- Home

- »

- Automotive & Transportation

- »

-

Marine Propulsion Engines Market Size & Trends Report, 2030GVR Report cover

![Marine Propulsion Engines Market Size, Share & Trends Report]()

Marine Propulsion Engines Market (2023 - 2030) Size, Share & Trends Analysis Report By Fuel Type (Diesel, Heavy Fuel Oil, Natural Gas, Other Fuels), By Application, By Power Range, By Region, And Segment Forecasts

- Report ID: 978-1-68038-387-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Propulsion Engines Market Summary

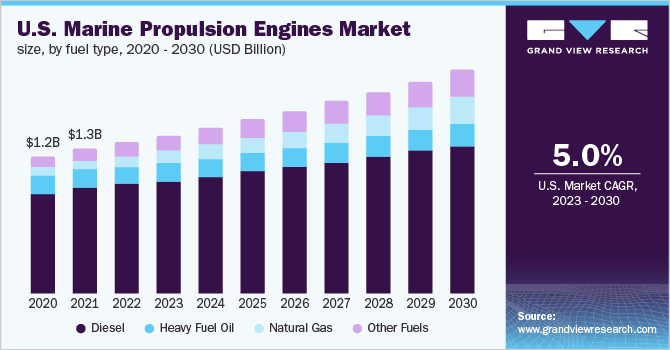

The global marine propulsion engines market was estimated at USD 15,789.3 million in 2022 and is predicted to expand at a CAGR of 4.4% from 2023 to 2030. The marine industry is increasing steadily due to dependency on the ships for transportation of goods required such as natural resources, and consumer supplies among other resources.

Key Market Trends & Insights

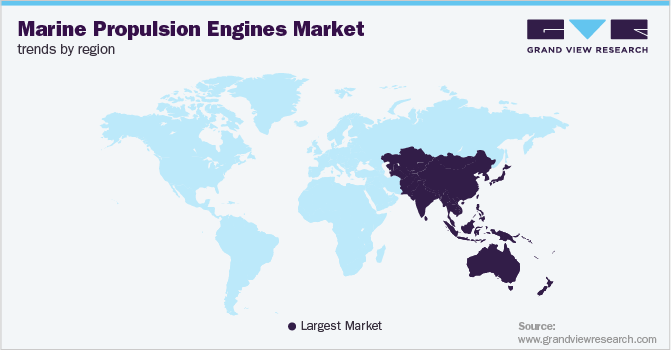

- Asia Pacific dominated the global marine propulsion engines market with the largest revenue share 2022.

- The marine propulsion engines market in China led the Asia Pacific market and held the largest revenue share in 2022.

- By fuel type, the diesel segment led the market, holding the largest revenue share of over 70% in 2022.

- By application, the commercial segment is expected to grow at the fastest CAGR of 5.0% 2023 to 2030.

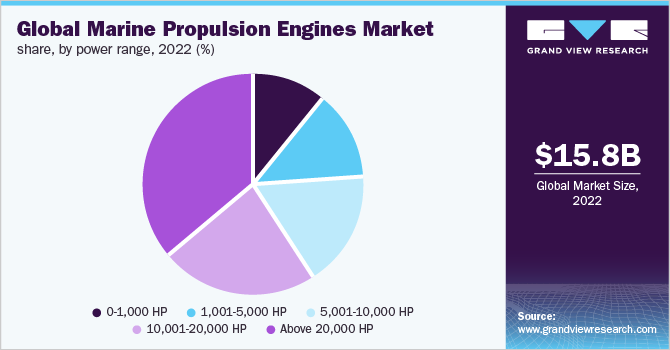

- By power range, the above 20,000 HP segment held the dominant position in the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 15,789.3 Million

- 2030 Projected Market Size: USD 22,218.5 Million

- CAGR (2023-2030): 4.4%

- Asia Pacific: Largest market in 2022

The ships require high-performance engines for sailing the distance in lesser time and also powerful engines to bear the load of the ships. Such engines are usually powered by diesel engines, as they are reliable and require less maintenance as compared with other types of engines. The rising international trade on account of increasing globalization and industrialization is escalating the demand for container ship to transport various products such as oil, natural gas, and minerals.

The increasing focus on reducing fossil fuel consumption and improving efficiency is escalating the adoption of marine electric propulsion engines. The increase in the usage of LNG and nuclear propulsion, along with the rise in demand for the diesel-based marine propulsion engine market is driving the growth of the market. Moreover, as newer technologies engines that are installed in the ships are mostly based on nuclear power which works without refueling for more than 20 years, a small amount of nuclear fuel is also engaged in providing energy equivalent to a larger amount of coal and oil engines.

Dual-fuel diesel (DFD) marine propulsion engines have been installed as prime movers aboard LNG carriers to maximize natural gas use. LNG vessel propulsion systems are usually equipped with waste heat reduction systems (WHRs) as such systems help reduce emissions, enhanced fuel efficiency, and better engine performance. Switching to LNG-powered vessels is a complicated task for companies, however, they can combine modern WHRs with the engines to enhance their performance. Furthermore, the increased emphasis on decreasing fossil fuel use and improving energy efficiency encourages the global adoption of marine electric propulsion engines. Alternative fuels such as algal oils and bio-methane are also being utilized to power marine propulsion engines with minimal gas emissions as technology progresses and environmental awareness rises.

Fuel Type Insights

Diesel-based marine propulsion engines are expected to account for more than 70% of the global market share in 2022, owing to superior efficiency and economy than other energy-propelled equivalents. According to a Universal Technical Institute publication, diesel engines deliver 20% better thermal efficiency than gas engines. The changing cost of marine gas and diesel oil also contributes to the increased demand for diesel propulsion engines. The rates of marine gasoline and diesel do not have a significant difference, but when it comes to larger vessels that travel regularly, diesel is the favored alternative, becoming more inexpensive. Gas propulsion engines are also used in naval and non-naval ships as this type of fuel type engine aids in faster movement of ships which is necessary in case of the ship coming under attack.

Application Insights

Commercial application is gaining momentum which is going to have a CAGR of 5.0% during the forecast period. The increased maritime commerce activities are likely to boost demand for marine propulsion engines in commercial vessels. Commercially linked ships transport supplies such as crude oil, steel, electrical gadgets, automobiles, and food products between nations. Private shipping businesses have been growing their fleet sizes to leverage the import-export operations carried out worldwide. At the same time, these shipping companies largely focus on boosting efficiency by cutting journey times. By connecting to a network, commercial ships can select the quickest possible path to their destination based on characteristics such as traffic congestion and port availability. Defense application is going to back up the market as after commercial ships there are a lot of defense ships sailing in the oceans which are mostly diesel-powered or nuclear-powered engines and have gained momentum as countries are aiming to expand their naval presence.

Power Range Insights

In 2022, above 20,000 HP power segment is gaining momentum and is likely to have a CAGR of around 5.0% during the forecast period. The requirement for higher power engines is more due to the increased load capacity of the vessels as global trade is gaining momentum. The revival of maritime trade and the requirement for more and more vessels are expected to drive the growth of the above 20,000 HP power range engine market during the forecast period. The engines powered by the 10,001 - 20,000 HP power range segment are majorly used in most of the container ships that have to travel shorter distances with cargo and are also used in naval ships. The segment is likely to expand at a CAGR of 4.0% during the forecast period.

Regional Insights

Currently, Asia Pacific is witnessing strong maritime trade and shipping growth, resulting in an increase in demand for marine propulsion engines. The market is gaining momentum and is anticipated to reveal a CAGR of 4.0% during forecast period. China has become the world's largest exporter, necessitating a significant number of commercial ships, boosting the market expansion of the marine propulsion engines industry. Furthermore, Asian navies are expanding their maritime defense capabilities, likely raising market size.

North America is anticipated to have a significant impact on the marine propulsion engines market throughout the projected period. The area anticipates requiring marine engine producers to create motors that adhere to US EPA New Source Performance Standards (NSPS). Due to the expanding seaborne trade, the region's marine propulsion engine market is expected to develop faster than the world average.

Key Companies & Market Share Insights

Key players in the marine propulsion engines market are focusing on the engine's technological advancement by increasing the engine's efficiency and reducing fuel consumption. Daihatsu's 6DE20DF dual fuel engine was shipped to a 95,000D/W coal carrier as they received the order from NYK Line and built by Oshima Shipbuilding Co. Ltd. Volvo Penta created a fuel-efficient, reliable, compact IMO Tier III solution. This system will smooth the transition to IMO III compliance for Volvo Penta IPS and traditional inboard shaft installations. Some of the prominent key players in the global marine propulsion engines market include:

-

Caterpillar

-

Daihatsu Diesel MFG Co. Ltd.

-

General Electric Company

-

Hyundai Heavy Industries Co. Ltd.

-

IHI Power Systems Co. Ltd.

-

Mitsubishi Heavy Industries Ltd.

-

Rolls Royce Plc

-

Volkswagen Group (MAN Energy Solutions S.E.)

-

Volvo Penta

-

Wartsila

-

Yanmar Holdings Co. Ltd.

Marine Propulsion Engines Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16,447.7 million

Revenue forecast in 2030

USD 22,218.5 million

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Fuel type, application, power range, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Caterpillar; Hyundai Heavy Industries Co. Ltd.; Mitsubishi Heavy Industries Ltd.; Volvo Penta; Daihatsu Diesel MFG. Co. Ltd.; General Electric Company; Yanmar Holdings Co. Ltd.; IHI Power Systems Co. Ltd.; Wartsila; Rolls Royce Plc; Volkswagen Group (MAN Energy Solutions S.E.), Others

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Marine Propulsion Engines Market Segmentation

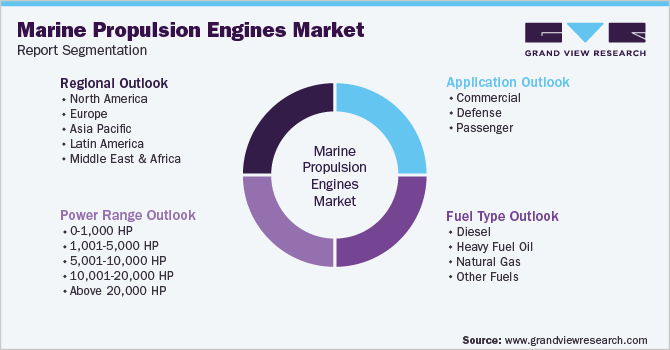

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global marine propulsion engines market report based on fuel type, application, power range, and region:

-

Fuel Type Outlook (Revenue, USD Million 2018 - 2030)

-

Diesel

-

Heavy Fuel Oil

-

Natural Gas

-

Other Fuels

-

-

Application Outlook (Revenue, USD Million 2018 - 2030)

-

Commercial

-

General Cargo Ships

-

Container Ships

-

Bulk Carriers

-

Tankers

-

Others

-

-

Defense

-

Destroyers

-

Frigates

-

Submarines

-

Corvettes

-

Aircraft Carriers

-

Offshore Patrol Vessels

-

Other Vessel Types

-

-

Passenger

-

-

Power Range Outlook (Revenue, USD Million 2018 - 2030)

-

0-1,000 HP

-

1,001-5,000 HP

-

5,001-10,000 HP

-

10,001-20,000 HP

-

Above 20,000 HP

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global marine propulsion engines market size was estimated at USD 15,789.3 million in 2022 and is expected to reach USD 16,447.7 million in 2023.

b. The global marine propulsion engines market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 22,218.5 million by 2030.

b. Asia Pacific dominated the marine propulsion engines market with a share of around 66% in 2022. This is attributed to the augmented international trade and export from the region. India and China become major hubs of business in the region, which increased the pace of activity in the marine manufacturing sector.

b. Some key players operating in the marine propulsion engines market include Caterpillar, Hyundai Heavy Industries Co. Ltd., Mitsubishi Heavy Industries Ltd., Volkswagen Group (MAN Energy Solution SE), Wartsila, and many others.

b. Key factors that are driving the marine propulsion engines market growth include the rising international trade on account of increasing globalization and industrialization thereby escalating the demand for container ships to transport various products such as oil, natural gas, and minerals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.