- Home

- »

- Medical Devices

- »

-

Medical Waste Management Market Size, Share Report 2030GVR Report cover

![Medical Waste Management Market Size, Share & Trends Report]()

Medical Waste Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment Site (Onsite, Offsite), By Treatment (Incineration, Autoclaving, Chemical Treatment), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-777-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Waste Management Market Summary

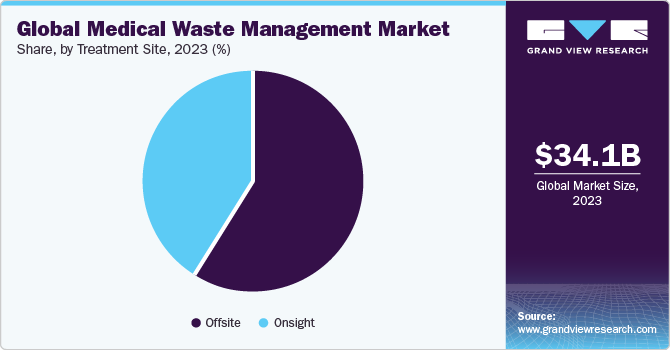

The global medical waste management market size was estimated at USD 34.06 billion in 2023 and is projected to reach USD 59.42 billion by 2030, growing at a CAGR of 8.0% from 2024 to 2030. The expansion of the overall medical and healthcare sector is driving the need for these systems. Ongoing research and development efforts in the industry are yielding advanced diagnostic, surgical, and treatment solutions.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 30.36% in 2023.

- The U.S. accounted for the largest share of the market in North America region in 2023.

- Based on treatment, the incineration segment led the market with a largest revenue share of 39.73% in 2023

- Based on treatment, the incineration segment led the market with a largest revenue share of 39.73% in 2023

Market Size & Forecast

- 2023 Market Size: USD 34.06 Billion

- 2030 Projected Market Size: USD 59.42 Billion

- CAGR (2024-2030): 8.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing incidence of diseases like cancer and other chronic disorders, along with an increasing elderly population and road accidents, is leading to a heightened demand for these advanced medical solutions. Consequently, the widespread availability of advanced medical solutions, combined with a growing patient population, is resulting in a significant volume of waste and byproducts.

The pharmaceutical industry is experiencing swift progress in the adoption of innovative manufacturing techniques for drugs and medical devices. In addition, the market's expansion is evident in the effective supply chain management of inventories crucial for the daily operations of hospitals, clinics, and diagnostic centers. Consequently, this heightened activity contributes to an increased generation of medica leftover material. To manage these by-products and residues, there is a growing need for a systematic and efficient service encompassing collection, transportation, disposal, and recycling of specific materials, as needed.

Certain treatment, disposal, and recycling processes emit harmful gases and compounds, including mercury and oxides. For instance,as per study entitled "Application of the Sterilization Process for Inactivation of Bacillus Stearothermophilus in Biomedical Waste and Associated Greenhouse Gas Emissions," published in July 2020, it was reported that the annual production of biomedical waste rose from 1,362 tons in 2009 to 2,375 tons in 2019. These hazardous substances pose the risk of land, air, and water pollution, leading to the dissemination of infectious agents and potential cancer risks. The growth of the industry is consequently influenced by advancements in techniques for the treatment, disposal, and recycling of these materials.

In addition, the positive governmental initiatives, especially those involving financial support for medical waste management initiatives in developing economies, are anticipated to act as drivers for expansion. For instance, in May 2021, a strategic partnership between Stericycle and UPS Healthcare was established to manage the reverse logistics of medical residue. Within the framework of this agreement, Stericycle will play a role in supporting UPS Healthcare in the reverse logistics processes related to medical leftover material, including residue categorization and disposal. The collaborative effort is designed to deliver comprehensive logistical assistance to the healthcare sector, furnishing end-to-end solutions

Also, there is a rise in R&D investment and expansion in facilities by pharmaceutical and biotechnology firms for approval and launch of new drugs in the market. High investments in R&D and adequate supply and logistical facilities are likely to increase the possibility of successful drug/medicine. For instance, in July 2022, DHL Freight expanded its network in Germany with the purchase of a new terminal in Mettmann, close to Düsseldorf, Germany. This initiative was undertaken after a new facility was recently opened in Erlensee, close to Frankfurt, Germany, and a site was acquired from the logistics firm Leupold in Gochsheim, close to Würzburg, Germany.

However, an anticipated significant transition in the market, moving from larger players to smaller-sized local players, is expected to hinder growth. Developing countries allocate substantial capital for the adoption of advanced technologies aimed at mitigating pollution and other adverse effects on the ecosystem during the treatment and disposal processes. However, these nations lack clear and stringent guidelines and regulations for the management of medical waste, posing a hindrance to market growth.

Market Concentration & Characteristics

The market is experiencing a notable degree of innovation with the introduction of advanced technologies and solutions for the efficient and sustainable handling, treatment, and disposal of hazardous biological material.

Several market players such as Republic Services, Inc, REMONDIS SE & Co. KG, and Stericycle, Inc. are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in February 2022, Republic Services, Inc. (US) has acquired US Ecology (US) with the aim of broadening its presence throughout the U.S. and Canada.

Regulations significantly impact the market by ensuring stringent compliance standards for product safety, quality, and documentation. While promoting patient welfare, these regulations also necessitate rigorous tracking, reporting, and adherence to good clinical practice (GCP)

Emerging technologies and sustainable alternatives, such as on-site sterilization systems and innovative hazardous biological material reduction methods, pose as potential substitutes in the market, offering more eco-friendly and cost-effective solutions for healthcare waste disposal.

Market players are strategically expanding their presence regionally, establishing partnerships and facilities to cater to the increasing demand for advanced waste management solutions, reflecting a proactive approach to address diverse regional needs and regulations.

Treatment Insights

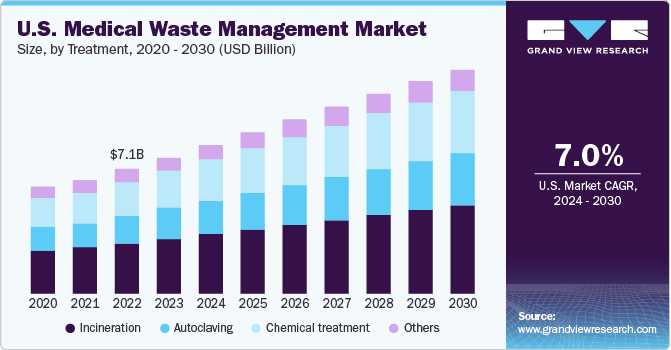

Based on treatment, the incineration segment led the market with a largest revenue share of 39.73% in 2023,due to its simplicity and convenience. It is the most common and preferred method for disposing of medical waste, despite concerns about environmental safety. During the COVID-19 pandemic, many hospitals and healthcare settings considered incineration as a viable option for leftover medical material disposal because it helped limit the spread of the virus. Moreover, factors such as lower capital investments are likely to boost the growth of this segment in the future. The introduction of government programs and new ventures are also projected to drive the market growth.

The autoclave segment has been anticipated to grow a lucrative CAGR over the forecast period driven by factors such as the escalating generation of medical waste due to the growing prevalence of chronic diseases and surgeries. The demand for efficient leftover medical material management solutions has surged, and autoclaves utilize high-pressure saturated steam to eliminate microorganisms in leftover medical material, ensuring safe disposal. Their widespread adoption is influenced by benefits like cost-effectiveness, efficiency, and minimal environmental impact.

Treatment Site Insights

Based on treatment site, the offsite segment led the market with the largest revenue share of 58.86% in 2023, due to the rise in the use of advanced, single-use surgical products. These products generate large volumes of medical wastage that need to be managed efficiently. The offsite treatment process allows these facilities to manage the medical leftovers in a centralized location, reducing the environmental impact and ensuring compliance with regulations. Furthermore, it offers convenience for hospitals, diagnostic laboratories, and other waste generators, as they do not have to deal with the waste on-site.

The on-site segment is expected to register the lucrative CAGR during the forecast period, due to the increasing adoption of advanced on-site equipment. These technologies allow healthcare facilities to manage their waste more effectively, reducing the need for transportation and storage. In addition, on-site treatment provides real-time data about waste generation, enabling better planning and resource allocation. This shift towards on-site treatment is also influenced by stringent regulations and the growing awareness about the importance of minimizing environmental impact.

Regional Insights

North America dominated the market with a revenue share of 30.36% in 2023. The advanced healthcare infrastructure in North America contributes to the dominance of the region in the medical waste management sector. The U.S and Canada, in particular, have a vast network of hospitals, clinics, research institutions, and pharmaceutical companies that generate substantial amounts of medical waste. The sheer volume and diversity of medical waste generated in the region creates a robust market for specialized waste management services.

The U.S. accounted for the largest share of the market in North America region in 2023. The U.S has a well-established industry of waste management companies that offer comprehensive solutions for the proper disposal and treatment of medical waste. These companies leverage advanced technologies to ensure compliance with environmental regulations and the safe handling of biohazardous materials. The presence of these experienced and specialized service providers, coupled with the country's large healthcare landscape, positions the U.S. as a dominant player in the North American market.

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The heightened awareness of environmental sustainability and public health has prompted a shift towards more advanced and environmentally friendly waste management practices in the Asia Pacific. Further, countries such as China, Japan are increasingly adopting modern technologies for the treatment and disposal of medical waste, including incineration, autoclaving, and non-incineration technologies. This shift not only addresses the environmental impact of medical waste but also presents a significant business opportunity for companies offering innovative and sustainable medical waste management solutions.

Japan accounted for the largest share of the market in the Asia Pacific region in 2023. Japan boasts a highly advanced and well-established healthcare system with a strong emphasis on technology and innovation. The country's sophisticated medical infrastructure, including numerous hospitals, research institutions, and pharmaceutical companies, generates a substantial amount of medical waste. To address environmental concerns and public health safety, Japan has implemented stringent regulations governing the proper disposal and management of medical waste, creating a robust demand for cutting-edge waste management solutions.

Key Medical Waste Management Company Insights

Some of the key players operating in the market include REMONDIS SE & Co. KG, and Republic Services, Inc. These players are continuously focusing on adoption of advanced technologies for efficient waste treatment, strategic partnerships to enhance service offerings, and compliance with stringent environmental regulations to ensure safe disposal and management of medical waste.

Stericycle, Inc and Veolia are some of the emerging market players in the market. These market players employ strategies such as technological innovation to differentiate their services, targeting niche segments within the healthcare industry, and forming strategic collaborations to gain market visibility.

Key Medical Waste Management Companies:

The following are the leading companies in the medical waste management market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these medical waste management companies are analyzed to map the supply network.

- REMONDIS SE & Co. KG

- Republic Services, Inc

- Sharp Compliance, Inc

- Stericycle, Inc

- Suez environment

- Veolia

- Waste Management, Inc

- Clean Harbors, Inc.

- BioMedical Waste Solutions, LLC

- Daniels Sharpsmart, Inc.

Recent Developments

-

In June 2023, Cabinet Health, the innovators behind the world's first refillable and compostable medicine system, introduced a nationwide recycling initiative for pill bottles. This program aims to address the challenge of pharmaceutical plastic waste

-

In February 2023, EcoSteris, a leader in healthcare waste treatment and disposal, has unveiled a state-of-the-art medical waste facility in Summerville, establishing a unique and innovative presence in the industry

-

In April 2022, Stericycle, Inc. introduced its latest product, the SafeShield medical waste containers, designed with a focus on high quality and tailored for the safe storage of regulated medical waste

Medical Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.45 billion

Revenue forecast in 2030

USD 59.42 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment site, treatment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

REMONDIS SE & Co. KG; Republic Services, Inc.; Sharp Compliance, Inc.; Stericycle, Inc.; Suez environment; Veolia; Waste Management, Inc.;Clean Harbors, Inc.; BioMedical Waste Solutions; LLC; Daniels Sharpsmart, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global medical waste management market report based on treatment site, treatment, and region:

-

Treatment Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Onsite

-

Collection

-

Treatment

-

Recycling

-

Others

-

-

Offsite

-

Collection

-

Treatment

-

Recycling

-

Others

-

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Incineration

-

Autoclaving

-

Chemical treatment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global medical waste management market size was estimated at USD 34.06 billion in 2023 and is expected to reach USD 37.45 billion in 2024.

b. The global medical waste management market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 59.42 billion by 2030.

b. North America dominated the medical waste management market with a share of 30.36% in 2023. This is attributable to a highly developed healthcare sector and rising prevalence of infectious & chronic diseases.

b. Some key players operating in the medical waste management market include REMONDIS SE & Co. KG; Republic Services, Inc.; Sharp Compliance, Inc.; Stericycle, Inc.; Suez environnement; Veolia; and Waste Management, Inc.

b. Key factors that are driving the market growth include rising prevalence of diseases, commercial availability of advanced medical solutions, and growth of the overall medical and healthcare industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.