cost of ownership outweighs high energy density requirements. Meanwhile, motive batteries are gaining traction due to rising automation in logistics and warehousing, leading to increased deployment of electric forklifts, AGVs, and cleaning equipment. Although both stationary and motive batteries are expanding rapidly, their combined share remains below that of SLI batteries because their adoption is concentrated in specific commercial and industrial applications.

Application Insights

The automotive segment dominates global demand, as lead acid batteries remain integral for starting, lighting, and ignition in conventional vehicles, which still account for the majority of global automotive sales. Rising vehicle ownership, particularly in high-growth economies across the Asia-Pacific region, has led to sustained replacement cycles and increased consumption of SLI batteries. The segment also benefits from demand in commercial vehicles and light utility fleets, which require reliable and cost-effective battery solutions. Even as EV adoption accelerates, the vast installed base of internal combustion engine vehicles ensures that the automotive segment maintains its leading share for the foreseeable future.

UPS and telecom applications represent high-growth verticals driven by expanding data center infrastructure, rising digital connectivity, and the proliferation of telecom towers in developing regions. Lead acid batteries remain preferred for these uses due to their stability, safety, and lower cost per cycle. Electric bikes and transport vehicles continue to utilize lead-acid systems in markets that prioritize affordability over high energy density, such as South Asia and parts of Africa. Meanwhile, niche applications, including marine, emergency lighting, and security systems, provide steady, recurring demand. Although these segments are expanding, their cumulative share remains below that of the automotive sector due to more specialized deployment and smaller installed bases.

Regional Insights

North America lead acid battery industry maintains a stable and mature demand for lead acid batteries, underpinned by the dominance of automotive SLI batteries and the large installed base of conventional vehicles. Industrial applications, including telecom backup systems, UPS for data centers, and motive power solutions, continue to expand due to the growth of digitization and logistics. The region is also witnessing an incremental uptake in renewable energy storage, where lead-acid remains a cost-efficient solution for off-grid and backup functions, despite competition from lithium-ion.

U.S. Lead Acid Battery Market Trends

The U.S. lead acid battery industry is the largest contributor within North American region, driven by high replacement rates in the automotive sector and a strong aftermarket ecosystem supported by widespread vehicle ownership. Robust investments in data centers, healthcare infrastructure, and manufacturing facilities are sustaining demand for VRLA and flooded batteries in UPS and stationary storage applications. Environmental regulations and established recycling networks further reinforce the market, as the country has one of the world’s highest lead battery recycling efficiencies, supporting sustainable supply chains.

Asia Pacific Lead Acid Battery Market Trends

Asia Pacific lead acid battery industry is the fastest-growing regional market, driven by large-scale automotive production, rapid urbanization, and industrial expansion in China, India, and Southeast Asia. High demand for two-wheelers, commercial vehicles, and passenger cars strengthens the leadership of SLI batteries. The region also experiences strong uptake in renewable energy storage, telecom towers, and UPS systems due to the expansion of digital infrastructure, making APAC the global growth engine for both flooded and VRLA lead-acid technologies.

Europe Lead Acid Battery Market Trends

Europe lead acid battery industry growth is influenced by the stringent environmental regulations, advanced automotive manufacturing, and robust industrial power backup requirements. The replacement demand for SLI batteries remains resilient, largely due to the large number of ICE-based vehicles still on the road, despite ongoing electrification. Europe’s mature telecom and industrial sectors, along with initiatives focused on grid stability, continue to support the adoption of VRLA batteries for backup and energy storage.

Latin America Lead Acid Battery Market Trends

Latin America’s lead acid battery industry is expanding steadily, driven primarily by strong automotive replacement demand in major economies such as Brazil, Mexico, and Argentina, where SLI batteries dominate due to their affordability and suitability for diverse operating conditions. Industrial consumption is also increasing across various sectors, including telecom, power backup, mining, and renewable energy projects, with VRLA batteries gaining traction in off-grid and hybrid solar systems. Despite rising interest in lithium-ion alternatives, the region’s robust recycling infrastructure and cost-sensitive end user base continue to underscore the relevance of lead-acid technologies.

Middle East & Africa Lead Acid Battery Market Trends

The Middle East & Africa lead acid battery industry is expanding steadily, supported by rising investments in telecom networks, off-grid power systems, and backup solutions for industrial and commercial facilities. Hot climatic conditions increase the frequency of battery replacements, particularly in automotive applications, reinforcing the dominance of SLI batteries. Government-led infrastructure development, growth in mining and oil & gas operations, and the increasing deployment of solar battery hybrid systems are further strengthening the adoption of lead-acid batteries across the region.

Key Lead Acid Battery Company Insights

Some of the key players operating in the global lead acid battery industry include Clarios, Exide Industries, GS Yuasa Corporation, among others.

-

Clarios is one of the largest global producers of lead-acid batteries, strategically positioned across automotive, industrial, and energy-storage applications. The company focuses on advanced lead-acid technologies, including AGM and enhanced flooded batteries, delivering reliable performance, extended cycle life, and maintenance-free operation. Clarios’ global growth strategy emphasizes partnerships with automotive OEMs, industrial clients, and renewable energy providers, while investing in recycling and circular economy initiatives to enhance sustainability and cost efficiency across its product portfolio.

-

Exide Industries, a leading international player in the lead-acid battery industry, leverages its extensive manufacturing and distribution network to serve automotive, telecom, UPS, and industrial segments. The company specializes in SLI, stationery, and motive-power batteries, focusing on delivering high reliability, robust performance, and long service life. Exide’s strategic roadmap includes innovation in VRLA and lead-carbon technologies, global partnerships with OEMs and infrastructure developers, and expansion in emerging markets to capture demand from energy storage and industrial backup applications.

-

GS Yuasa Corporation is a leading global manufacturer of lead-acid and industrial batteries, recognized for its high-performance automotive, industrial, and energy storage solutions. The company emphasizes the technology-driven development of AGM and VRLA batteries, which offer superior deep-cycle capabilities, rapid recharge, and durability under demanding conditions. GS Yuasa’s strategic initiatives include collaboration with automotive manufacturers, renewable energy integrators, and industrial clients, aiming to strengthen its presence in global markets while advancing sustainable battery technologies and recycling practices.

Key Lead Acid Battery Companies:

The following are the leading companies in the lead acid battery market. These companies collectively hold the largest market share and dictate industry trends.

- C&D Technologies, Inc.

- Chaowei Power Holdings

- Clarios

- Crown Battery Corporation

- East Penn Manufacturing

- EnerSys

- Exide Industries

- GS Yuasa Corporation

- Leoch International Technology

- Panasonic Corporation

Recent Developments

-

In March 2025, Clarios unveiled its new generation of enhanced flooded batteries (EFB) for start-stop vehicles, demonstrating a 20% improvement in charge acceptance and cycle life under real-world automotive conditions. The launch supports the expanded adoption of hybrid vehicles in European and North American markets, strengthening Clarios’ position in high-performance automotive energy storage solutions.

-

In July 2025, Exide Industries commissioned a state-of-the-art VRLA battery manufacturing line in India, capable of producing 1 million units annually with advanced quality control and environmental safeguards. This development aims to meet rising demand from telecom towers, industrial UPS systems, and renewable energy storage, while enhancing supply chain resilience across emerging markets.

-

In September 2025, GS Yuasa Corporation introduced lead-carbon VRLA batteries optimized for microgrid and solar-storage applications in Southeast Asia, achieving a 30% longer cycle life under partial-state-of-charge operation. This innovation supports expanding renewable energy projects and off-grid electrification programs, reinforcing GS Yuasa’s commitment to sustainable and reliable energy storage technologies.

Lead Acid Battery Market Report Scope

Report Attribute

Details

Market Definition

The lead-acid battery market comprises the production, sales, and distribution of rechargeable lead sulfuric acid batteries used across automotive, industrial, and backup-power applications. It is defined in terms of both revenue generated from battery sales and the total energy storage capacity (Ah/MWh) supplied to end-use sectors worldwide.

Market size value in 2026

USD 47.16 billion

Revenue forecast in 2033

USD 62.09 billion

Growth rate

CAGR of 4.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Construction method, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; UK; Germany; Italy; Russia; China; India; Brazil; UAE; South Africa

Key companies profiled

C&D Technologies, Inc.; Chaowei Power Holdings; Clarios; Crown Battery Corporation; East Penn Manufacturing; EnerSys; Exide Technologies; GS Yuasa Corporation; Leoch International Technology; Panasonic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lead Acid Battery Market Report Segmentation

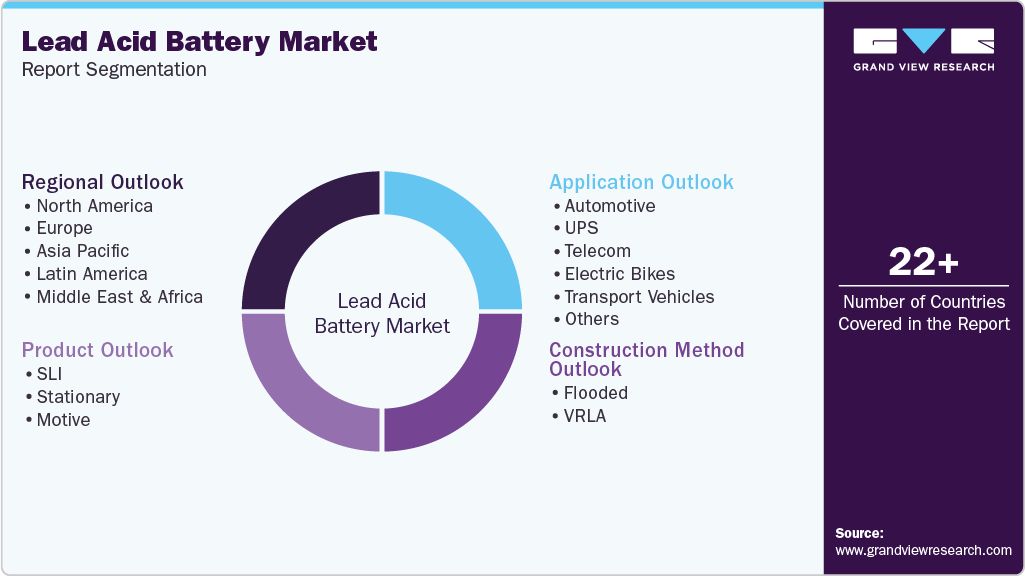

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lead acid battery market report based on construction method, product, application, and region:

-

Construction Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Flooded

-

VRLA

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

SLI

-

Stationary

-

Motive

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

UPS

-

Telecom

-

Electric Bikes

-

Transport Vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lead acid battery market size was estimated at USD 44.91 billion in 2025 and is expected to reach USD 47.16 billion in 2026.

b. The global lead acid battery market is expected to grow at a compound annual growth rate of 4.0% from 2026 to 2033 to reach USD 62.09 billion by 2033.

b. By construction method, the flooded lead acid batteries held the largest market share of over 65.0% in 2025.

b. Some of the key players operating in the global lead acid battery C&D Technologies, Inc., Chaowei Power Holdings, Clarios, Crown Battery Corporation, East Penn Manufacturing, EnerSys, Exide Technologies, GS Yuasa Corporation, Leoch International Technology, Panasonic Corporation, and others.

b. The lead acid battery market is primarily driven by strong demand for reliable, cost-effective energy storage in automotive, industrial, and backup power applications. Widespread vehicle replacement cycles, growing telecom and UPS infrastructure, and efficient recycling systems further support global market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.