- Home

- »

- Biotechnology

- »

-

Next Generation Sequencing Market, Industry Report, 2033GVR Report cover

![Next Generation Sequencing Market Size, Share & Trends Report]()

Next Generation Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Targeted Sequencing & Resequencing, WGS), By Product (Platform, Consumables), By Application, By Workflow, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-428-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Next Generation Sequencing Market Summary

The global next-generation sequencing market size was estimated at USD 9.56 billion in 2024 and is anticipated to reach USD 42.25 billion by 2033, growing at a CAGR of 18.0% from 2025 to 2033. This growth is driven by the increasing demand for advanced genomic research, rising applications of next-generation sequencing (NGS) in clinical diagnostics, and ongoing technological advancements in sequencing platforms.

Key Market Trends & Insights

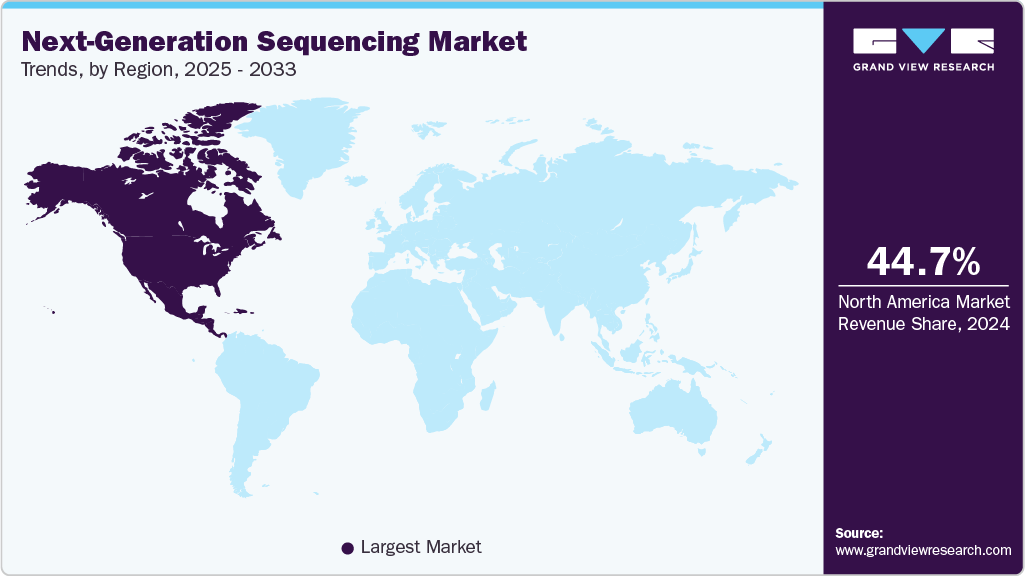

- The North America next-generation sequencing market held the largest share of 44.74% of the global market in 2024.

- The next-generation sequencing industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the oncology segment held the largest market share of 31.71% in 2024.

- By product, the consumables segment held the largest market share in 2024.

- By technology, the targeted sequencing & resequencing segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.56 Billion

- 2033 Projected Market Size: USD 42.25 Billion

- CAGR (2025-2033): 18.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increased Applications in Clinical Diagnostics

One of the key drivers fueling the growth of the next-generation sequencing (NGS) market is the increasing adoption of NGS in clinical diagnostics. Technology revolutionizes how diseases are diagnosed and monitored, offering precise, rapid, and comprehensive genomic insights. Its application in non-invasive prenatal testing (NIPT) is particularly notable, providing early and accurate detection of chromosomal abnormalities without posing risks to the fetus. Moreover, NGS is used extensively for rare disease diagnosis, carrier screening, and oncology-based testing, where identifying genetic mutations is crucial for targeted therapy and disease management.

Examples of targeted panels available in research and diagnostic settings

Disease Condition

Available Panel

Type of Inheritance

Specimen Type

Inherited cardiovascular defects

Cardiovascular research panel

Germline

Blood

Arrhythmias and cardiomyopathies

Arrhythmias and cardiomyopathy research panel

Germline

Blood

Sensitivity to pharmacological drugs

Pharmacogenomics research panel (PGex Seq panel)

Germline

Blood

Antimicrobial treatment efficacy testing

Antimicrobial resistance research panel

Microbial gene testing

Bacterial culture

Infertility conditions

Infertility research panel

Germline

Blood

Homologous recombination defect analysis

HRR gene panel

Somatic

Tumor tissue

Myeloid cancers

Myeloid cancer panel

Somatic

Blood

HIV speciation and drug resistance

HIV-Xgene panel

Pathogen detection

HIV-positive plasma

Antimicrobial resistance in MTB

TB research panel

Pathogen detection

MTB-positive specimen

Inborn errors of metabolism

Error of metabolism research panel

Germline

DBS/blood

Hereditary cancers

BRACA and extended breast and ovarian cancer research panel, inherited cancer research panel

Germline

Blood

NGS is also transforming the field of infectious disease diagnostics by enabling the detection of pathogens and monitoring disease outbreaks with unprecedented speed and accuracy. Its utility was demonstrated during the COVID-19 pandemic and continues to play a role in tracking variants and emerging threats. Moreover, increasing regulatory approvals of NGS-based clinical tests and the gradual inclusion of these tests in standard clinical guidelines have further legitimized their use. With supportive reimbursement policies and the ongoing shift toward precision medicine, the demand for NGS in diagnostic settings is expected to grow significantly, positioning it as a major driver of market expansion.

Advancements in Technology

Technological innovation is one of the most significant drivers propelling the next-generation sequencing (NGS) market growth. Continuous advancements in sequencing platforms such as whole genome sequencing (WGS), whole exome sequencing (WES), and targeted sequencing have significantly enhanced NGS's accuracy, speed, and scalability. These innovations have reduced sequencing costs and turnaround times, making genomic analysis more accessible to a wider range of laboratories and clinical settings. As a result, researchers and clinicians can now produce high-quality data with greater efficiency, enabling deeper insights into genetic diseases, cancer, and infectious agents.

Developing portable, automated, and high-throughput sequencing systems has played a crucial role in broadening the adoption of NGS. Technologies such as benchtop sequencers and nanopore-based platforms have made sequencing more flexible and adaptable, supporting decentralized testing in developed and emerging markets. Integration with AI-driven bioinformatics tools and cloud-based data analysis platforms has further enhanced the utility of NGS by simplifying complex data interpretation and enabling real-time, large-scale analysis. These continuous innovations are not only expanding the practical applications of NGS across research and clinical domains. Still, they are also creating new opportunities in personalized medicine, epidemiology, and drug development, cementing technological advancement as a key market growth driver.

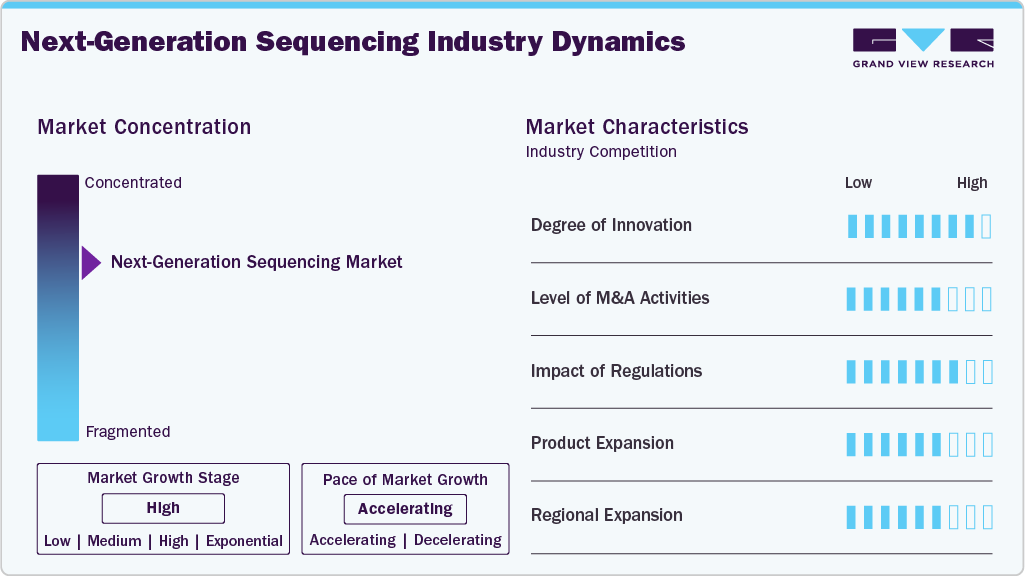

Market Concentration & Characteristics

The NGS industry benefits from a high degree of innovation, with ongoing advances in sequencing technologies such as single-cell and long-read sequencing and AI-driven data analysis. For instance, in February 2025, Roche launched its SBX sequencing technology in the U.S., introducing Xpandomer chemistry to enhance signal clarity, accuracy, and scalability for clinical and research genomic applications. These innovations enhance accuracy, speed, and clinical utility while reducing costs, driving broader research, diagnostics, and personalized medicine adoption.

The NGS industry is witnessing significant merger and acquisition (M&A) activity, which is fueling market growth and consolidation. Leading companies are acquiring innovative and smaller startups to expand their technological capabilities, product portfolios, and geographic reach. These strategic partnerships enable faster development of new sequencing platforms, improved bioinformatics solutions, and enhanced service offerings. For instance, in June 2025, Illumina agreed to acquire SomaLogic from Standard BioTools for up to USD 425 million, aiming to improve its proteomics and multi-omics capabilities. This trend is expected to continue as players seek to capitalize on emerging opportunities in genomics and personalized medicine.

Regulatory frameworks are crucial in shaping the next-generation sequencing (NGS) market by ensuring the safety, efficacy, and quality of sequencing technologies and diagnostic tests. Increasing approvals from regulatory bodies such as the FDA and European CE marking have bolstered clinical adoption of NGS-based assays. Clear guidelines and standards help build confidence among healthcare providers and patients, facilitating integration into routine clinical practice. Moreover, evolving regulations around data privacy and genetic information influence the development of secure and compliant NGS platforms. While stringent regulations can pose challenges, a supportive regulatory environment drives innovation, market growth, and broader acceptance of NGS technologies.

Product expansion is a key driver in the next-generation sequencing market, with companies continuously launching new sequencing platforms, reagents, and bioinformatics tools to meet diverse research and clinical needs. Innovations such as portable sequencers, improved library preparation kits, and advanced data analysis software are enhancing workflow efficiency and expanding application areas. By broadening their product portfolios, market players can target a wider range of end users, including academic institutions, pharmaceutical companies, and healthcare providers, accelerating market growth and adoption.

Regional expansion drives significant growth in the next-generation sequencing industry as companies increase their presence in emerging markets across Asia-Pacific, Latin America, and the Middle East. Growing healthcare infrastructure, rising government initiatives for genomic research, and raising awareness about personalized medicine in these regions fuel demand. Moreover, expanding distribution networks and local partnerships enable better access to NGS technologies, helping companies tap into underserved markets and diversify their customer base. This geographic expansion is critical to sustaining long-term market growth worldwide.

Product Insights

The consumables segment held the largest market share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. This segment's larger share and exponential growth rate are mainly attributed to the consumables' recurrent usage and high demand in NGS's commercial and research applications. These consumables include sample preparation kits and kits for target enrichment. The adoption of NGS consumables has increased as most pharmaceutical companies and research institutes are utilizing NGS for several diagnostic applications and cancer research. For instance, in June 2022, PerkinElmer launched three RUO NGS library prep kits: NEXTFLEX Small RNA-Seq Kit v4, NEXTFLEX Rapid XP V2 DNA-Seq Kit, and PG-Seq Rapid Kit v2, designed to streamline workflows and improve accuracy.

The platform segment is anticipated to grow at a significant CAGR during the forecast years, driven by the increasing adoption of next-generation sequencing (NGS) platforms across research, clinical, and pharmaceutical applications. Continuous innovations in sequencing chemistry, automation, and data analysis software further enhance platform performance, scalability, and accessibility.

Technology Insights

The targeted sequencing and resequencing segment held the largest revenue share of 48.46% in 2024. This segment is expected to witness the growth in demand after the development of whole genome sequencing, as the availability of a large amount of whole genome data likely to require analytical identification of specific gene locations and isolated genetic expressions. For instance, in June 2025, BJ Medical College and Sassoon Hospital in Pune began targeted genome sequencing of 50 TB samples to identify drug resistance mutations, highlighting this approach's practical application and ongoing importance in clinical research.

The whole exome sequencing segment is projected to grow at the fastest CAGR over the forecast period. The rising adoption of WES in clinical diagnostics, precision medicine, and translational research, coupled with advancements in bioinformatics pipelines for variant interpretation, is fueling its rapid growth.

Application Insights

The oncology segment held the largest revenue share of 31.71% in 2024, driven by the critical role of genomics data analysis in cancer research, diagnostics, and targeted therapy development. Genomic profiling makes finding mutations linked to cancer, biomarkers, and molecular signatures possible and is crucial for precision medicine and individualized treatment plans. The use of genomics data analysis in oncology has increased due to the rising incidence of cancer worldwide and developments in next-generation sequencing (NGS) technology and bioinformatics tools.

The consumer genomics segment is projected to grow at the fastest CAGR over the forecast period, driven by the rising interest among individuals in ancestry tracing, health risk assessment, and personalized wellness insights. Adoption is accelerating across various demographics due to rising awareness of genetic testing and the accessibility of reasonably priced direct-to-consumer (DTC) genomics services. Consumer access to genomic information has increased thanks to developments in sequencing technologies, streamlined testing procedures, and intuitive reporting platforms; regulatory approvals and privacy protections are also strengthening consumer confidence in these services.

Workflow Insights

The sequencing segment held the highest market share of 64.10% in 2024 and is expected to grow with the fastest rate over the forecast period. NGS sequencing is the most important phase of the workflow and consequently accounts for the largest share of the market. These systems can provide an accurate amount of liquid, which is important in NGS. Moreover, functions such as changing tubes and micro-liter plates are also carried out by the system, which helps streamline workflow. The advantage of using a robotic liquid handling system is that it enables researchers to focus on analyzing the data rather than managing the process.

NGS Data Analysis segment is anticipated to grow with a significant CAGR over the forecast period. A key factor contributing to the industry's growth is the growing acceptance of sequencing platforms for clinical diagnosis due to a huge reduction in installation costs. Moreover, easy genomic and proteomic information availability is anticipated to create significant growth opportunities in this industry during the forecast period. For instance, Illumina's BaseSpace Suite aids in the analysis of sequencing data and the production of findings quickly. The company has also purchased DRAGEN Bio-IT Platform (DRAGEN) and Edico Genome to expand its data analytics capabilities.

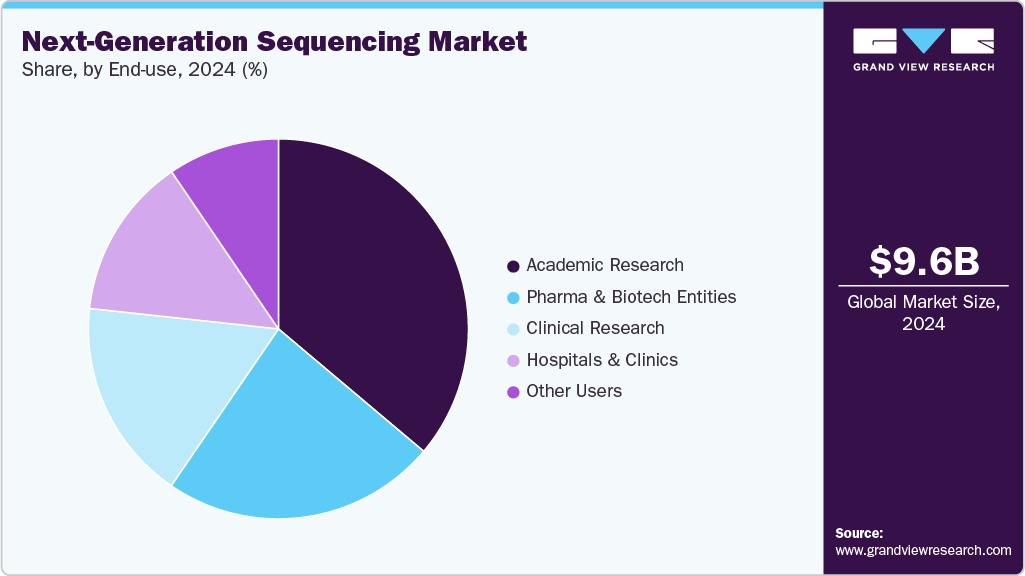

End Use Insights

The academic research segment held the largest revenue share of 36.15% in 2024. The application of NGS solutions in research projects that are carried out in universities and research centers can be attributed to the largest share of this segment in the market. Moreover, scholarships offered for PhD projects in NGS are anticipated to drive demand for NGS products and services, resulting in lucrative growth over the forecast period. The provision of on-site bioinformatics courses that include workshops on the practical implementation of NGS sequencing and data analysis is also expected to boost revenue generated by the academic research segment in the forecast period.

The clinical research segment is anticipated to be the fastest-growing segment during the forecast period, owing to the use of NGS in cancer research and, more specifically, in discovering new cancer-related genes, studying tumor heterogeneity, and identifying alterations contributing to tumorigenesis. For instance, in February 2025, BioSpectrum Asia reported on Asia’s growing use of NGS in precision oncology, highlighting national efforts to expand genomic profiling, clinical trials, and personalized cancer care across the region. Moreover, the availability of clinical research solutions through market entities such as Illumina, Thermo Fisher Scientific Corporation, and Agilent Technologies for target enrichment & detection is anticipated to provide this segment with high growth opportunities over the forecast period.

Regional Insights

North America next generation sequencing market dominated the respective global market with the largest share of 44.74% in 2024. The regional market is driven by multiple clinical laboratories employing NGS to provide genetic testing services. Moreover, due to the presence of high R&D investment and the availability of a technologically advanced healthcare research framework, the development of NGS in the region is also expected to serve as a critical factor for the growth of the North American NGS market throughout the forecast period.

U.S. Next-Generation Sequencing Market Trends

The U.S. holds the largest share of the region's NGS market, owing to its advanced healthcare system, strong research funding, and dominance of key players such as Illumina, Thermo Fisher, and Pacific Biosciences. The country is a global leader in genomic medicine, with large-scale initiatives such as the All of Us Research Program propelling widespread adoption of NGS in both research and clinical settings. For instance, in October 2022, PathoQuest formally opened a 7,000 sq ft NGS testing facility in Wayne, Pennsylvania, USA, backed by a USD 10 million investment to accelerate biopharma biosafety and viral safety services.

Europe Next-Generation Sequencing Market Trends

Europe represents a significant share of the global NGS market, driven by strong government support for genomic research, expanding applications in clinical diagnostics, and well-established healthcare infrastructure. Countries such as Germany and the UK are at the forefront, investing heavily in precision medicine and national genome initiatives. Moreover, widespread adoption of NGS in oncology and infectious disease surveillance is further accelerating market growth across the region. For instance, in May 2025, France-based SeqOne raised funding to expand its AI-driven NGS platform for oncology and rare disease diagnostics.

The UK NGS market is expected to grow significantly owing to an increase in the development of companion diagnostics and the subsequent establishment of molecular diagnostic development facilities by key market players. Moreover, ongoing strategic alliances between players in European and Eastern markets are expected to fuel the growth of the next-generation sequencing market during the region's forecast period.

Next-Generation sequencing market in Germany is pivotal in Europe’s NGS landscape due to its robust biotechnology sector, academic research strength, and government-led precision medicine programs. The country invests in digitized healthcare and integrates NGS into cancer genomics, rare disease diagnostics, and infectious disease monitoring. Public-private collaborations are also boosting innovation in sequencing technologies and applications.

Asia Pacific Next-Generation Sequencing Market Trends

Asia-Pacific is the fastest-growing region in the NGS market with the CAGR of 18.4%, supported by rising healthcare expenditure, expanding genomic research, and growing awareness of precision medicine. Countries such as China, Japan, India, and South Korea invest heavily in national genomic databases, advanced sequencing facilities, and public-private partnerships. Local biotech companies are emerging rapidly, driving innovation and regional competition. For instance, in April 2025, a Bengaluru, India lab launched free NGS-based biomarker testing for lung cancer patients under India’s LuNGS Alliance, backed by pharma firms and 4baseCare to support personalized treatment.

Next-Generation sequencing market in China is experiencing rapid growth in the region, backed by aggressive government funding, a strong domestic biotech sector, and increasing clinical adoption. For instance, in June 2025, Gene Solutions and Shenzhen USKBio partnered to launch an NGS lab in southern China, combining AI-driven ctDNA tests and PCR-based diagnostics to enhance cancer detection and treatment access. National initiatives like the China Precision Medicine Initiative and genomic data repositories are boosting research and diagnostics capabilities. Local players such as BGI Genomics are expanding globally and challenging established Western firms in terms of cost and scalability.

Japan next-generation sequencing market has a well-established NGS market in the region driven by its aging population, government support for genomic medicine, and advanced healthcare technologies. Programs such as the Japan Agency for Medical Research and Development (AMED) promote NGS adoption in cancer diagnostics and drug discovery. Japanese companies and research institutions are also advancing sequencing technologies tailored to regional needs.

MEA Next-Generation Sequencing Market Trends

The NGS market in MEA is developing but shows strong potential due to the increasing government focus on healthcare modernization and precision medicine. Countries like Kuwait, Saudi Arabia, and the UAE are investing in genomics research and personalized healthcare as part of their national health strategies, which further supports the NGS industry's expansion.

Kuwait next-generation sequencing market represents an emerging NGS market within the Middle East, where growing investment in healthcare infrastructure and personalized medicine is beginning to drive adoption. While the market is still developing, government-funded genomic research projects and collaborations with international institutions are laying the foundation for future growth. Expansion of NGS-based diagnostics, especially in oncology and rare diseases, is expected in the forecasted period.

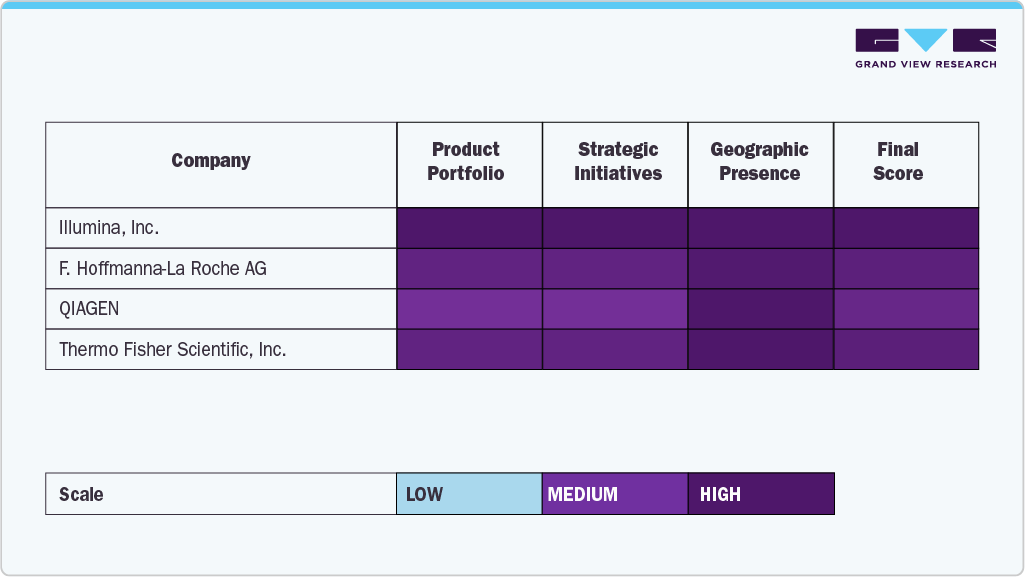

Key Next-Generation Sequencing Company Insights

The NGS industry is dominated by several well-established players who maintain their leadership through robust product portfolios, strategic partnerships, and sustained investments in research and development. Industry leaders such as Illumina, F. Hoffman-La Roche Ltd., QIAGEN, and Thermo Fisher Scientific, Inc. hold significant market share owing to their advanced sequencing platforms, comprehensive service offerings, and extensive global distribution networks.

Companies such as Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, PierianDx, and Genomatix GmbH are rapidly expanding their footprint by introducing innovative sequencing solutions, bioinformatics tools, and customized services that address the evolving needs of research institutions, clinical laboratories, and pharmaceutical companies. These firms focus on enhancing sequencing accuracy, throughput, and data analysis capabilities to support diverse applications ranging from oncology and rare disease diagnostics to infectious disease surveillance and precision medicine.

Organizations such as DNASTAR, Inc., Perkin Elmer, Inc., Eurofins GATC Biotech GmbH, and BGI further enrich the competitive landscape, which continues to drive innovation through cutting-edge technologies and strategic growth initiatives. These companies have solidified their leadership in the NGS market by combining scientific excellence with customer-focused solutions. As demand for personalized medicine, genomics-driven drug development, and population-scale sequencing projects grows, market dynamics are likely to influence factors such as cost-efficiency, data security, and regulatory compliance.

The NGS market is marked by dynamic collaboration between industry veterans and emerging innovators. Mergers and acquisitions, strategic alliances, and technological breakthroughs in sequencing speed, accuracy, and scalability are intensifying competition. Companies that successfully integrate technological advancements with comprehensive service ecosystems are poised to deliver sustained value and shape the future of genomics research, clinical diagnostics, and precision healthcare.

Key Next-Generation Sequencing Companies:

The following are the leading companies in the next-generation sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- PacBio

- Oxford Nanopore Technologies

- Revvity, Inc.

- Merck KGaA

- BGI

Recent Developments

-

In July 2025, QIAGEN expanded its NGS portfolio in India by launching QIAseq xHYB Long-Read Panels, enhancing target enrichment capabilities for clinical and translational research in oncology and genetic diseases.

-

In July 2025, Thermo Fisher Scientific enabled precision oncology advancements in the U.S. by launching the Oncomine Comprehensive Assay Plus on the Genexus System, accelerating next-day comprehensive genomic profiling for researchers.

-

In May 2025, Illumina supported a high‑speed, high‑tech NGS laboratory in Australia’s Northern Territory by enabling Territory Pathology to deploy MiSeq and NextSeq systems with cloud‑based analytics, accelerating local pathogen and oncology genomic services.

Next-Generation Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.26 billion

Revenue forecast in 2033

USD 42.25 billion

Growth rate

CAGR of 18.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, workflow, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Illumina; QIAGEN; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Inc.; BGI; Bio-Rad Laboratories, Inc.; PacBio; Revvity, Inc.; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Next-Generation Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the next-generation sequencing market based on technology, product, workflow, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

WGS

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing

-

DNA-based

-

RNA-based

-

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Platform

-

Sequencing

-

Data Analysis

-

-

Consumables

-

Sample Preparation

-

Target Enrichment

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Diagnostics and Screening

-

Oncology Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

Research Studies

-

-

Clinical Investigation

-

Infectious Diseases

-

Inherited Diseases

-

Idiopathic Diseases

-

Non-Communicable/Other Diseases

-

-

Reproductive Health

-

NIPT

-

Aneuploidy

-

Microdeletions

-

-

PGT

-

Newborn Genetic Screening

-

Single Gene Analysis

-

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Sequencing

-

Nucleic Acid Extraction

-

Library Preparation

-

-

Sequencing

-

NGS Data Analysis

-

NGS Primary Data Analysis

-

NGS Secondary Data Analysis

-

NGS Tertiary Data Analysis

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global next generation sequencing market size was estimated at USD 9.56 billion in 2024 and is expected to reach USD 11.26 billion in 2025.

b. The global next generation sequencing market is expected to grow at a compound annual growth rate of 17.98% from 2025 to 2033 to reach USD 42.25 billion by 2033.

b. North America dominated the NGS market with a share of 44.74% in 2024. This is attributable to the presence of major clinical laboratories that are using next-generation sequencing technology to perform genetic tests.

b. Some key players operating in the NGS market include Illumina, QIAGEN; Thermo Fisher Scientific Inc.; F Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; and Bio-Rad Laboratories, Inc.

b. Key factors that are driving the NGS market growth include exponentially decreasing costs for genetic sequencing, development of companion diagnostics and personalized medicine, rise in competition amongst prominent market entities, a rising clinical opportunity for NGS technology, technological advancements in cloud computing and data integration, growing healthcare expenditure, and increasing prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.