- Home

- »

- Communication Services

- »

-

Network Functions Virtualization Market Size Report, 2030GVR Report cover

![Network Functions Virtualization Market Size, Share & Trends Report]()

Network Functions Virtualization Market Size, Share & Trends Analysis Report By Component, By Organization Size, By Applications, By End-user (Service Providers, Data Centers, Enterprises), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-957-7

- Number of Report Pages: 176

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

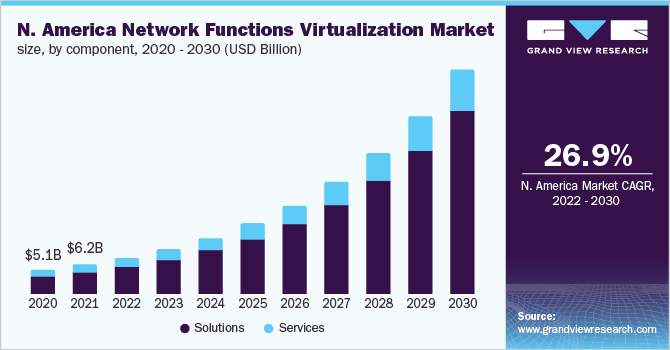

The global network functions virtualization market size was valued at USD 19.95 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 26.9% from 2022 to 2030. The growing need for an efficient and cost-effective network management system, rising adoption of telecom equipment and services across commercial and data center applications, the ever-increasing pace of network automation & virtualization technology adoption, and the server virtualization, cloud services, and growing data center consolidation is significantly contributing to the growth.

As networks become more complex, the demand for cloud-based services, IoT deployments, security agility, and cloud migration continues to grow, increasing the demand for network virtualization and automation. In addition, the need for advanced network management systems is a key driving factor for the growth of the NFV market. However, factors such as increased network security risks in NFV and worsening economic conditions due to the COVID-19 pandemic pose serious challenges to growth.

Network functions virtualization addresses the issues of high capital investment, support & maintenance, and end-of-life events of the hardware networking devices by leveraging off-the-shelf IT. Virtualization integrates many network devices into high-capacity industry-standard servers, switches, and storage that can be deployed in data centers, network nodes, and end-user facilities.

The market is characterized by emerging technological innovations to keep pace with the customers' changing needs. Technologies such as SD-WAN and virtualization are some of the latest innovations in the telecom industry. Large investment in infrastructure modernization and increasing adoption of automation technologies such as the Internet of Things (IoT) and artificial intelligence (AI) are primarily driving the growth of the for-network functions virtualizations industry across the U.S.

Some groups are working on standards and best practices for network function virtualization. The groups such as Broadband Forum Member, The European Telecommunications Standards Institute, The International Telecommunication Union Telecommunication Standardization Sector, and others are concerned with the best practices and standards related to NFV.

COVID-19 Impact on the Network Functions Virtualization (NFV) Market

The COVID-19 pandemic has resulted in a negative impact on many countries. Countermeasures such as blockades, social distances, and quarantine to fight COVID-19 are having a severe negative impact on many industries around the world, including the IT and telecommunications sectors. With a few employees working from home and students learning virtually, corporate VPN (Virtual Private Network) servers are now the lifeline of organizations/schools. According to UNESCO, 850 million students are currently studying and attending at home. At the same time, hundreds of millions of workers suddenly switch to remote work, making a big difference in how they use their communications networks. Network traffic in Europe is increasing by about 50% because much of the population is tied to their homes.

The impact of the COVID-19 outbreaks on the NFV market began in early 2020 in China, one of the world's largest manufacturers and consumers of end devices such as smartphones, computers, and tablets. China's manufacturing plants were closed for several months, limiting the import and export of end devices to and from restricted areas of China, affecting the supply chain, and seriously impacting the industry's production, sales, and operations.

In March 2020, 3GPP, a global association developing 5G technology, announced that COVID 19 would delay the final decision on 5G specifications by three months. Delayed releases slowdown of commercial development and 5G deployment of NFV devices. The supply chain disruptions and delays in the release of 5G specifications are expected to impact the global network functions virtualization market and revenues in 2020 and 2021.

However, some companies are working hard to get the NFV industry back on track. In addition, local governments have taken some remedies to mitigate the negative effects of COVID-19. As a result, the NFV industry is expected to slowly regain its original path after 2022.

Component Insights

The solution segment has accounted for a notable revenue share of 74.1% in 2021 and is expected to keep dominating during the forecast period. Its growth can be attributed to the increasing adoption of virtualization and automation technologies. The growing demand for mobility services and the growing importance of enterprises in reducing operating costs with NFV are expected to significantly drive the growth.

The solution includes orchestration and automation and other components such as virtual infrastructure managers, software-defined networking (SDN) controllers, NFV orchestrator, and wide area network (WAN) configurations. The primary purpose of orchestration is to automate and enhance the creation of network services through virtualized network capabilities (VNF), scaling, self-healing, and resource lifecycle management of network services.

Without a cross-domain network orchestra, VNF interacts with the service orchestrator. Due to the ease and importance of orchestration and automation, their use is widely observed, especially if there is no vendor lock-in and the solution is customized and marketed.

Organization Size Insights

The large enterprises' segment led the entire market in 2021, accounting for 61.3% of the total revenue share, and is expected to witness substantial growth over the forecast period. The rising adoption of network functions, virtualization solutions, and services across large enterprises is expected to drive the segment's growth. Additionally, large enterprises are the early adopters of advanced technologies such as virtualization, orchestration, and automation are driving the demand for network functions, virtualization solutions, and services.

Large enterprises require robust network infrastructure to efficiently manage their resources and increase productivity. Thus, NFV helps to reduce device costs and power consumption by consolidating devices and leveraging the economies of scale of the large enterprise.

Application Insights

The virtual appliance segment led the entire market in 2021, accounting for 56.9% of the total revenue share, and is expected to witness substantial growth over the forecast period. Virtual appliances primarily include a variety of network operations such as traffic forwarding, monitoring, security, caching, intrusion detection systems, and domain name services. These operations are primarily sent over the edge via the Virtual Customer Home Appliance (VCPe). This has allowed enterprises to streamline their networks' complexity; thus, the segment is expected to show decent momentum over the next few years.

The core network segment is expected to grow at a CAGR of 24.9% during the forecast period 2022-2030 in the global industry. Increasing complexity in complex networks and increasing demand for network virtualization and automation are driving the growth of this segment. The core network mainly includes network operations such as traffic forwarding, security monitoring, domain name services, and intrusion detection systems.

These operations are primarily sent over the edge through the virtual developed packet core, which has significantly impacted the organization to streamline network complexity. Due to the benefits of the core network segment, few NFV solution providers are heavily investing in the R & D of NFV for core networks to make it better and more affordable for SMEs. This is expected to support the segment's rapid growth during the forecast period.

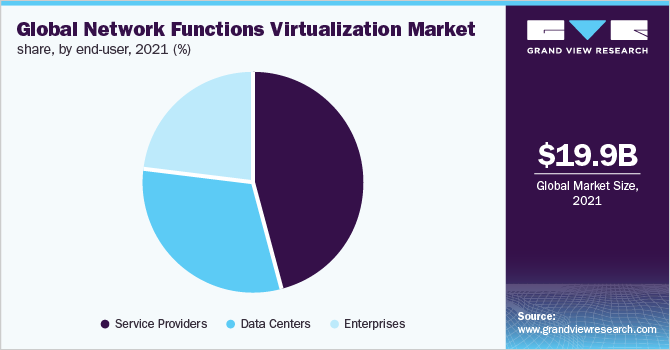

End-user Insights

The service provider segment accounted for the largest revenue share of 46.4% in 2021 and is expected to witness substantial growth over the forecast period. Increasing data diversity and volume, connectivity for IoT / M2M devices, and rising adoption of smartphones leading to higher data consumption per user are putting significant pressure on the service providers' network infrastructure. This enables the service providers to add capacity to meet this growing demand quickly.

However, current network architectures consist of expensive hardware-based devices with tightly embedded software. This not only makes the network robust and fragmented but also limits scalability and makes it expensive. Therefore, the NFV transforms the network architecture to provide applications with real-time visibility into the network. Applications can program the network as needed to help create a flexible infrastructure to meet changing needs.

The enterprise segment is expected to grow at a CAGR of 24.9% during the forecast period 2022-2030 in the global network functions virtualization industry. Enterprise customers are ready to adopt NFV because it offers significant benefits such as centralized management for network efficiency, IT agility, and fast and reliable application services for network adaptation.

Enterprise end-users are divided into banking, financial services and insurance (BFSI), hospitality, transportation and logistics, manufacturing, healthcare, education, retail, energy and utilities, transportation and logistics, media and entertainment, and others. In this scenario, the NFV deployment is widespread in the BFSI, manufacturing, and healthcare industries.

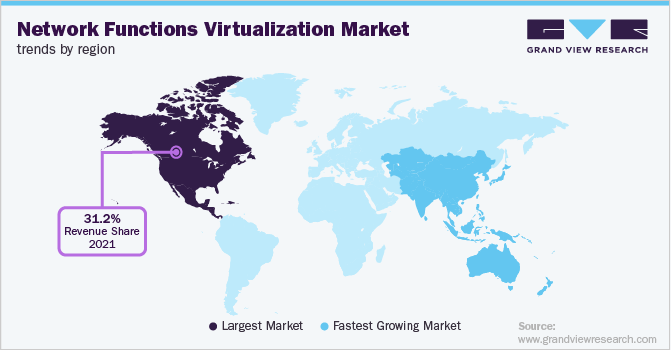

Regional Insights

North America held the leading revenue share of approximately 31.2% in 2021. The growth is supported by the growing adoption of technologies such as Software Defined Everything (SDx), cloud computing, and IoT. The high degree of industrialization of countries such as the United States and Canada has been a positive factor in the rapid growth of various industries. North American countries have favorable standards and regulations that help drive the growth of the NFV industry.

There are numerous NFV infrastructure providers in North America, including Juniper Networks, IBM Corporation, Cisco, and Extreme Networks. It is also a potential investment industry and opens up new opportunities for adopting NFV infrastructure. As 5G deployments increase, NFV adoption in the region will increase. However, with NFV, the control of the entire network is left to the controller. Therefore, deployment would require various organizational, functional, and cultural changes.

Asia Pacific is expected to experience rapid growth over the forecast period. The growth is driven primarily by the increasing adoption of technologies such as Software Defined Everything (SDx), cloud computing, and the IoT. Furthermore, the region consists of countries such as China, India, and Japan which in addition leads to the expansion of the subscriber base, favorable government policies and regulations, and the demand for more data storage and security across the region, which is expected to drive the growth.

Key Companies & Market Share Insights

Key manufacturers are strategically focused on product developments to enhance the capabilities of the NFV. In November 2019, VMware expanded its partnership with Nokia to facilitate large-scale multi-cloud operations. This partnership also aims to increase investment along with technological collaboration and advanced R & D to develop integrated solutions. Some prominent players in the global network functions virtualization market include:

-

Alcatel-Lucent

-

Ericsson AB

-

6Wind SA

-

Huawei Technologies Co. Ltd.

-

Amdocs Inc.

-

Nokia Solutions and Network

-

CIMI Corporation

-

Connectem Inc.

-

Intel Corporation

-

ConteXtream Inc.

-

Juniper Network Inc.

-

F5 Network Inc.

-

Open Wave Mobility Inc.

-

NEC Inc.

-

Opera Software

-

HP

-

Oracle Corporation

Network Functions Virtualization Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 24.88 billion

Revenue forecast in 2030

USD 167.03 billion

Growth rate

CAGR of 26.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, value forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Alcatel-Lucent; Ericsson AB; 6Wind SA; Huawei Technologies Co. Ltd.; Amdocs Inc.; Nokia Solutions and Network; CIMI Corporation; Connectem Inc.; Intel Corporation; ConteXtream Inc.; Juniper Network Inc.; F5 Network Inc.; Open Wave Mobility Inc.; NEC Inc.; Opera Software; HP; Oracle Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Network Functions Virtualization Market Segmentation

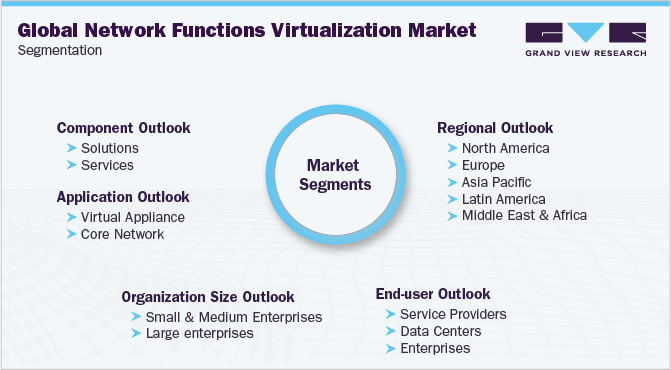

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network functions virtualization market report based on component, organization size, application, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Services

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises

-

Large enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Virtual Appliance

-

Core Network

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Service Providers

-

Data Centers

-

Enterprises

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare

-

Retail

-

Manufacturing

-

Government and Defense

-

Education

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global Network Function Virtualization market size was estimated at USD 19.95 billion in 2021 and is expected to reach USD 24.88 billion in 2022.

b. The global Network Function Virtualization market is expected to grow at a compound annual growth rate of 26.9% from 2022 to 2030 to reach USD 167.03 billion by 2030.

b. North America dominated the Network Function Virtualization market with a share of 31.2% in 2021. This is attributable to the rising acceptance of cloud-based technologies and constant research and development initiatives.

b. Some key players operating in the Network Function Virtualization market include Cisco Systems, Inc., VMware, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Nokia Corporation, NCE Corporation.

b. Key factors that are driving the Network Function Virtualization market growth include increasing technological innovation in communication technology across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."