- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Flame Retardant Thermoplastic Market Report, 2030GVR Report cover

![North America Flame Retardant Thermoplastic Market Size, Share & Trends Report]()

North America Flame Retardant Thermoplastic Market Size, Share & Trends Analysis Report By Product (Acrylonitrile Butadiene Styrene, Polycarbonate, Polypropylene, Polystyrene), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-478-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

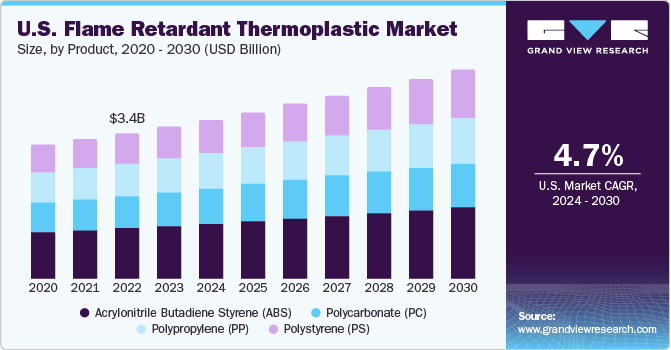

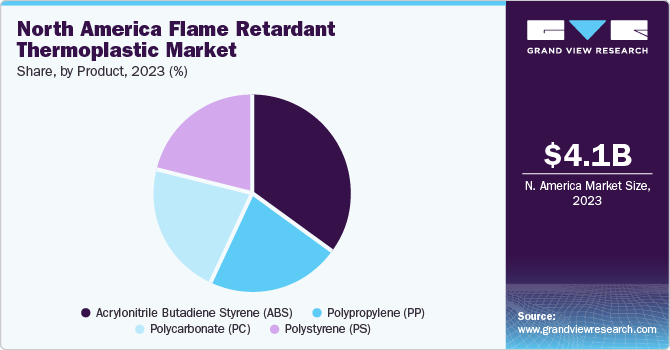

The North America flame retardant thermoplastic market size was estimated at USD 4.06 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. Recent developments in the electrical & electronics and automotive & transportation industry are likely to drive the demand for thermoplastics market in these application segments. An increase in use of environment-friendly and energy-saving products is also expected to influence the market positively.

Ongoing research & developments in technology-based flame retardant thermoplastics are likely to boost the market growth as they offer excellent strength and thermal resistance with lower thickness. Technological breakthroughs, innovations, and studies carried out for expanding the product’s application scope are projected to foster the demand.

Rising utilization of flame-retardant thermoplastics in the electrical & electronics, automotive & transportation, building & construction, and industrial application sectors is anticipated to push the manufacturers to backward integration in the value chain during the coming years. Greater participation in the value chain is likely to result in time reduction for transforming raw materials into finished products and in gaining cost advantage. Building & construction industry in Canada is witnessing lucrative growth opportunities. The low cost involved in a facility setup and availability of labor at low cost in comparison with that of the U.S. are the factors that are attracting the attention of the manufacturers to set up their plants in Canada.

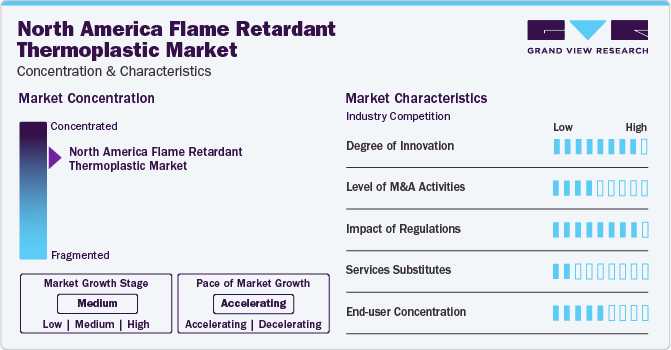

Market Concentration & Characteristics

Flame retardant thermoplastics manufacturers are expanding in terms of production capacity and infrastructure, intending to cater to the growing market requirements. Moreover, many product manufacturing companies are using acquisition and partnership strategies for procuring raw materials. Mergers and joint ventures are an integral part of this market and allow companies to expand their market position.

In August 2023, LANXESS, a major flame retardant thermoplastic manufacturer along with FRX Innovations, a developer and manufacturer of environmentally sustainable polymeric flame-retardant additives, announced their partnership for serving higher customer-base across the globe, especially across North American regions.

Product Insights

In terms of product, Acrylonitrile butadiene styrene (ABS) segment led the market in 2023 with a largest revenue share of 34.0%. Its properties, such as high strength, rigidity, dimensional stability, and low cost over other substitutes make it suitable for the various industries. The lighter weight of ABS also results in ease of usage and transport.

ABS is widely used in electrical & electronics and automotive & transportation application and is gaining popularity owing to its high strength, rigidity, and dimensional stability. ABS is a tough flame-retardant thermoplastic material and is resistant to physical impact, corrosive chemicals, and heat. Thermoplastics, such as ABS, liquefy, which allows them to be easily injected, molded, and recycled. However, ABS is not used in high-heat situations because of its low melting point. LEGO toys and computer keyboards are also significant applications for Acrylonitrile butadiene styrene thermoplastic compounds.

The demand for polycarbonate in electrical & electronics and automotive & transportation applications has been tremendously rising in the recent past. It is easily moldable and flexible, making it an ideal material for thermoforming applications. Polycarbonate is tough & strong and some grades of the plastic are even optically transparent, making it easy to be engineered. Polycarbonate materials are produced by the overall reaction of phosgene and bisphenol A (BPA).

Owing to its chemical and mechanical properties, polypropylene is extensively used in manufacturing automotive components, packaging & labeling, medical devices, and diverse laboratory equipment among various others. It is resistant to several chemical solvents, acids, and bases and has excellent mechanical strength. It is also among the most highly formulated thermoplastics across the globe.

Country Insights

U.S. held the largest market share in the North America flame retardant thermoplastic market with a revenue share of 33.0% in 2023. The growing building & construction industry in the U.S. is expected to significantly contribute to the growth of the flame-retardant thermoplastics market. In recent years, the construction industry has witnessed favorable growth in the U.S. on account of increasing infrastructural developments.

Flame retardant thermoplastics are finding increased utilization in the building & construction industry for commercial & industrial applications. The construction industry in the U.S. is expected to observe growth owing to new import tariffs, changing trade deals, a strong economy, proliferation of mega projects, focus on smart cities, and increasing household construction.

The electrical & electronics industry in the U.S. is growing due to the increasing demand for electronics equipment from the gaming industry. According to Game Industry Biz, the global gaming industry was worth USD 135 billion in 2018 and is continuously growing.

Major companies, such as Electronic Arts Inc., Nintendo, Zynga, and Activision Publishing, Inc., among others, in the gaming industry organize global gaming tournaments that require the construction of various game zones for practicing games. Thus, the growing gaming industry is expected to fuel the growth of the North America flame-retardant thermoplastics market during the forecast period.

The growth of the construction industry, including residential, industrial, and commercial construction, in Mexico is anticipated to contribute to the market growth during the forecast period. Reconstruction and development of urban infrastructure in marginalized communities are expected to provide major growth opportunities for flame retardant thermoplastics in the building & construction industry.

Key Companies & Market Share Insights

Key players operating in market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements.

Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives to maintain competitive environment.

Key North America Flame Retardant Thermoplastic Companies:

- BASF SE

- LANXESS

- Dow Inc.

- ICL

- RTP Company

- Huber Engineered Materials

- Clariant AG

- Plastics Color Corporation

- Albemarle Corporation

- PolyOne Corporation

- SABIC

- Asahi Kasei Corporation

- WASHINGTON PENN PLASTIC CO., INC.

- Koninklijke DSM N.V.

- Teknor Apex

North America Flame Retardant Thermoplastic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.26 billion

Revenue forecast in 2030

USD 5.66 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, country

Country Scope

U.S.; Canada; Mexico

Key companies profiled

BASF SE; LANXESS; Dow Inc.; ICL; RTP Company; Huber Engineered Materials; Clariant AG; Plastics Color Corporation; Albemarle Corporation; PolyOne Corporation; SABIC; Asahi Kasei Corporation; WASHINGTON PENN PLASTIC CO., INC.; Koninklijke DSM N.V.; and Teknor Apex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Flame Retardant Thermoplastic Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this report, Grand View Research has segmented North America Flame Retardant Thermoplastic market report based on product, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polycarbonate (PC)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America flame retardant thermoplastic market size was estimated at USD 4.06 billion in 2023 and is expected to reach USD 4.26 billion in 2024.

b. The North America flame retardant thermoplastic market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 5.66 billion by 2030.

b. The U.S. dominated the North America flame retardant thermoplastic market with a share of more than 33% in 2023. This is attributable to increased utilization in the building and construction industry for commercial and industrial applications.

b. Some key players operating in the North America flame retardant thermoplastic market include BASF SE; LANXESS; Dow Inc.; ICL; RTP Company; Huber Engineered Materials; Clariant AG; Plastics Color Corporation; Albemarle Corporation; and PolyOne Corporation.

b. Key factors that are driving the North America flame retardant thermoplastics market growth include rising utilization of flame-retardant thermoplastics in the electrical and electronics, automotive and transportation, building and construction, and industrial application sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."