- Home

- »

- Food Additives & Nutricosmetics

- »

-

Natural Food Colors Market Size, Industry Report, 2033GVR Report cover

![Natural Food Colors Market Size, Share & Trends Report]()

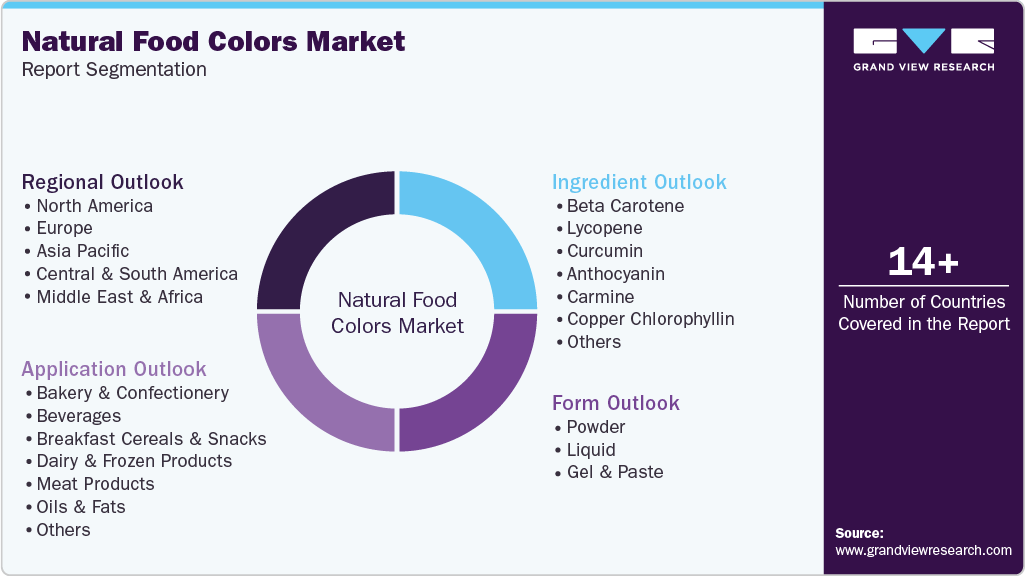

Natural Food Colors Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredient (Beta Carotene, Lycopene, Anthocyanin), By Form (Powder, Liquid, Gel & Paste), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-740-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Food Colors Market Summary

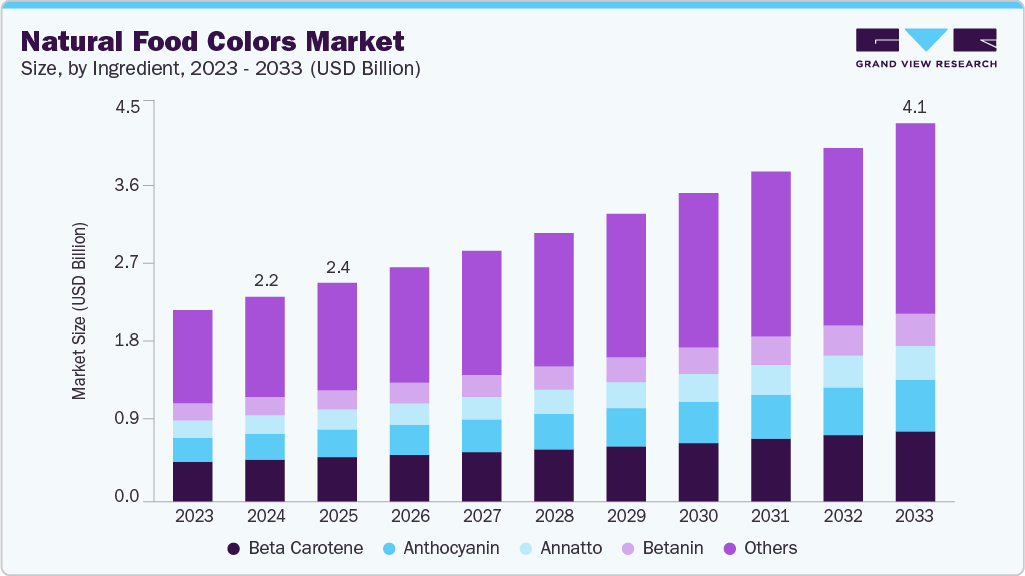

The global natural food colors market size was estimated at USD 2,224.9 million in 2024 and is projected to reach USD 4,114.2 million by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The global market for natural food colors is experiencing significant growth, propelled by several key factors.

Key Market Trends & Insights

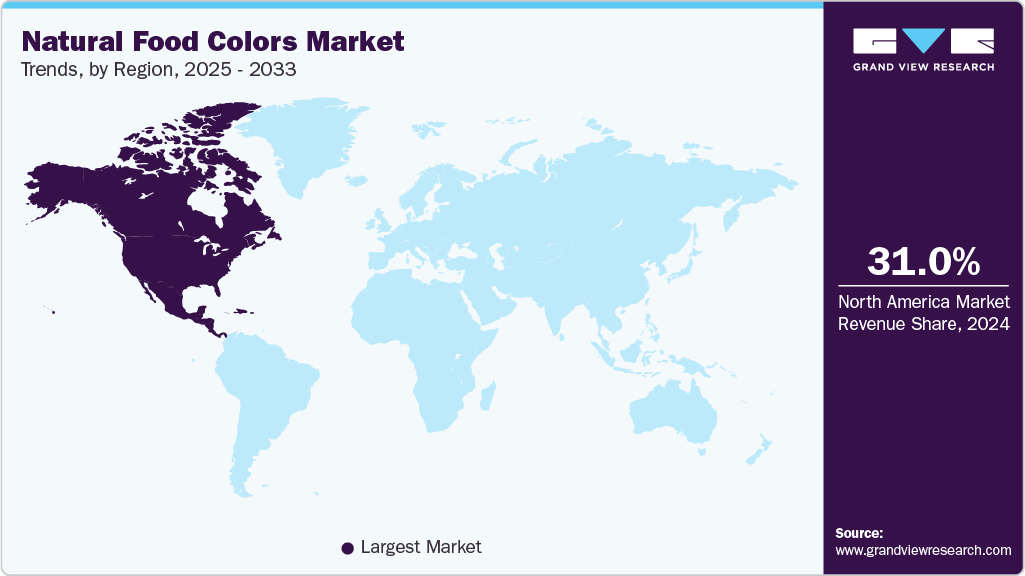

- By region, North America led the global market with a share of 31.0% in 2024.

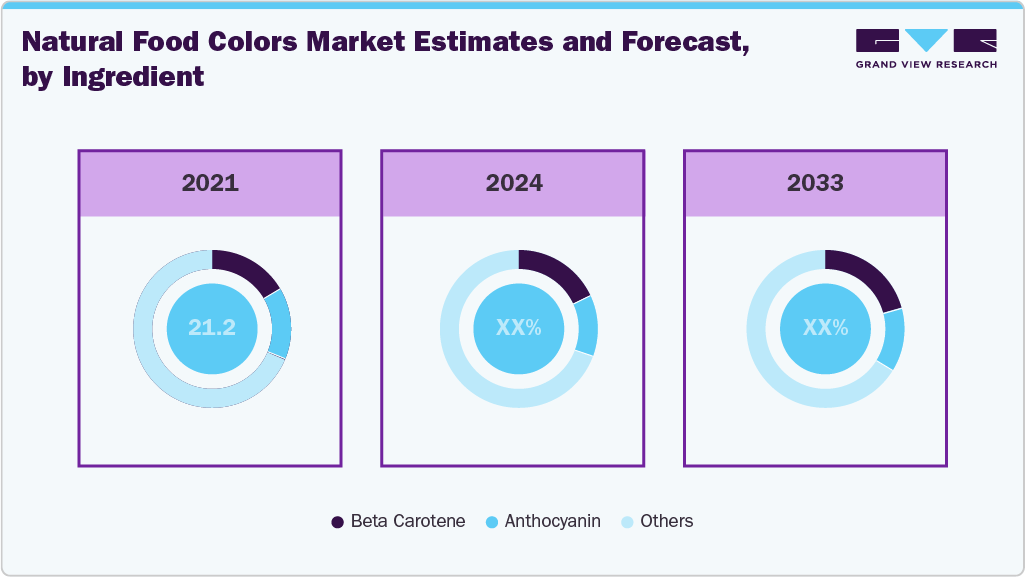

- By ingredient, beta carotene led the market and accounted for a share of 20.4% in 2024.

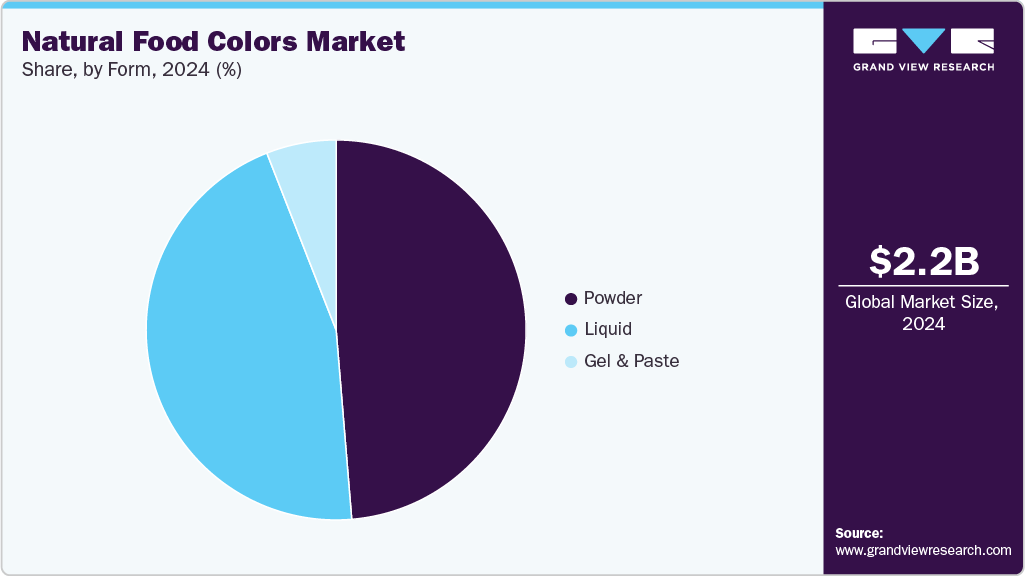

- By form, the powdered natural food colors industry led the market and accounted for a share of 48.7% in 2024.

- By application, the beverages segment led the market and accounted for a share of 26.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,224.9 Million

- 2033 Projected Market Size: USD 4,114.2 Million

- CAGR (2025-2033): 7.1%

- North America: Largest Market in 2024

Consumers' increasing demand for clean-label products, free from synthetic additives, is driving manufacturers to adopt natural colorants. Health concerns over artificial dyes, such as potential links to hyperactivity in children, have further accelerated this shift toward natural alternatives. Stringent regulatory standards governing the use of synthetic colors also encourage the adoption of natural options. Technological advancements in extraction and stabilization processes have improved the quality and application of natural colors, making them more viable for widespread use. In addition, the expansion of the food and beverage industry in emerging markets contributes to the increasing demand for natural food colors.

The natural food colors industry is significantly influenced by the increasing consumer demand for clean-label products. This shift is primarily driven by a growing awareness of health & wellness among consumers, who are becoming more discerning about the ingredients in their food. As people become more educated about nutrition and the potential health risks associated with artificial additives, they are actively seeking out products that feature natural ingredients. According to data published in July 2024, 75% of global consumers are willing to pay a premium for clean-label products, including those free from artificial colors.

In addition, the rising number of health-conscious consumers plays a crucial role in this shift. Consumers are increasingly becoming aware of the long-term effects of consuming synthetic additives, preservatives, and artificial colors. Reports indicate that many individuals associate these substances with various health issues, including allergies and chronic diseases. For instance, according to the Healthline Media LLC data published in March 2025, some people who are sensitive to food dyes such as Carmine, Red 40, and Yellow 5 develop intolerance or allergic reactions if consumed. Such negative perceptions associated with artificial food colorants have led to an increased demand for natural food colors, boosting market growth.

Ingredients Insights

The beta-carotene food colors held the largest share in the market, accounting for a share of 20.4% in 2024. Beta-carotene, derived primarily from carrots, sweet potatoes, and algae, has become a prominent natural food colorant due to its dual role as a colorant and a provitamin A compound. Its vibrant orange hue makes it ideal for a wide range of food applications, such as beverages, bakery products, and dairy. Consumers’ growing awareness of the health benefits of vitamin A, especially for vision and immunity, has driven demand for this ingredient. According to the National Library of Medicine data published in March 2025, the commonly used provitamin A carotenoid in foods is beta-carotene.

In addition, antioxidants such as beta-carotene help reduce and prevent oxidative stress in the body. As functional foods and fortified products gain traction, this ingredient offers value beyond aesthetics, aligning with the market’s shift toward nutrition-driven formulations. This dual advantage supports long-term growth and innovation opportunities in the natural color space.

Blue spirulina food colors are anticipated to witness a CAGR of 9.0% from 2025 to 2033. Blue spirulina, a type of blue-green algae, is one of the few natural sources of a vivid blue color, a rare trait in natural food colors, and is popular for its intense blue hue. It is especially favored in smoothies, candies, and plant-based novelty products where bright, Instagram-friendly hues are desirable.

The surge in demand for visually striking superfoods has made blue spirulina a go-to for health-conscious, young consumers interested in functional aesthetics. Its association with detox, immune support, and sustainability due to algae cultivation enhances its brand alignment with modern wellness values. The FDA has approved spirulina extract as a color additive in gum and candy, and it is increasingly being used in beverages such as smoothies and sports drinks. Various companies are partnering with each other to develop natural sources to achieve the blue hue that can be used in food and beverages. For instance, in January 2025, Oterra partnered with VAXA Technologies to create Arctic Blue, their first natural blue color product, designed with a low carbon footprint.

Application Insights

The beverages application held the largest share in the market, accounting for a share of around 26.1% in 2024. Beverages are one of the most dynamic categories for color trends, especially in juices, carbonated drinks, flavored waters, and energy drinks. As consumers gravitate toward "free-from" products, the shift from synthetic to natural colors is driven by the desire for healthier lifestyle choices and reduced chemical intake.

In addition, functional and plant-based beverages often highlight natural ingredients, where color plays a role in signaling flavor and function, including green for detox and red for energy. Botanical extracts such as hibiscus, spirulina, and elderberry serve dual roles, providing both color and nutritional value, which aligns with the wellness trend. According to the data published in November 2024, color choice in beverages and drinks is important as it depicts the flavor, sends subconscious signals about what type of beverage it is.

The meat alternatives/plant-based meat applications are anticipated to witness a CAGR of 8.0% from 2025 to 2033. Plant-based meats mimic the appearance and texture of traditional meat, making color one of the most important elements. Natural colorants such as beetroot extract, pomegranate powder, and red radish help replicate raw and cooked meat hues. The goal is visual authenticity to appeal to flexitarians and meat-reducers. Consumer demand for vegan and vegetarian alternatives comes with expectations for clean labels and minimal artificial additives. Natural colors align with these values, supporting the broader health and sustainability messaging of meat alternatives. Innovation in encapsulated color technology helps simulate color change during cooking, just like real meat.

Form Insights

Powdered natural food colors held the largest share in the market, accounting for a share of around 48.7% in 2024. The powder segment has achieved a significant revenue share due to its distinct advantages in terms of storage, handling, and application precision. Powdered natural food colors have an extended shelf life compared to liquid forms, making them highly suitable for manufacturers aiming to reduce waste and optimize inventory management. In addition, powders are easier to store and transport, as they are less susceptible to spillage or degradation during transit. These attributes are particularly valuable in large-scale food production environments where operational efficiency is critical.

Gel & paste natural food colors are anticipated to witness a CAGR of 7.9% from 2025 to 2033. These forms are particularly favored in bakery and confectionery products, where achieving intricate designs and vibrant colors is essential. Gel and paste natural food colors offer concentrated pigmentation, allowing manufacturers to use smaller quantities while obtaining intense hues. For instance, gel-based natural colorants are widely used in cake decorating to create detailed patterns without compromising the texture or consistency of the frosting.

Another key advantage of gel and paste forms is their ability to provide excellent stability under diverse processing conditions. Unlike liquid or powder forms, gels and pastes maintain their consistency during high-temperature baking or prolonged storage, ensuring consistent color quality in finished products. This makes them ideal for applications such as fondant coloring or chocolate molding, where color integrity is critical. For instance, paste-based anthocyanins derived from berries are used in premium chocolates to achieve rich purple tones while resisting fading over time.

Regional Insights

The North America natural food colors industry accounted for a share of around 31.0% in 2024, driven by increasing consumer demand for clean-label and health-conscious products. In the U.S., there is a growing preference for foods free from synthetic additives, leading to a shift towards natural food colors. Canada follows suit with a strong inclination towards organic and minimally processed foods. Mexico, with its rich biodiversity, is leveraging native plants for natural colorants, aligning with both local and global health trends.

Moreover, regulation support fuels the demand for natural food colors as the U.S. Food and Drug Administration (FDA) has implemented stringent regulations on artificial food colors, prompting manufacturers to adopt natural alternatives. Canada's regulatory framework also encourages the use of natural ingredients, while Mexico is enhancing its food safety standards to promote natural food colorants. For instance, according to the data published in November 2023, manufacturers are choosing natural food color alternatives as FDA regulations support natural food colorants in their favor.

Europe Natural Food Colors Market Trends

The natural food colors industry in Europe is experiencing significant growth due to heightened consumer awareness of health and wellness. Countries like Germany and France are witnessing a shift towards natural ingredients, with consumers preferring products free from artificial additives. The UK and Italy are also embracing natural food colors, influenced by trends in organic and clean-label products. According to the data published in March 2024, nearly 46% of UK consumers prefer clean-label products. In addition, regulatory frameworks across Europe are stringent regarding synthetic food additives, encouraging the adoption of natural alternatives. The European Union mandates clear labeling and has set limits on certain artificial colors, prompting manufacturers to seek natural colorants. Natural food colors are subject to safety standards, as each authorized food color is subject to rigorous safety assessment by the European Food Safety Authority (EFSA).

Asia Pacific Natural Food Colors Market Trends

The Asia Pacific natural food color industry is anticipated to grow at a CAGR of 8.6% from 2025 to 2033, influenced by a blend of traditional practices and modern health trends. China and India, with their rich agricultural resources, are utilizing native plants and spices to extract natural colorants. Japan's focus on health and wellness is driving demand for natural ingredients in food products. Australia and New Zealand are witnessing a surge in organic and clean-label products, further propelling the market.

In addition, regulatory support varies across the region. China and India are strengthening their food safety standards, promoting the use of natural colorants. According to the ORF (Observer Research Foundation) data published in June 2024, the Chinese government has strengthened food safety regulations over the years by initially establishing the China State Food and Drug Administration in 2003, followed by China’s Food Safety Law in 2015, to ensure food safety, health & life of the citizens. In addition, the government established a national strategy for food safety with the aim of zero tolerance for food safety risks by 2020, further aiming to establish food safety standards and government by 2050.

Central & South America Natural Food Colors Market Trends

The Central & South America natural food color industry is anticipated to grow at a CAGR of 7.9% from 2025 to 2033. In Central & South America, the natural food color market is expanding due to increasing consumer demand for healthier and more natural food options. Brazil, with its rich biodiversity, is utilizing native plants like annatto and beetroot for natural colorants. Argentina is following suit, focusing on natural ingredients to cater to health-conscious consumers.

The food industries in the Central and South American region are increasingly incorporating natural food colors into a variety of products. The diverse food sector, including beverages and processed foods, is a significant driver of this trend. In addition, growing exports of food items, especially to health-conscious markets, are also contributing to the demand for natural colorants.

Middle East & Africa Natural Food Colors Market Trends

The Middle East and Africa natural foods colors industry is gaining momentum with consumers becoming more health-conscious and seeking products free from artificial additives. In South Africa, there is a growing awareness of the potential health risks associated with synthetic additives, including artificial colors. Plant and animal-based natural colors are perceived as safer and healthier alternatives, aligning with the demand for clean, natural, and minimally processed foods. According to the ScienceDirect data published in June 2023, a shift is recorded in South Africa from the consumption of grains & pulses to the consumption of easily accessible, high-energy, and ultra-processed foods, contributing to the growth of the natural food color market.

Key Natural Food Colors Company Insights

Leading players in the natural food colors industry include BASF, Archer Daniels Midland Company, Chenguang Biotech Group Co., Ltd., among others. The market remains highly competitive, with brands emphasizing product expansion across online and offline retail platforms. Companies invest in advanced extraction and formulation technologies to improve color stability, vibrancy, and compatibility across diverse food applications. Rising consumer awareness about clean-label products, health safety, and the demand for plant-based ingredients further propels adoption. This growing preference for natural and sustainable alternatives continues to position the natural food colors industry for robust growth in the coming years.

Key Natural Food Colors Companies:

The following are the leading companies in the natural food colors market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Archer Daniels Midland Company (ADM)

- San-Ei Gen F.F.I., Inc.

- GNT Group (EXBERRY)

- Chenguang Biotech Group Co., Ltd.

- Oterra A/S

- Allied Biotech Corporation

- Givaudan Sense Colour

- Döhler GmbH

- Sensient Technologies Corporation

Recent Developments

-

In February 2025, Oterra, a global leader in natural food colors, inaugurated a new color blending and application center in Kochi, Kerala, India. The facility, located at the site of its subsidiary Akay Natural Ingredients, was established to cater to the growing demand for natural colors across India, the Asia-Pacific region, and the Middle East. Previously reliant on exporting raw materials to Europe for processing, Oterra now offers direct supply of popular color shades such as yellow, orange, red, and pink made from turmeric, paprika, annatto, and red beet. This strategic move not only streamlines the supply chain but also ensures quicker response times to customer demands in emerging markets.

-

In December 2024, Oterra announced the opening of its state-of-the-art innovation, collaboration, and production hub in Mount Pleasant, Wisconsin, strengthening its presence in the U.S. market. The 155,000-square-foot facility integrates innovation and application labs with manufacturing and logistics capabilities to meet the growing demand for natural colors and coloring foodstuffs. In addition, the site includes 40,000 square feet of expansion space for new color products and pilot production lines. This strategic investment underscores Oterra’s commitment to supporting environmentally conscious and health-focused consumers while helping customers transition toward natural color solutions.

-

In July 2024, GNT announced its plans to develop plant-based EXBERRY color solutions using innovative fermentation technologies. This expansion marked a significant step in increasing the sustainability and functionality of its natural color portfolio, which has traditionally relied on fruits, vegetables, and plants since the company’s founding in 1978. By partnering with Plume Biotechnology, a UK-based startup specializing in fermentation science, GNT aimed to scale production through bioreactors that optimize biomass yield and pigment concentration. The collaboration underscored GNT’s commitment to pioneering sustainable solutions while enhancing the performance and year-round availability of its natural food colors.

Natural Food Colors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,379.0 million

Revenue Forecast in 2033

USD 4,114.2 million

Growth rate

CAGR of 7.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Key companies profiled

BASF; Archer Daniels Midland Company (ADM); San-Ei Gen F.F.I., Inc.; GNT Group (EXBERRY); Chenguang Biotech Group Co., Ltd.; Oterra A/S; Allied Biotech Corporation; Givaudan Sense Colour; Döhler GmbH; Sensient Technologies Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Food Colors Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global natural food colors market report based on ingredient, form, application, and region.

-

Ingredient Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Beta Carotene

-

Lycopene

-

Curcumin

-

Anthocyanin

-

Carmine

-

Copper Chlorophyllin

-

Paprika

-

Betanin

-

Riboflavin

-

Blue Spirulina

-

Caramel

-

Annatto

-

Others

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid

-

Gel & Paste

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Bakery & Confectionery

-

Beverages

-

Breakfast Cereals & Snacks

-

Dairy & Frozen Products

-

Meat Products

-

Oils & Fats

-

Fruits & Vegetables

-

Meat Alternatives/Plant-based Meat

-

Pet Food

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural food colors market size was estimated at USD 2,224.9 million in 2024 and is expected to reach USD 2,379.04 million in 2025.

b. The global natural food colors market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2033 to reach USD 4,114.19 million by 2033.

b. Europe dominated the natural food colors market with a share of 31.8% in 2024. This is attributable to adoption of the products such as carotenoids, carmines, curcumin, and anthocyanin in applications such as bakery & confectionery, beverages, and meat, among others.

b. Some key players operating in the natural food color market NATUREX, Givaudan, BASF SE, Sensient Technologies Corporation, ADM, Spring TopCo DK ApS (Oterra), Allied Biotech Corporation, ROHA Group, Kalsec Inc, Döhler GmbH, San-Ei Gen F.F.I., Inc., AROMATAGROUP SRL, Ingredion, Vivify, Roquette Frères, INCOLTEC, IFC Solutions, and Australian Food Ingredient Suppliers.

b. Key factors that are driving the market growth include rapid growth over the forecast period owing to high demand in confectionery and bakery goods. In addition, stringent regulations pertaining to the use of synthetic and identical colors is likely to emerge as the major driver for the industry growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.