- Home

- »

- Next Generation Technologies

- »

-

Internet of Things (IoT) Market Size And Share Report, 2030GVR Report cover

![Internet of Things (IoT) Market Size, Share & Trends Report]()

Internet of Things (IoT) Market (2024 - 2030) Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), By Deployment (On-premise, Cloud), By Connectivity, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-697-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Internet of Things (IoT) Market Summary

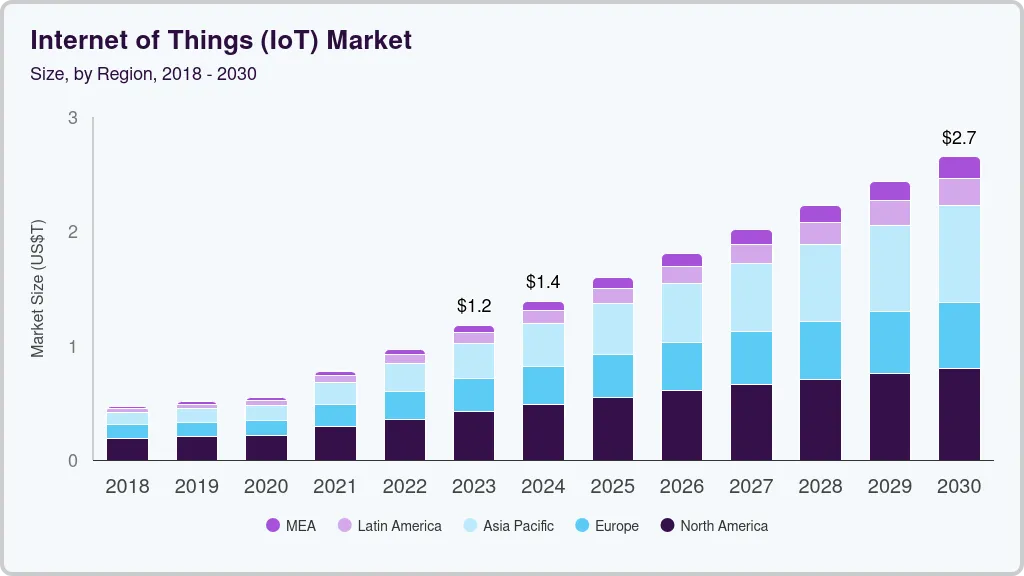

The global Internet of Things (IoT) market size was valued at USD 1.18 trillion in 2023 and is projected to reach USD 2.65 trillion by 2030, growing at a CAGR of 11.4% from 2024 to 2030. IoT technology enables providers to monitor various aspects such as patient health in healthcare settings, inventory management in retail, and agricultural monitoring in the agriculture sector. This widespread adoption across diverse industries is fueling the growth of the IoT market.

Key Market Trends & Insights

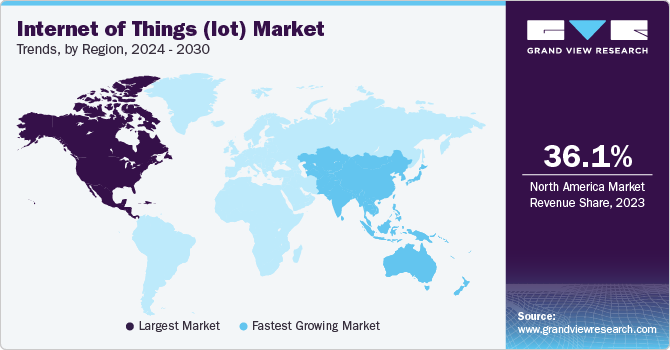

- The North America Internet of Things (IoT) market accounted for the largest market revenue share of 36.1% in 2023.

- The U.S. Internet of Things (IoT) market dominated the North America market in 2023.

- By component, the hardware segment dominated the market and accounted for a market revenue share of 57.4% in 2023.

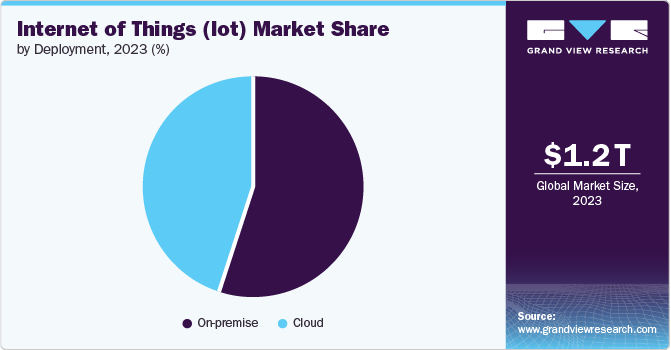

- By deployment, the on-premise segment accounted for the largest market revenue share in 2023.

- By connectivity, the Wi-Fi segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.18 Trillion

- 2030 Projected Market Size: USD 2.65 Trillion

- CAGR (2024-2030): 11.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The expansion of high-speed connectivity technologies, such as 5G, has significantly contributed to the growth of the IoT market. High-speed and low-latency networks are crucial for seamless data transmission between IoT devices and centralized systems. The rollout of 5G networks offers substantial improvements over previous generations of mobile networks, including higher data transfer rates, increased network capacity, and reduced latency. These advancements enable more devices to connect simultaneously and support real-time data processing, which is essential for autonomous vehicles, remote healthcare, and smart city infrastructure applications. As 5G technology becomes more widespread, it is expected to drive substantial growth in the IoT market by supporting the development of advanced applications and services.

Cloud computing provides scalable and cost-effective infrastructure for managing and analyzing the vast data IoT devices generate. By leveraging cloud services, businesses can avoid the high costs of maintaining on-premises servers and benefit from flexible storage and processing capabilities. Cloud platforms also offer advanced analytics tools that transform raw data into actionable insights, facilitating improved decision-making and operational efficiency. As more organizations recognize the benefits of cloud computing for IoT applications, the market for IoT solutions is expected to experience significant growth, driven by the demand for scalable and efficient data management solutions.

Component Insights

The hardware segment dominated the market and accounted for a market revenue share of 57.4% in 2023. IoT devices and sensors are essential for collecting and transmitting data in IoT systems, and the proliferation of smart devices, wearables, and connected appliances has significantly boosted the demand for IoT hardware. As the IoT ecosystem expands, the need for a diverse range of hardware components and devices continues to grow.

The services segment is anticipated to register the fastest CAGR of 14.1% over the forecast period. As businesses and organizations recognize the potential of IoT technologies to enhance operational efficiency and create new revenue streams, they seek professional services to design, implement, and manage these complex systems. Integration services, which involve connecting disparate IoT devices, platforms, and applications, ensure IoT solutions work seamlessly across various environments.

Deployment Insights

On-premise accounted for the largest market revenue share in 2023. Many IoT applications, particularly in sectors such as manufacturing, automotive, and critical infrastructure, require real-time data processing and low-latency responses to ensure operational efficiency and safety. On-premise deployments allow organizations to process data locally rather than relying on remote cloud servers, which can reduce latency and improve application performance.

Cloud is expected to register the fastest CAGR during the forecast period. Cloud platforms provide on-demand access to vast resources, including computing power, storage, and network bandwidth. This flexibility allows organizations to scale their IoT solutions up or down based on their current needs without physical hardware limitations. Businesses can easily adjust their cloud resources to handle fluctuations in data volume generated by IoT devices or expand their capabilities as their IoT deployments grow.

Connectivity Insights

Wi-Fi accounted for the largest market revenue share in 2023. Smart home technologies, including smart thermostats, lighting systems, security cameras, and voice assistants, rely heavily on Wi-Fi connectivity. Wi-Fi provides a convenient and cost-effective means of connecting these devices, allowing users to control and monitor their home environments through mobile apps and voice commands. The growing consumer preference for smart home solutions, driven by the desire for convenience, energy efficiency, and enhanced security, fuels the demand for reliable, high-performance Wi-Fi networks.

Z-Wave is anticipated to register a significant CAGR over the forecast period. Z-Wave technology supports many smart home products, from sensors and locks to thermostats and lighting systems. The Z-Wave Alliance boasts an extensive network of member companies that produce a diverse array of Z-Wave-certified devices, ensuring that consumers can access a wide selection of compatible products. For example, products from companies such as Aeotec, Schlage, and Fibaro integrate seamlessly with Z-Wave technology, offering a broad choice of smart home solutions.

End-use Insights

The consumer electronics segment accounted for the largest market revenue share in 2023. Consumers increasingly seek convenience, energy efficiency, and enhanced security in their living environments, driving the demand for smart home devices. Products such as smart thermostats, lighting systems, locks, and voice assistants are becoming mainstream as they offer users greater control over their home environments through IoT connectivity.

Aerospace & defense is anticipated to register the fastest CAGR over the forecast period. Automatic Dependent Surveillance-Broadcast (ADS-B) uses IoT to transmit information to air traffic control and other aircraft, improving air traffic management and safety. The continuous evolution of avionics technology, including IoT capabilities, supports sophisticated flight operations and contributes to the expansion of the aerospace and defense IoT market.

Regional Insights

The North America Internet of Things (IoT) market accounted for the largest market revenue share of 36.1% in 2023. North American countries, particularly the U.S. and Canada, are leading the development of advanced IoT technologies and solutions. A robust technology firm, research institution, and venture capital ecosystem drive this innovation. Companies such as IBM, Cisco, and Microsoft invest heavily in IoT technologies, including edge computing, artificial intelligence (AI), and 5G networks.

U.S. Internet of Things (IoT) Market Trends

The U.S. Internet of Things (IoT) market dominated the North America market in 2023. Increased investment in smart city projects across the country is encouraging the adoption of IoT technologies to improve urban infrastructure, public services, and residents' quality of life. Smart city initiatives encompass a range of applications, including intelligent traffic management systems, smart lighting, and advanced waste management solutions. For instance, in November 2023, San Diego implemented a smart streetlight program that uses IoT sensors to manage lighting based on real-time conditions and save energy.

Europe Internet of Things (IoT) Market Trends

The Europe Internet of Things (IoT) market was identified as a lucrative region in 2023. The European Union and individual countries invest heavily in R&D to advance IoT technologies and applications. Programs such as Horizon Europe, the EU’s key funding program for research and innovation, provide significant financial support for IoT research projects. For instance, Horizon Europe funds projects such as “IoT4CPS”, focuses on developing IoT-based cyber-physical systems for industrial applications.

The UK Internet of Things (IoT) market held a substantial market share in 2023. The UK government has launched several initiatives to promote IoT technologies and drive digital transformation. The “UK Digital Strategy” aims to enhance the country’s digital infrastructure and support innovations across various sectors through IoT. The “Connected and Automated Mobility” (CAM) program is designed to support the development of autonomous vehicles and smart transportation solutions with the integration of IoT.

Asia Pacific Internet of Things (IoT) Market Trends

The Asia Pacific Internet of Things (IoT) market is anticipated to register the fastest CAGR over the forecast period. The region is experiencing unprecedented urban growth, with major cities like Beijing, Tokyo, and Mumbai rapidly expanding. This urban expansion creates a significant demand for smart city solutions that utilize IoT technologies to manage urban infrastructure, improve public services, and enhance residents' quality of life.

India Internet of Things (IoT) market is expected to grow rapidly in the coming years. India is experiencing one of the fastest urban growth rates in the world, with millions of people migrating to cities every year. This rapid urbanization creates a substantial demand for smart city solutions that leverage IoT technologies to manage urban infrastructure, improve public services, and enhance the quality of life. The “Smart Cities Mission,” launched by the Indian government, aims to develop 100 smart cities nationwide by implementing IoT solutions for smart traffic management, intelligent street lighting, and efficient waste management.

Key Internet of Things (IoT) Company Insights

Some of the key companies in the Internet of Things (IoT) market include Microsoft, Amazon.com, Inc., Qualcomm Technologies, Inc, and Intel Corporation. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft offers a robust suite of Internet of Things (IoT) solutions through its Azure IoT platform, designed to cater to a broad range of industries and applications. Azure IoT Hub provides a secure and scalable cloud service for bi-directional communication between IoT applications and devices, supporting functions such as device provisioning, telemetry data collection, and command and control operations.

-

Qualcomm Technologies, Inc provides diverse Internet of Things (IoT) solutions through its comprehensive portfolio of hardware, software, and connectivity technologies. Qualcomm’s QCS and QCM Platforms offer scalable solutions for device makers to develop everything from consumer electronics to enterprise-grade IoT systems.

Key Internet of Things (IoT) Companies:

The following are the leading companies in the internet of things (IoT) market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc

- Microsoft

- Qualcomm Technologies, Inc

- Intel Corporation

- PTC

- Cisco Systems, Inc.

- Oracle

- SAP SE

- Siemens

- General Electric Company

Recent Developments

-

In June 2024, Cisco Systems, Inc. launched an Intelligent Industrial IoT Network as a foundation for Artificial Intelligence (AI) and Machine Learning (ML) applications. This network enhances various aspects of industrial operations, such as uptime, yield, security, and revenue generation.

-

In January 2023, PTC completed the acquisition of ServiceMax, a provider of service management solutions. The acquisition enhances PTC’s IoT offerings by combining field service management with advanced IoT analytics and AR for improved service operations and customer support.

Internet of Things (IoT) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.39 trillion

Revenue forecast in 2030

USD 2.65 trillion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, connectivity, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

Amazon.com, Inc, Microsoft, Qualcomm Technologies, Inc, Intel Corporation, PTC, Cisco Systems, Inc., Oracle, SAP SE, Siemens, General Electric Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet of Things (IoT) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Internet of Things (IoT) market report based on component, deployment, connectivity, end-use and region:

-

Component Outlook (Revenue, USD Trillion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Trillion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Connectivity Outlook (Revenue, USD Trillion, 2018 - 2030)

-

Zigbee

-

Wi-Fi

-

Bluetooth

-

Z-Wave

-

Others

-

-

End-use Outlook (Revenue, USD Trillion, 2018 - 2030)

-

Consumer Electronics

-

Wearable Devices

-

Automotive & Transportation

-

BFSI

-

Healthcare

-

Retail

-

Building Automation

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Trillion, 2018 - 2030)

-

North America

-

LOUSE

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.