- Home

- »

- Medical Devices

- »

-

Minimally Invasive Surgery Market Size, Industry Report 2033GVR Report cover

![Minimally Invasive Surgery Market Size, Share & Trends Report]()

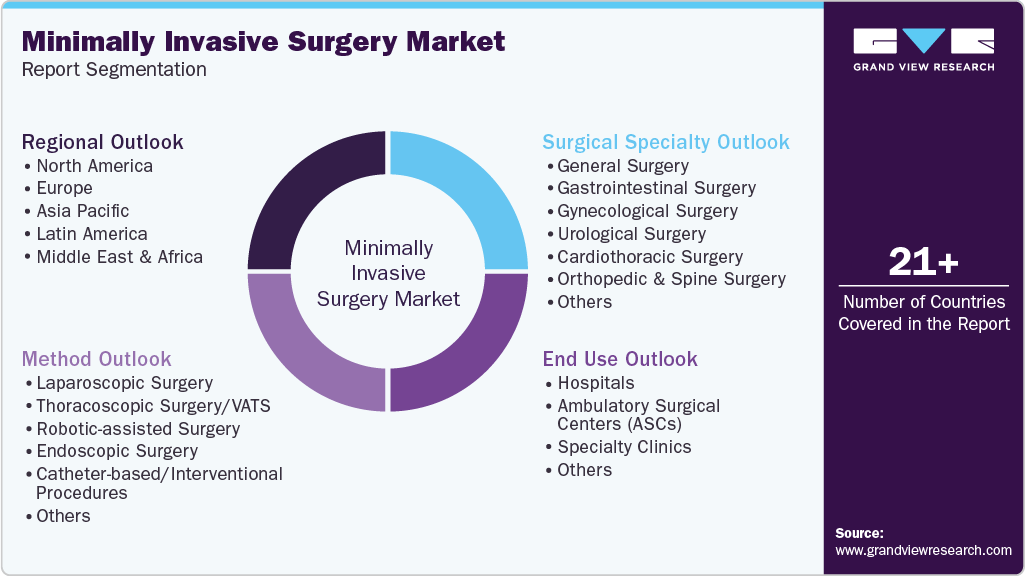

Minimally Invasive Surgery Market (2025 - 2033) Size, Share & Trends Analysis Report By Surgical Specialty (General Surgery, Gynecological Surgery), By Method (Laparoscopic, Robotic-assisted), By End Use (Hospitals, ASCs), By Region And Segment Forecasts

- Report ID: GVR-4-68040-753-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Minimally Invasive Surgery Market Trends

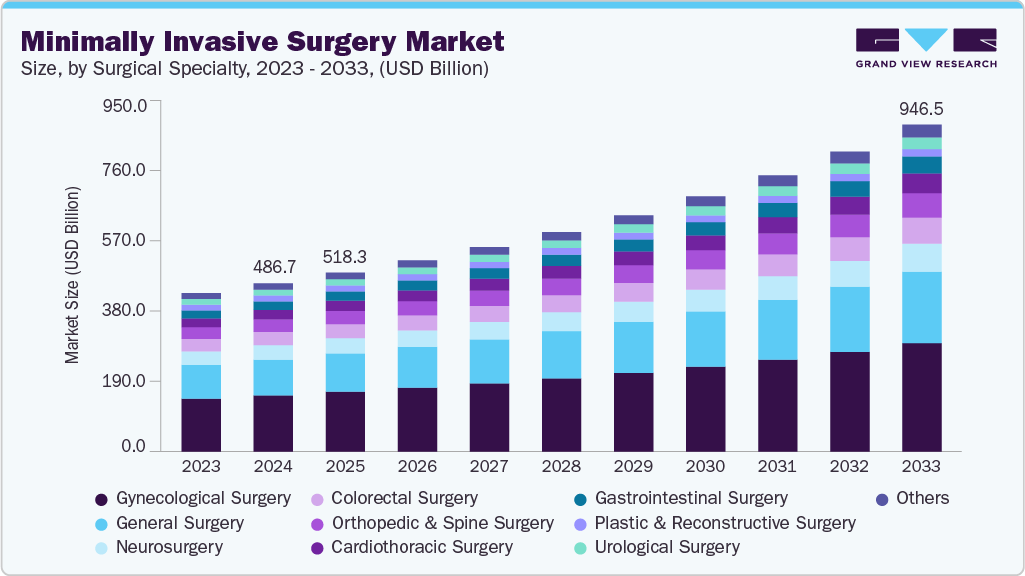

The Minimally Invasive Surgery market size was valued at USD 486.72 billion in 2024 and is projected to reach USD 946.50 billion by 2033, growing at a CAGR of 7.82% from 2025 to 2033. The industry outlook is attributed to technological advancements, a growing geriatric population, and an increasing chronic disease burden. An important growth driver of minimally invasive surgery is the rising global surgical volume combined with a strong preference for less invasive approaches.

Key Market Trends & Insights

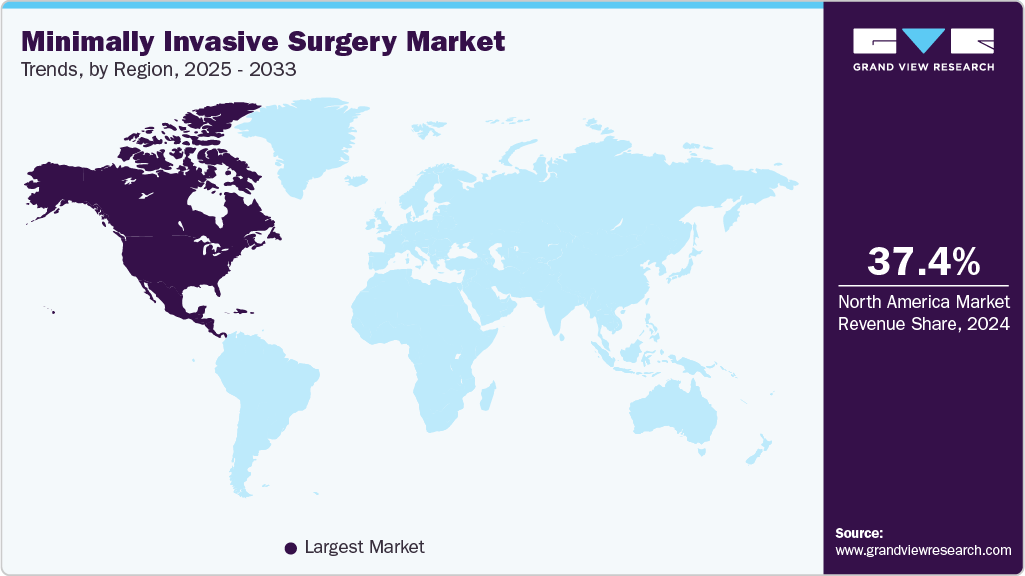

- North America's minimally invasive surgery (MIS) market held the largest share of 37.42% of the global market in 2024.

- The U.S.'s minimally invasive surgery industry is expected to grow significantly over the forecast period.

- By surgical specialty, the gynecological surgery segment held the highest market share of 33.43% in 2024.

- By method, the robotic-assisted surgery segment held a leading market share in 2024.

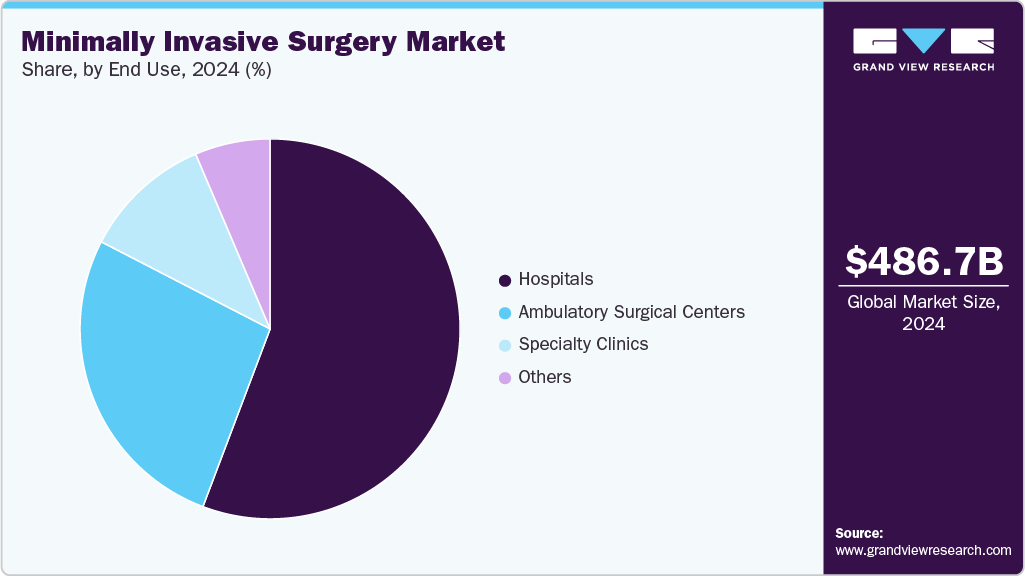

- Based on end use, the hospitals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 486.72 Billion

- 2033 Projected Market Size: USD 946.50 Billion

- CAGR (2025-2033): 7.82%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Minimally invasive surgeries have steadily increased over the years, becoming the preferred approach for many procedures due to their safety and faster recovery benefits. In July 2025, a research article noted that minimally invasive surgeries were linked with increased clinical outcomes, such as shorter hospital stays, fewer complications, and decreased recovery time. Furthermore, the report explains that when a hospital adopts the concept of MIS, the overall rate of minimally invasive surgery, such as laparoscopic or robotic, is likely to increase quickly, as both patients and surgeons prefer this method. These observations illustrate that the upward trajectory of surgical volumes, combined with the changing practice towards minimally invasive surgical techniques, is a large part of the current growth of this sector.

Minimally invasive surgery usage varies significantly between low- and middle-income countries (LMICs) and high-income countries (HICs). The main reasons are that the healthcare infrastructure, the surgical experts, and the resources are very different in these two. For example, in LMICs such as Uganda, Malaysia, and Vietnam, around 90% of MIS surgeries belong to the gynecology department, which includes uterine surgeries, appendectomy, and cholecystectomy. Those are the most common surgeries, and the local hospitals have the necessary instruments to perform them. Japan, Singapore, and the U.S. have fewer limitations on health care resources, and they can go a step further in the use of MIS for the various numbers of surgeries that they want to include in their operation profile, such as choledochal cyst excision and thoracic surgery that require not only the equipment but also the surgeon to train in that. The types of MIS procedures in different countries depend on healthcare resources and the system's maturity level.

Commonly Performed Minimally Invasive Surgeries by Country Income Group

Country Group

Country Name

Most commonly performed MIS

Low and middle-income countries

Uganda, Malaysia, Vietnam

Appendectomy (57%), Cholecystectomy (53%), Uterine surgery (71%), Antireflux procedures (57%)

High-Income Countries

Japan, Singapore, U.S

Inguinal hernia repair (57%), Choledochal cyst excision (100%), Thoracic cases (71%)

Source: GVR Analysis

The use of minimally invasive surgeries has significantly evolved due to technological advancements such as intraoperative imaging, navigation systems, augmented reality, and computational planning. These all enhance precision, visualization, and surgical outcomes, and help increase the use of minimally invasive procedures. Globally, hospitals and surgical centers are increasingly acquiring minimally invasive surgical technologies and enlarging their capabilities. For instance, in January 2024, a report by Vinita Health mentioned the benefits of minimally invasive surgery, underlines the use of robotic-assisted laparoscopic systems in various procedures, which allow health care professionals to carry out complicated surgeries more accurately. These technologies help reduce the risk of infection, shorten recovery times, and improve overall patient outcomes. A range of specialized instruments, capital equipment, and consumables is used to enable these advancements in minimally invasive surgery. Key examples of these devices are summarized in the table below.

Types of Minimally Invasive Surgery Devices, by Category

Minimally Invasive Product Categories

Devices

Instruments

• Endoscopes & Laparoscopes

• Surgical Cameras

• Energy-Based Devices

• Sealing & Stapling Devices

• Suction & Irrigation Systems

• Tumor Localization Systems

• Ligation Clips & Dilators

• Specimen Retrieval Systems

• Magnetic Millirobots

Capital Equipment

• Robotic Surgical Systems (da Vinci)

• Inflation Devices (Insufflators)

• Monitoring & Visualization Devices

• Surgical Access Devices

Consumables

• Hemostatic Agents & Adhesive Sealants

• Ligation Clips (single use)

• Stapler Cartridges (disposable)

• Single-Use Specimen Bags

• Disposable insufflation tubing/single-use trocars

Source: Company Websites, GVR Analysis

Advances in minimally invasive surgery are driving the global market, with a mix of cutting-edge tools, specialized equipment, and supportive supplies that make procedures safer, faster, and more precise. As patients and healthcare providers seek shorter hospital stays, quicker recoveries, and lower costs, the demand for these technologies is growing worldwide. Using robotics, real-time imaging, and next-generation navigation systems has opened new procedures that can be done through smaller incisions, leading to better clinical outcomes with less patient trauma. At the same time, improvements in disposable components and other surgical aids are boosting safety and efficiency, especially in high-volume surgical centers. These advancements are part of a global shift toward precise, technology-driven care that prioritizes patient comfort without sacrificing surgical effectiveness.

Surgical Specialty

2024

2025

2033

Gynecological Surgery

162.7

173.1

314.2

General Surgery

103.7

110.7

206.4

Neurosurgery

41.7

44.4

81.5

Colorectal Surgery

38.0

40.5

74.8

Orthopedic & Spine Surgery

36.4

38.8

71.3

Cardiothoracic Surgery

27.3

29.3

56.9

Gastrointestinal Surgery

24.9

26.5

49.3

Urological Surgery

17.2

18.3

33.8

Plastic & Reconstructive Surgery

17.1

17.5

21.4

Bariatric Surgery

12.4

13.3

26.3

Vascular & Endoscopic Surgery

5.3

5.6

10.8

Total

486.72

518.27

946.50

Another key reason behind the increasing adoption of minimally invasive surgery is the expanding geriatric population and the rising burden of chronic diseases. Elderly patients frequently face higher surgical risk and increased recovery time. Hence, the demand for safer and minimally invasive surgical techniques is more critical than ever. Minimally Invasive Surgery approaches are performed through small incisions, which optimize benefit to patients by minimizing trauma, blood loss, and recovery time. For chronic diseases, such as coronary heart disease and chronic pancreatitis, laparoscopic surgery and robotic assisted minimally invasive surgery can yield reliable results with decreased scarring, a reduced likelihood of infection, and a shorter duration of hospital stay, all of which improve quality of life.

Case Study: AI-Guided Solo Surgery: Advancing Precision and Efficiency in Minimally Invasive Procedures

Dr. Ricardo Funke performed a groundbreaking procedure at Clinica Las Condes in Santiago, Chile, using an AI-powered camera system. He successfully removed a patient's gall bladder entirely on his own. The intelligent camera, equipped with artificial intelligence, tracked Dr. Funke’s surgical tools and adjusted its angle, eliminating the need for a second person in the operating room. By leveraging AI, Dr. Funke made the operation more efficient and precise, potentially reducing the need for additional assistants. This innovative surgery showcases how AI can enhance surgical procedures, lower staffing requirements, and reduce healthcare costs worldwide. It also highlights a global trend toward using robotic and AI-based tools to make surgery safer, more efficient, and increasingly automated.

To better understand the impact of AI-guided solo surgery, the table below compares traditional minimally invasive surgeries with AI-assisted procedures, highlighting how AI enhances precision, reduces the need for human assistants, and improves efficiency.

Comparison Between Traditional Minimally Invasive Surgeries and AI-assisted Procedures

Factors

Traditional Surgery

AI-Guided Solo Surgery

Assistants Required

1-2 human assistants

None (AI camera)

Camera Control

Manual

Automated by AI

Precision

High, depends on the team

Very high, AI-assisted

Recovery & Efficiency

Standard

Faster, more precise

Source: Reuters

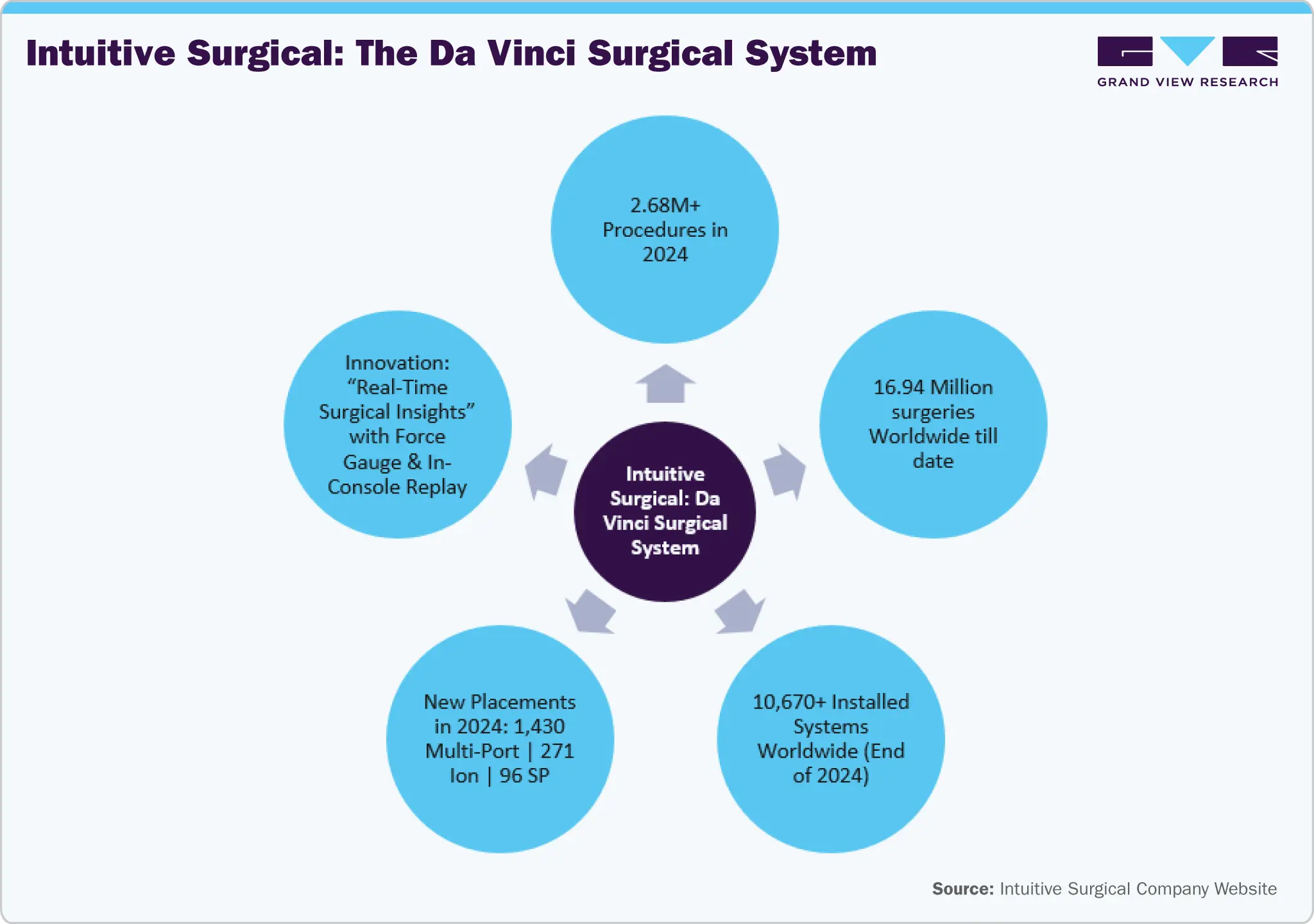

Globally, the rate of adoption of robotic surgical systems is going up very fast. The main reason for this is these systems' ability to improve precise surgery, minimize patient trauma, and shorten the recovery period. The U.S., as well as Western Europe, remains the two biggest markets where these systems have found their way beyond the installation of hospitals using, for example, platforms like da Vinci by Intuitive, to perform operations of urology, gynecology, general surgery, and cardiothoracic care. Besides, Japan and South Korea have also become the leading acceptors of these systems, with the support of the advanced healthcare infrastructure and the friendly reimbursement policies.

By comparison, Latin America, the Middle East, and parts of Southeast Asia are still at the initial stages of adoption, where limited access to costly technologies and the necessity of professional training have remained obstacles. Furthermore, the pace at which India and China are adopting is showing a significant increase. This is due to the local innovations, the private hospital networks, and the high surgical volumes that have been allowed to grow by the two countries. In fact, while robotic systems are already well entrenched in the developed economies, the underdeveloped regions are a billion-dollar untapped market for the next frontier of growth as costs keep falling and training becomes more accessible.

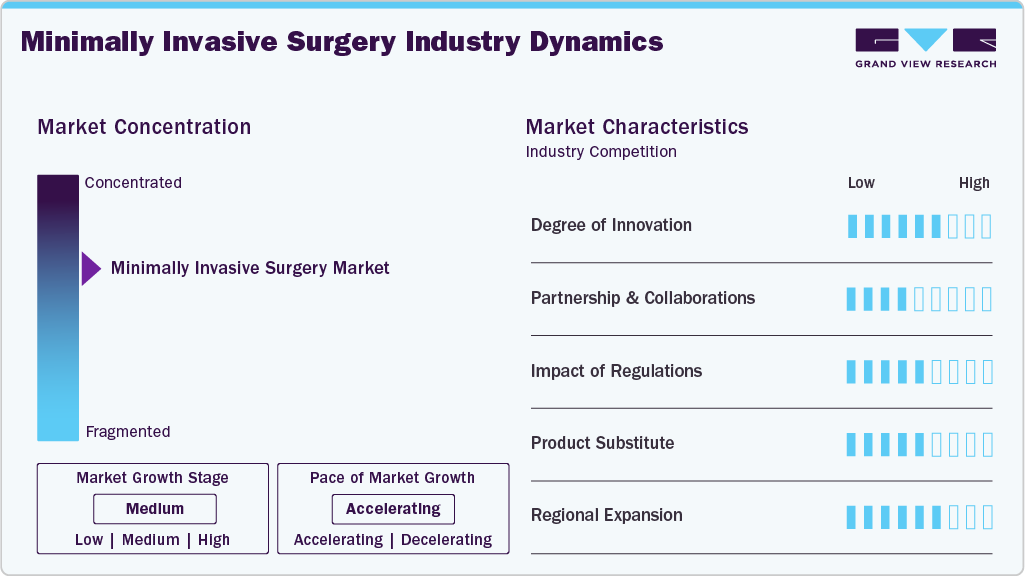

Market Concentration & Characteristics

The market for minimally invasive surgery is highly concentrated, with leading firms such as Medtronic plc, Intuitive Surgical, CMR Surgical, and Smith & Nephew plc fostering innovation and competition. The rising volume of surgical procedures, enhanced technologies, and an emphasis on patient safety support continued growth. Furthermore, adopting artificial intelligence and robotic-assisted modalities enhances precision, on-screen decision-making, and surgical outcomes. In addition, patient demand for faster recovery times, less pain, and fewer stays in the hospital facilitates market growth. Overall, MIS continues to develop as advanced technologies transform modern surgical practice.

3D bioprinting and soft robotics revolutionize minimally invasive surgery, driving groundbreaking innovation. With robotic-assisted bioprinting, doctors can precisely place living cells and biomaterials right where needed, promoting tissue regeneration with minimal trauma. Soft robotic platforms enable flexible, minimally invasive access to complex areas, opening new surgical possibilities. These technologies combined increase precision, efficiency, and patient outcomes, showcasing the remarkable innovation transforming the global MIS market.

The minimally invasive surgery (MIS) industry has seen a surge in partnerships and collaborations to advance surgical technology and improve patient outcomes. Medical device firms, hospitals, and tech innovators are collaborating to advance robotic-assisted systems and expand the scope of minimally invasive surgery. For example, Johnson & Johnson and Google are collaborating to create a robotic surgical system that enhances precision and reduces patient trauma. Similarly, Vicarious Surgical partnered with LSU Health New Orleans to integrate its robotic technology into hospital surgical practices. In the corporate space, Stryker’s acquisition of Vertos Medical expands its portfolio in minimally invasive treatments for chronic back pain. These initiatives collectively accelerate the adoption, training, and accessibility of advanced MIS solutions worldwide.

Regulations are key to ensuring minimally invasive surgery safety. The FDA categorizes medical devices into Classes I, II, or III, with increasing oversight and stricter approval requirements as the risk level rises. The FDA must clear computer-assisted surgical systems (including robotically assisted devices), and manufacturers must offer proper training programs for users. The Association of Perioperative Registered Nurses (AORN) recently updated its MIS guidelines to include safety steps like assessing risks before surgery, planning for emergencies, ensuring precautions in robotic-assisted procedures, and creating workflows to prevent complications.

The market faces potential competition from alternative therapeutic methods that reduce or eliminate the need for traditional surgery. Non-invasive treatments, such as focused ultrasound, image-guided ablation, and targeted drug therapies, are increasingly used for conditions traditionally treated with MIS procedures. Likewise, advances in pharmacological management, regenerative medicine, and percutaneous interventions provide clinicians with effective options that can produce similar results with less procedural risk. While MIS remains the preferred option for complex or high-precision surgeries, these alternatives can affect market dynamics by offering lower-cost, lower-risk, or outpatient-friendly options, highlighting the importance of ongoing innovation to maintain the competitive edge of minimally invasive solutions.

The minimally invasive surgery (MIS) sector is significantly expanding across geographies as newer economies embrace robotic platforms as health systems mature. Accelerating hospital infrastructure and programs for training surgeons is further contributing to this effort. For instance, increasing adoption of robotic MIS in uro-oncological procedures in Asia, Europe, and North America indicates global action to increase access to and standardize advanced surgical care.

Surgical Specialty Insights

The gynecological surgery segment accounted for the largest market share of 33.43% in 2024, and it is poised to exhibit a CAGR of 7.74% during the forecast period. The large market share is due to the significant adoption of surgical procedures such as hysterectomy, myomectomy, and endometriosis treatment. The growth outlook comes on the back of minimally invasive surgery, which offers many advantages such as relatively low recovery time, lower complication rates, and improved precision. For example, laparoscopic and robotic-assisted gynecological surgeries have been preferred in North America. Moreover, surgical techniques and instruments continue to improve and support gynecological surgery in the minimally invasive surgery market.

The bariatric surgery segment is expected to witness significant growth at a CAGR of 8.88% from 2025 to 2033, driven by the increasing prevalence of obesity and advancements in minimally invasive surgical techniques. This growth is attributed to the rising demand for effective weight loss solutions and the adoption of minimally invasive procedures that offer quicker recovery times and reduced complications. Furthermore, integrating bariatric surgery with weight-loss medications like GLP-1 agonists enhances treatment outcomes, further fueling market expansion.

Method Insights

The robotic-assisted surgery captured the largest market share of 33.57% in 2024, and it is expected to depict a CAGR of 8.98% over the forecast period. It emphasizes precision and recovery time for patients. Hospitals are adopting robotic systems for more complex procedures in various surgical specialties, including urology, gynecology, and cardiothoracic surgery. For instance, in November 2024, NYU Langone Health (NY, USA) completed the first fully robotic double lung transplant globally, showcasing the advancements and capabilities of robotic-assisted surgeries in more complex surgical procedures. This widespread adoption is largely driven by physician training and hospital infrastructure expanding in conjunction with the growth of robotic surgery in the related market.

The thoracoscopic surgery/VATS segment is poised to grow at a CAGR of 8.09% during the forecast period. This is driven by its less invasive method, quicker recovery, and less complications than open thoracic surgery. VATS is now being used with increasing frequency by hospitals for lung resections, esophageal operations, and various other thoracic surgeries because of its precision and cost efficiency. In favorable environments for VATS development, the increase in participation is boosted by surgeon training activities and growing hospital infrastructure. Increasing volumes of VATS are being performed as hospitals universally begin to adopt VATS in their standard thoracic practice.

End Use Insights

The hospitals segment dominated the global market in 2024 with a share of 55.70% and it is expected to observe a CAGR of 7.78% during the forecast period. This dominance is attributed to hospitals' advanced infrastructure, skilled surgical teams, and the ability to perform a wide range of complex procedures. For instance, in October 2023, Mayo Clinic surgeons performed Minnesota's first robotic-assisted kidney transplant, highlighting the hospital's commitment to adopting cutting-edge MIS technologies. Such procedures improve patient outcomes and reduce recovery times and hospital stays. The continuous investment in MIS technologies and training programs ensures hospitals maintain their leading role in the MIS market.

The ambulatory surgical centers (ASCs) segment is touted to grow significantly at a CAGR of 8.29% during the forecast period. This growth is because these centers provide Minimally Invasive Surgical techniques, which offer the benefits of lower cost, faster scheduling, and discharge on the same day, all of which are attractive to patients and providers. Changes in surgical technology (laparoscopy, imaging, and robotics), allow some of the more advanced applications of minimally invasive surgical techniques to be feasible and safe in the outpatient setting. For example, the Orthopedic Surgery Center of Gainesville in Florida, U.S. has incorporated robotic-assisted joint replacement surgeries into multiple ASCs, which lead to a reduced length of stay in the hospital and better recovery outcomes.

Regional Insights

The North American Minimally Invasive Surgery (MIS) industryis witnessing notable growth due to an aging population, increased chronic disease, and rapid developments in robotic-assisted technology. Patients prefer minimally invasive surgery because of their fast recovery, less pain, and smaller scars. For example, a study in the U.S. noted an exponential adoption of robotic surgery for both Medicare and privately insured patients, demonstrating unmet demand supported by reimbursement policies and a strong healthcare infrastructure.

U.S. MIS Market Trends

The Minimally Invasive Surgery industry in the U.S.is expected to grow due to the rising patient demand for procedures that reduce overall recovery time and complications related to surgery. Innovations in surgical technology, such as robotic systems, high-definition imaging, and laparoscopic instruments, have made complex surgeries safer and more precise.

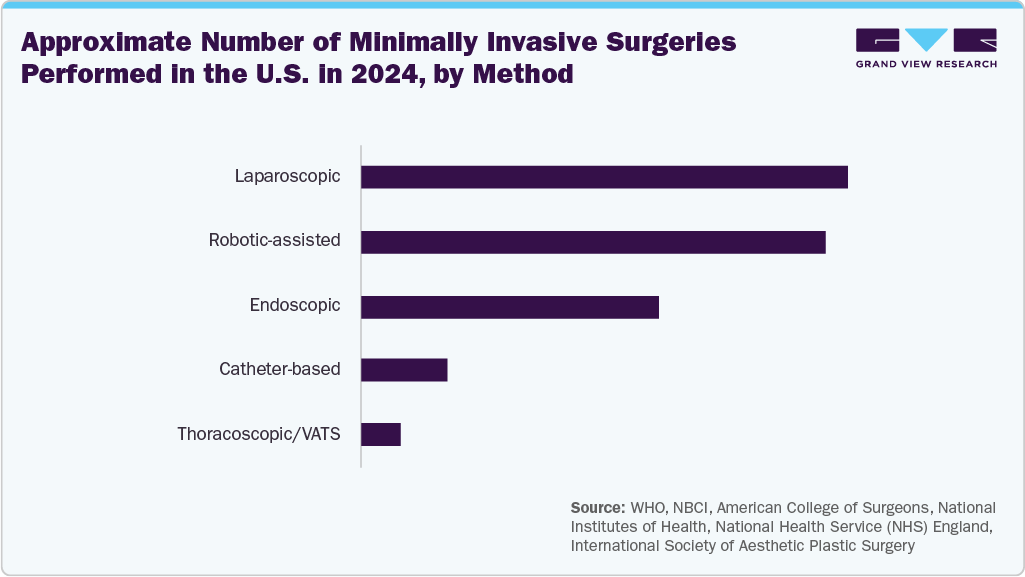

This chart above shows the number of minimally invasive surgical procedures performed in the U.S., with laparoscopic and robotic-assisted surgeries being the most common, followed by endoscopic, catheter-based, and thoracoscopic/VATS procedures. Patients increasingly prefer minimally invasive surgeries because they involve smaller incisions, less pain, and shorter hospital stays. Surgeons are also more widely trained in the technologies used in MIS, which helps drive broader adoption across specialties.

Europe Minimally Invasive Surgery Market Trends

The Europe MIS industry is growing significantly due to technological advancements, public healthcare support, and demographic changes. New technologies, like robotic-assisted surgical systems, and emerging imaging technologies have improved surgical accuracy and shortened recovery times, increasing the attractiveness of MIS to patients and healthcare providers alike. Moreover, Europe's aging population has increased the number of chronic diseases, which leads to increased use of advanced surgical treatments like MIS to improve patient outcomes and quality of life.

In addition to the above trends, EU-wide support such as the European Regional Development Fund has encouraged collaboration among public agencies, academia, and healthcare providers, creating innovative solutions and increasing access to MIS across member states.

The MIS industry in the UK is growing steadily, it is driven by technological innovations such as robotic-assisted systems and advanced imaging, which improve precision and decrease recovery times. Growing demand for less invasive and cost-effective procedures and an aging population further support market expansion. According to the Cancer Research UK, the rise of interventional oncology, where image-guided MIS procedures target tumors directly, leading to shorter hospital stays and better patient outcomes. This demonstrates MIS's increasing adoption and effectiveness in the UK healthcare system.

The Germany minimally invasive surgery industry is growing rapidly. A strong public healthcare system, early adoption of new surgical technologies, and an established hospital system support this. Hospitals and surgical centers across Germany have widely implemented robotic-assisted and image-guided procedures, improving precision and outcomes. With a focus on evidence-based practice and ongoing training of surgeons, Germany has embedded MIS into many routine forms of care. Advanced centers, such as the German Heart Centre, highlight the advantages of MIS in cardiac surgery, helping to provide faster recovery times and reduce trauma caused by surgery. There continues to be a great deal of innovation and adoption of new technologies to facilitate increased MIS across Germany.

The Minimally Invasive Surgery industry in France is growing rapidly, led by innovation centers like IRCAD and the adoption of advanced surgical techniques. Hospitals are increasingly performing gastrointestinal and liver tumor removals using scarless and percutaneous approaches, which reduce trauma and speed up recovery. At the same time, artificial intelligence is being integrated into clinical practice, helping doctors detect tumors more accurately during procedures such as colonoscopy. In 2023, IRCAD highlighted natural orifice and percutaneous surgery, showing how France is positioning itself at the forefront of MIS innovation.

Asia Pacific Minimally Invasive Surgery Market Trends

The Minimally Invasive Surgery (MIS)industry in the Asia Pacific is driven by overall factors such as an aging population, increased burden of chronic diseases, and evolving surgical technologies. Countries such as Japan, South Korea, India, and China are leading this growth, supported by government-led initiatives and investment in healthcare infrastructure. This trend is attributable to the increase in robotic-assisted surgeries that provide benefits like shorter recovery times and improved clinical outcomes.

Additionally, India has been evolving as one of the leaders to incorporate advanced surgical technology integration in the healthcare system. In September 2025, AIIMS Raipur inaugurated 'Devhast', central India's first robotic surgical facility in a government-run hospital, with the installation of the da Vinci Xi Surgical System.

The Minimally Invasive Surgery industry in China is likely to grow in the wake of the rising demand for less invasive procedures, along with improved surgical outcomes, and advancements in technology, fueling the use of robotic-assisted systems for MIS. Across urban centers, hospitals use MIS in urology, cardiology, and general surgery to expedite recovery with fewer complications. According to PubMed Central, more than 580,000 robotic-assisted procedures had been conducted in China by December 2024, with the da Vinci system representing over 90% of all robotic platforms installed in the country. Although there were over 400 robotic surgical platforms, the demand continues to grow in regions with high population density, such as Shanghai. This rising demand for MIS in China is shaping the market.

The India Minimally Invasive Surgery industry is expanding rapidly as hospitals introduce new technologies to make surgery safer and faster. Procedures using laparoscopic surgery, robotic-assisted surgery, and endoscopic surgery are more commonly used in gastrointestinal and other surgical specialties. For instance, endoscopic submucosal dissection enables the use of “optical biopsy” to treat early cancers by not removing tissue. High-definition cameras and purposeful instrumentation are allowing surgeons to operate with greater precision, decreasing complications and recovery time for patients. Major hospitals are building MIS into routine care so that this more accessible and efficient technique can be used for more patients.

The Minimally Invasive Surgery industry in Japan is rapidly evolving, supported by the inclusion of gynecologic robotic surgical coverage by national insurance since 2018, a solid healthcare infrastructure, and internal innovations. As of 2022, more than 450 Da Vinci systems were present in hospitals across Japan, and the nation launched its own Hinotori Robotic Assisted Surgery System for both inpatient and outpatient programming. Consequently, hospitals are becoming more accustomed to employing robotic-based surgical techniques. There is evidence for improved clinical outcomes in numerous benign conditions that include myomectomy, hysterectomy, and endometriosis using robotic technology, including less blood loss and faster recovery times. While the role of MIS in malignant diseases will continue to be assessed in clinical evaluations, ongoing clinical trials being led by Japanese groups continue to reflect a commitment to promoting MIS in the future.

Latin America Minimally Invasive Surgery Market Trends

The MIS industry in Latin America is growing rapidly specifically in countries like Brazil and Colombia. The growth is attributed to an aging population and the shift toward advanced surgical technologies. Hospitals in both these countries are rapidly switching to MIS techniques to improve patient outcomes, reduce recovery times, and enhance surgical precision. For instance, robotic-assisted mitral valve surgery in Brazil and Colombia has shown promising results, with over 120 procedures performed across multiple centers and a 98% success rate, demonstrating the rising adoption of MIS in these countries.

The Brazil MIS industry is growing substantially due to the increasing burden of chronic disease and the introduction of more technology-driven surgical procedures. More hospitals develop capacity to perform video-assisted thoracoscopic surgery (VATS) and robotic-assisted thoracic surgery (RATS) for improved surgical accuracy, fewer surgical complications, and shorter lengths of stay. As noted in the JOVS article, numerous thoracic surgeons are launching MIS programs, which presents increasing confidence in their use. This confidence is also enhanced by hospital investment in their capacity and training, which will create access to modern, minimal invasive procedures.

Middle East And Africa Minimally Invasive Surgery Market Trends

The Middle East and Africa Minimally Invasive Surgery industryis driven by various factors, including the adoption of new surgical technology, increased patient awareness, and investment into modern healthcare infrastructure. The UAE, Saudi Arabia, and Qatar are leading the way with robotic-assisted systems to enhance surgical efficiency, precision, and recovery time. Hospitals are routinely performing complex surgeries using robotic technology and similar advanced technologies with positive outcomes and greater patient satisfaction. Demand for complex surgical procedures reflects a regional shift toward less invasive procedures, technology-assisted surgical care, along with support from government officials in MEA countries with high income populations.

The Minimally Invasive Surgery industry in Saudi Arabia is rapidly growing, encouraged by enhancing healthcare infrastructure, advanced training of surgeons, and patient awareness of superior post-operative recovery. More hospitals are increasingly integrating robotic systems, making MIS a routine procedure. For example, Johns Hopkins Aramco Healthcare (JHAH) runs the busiest da Vinci Xi robot in the Kingdom, which, through early 2024, performed over 600 surgeries, indicating that robotic MIS is becoming part of the healthcare delivery design in Saudi Arabia.

The UAE Minimally Invasive Surgery industry is growing as leading hospitals including Burjeel Medical City utilize the latest laparoscopic and robotic-assisted techniques. These techniques are being performed across specialties, including gastrointestinal surgery, bariatrics, gynecology, urology, thoracic, and hernia repair, and they provide patients with smaller incisions, shorter hospital stays, and faster recovery times. In particular, high-definition imaging, robotic platforms, and AI assistance improve accuracy and outcomes, making the UAE a focal point for contemporary surgical innovation in the region.

The Minimally Invasive Surgery industry in Qatar is developing because of large investments in the healthcare system within the country, rising costs, demand for safer, quicker, and less burdensome procedures, and the utilization of emerging robotic systems. Hospitals are performing more robotic-assisted surgeries to improve accuracy and efficacy while reducing the rate of complications and speed up the recovery of patients. For instance, specialists at leading hospitals within Qatar are employing the da Vinci robotic system that allows for complex surgeries with a considerable reduction of blood loss, blood scars, and improves the healing process which illustrates how technology is changing surgical care and continuing to evolve.

Key Minimally Invasive Surgery Company Insights

The market for Minimally Invasive Surgery (MIS) is highly competitive, with key players such as Medtronic plc, Intuitive Surgical., and CMR Surgical holding significant positions. The major companies undertake various organic and inorganic strategies, such as product introduction, collaborations, and regional expansion, to serve the unmet needs of their customers.

Key Minimally Invasive Surgery Companies:

The following are the leading companies in the MIS market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Intuitive Surgical

- CMR Surgical

- Smith & Nephew plc

- Renishaw

- Monteris Medical

- PROCEPT BioRobotics

- EndoQuest Robotics

- Moon Surgical

- Asensus Surgical US, Inc.

- Olympus Corporation

Recent Developments

-

In July 2025, Intuitive received FDA clearance for its Vessel Sealer Curved, a fully wristed advanced bipolar electrosurgical instrument compatible with da Vinci multiport systems. It can seal, cut, grasp, dissect tissue, and transect lymphatic vessels.

-

In May 2025, Intuitive received FDA approval to use its da Vinci Single-Port (SP) system for transanal local excision and resection (i.e., procedures performed through a natural orifice, reducing or eliminating the need for abdominal incisions).

-

In November 2024, Team Toy Ortho highlighted the latest advances in minimally invasive orthopedic surgery, including ROSA robotic assistance, smart implants, and anterior hip replacement techniques to improve precision and patient recovery.

-

In October 2023, Hologic, in collaboration with AAGL and Inovus Medical, launched an initiative to enhance OB-GYN training in minimally invasive surgeries, integrating hands-on hysteroscopy skills into the EMIGS program.

Minimally Invasive Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 518.27 billion

Revenue forecast in 2033

USD 946.50 billion

Growth rate

CAGR of 7.82% from 2025 to 2033

Actual period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surgical specialty, method, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Intuitive Surgical; CMR Surgical; Smith & Nephew plc; Renishaw; Monteris Medical; PROCEPT BioRobotics; EndoQuest Robotics; Moon Surgical; Asensus Surgical US, Inc.; Olympus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Minimally Invasive Surgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Minimally Invasive Surgery (MIS) market report on the basis of surgical specialty, method, end use, and region:

-

Surgical Specialty Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gastrointestinal Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Cardiothoracic Surgery

-

Orthopedic & Spine Surgery

-

Neurosurgery

-

Colorectal Surgery

-

Bariatric Surgery

-

Vascular & Endoscopic Surgery

-

Plastic & Reconstructive Surgery

-

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Laparoscopic Surgery

-

Thoracoscopic Surgery/VATS

-

Robotic-assisted Surgery

-

Endoscopic Surgery

-

Catheter-based/Interventional Procedures

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Kuwait

-

UAE

-

Saudi Arabia

-

Qatar

-

Oman

-

Rest of the Middle East

-

Rest of Africa

-

-

Frequently Asked Questions About This Report

b. The global minimally invasive surgery market size was valued at USD 486.72 billion in 2024 and is expected to reach a value of USD 518.27 billion in 2025.

b. The global minimally invasive surgery market is expected to grow at a compound annual growth rate of 7.82% from 2025 to 2033 to reach USD 946.50 billion by 2033.

b. The gynecological surgery segment accounted for the largest revenue share in 2024, due to the significant adoption of surgical procedures such as hysterectomy, myomectomy, and endometriosis treatment.

b. Some key players operating in the global minimally invasive surgery (MIS) market include Medtronic plc, Intuitive Surgical, CMR Surgical, Smith & Nephew plc, Renishaw, Monteris Medical, PROCEPT BioRobotics, EndoQuest Robotics, Moon Surgical, Asensus Surgical US, Inc., and Olympus Corporation.

b. Key factors driving the growth of the minimally invasive surgery (MIS) market include technological advancements, a growing geriatric population, and an increasing chronic disease burden. Another important driver for minimally invasive surgery (MIS) growth is the rising global surgical volume combined with a strong preference for less invasive approaches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.