- Home

- »

- Communications Infrastructure

- »

-

Military Radar Market Size And Share, Industry Report, 2030GVR Report cover

![Military Radar Market Size, Share & Trends Report]()

Military Radar Market (2025 - 2030) Size, Share & Trends Analysis Report By Radar (Ground-based, Naval, Airborne, Space based), By Component (Antenna, Transmitter, Receiver), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-015-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Radar Market Summary

The global military radar market size was valued at USD 1.59 billion in 2024 and is expected to reach USD 2.14 billion in 2030, growing at a CAGR of 5.1% from 2025 to 2030. The increasing geopolitical tensions and the need for enhanced national security have led to significant investments in advanced radar systems.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 39.6% in 2024.

- The U.S. military radar market dominated the regional market in 2024.

- By radar, the ground-based segment dominated the market with a revenue share of 35.8% in 2024.

- By component, the antenna segment dominated the market with the largest revenue share in 2024.

- By application, the air and missile defense segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.59 Billion

- 2030 Projected Market Size: USD 2.14 Billion

- CAGR (2025-2030): 5.1%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

In addition, the demand for improved situational awareness in defense operations has prompted military organizations to upgrade their existing radar technologies. Innovations in radar capabilities, particularly in enhanced target detection and tracking, have significantly influenced the current landscape of the military radar industry.

The ongoing advancements in technology, particularly in areas such as artificial intelligence and machine learning, are set to enhance radar functionalities, allowing for real-time data processing and improved accuracy. For instance, over 70 F-16 Fighting Falcons from 12 Air National Guard units are equipped with advanced active electronically scanned array (AESA) radar systems. This upgrade enhances the aircraft's capabilities, enabling pilots to detect, target, identify, and engage a variety of threats at extended ranges with improved precision. Furthermore, the integration of radar systems with Unmanned Aerial Vehicles (UAVs) and other advanced platforms is likely to expand their operational capabilities.

Moreover, collaborative efforts between defense contractors and government agencies are expected to foster innovation within the military radar sector. Strategic partnerships and mergers may lead to the development of next-generation radar systems that incorporate cutting-edge technologies. The increasing focus on joint military exercises and interoperability among allied forces drives the demand for advanced radar solutions that seamlessly integrate with various defense systems. These factors collectively indicate robust growth for the military radar industry in the coming years.

Radar Insights

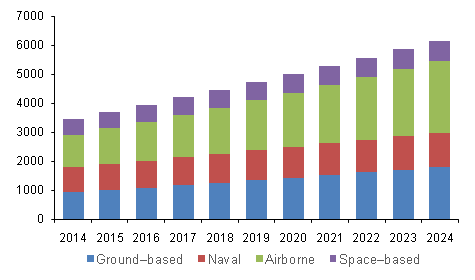

The ground-based segment dominated the market with a revenue share of 35.8% in 2024 due to the rising need for robust surveillance capabilities and situational awareness in ground operations. Ground-based radar systems are vital for monitoring borders, critical infrastructure, and troop movements, ensuring comprehensive coverage against potential threats. As military forces focus on enhancing their defensive measures, investments in advanced ground radar technologies have surged, enabling better detection and response to various security challenges.

The airborne segment is projected to grow at the highest CAGR during the forecast period, driven by advancements in aerial surveillance technology. The growing deployment of UAVs and the need for real-time intelligence significantly contribute to this trend. Airborne radar systems are essential for gathering reconnaissance data and providing situational awareness in dynamic environments. As military operations evolve to include more complex scenarios, the demand for sophisticated airborne radar systems capable of delivering accurate data becomes increasingly critical for effective mission execution.

Component Insights

The antenna segment dominated the market with the largest revenue share in 2024. Antennas are fundamental components that facilitate effective signal transmission and reception, directly impacting the accuracy and reliability of radar systems. Innovations in antenna technology, such as phased array systems and electronically scanned arrays, enhance capabilities and support diverse military applications. These advancements enable military forces to maintain superior situational awareness and improve their operational effectiveness across various platforms.

The duplexer segment is projected to grow at the highest CAGR during the forecast period due to its importance in radar signal processing. Duplexers allow for simultaneous transmission and reception of signals, essential for efficient radar operation. As military forces seek to enhance their radar systems' responsiveness and effectiveness, investments in advanced duplexer technologies are expected to increase. This growth reflects a broader trend toward integrating more sophisticated signal processing capabilities into the military radar industry.

Application Insights

The air and missile defense segment dominated the market with the largest revenue share in 2024, driven by rising global security threats. The increasing frequency of aerial threats has led to significant investments in advanced radar systems capable of detecting and tracking missiles and aircraft. This focus on air and missile defense highlights a broader trend toward enhancing national security through technological advancements. As nations prioritize their defense capabilities, the demand for integrated air and missile defense solutions continues to grow. For instance, India is set to finalize a defense agreement valued at USD 4 billion with Russia. This agreement aims to secure an advanced early warning radar system with long-range, which will enhance the country's capabilities in air defense and missile detection.

The navigation and weapon guidance segment is expected to grow at the highest CAGR over the forecast period as militaries increasingly rely on precise targeting capabilities. Advanced radar systems play a vital role in guiding munitions accurately to their targets, thereby improving operational effectiveness. The integration of advanced navigation technologies into military radar systems enhances overall mission success rates by ensuring that forces can engage targets with high precision under various conditions.

Regional Insights

North America military radar market dominated the global market with a revenue share of 39.6% in 2024, reflecting its strong defense infrastructure and technological capabilities. The region's emphasis on modernization and innovation in military technologies has led to increased investments in advanced radar systems. North America's robust research and development environment fosters collaboration among defense contractors, resulting in cutting-edge solutions that enhance national security efforts across the land, air, and maritime domains.

U.S. Military Radar Market Trends

The U.S. military radar market dominated the regional market in 2024 due to its extensive defense spending and focus on cutting-edge technology development. The presence of leading defense contractors such as Raytheon and Northrop Grumman ensures continuous innovation within the sector. Ongoing government initiatives to enhance national security further contribute to this dominance by driving demand for advanced radar technologies that support various military operations.

Europe Military Radar Market Trends

Europe military radar market is expected to grow at a significant CAGR from 2025 to 2030, driven by increasing investments in defense capabilities across member states. Collaborative defense initiatives among European nations are likely to spur demand for advanced radar technologies that promote interoperability among allied forces. As countries seek to strengthen their collective security posture through shared resources and technology development, advancements in military radar systems will play a crucial role in achieving these objectives.

Asia Pacific Military Radar Market Trends

The Asia Pacific military radar market is expected to grow at the highest CAGR from 2025 to 2030 due to rapid technological advancements and rising defense budgets among regional powers. Countries such as India and Japan are investing heavily in modernizing their military capabilities, including advanced radar systems that enhance situational awareness and operational readiness. This trend reflects a broader regional commitment to strengthening national security through technological innovation within the military radar industry.

China military radar market dominated the Asia Pacific region in 2024 due to its large manufacturing capabilities focused on producing high volumes of advanced sensors efficiently. The country's significant investments in research and development position it as a key player within the global military radar sector. As China continues to expand its military modernization efforts, demand for sophisticated radar solutions is expected to rise substantially across various applications, including air defense and surveillance operations.

Key Military Radar Company Insights

The military radar market features several key players who shape its landscape. L3Harris Technologies, Inc. specializes in advanced sensor systems for defense applications, enhancing situational awareness, while BAE Systems develops electronic warfare and radar solutions that improve detection capabilities. Leonardo S.p.A. designs radar systems for various military operations, focusing on air defense technology, while General Dynamics Corporation provides radar solutions that enhance surveillance and reconnaissance for military forces. These companies play a significant role in shaping the military radar industry.

-

BAE Systems develops a range of military radar systems that enhance situational awareness and operational effectiveness for defense forces. The company focuses on electronic warfare and advanced radar solutions, enabling improved detection capabilities and mission success across various military applications. BAE Systems emphasizes innovation and technology integration to meet the evolving needs of modern defense environments.

-

Leonardo S.p.A. specializes in designing and manufacturing radar systems for military operations, strongly emphasizing air defense technology. The company provides advanced solutions that support surveillance, reconnaissance, and target acquisition. Leonardo is committed to leveraging cutting-edge technology to enhance the armed forces' capabilities and ensure their effectiveness in complex operational scenarios.

Key Military Radar Companies:

The following are the leading companies in the military radar market. These companies collectively hold the largest market share and dictate industry trends.

- L3Harris Technologies, Inc.

- BAE Systems

- Leonardo S.p.A.

- General Dynamics Corporation

- Lockheed Martin Corporation

- Northrop Grumman.

- RTX

- Airbus

- Thales

- Saab

Recent Development

-

In December 2024, South Korea's Defense Acquisition Program Promotion Committee approved a plan to upgrade the Boeing F-15K Slam Eagle combat aircraft, as reported by the Defence Acquisition Program Administration (DAPA). This decision was made during the committee's 165th meeting at the Ministry of National Defense, where it was emphasized that the upgrades would enhance essential components, including radar, and improve the operational capabilities and survivability of the F-15K fighter jets currently in service with the Republic of Korea Air Force (RoKAF).

-

In July 2024, Raytheon, a business unit of RTX, received a USD 1.2 billion contract to provide Germany with additional missile defense and Patriot air systems. These systems are intended to enhance Germany's air defense infrastructure by supplying key components such as the latest command and control stations, launchers, Patriot Configuration 3+ radars, and associated spare parts and support services.

Military Radar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.67 billion

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Radar, component, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, Israel

Key companies profiled

Airbus; BAE Systems; Leonardo S.p.A.; General Dynamics Corporation; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Northrop Grumman.; RTX; Thales; Saab

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Radar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military radar market report based on radar, component, application, and region.

-

Radar Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground-Based

-

Naval

-

Airborne

-

Space-Based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Antenna

-

Transmitter

-

Receiver

-

Duplexer

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Air and Missile Defense

-

Intelligence, Surveillance and Reconnaissance

-

Navigation and Weapon Guidance

-

Space Situation Awareness

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

Israel

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.