- Home

- »

- Drilling & Extraction Equipments

- »

-

Mining Lubricants Market Size, Share & Growth Report, 2030GVR Report cover

![Mining Lubricants Market Size, Share & Trends Report]()

Mining Lubricants Market Size, Share & Trends Analysis Report By Product (Mineral Oil, Synthetic, Bio-based), By Application (Coal Mining, Iron Ore Mining), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-528-1

- Number of Pages: 103

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Bulk Chemicals

Report Overview

The global mining lubricants market size was valued at USD 6.40 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2022 to 2030. This is attributed to the growing demand for products to improve the performance of equipment and machinery in mining operations. The global market continues to expand, due to rising consumer awareness about the advantages of adopting automatic lubrication systems. Major mining companies worldwide are gradually transitioning from inefficient manual lubrication techniques to highly effective automatic lubrication procedures. This switch from manual to automatic lubrication systems remains the primary driver of growth. The industry is undergoing significant changes in terms of production shift from synthetic to bio-based. Although the shift in the sector is gradual, various factors including demand patterns for lubricant oil, government directives, feedstock choices, and products across all major businesses play a vital role in propelling the market.

The demand for products with long life, low volatility, and high purity is expected to surge in the near future. The molecular structure of the product continues to undergo major innovation to provide improved lubrication to different machines and equipment. This is anticipated to lead to enhanced product composition and the utilization of improved feedstocks, hydro-processing catalysts, and processes.

Product Insights

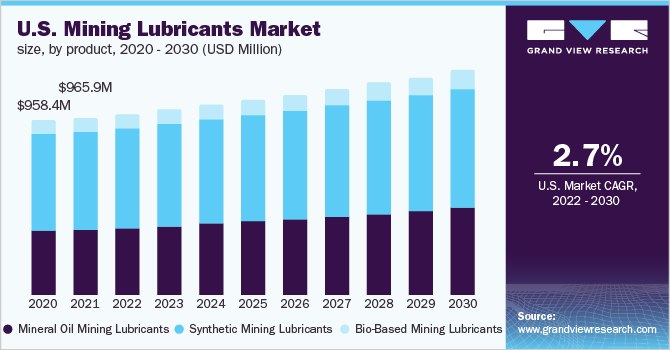

The synthetic mining lubricants segment held the highest revenue share of 53.04% in 2021. The growth is attributed to the extensive use of synthetic oils. The trend in the industry continues to shift towards higher-performance oils and greases, including synthetics, as the technology in both equipment and lubricants undergoes advancements. This is expected to lead to longer oil drain times, improved energy efficiency, and longer lifespan of components. This is expected to propel the demand for synthetic products over the forecast period.

The mineral oil mining lubricant was the second-largest segment and accounted for a revenue share of 40.0% in 2021. The growth is attributed to its compatibility with various material surfaces including seals, metals, and coatings. Its composition can also be chemically altered to make it semi-synthetic via the distillation process. This is anticipated to propel the demand for mineral oil-based lubricants over the forecast period. The mineral oil mining lubricants are produced by distilling crude. These lubricants can be quickly disposed of and used again due with the help of the existing infrastructure.

Mineral oil mining lubricants are often used for multipurpose lubrication of mechanical components. These include components such as slides, chains, bearings, gears, and other threaded connections, wherein the operating temperatures range from -62.6°F to 302°F

Application Insights

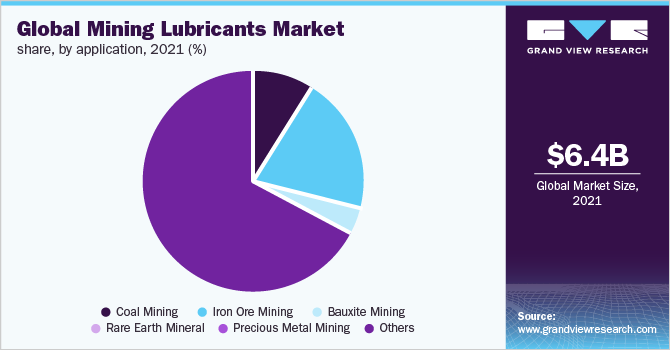

The iron ore mining segment dominated the market with a revenue share of 20.7% in 2021. This is attributed to its importance as the crucial raw material for manufacturing steel. Moreover, Steel is indispensable for the preservation of a robust industrial base. Steelmaking uses 98% of the mined iron ore. Around 50 different nations mine iron ore including Australia, China, Brazil, India, and others.

About three-quarters of the world's production can be traced back to just seven major countries. Furthermore, Australia and Brazil account for nearly one-third of all iron ore exports and dominate the market. With increased production of iron ore in developing countries, the demand for iron ore mining lubricants is anticipated to increase over the forecast period.

Coal mining was the second-largest segment and accounted for a revenue share of over 8.8% in 2021. The growth is attributed to the application of coal for numerous purposes. These include the production of steel, cement, production of thermal energy, and heating. Mining operations are expected to expand as a result of the high demand for coal in chemicals, ceramics, fabrication of various metals, and papers by manufacturing facilities, This would, in turn, boost the demand for mining lubricants in coal mining.

Mining lubricants are also used in heavy machinery, which increases its demand in several key industries heavily reliant on heavy machinery Furthermore, coal mines require high-performance lubricants with high viscosity index, oxidation resistance, and corrosion prevention qualities, making way for continuous product enhancements.

Regional Insights

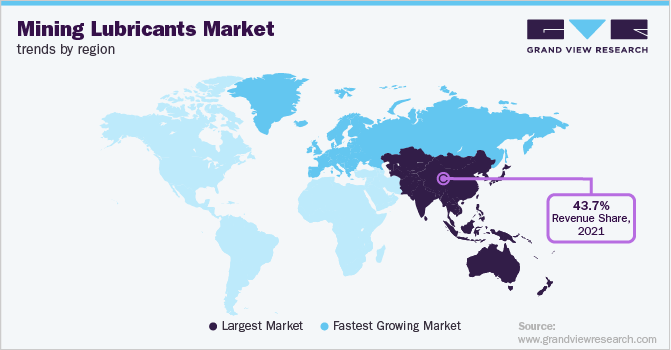

Asia Pacific accounted for the largest revenue share of 43.7% in 2021. It is expected to continue its dominance over the forecast period. This can be attributed to rising steel demand in developing countries, particularly in China and India, thanks to the region's dependence on steel for construction and transportation activities.

China accounted for the largest revenue share of 42.0% of the regional market in 2021. It is the largest producer of coal, gold, and other earth minerals. Increasing foreign investment in Asia Pacific countries, mainly China and India has contributed to the growth. China is home to numerous mines, which are being prepared and developed for operations. The product is extensively utilized in mining machinery and equipment in the country to reduce downtime. This is expected to propel the growth of the market in China during the forecast period.

India is the world's second-largest producer of coal and fourth-largest producer of iron ore. Significant mining activities in the country are expected to promote the utilization of products in India over the forecast period. In addition, liberalized foreign direct investment (FDI), and favorable policies to promote investments in India are anticipated to fuel the growth of the mining industry. This is anticipated to drive strong demand for the product. India has abundant natural reserves of limestone, bauxite, coal, and diamond. It is anticipated that the country's booming mining and mineral processing industries will encourage the use of these products in the area. In the upcoming years, this is anticipated to fuel the growth of the market in Asia Pacific over the forecast period

Europe accounted for a revenue share of 19.6% in 2021 and is predicted to grow at a CAGR of more than 2% over the forecast period. Europe remains mature, technologically advanced, and innovative. The region has abundant mineral resources and therefore, mineral extraction plays a pivotal role in the economy. Increasing consumption of metals and minerals in Europe is anticipated to drive the demand for mining lubricants. However, rigid environmental regulations, particularly in relation to the coal industry, are anticipated to promote the development of sustainable products over the forecast period.

Key Companies & Market Share Insights

Market players are involved in adopting several strategies including joint ventures business expansions, and new product development to increase their global presence. For instance, in September 2019, Chevron Corporation entered into a three-party collaboration with Schlumberger Limited & Microsoft to accelerate the development of innovative petrotechnical and digital technologies. Some prominent players in the mining lubricants market include:

-

Exxon Mobil Corporation

-

Shell plc

-

Quaker Chemical Corporation

-

BASF SE

-

Sinopec Corp.

-

BP P.L.C.

-

FUCHS

-

Total S.A.

-

Kluber Lubrication

-

Chevron Corporation

Mining lubricants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.62 billion

Revenue forecast in 2030

USD 8.96 billion

Growth Rate

CAGR of 3.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; Italy; China; Japan; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Exxon Mobil Corporation; Shell plc; Quaker Chemical Corporation; BASF SE, Sinopec Corp.; BP P.L.C., FUCHS; Total S.A.; Kluber Lubricantion; Chevron Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Lubricants Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining lubricants market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Oil Mining Lubricants

-

Synthetic Mining Lubricants

-

Bio-Based Mining Lubricants

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coal Mining

-

Iron Ore Mining

-

Bauxite Mining

-

Rare Earth Mineral

-

Precious Metal Mining

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining lubricants market size was estimated at USD 6.40 billion in 2021 and is expected to reach USD 6.62 billion in 2022.

b. The global mining lubricants market is expected to grow at a compound annual growth rate of 3.8% from 2022 to 2030 to reach USD 8.96 billion by 2030.

b. Asia Pacific dominated the mining lubricants market with a share of 43.69% in 2021. This is attributable to rising steel demand in developing countries, particularly in China and India, as well as the region's dependence on steel for construction and transportation activities.

b. Some key players operating in the mining lubricants market include Exxon Mobil Corporation, Shell plc, Quaker Chemical Corporation, BASF SE, Sinopec Corp., BP P.L.C., FUCHS, Total S.A., Kluber Lubricantion and Chevron Corporation.

b. Key factors that are driving the market growth include rising demand for mining equipment and increasing implementation of automatic lubrication systems in mining operations thereby fueling the consumption of mining lubricants used in them.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."