- Home

- »

- Advanced Interior Materials

- »

-

Steel Market Size To Reach $2.28 Trillion By 2033, CAGR: 5.9%GVR Report cover

![Steel Market Size, Share & Trends Report]()

Steel Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Flat, Long), By End Use (Building & Construction, Automotive & Aerospace, Railways & Highways), By Region (North America, Europe, APAC, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-863-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Market Summary

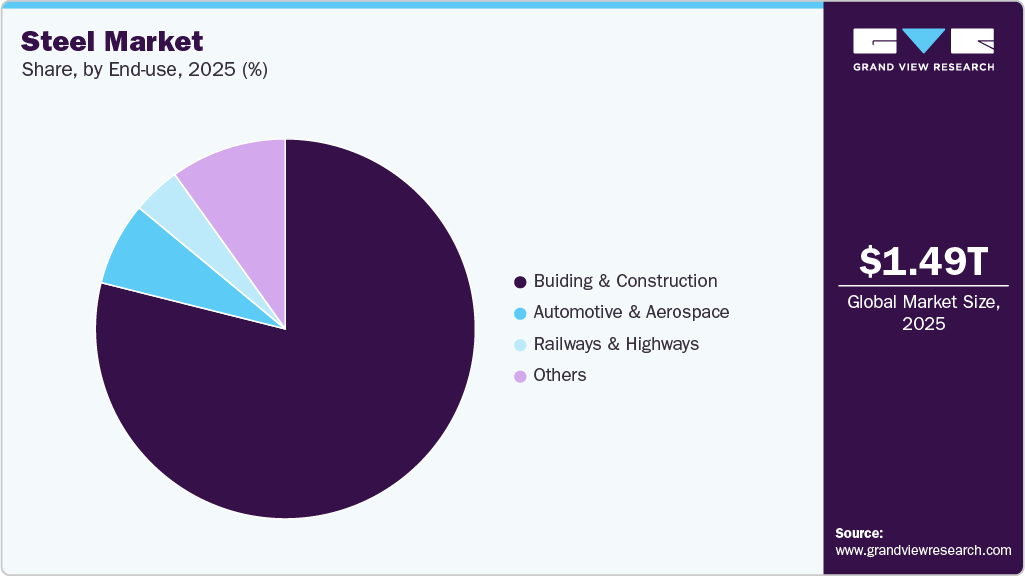

The global steel market size was estimated at USD 1.49 trillion in 2025 and is projected to reach USD 2.28 trillion by 2033, at a CAGR of 5.9% from 2026 to 2033. The global steel market is anticipated to be driven by rising investments in construction activities.

Key Market Trends & Insights

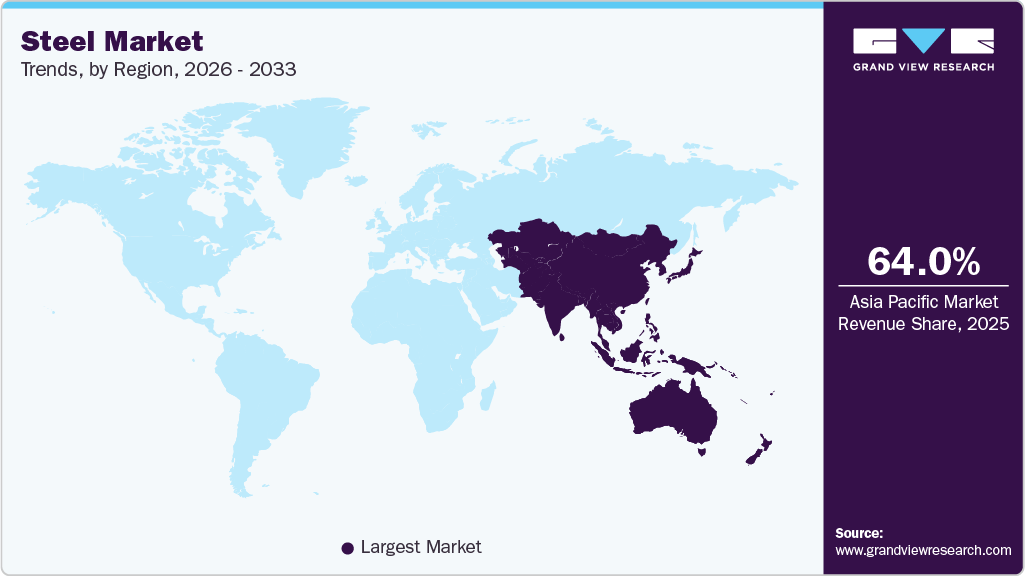

- Asia Pacific dominated the steel market with the largest market revenue share of over 64.0% in 2025.

- By product, flat steel accounted for the largest market revenue share of over 51.0% in 2025.

- By end use, building & construction is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 1.49 Trillion

- 2033 Projected Market Size: USD 2.28 Trillion

- CAGR (2026-2033): 5.9%

- Largest Market Region in 2025: Asia Pacific

Infrastructure and construction extensively require massive amounts of steel to enhance the aesthetic appeal and corrosion resistance of the structure. Steel products offer high strength and are 100% recyclable, which makes them applicable in residential, commercial, and infrastructural applications.

The global steel market is witnessing transformative trends and drivers that significantly shape its future. A major trend is the focus on sustainability, as steel manufacturers increasingly invest in green technologies to minimize carbon emissions. This includes adopting electric arc furnaces and developing low-carbon steel production methods to align with environmental standards and consumer preferences for eco-friendly products. Digital transformation is also becoming prevalent, with the industry leveraging IoT, AI, and data analytics to enhance operational efficiency and streamline manufacturing processes.

In addition, the shift towards electric vehicles and the need for durable, energy-efficient building materials are driving this demand. The steel industry is experiencing consolidation and strategic partnerships, as companies merge or join forces with tech firms to boost competitiveness and innovate production processes.

Furthermore, infrastructure development is crucial as global investments in infrastructure are projected to grow notably with steel being a key material in these projects. The automobile industry's growth, especially with the rise of electric vehicles, is also a significant factor, as evidenced by the International Energy Agency’s forecast of over 17 million electric car sales in 2024. Moreover, urbanization trends are increasing demand for residential and commercial buildings; the UN estimates that by 2050, 68% of the global population will reside in urban areas, necessitating substantial steel use in construction.

Drivers, Opportunities & Restraints

Rising investments in new construction activities across residential and non-residential sectors are among the major growth drivers for the market. The global construction industry is advancing at a moderate pace, marking a major share in the overall economic growth of various countries. For instance, the share of the construction sector in India for FY2023-24 was 8.99% compared to 7.43% in FY2016-17.

Rising investments in green construction are anticipated to present lucrative opportunities for the market to grow further. For instance, the U.S. Department of Energy has announced an investment of USD 6 billion for 33 projects in over 20 states, to decarbonize energy-intensive industries. These projects will be funded by the President’s Bipartisan Infrastructure Law and Inflation Reduction Act.

Shifting inclination towards adoption of lightweight materials like aluminum, copper, and carbon fibers restrict the consumption of steel products in numerous applications. For example, aluminum is replacing steel in automotive applications to achieve higher fuel efficiency. Also, carbon fiber is known to be five times stronger and two times stiffer than steel. In February 2023, the world’s first carbon concrete building, called Cube, was completed. It is made from concrete reinforced with carbon fiber. It was developed by the German firm Henn and the Technical University of Dresden and is located on the University’s campus.

Product Insights

The long steel segment dominated the global steel industry primarily driven by increasing construction and infrastructure activities worldwide. As urbanization accelerates and population levels rise, demand for long steel products, such as rebar and structural sections, continues to expand. In addition, major investments in infrastructure projects, including roads, bridges, and utilities, further contribute to this growth. Furthermore, industrialization in emerging economies plays a significant role in boosting the consumption of long steel products across various sectors.

The flat steel is expected to grow at a CAGR of 5.3% over the forecast period, owing to the rising demand from diverse industries, particularly automotive and construction. The shift towards electric vehicles necessitates high-strength flat steel for lightweight and energy-efficient designs. In addition, the construction sector's focus on sustainable building materials drives the need for flat steel products. Furthermore, technological advancements in manufacturing processes also enhance product quality and efficiency, making flat steel more appealing. Moreover, strategic partnerships among steel manufacturers and technology firms are fostering innovation and expanding market reach within this segment.

End Use Insights

Building & construction segment held the largest revenue share of over 79% in 2025. Building & construction segment's growth is attributed to increasing urbanization and infrastructure development. In addition, as populations rise, the demand for residential and commercial buildings intensifies, necessitating substantial steel use for structural integrity. Furthermore, the emphasis on sustainable construction practices encourages the use of steel due to its durability and recyclability, enhancing its market appeal.

The automotive and aerospace sectors are key growth engines for advanced steel demand. Automotive growth is driven by electric vehicle production and lightweight, high-strength steels for safety and efficiency. Aerospace expansion, fueled by rising air travel and aircraft output, relies on specialized steel alloys for critical, high-stress components. Together, sustained innovation in both mobility sectors ensures steel remains a vital, evolving material.

Regional Insights

Asia Pacific accounted for largest revenue share in 2025 of the global steel market and this trend is anticipated to continue over the forecast period. Countries such as China and India are investing heavily in construction projects, including highways, bridges, and commercial buildings, which significantly increases steel demand. In addition, the booming automotive industry requires substantial steel for vehicle production. Moreover, the region's diverse manufacturing sector, coupled with a growing emphasis on renewable energy projects, further propels the steel demand, solidifying the Asia Pacific's position as a global leader in steel consumption.

North America Steel Market Trends

The steel market in the North America is expected to grow significantly over the forecast period, driven by substantial investments in infrastructure and construction projects. The U.S. government has implemented initiatives aimed at revitalizing aging infrastructure, which significantly boosts steel demand across various sectors. Furthermore, the resurgence of manufacturing activities and reshoring efforts contribute to increased consumption of domestic steel products. Moreover, as industries prioritize sustainability, there is a growing trend towards using recycled steel materials, further enhancing the market's appeal within North America.

U.S. Steel Market Trends

The U.S. steel market led the North American market and accounted for the largest revenue share in 2025, due to robust construction activities and federal investments aimed at infrastructure improvement. In addition, the ongoing expansion of manufacturing sectors such as automotive and aerospace also fuels demand for high-quality steel products. Furthermore, initiatives promoting green building practices are increasing interest in sustainable steel solutions that meet environmental standards while supporting economic growth.

Europe Steel Market Trends

European countries are investing in modernizing their steel production processes to enhance energy efficiency and reduce carbon footprints. In addition, the automotive industry remains a significant consumer of steel products, particularly high-strength materials needed for lightweight vehicles. Furthermore, ongoing research and development initiatives within the region foster continuous improvement in production procedures and product quality, ensuring Europe's competitiveness in the global steel market.

Middle East & Africa Steel Market Trends

Steel production in Africa has been steadily increasing in the past few decades. However, the continent still lags behind other regions. The production of steel in Africa is primarily based on consumption of steel products in construction and infrastructure development. In June 2024, Dinson Iron and Steel Company’s Mvuma steel plant in Zimbabwe commenced pig iron production. The company is subsidiary of China-based Tsingshan Holding Group. The plant is anticipated to commence steel billets production as well with an initial capacity of 600 kilotons a year, which is expected to reach 5 million tons towards the final phase.

Key Steel Company Insights

Some of the key players operating in the market include Nippon Steel Corporation, ArcelorMittal, and Baosteel Grou.

-

Nippon Steel Corporation is Japan’s largest steelmaker. It operates through business segments, namely Steelmaking & Steel Fabrication, Engineering, Chemicals, New Materials, and System Solutions. Its core segment is Steelmaking and Steel Fabrication, which includes Engineering & Construction, Chemicals & Materials, and System Solutions. It delivers diverse products and caters to all key end-user industries of steel.

-

Baosteel Group, an integrated steel producer founded by the Shanghai Baosteel Group Corporation, produces various steel products such as HR steel, CR sheets, heavy plates, pipes & tubes, bars & wire rods, and rail & section steel. It has a total manufacturing capacity of 50.95 Mtpa across 4 plants in China.

Key Steel Companies:

The following are the leading companies in the steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel Group

- Emirates Steel

- JFE Steel Corporation

- Nippon Steel Corporation

- NUCOR

- Outokumpu

- POSCO

- Tata Steel

- Thyssenkrupp

Recent Developments

-

In January 2025, JFE Steel Corporation announced the sale of its JGreeX green steel to JFE Shoji Pipe & Fitting Corporation (JKK). This marks a significant milestone as it is the first instance of a Japanese steel distributor offering JGreeX in the steel pipe sector. The collaboration with JKK will facilitate a sales system designed for small-lot shipments and rapid deliveries, allowing JFE Steel to effectively market and supply its green steel to a diverse customer base.

-

In October 2024, JSW Group has signed a MoU with POSCO Group of Korea to develop an integrated steel plant in India, aiming an capacity of 5 million tonnes/annum initially. This partnership aims to improve India's steel production capabilities while also exploring opportunities in battery materials and renewable energy sectors, particularly for electric vehicles. The partnership is expected to bolster economic ties and promote sustainable practices in the steel industry, marking a pivotal step in India's industrial growth.

-

In October 2024, JFE Steel Corporation, in collaboration with JSW Steel Limited, announced the acquisition of thyssenkrupp Electrical Steel India Private Limited, a key manufacturer of electrical steel sheets located in Nashik, Maharashtra. This strategic move aims to enhance their production capabilities for grain-oriented electrical steel sheets (GOES) to meet the rising demand in India’s power generation sector.

Steel Market Report Scope

Report Attribute

Details

Market definition

The scope includes the consumption of steel and its products such as flat and long in various applications.

Market size value in 2026

USD 1.53 trillion

Revenue forecast in 2033

USD 2.28 trillion

Growth Rate

CAGR of 5.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026-2033

Quantitative Units

Volume in kilotons, revenue in USD trillion/billion/million, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; Japan; India; Brazil; Saudi Arabia; UAE

Key companies profiled

ArcelorMittal; Baosteel Group; Emirates Steel; JFE Steel Corporation; Nippon Steel Corporation; NUCOR; Outokumpu; POSCO; Tata Steel; thyssenkrupp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global steel market report on the basis of product, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flat

-

Long

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Automotive & Aerospace

-

Railways & Highways

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Steel is an extensively used material in various forms in construction, automotive, railways, aerospace, consumer electronics, and other such industries. Its large-scale production base and penetration across numerous applications aids to its market growth.

b. The global steel market size was estimated at USD 1.49 trillion in 2025 and is expected to reach USD 1.53 trillion in 2026.

b. The global steel market is expected to grow at a compound annual growth rate of 5.9% from 2026 to 2033 to reach USD 2.28 trillion by 2033.

b. Based on end use segment, building & construction held the largest revenue share of more than 79.0% in 2025 owing to growth of construction activities in various economies.

b. Some of the key vendors of the global steel market are Tata Steel, Nippon Steel Corporation, POSCO, ArcelorMittal, JFE Steel, Baosteel Group, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.