- Home

- »

- Disinfectants & Preservatives

- »

-

North America Automotive Air Filters Market, Report, 2030GVR Report cover

![North America Automotive Air Filters Market Size, Share & Trends Report]()

North America Automotive Air Filters Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Intake Filters, Cabin Filters), By Vehicle (Passenger Cars), By End Use (OEM, Aftermarket), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-434-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The North America automotive air filters market size was valued at USD 915.0 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. Increased investment in R&D activities to increase efficiency and improve engine performance, government regulations, and increased awareness about the importance of air filters in keeping the environment less polluted would further propel the market. In addition, the increase in vehicle sales due to increased construction projects and expansion of the logistics sector would further propel the market.

Rising automobile pollution has led governments to implement stricter air quality regulations, boosting demand for efficient vehicle technologies. Increased awareness about vehicle efficiency and the benefits of regular part replacement has further accelerated market growth. Technological innovations introduced advanced air filters designed for various vehicles, enhancing engine performance and extending engine life by ensuring proper combustion.

These advancements represent a significant shift in improving vehicle efficiency and reducing environmental impact. For instance, in January 2023, the Environmental Protection Agency (EPA) launched a program to impose stricter emission standards for heavy-duty engines and vehicles in the U.S., aiming to reduce air pollution. Automotive air filters play a crucial role by capturing harmful airborne particles, which helps lower emissions and enhances engine performance. This program underscores the importance of advanced filtration technology in meeting environmental regulations.

Advanced air filters prevent dust particles from entering engines, significantly enhancing engine longevity. With major automotive production hubs such as the USA, Canada, and Mexico, North America sees rising vehicle demand. Integrating advanced air filters in vehicles leads to lower engine maintenance, benefiting owners by extending engine life and improving vehicle efficiency. This trend underscores the importance of high-quality air filtration in the automotive industry. For instance, in 2022, Canada had 26.3 million registered road motor vehicles, a 0.3% increase from 2021. Light-duty vehicles comprised 91.7% of total registrations, with multi-purpose vehicles becoming the most common type. Electric vehicles represented 3.0% of light-duty registrations, up from 2.3% in 2021.

Product Insights

The intake filters segment dominated the market and accounted for a share of 52.2% in 2023. This dominance is attributed to stringent emission regulations, increasing vehicle production, and rising consumer awareness of vehicle maintenance. Advanced intake filters enhance engine performance and efficiency, meeting regulatory standards and extending engine life. The region's focus on reducing environmental impact and improving air quality fuels this demand.

The cabin filter segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. The factors that support the growth of the segment are its ability to filter the air entering the vehicle's cabin by heating and air conditioning system, its ability to ensure the proper ventilation system for the health of the passengers, and, apart from improving the health of the passengers, the ability of cabin filters to help reduce vehicle maintenance costs and restrict dirty, contaminated air from coming inside the cabin. For instance, in July 2024, MANN+HUMMEL introduced the Mann-Filter FreciousPlus, which utilizes nanofibers for enhanced cabin air filtration. This advanced filter efficiently captures ultra-fine particles and pollutants from external and internal sources. Additionally, it provides reliable protection against allergens, bacteria, and mold.

Vehicle Insights

The commercial segment dominated the market and accounted for a share of 62.2% in 2023 and is expected to grow at the fastest CAGR of 4.7% over the forecast period. The factors supporting the dominance and growth of the segment are the increase in demand for scheduled services, which these vehicles provide, the increase in the transportation and logistics sector, and rising awareness about the health disorders caused by improper ventilation in cabins. According to the Global Economy, North America's average commercial vehicle sales in 2023 were 5,070,269. The highest sales figures were in the U.S., at 12,892,621, followed by Canada and Mexico, at 2,361,778 and 815,830, respectively.

The passenger cars segment is expected to grow at a CAGR of 4.2% over the forecast period. The filters in passenger cars benefit the owners of the segment, as they save the cost of engine maintenance and do not compromise the health of the passengers. The demand for passenger cars is increasing because of the increase in income and population. The government’s regulations aim to improve the air quality index, helping the market grow.

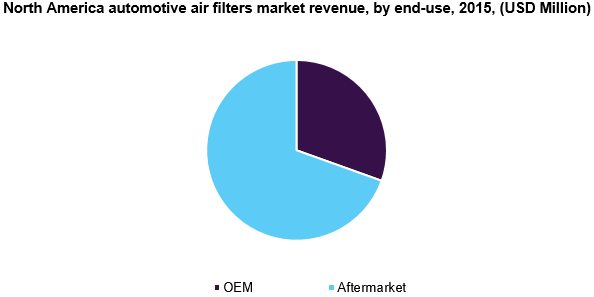

End Use Insights

The aftermarket segment dominated the market and accounted for a share of 72.8% in 2023 and is expected to grow at the fastest CAGR of 4.7% over the forecast period. This growth can be attributed to cheaper options compared to the stock filter, price-sensitive customers preferring the aftermarket filters, and the availability of these filters everywhere because of the expansion in retail outlets and garages. The aftermarket filters have nearly the same efficiency as the stock filter, further propelling the market.

The OEM (Original Equipment Manufacturer) segment is expected to grow at a CAGR of 3.7% over the forecast period. Factors such as an increase in passenger and commercial vehicle ownership, the increase in demand for original equipment parts, especially in passenger vehicles, the efficiency of these products as compared to the aftermarket filters, and the trust in the original equipment and its performance are driving the growth of the market.

Country Insights

U.S Automotive Air Filters Market Trends

U.S. automotive air filters market dominated the North America with a share of 58.0% in 2023 due to the consumption of commercial and passenger vehicles. Two-wheelers are rising due to the demand for filters, the increasing population, and the increase in disposable income, which have led to the demand for cars, which are the reasons for the growth of the market. Furthermore, the initiatives taken by the U.S. government have helped further expand the market. For instance, in May 2024, U.S. total vehicle sales reached 16.41 million, a 0.72% increase from 16.30 million in April and a 2.05% rise from 16.08 million in 2023. This metric, which includes auto, light truck, and heavy truck sales, reflects consumer spending trends and discretionary income. Historically, sales spiked to 22 million in late 2001 due to favorable financing programs from manufacturers.

Canada Automotive Air Filters Market Trends

The Canada automotive air filters market is expected to grow significantly over the forecast period. The increasing transportation and logistics sector, increasing awareness of environmental issues, and growing investment in filter technology have been the primary reasons for the segment's growth. In addition, vehicle owners' priorities for maintenance and fuel efficiency and demand for good-quality air flow filters further propel the market's growth.

Mexico Automotive Air Filters Market Trends

Mexico automotive air filters market is expected to grow at the fastest CAGR of 9.6% over the forecast period. The country's growth can be attributed to factors such as the growing automobile industry, which includes both domestic and international automobile players, the increasing aftermarket for vehicle repair, and the variety of filters available that appeal to customers. According to the International Trade Administration (ITA), Mexico is a major player in the heavy-duty vehicle industry, ranking as the world's fifth-largest manufacturer. 14 manufacturers and assemblers are setting up shop in 11 plants across the country, creating over 28,000 jobs. Moreover, Mexico is the leading global exporter of tractor trucks, with 95.1% going to their northern neighbor, the U.S.

Key North America Automotive Air Filters Company Insights

Some of the key players in the North America automotive air filters market are Fildex Filters Canada, Parker-Hannifin Corporation, K&N Engineering, Inc., Donaldson Company, Inc., Cummins Inc., MANN+HUMMEL, ACDelco, Hollingsworth & Vose, and Lydall, Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Fildex Filters Canada has expertise in manufacturing and distributing filters and lubricants offers wide range of air filters including the engine air filters and cabin air filters keeping in mind the wide range of vehicles.

-

Donaldson Company, Inc. provides filtration solutions, including advanced automotive air filters that enhance engine performance and longevity. Their innovative products serve a wide range of vehicles and ensure efficient contamination removal. The company's commitment to quality and technological advancement positions it as a key player in the automotive air filters market.

Key North America Automotive Air Filters Companies:

- Fildex Filters Canada

- Parker-Hannifin Corporation

- K&N Engineering, Inc.

- Donaldson Company, Inc.

- Cummins Inc.

- MANN+HUMMEL

- ACDelco

- Hollingsworth & Vose

- Lydall, Inc.

Recent Developments

-

In August 2023, Donaldson Company, Inc. and the National Automotive Parts Association (NAPA) partnered to innovate and distribute filtration products. The expertise of Donaldson in making filtration equipment and the expertise of NAPA in distributing was expected to benefit both companies.

-

In January 2023, Panasonic Automotive Systems Co., Ltd., a major car parts supplier, launched an in-car air purifier in North America. This nanoe X device uses technology to fight odors, viruses, bacteria, mold, and allergens, even on surfaces, which aims to create a cleaner, healthier in-car environment for drivers and passengers.

North America Automotive Air Filters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 956.8 million

Revenue forecast in 2030

USD 1.24 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Vehicle, End Use, and Region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Fildex Filters Canada; Parker-Hannifin Corporation; K&N Engineering, Inc.; Donaldson Company, Inc.; Cummins Inc.; MANN+HUMMEL; ACDelco; Hollingsworth & Vose; Lydall, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Automotive Air Filters Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America automotive air filters market report based on product, vehicle, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Intake Filter

-

Cabin Filter

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Two-Wheeler

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM (Original Equipment Manufacturer)

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.